WW Personal and Entry-Level Storage Market Finished Flat in 2014 – IDC

Annual shipment value down -1.5% Y/Y to $6.6 billion

This is a Press Release edited by StorageNewsletter.com on February 20, 2015 at 2:59 pmThe worldwide personal and entry-level storage (PELS) shipments remained flat year over year in 2014, finishing the year with 75.7 million units, according to the International Data Corporation‘s Worldwide Personal and Entry Level Storage Tracker.

Annual shipment values were down -1.5% year over year to $6.6 billion. Unit shipments were down slightly in 4Q14, declining -0.9% from a year ago to 20.5 million units, while 4Q14 shipment values were also down, declining -5.2% to $1.7 billion.

“The personal and entry-level storage market finished 2014 flat, despite strong growth during the previous quarter,” said Jingwen Li, research analyst, storage systems. “The entry-level portion of the market showed consistent growth throughout the year, but it remains too small to drive growth for the entire market. The largest market segment, personal storage, fell victim to continued price declines, increased competition from public cloud providers, and a shift in consumer preferences towards online streaming media.”

For 4Q14, HDD vendors continued to increase their share in PELS units shipped, gaining 1.7 percentage points year over year to grow to 80.2% market share. Although the entry-level storage market continued to be dominated by the mainstream non-HDD vendors, with 42.1% unit shipment market share, their market share continued to shrink by 17.6 points year over year. HDD vendors, on the other hand, gained 14.8 percentage points from a year ago to represent 30.8% of the entry-level market shipments.

Market Highlights

Personal storage represented 98.7% of PELS unit shipments and 87.1% of the market value in 4Q14. Entry-level storage represented 1.3% of the unit share and 12.9% of the shipment values in the PELS market.

USB remained the interface of choice for the PELS market and Ethernet remained the interface of choice for the entry-level market. Shipments of Thunderbolt-only offerings were down -5.7% year over year in 4Q14, which represents the first time this technology has experienced a decline. Dual interface products grew at a significant rate of 10.7% year over year, albeit off a small base.

End users continued to migrate to higher capacity points to meet storage needs. In the 3.5″ market, 4+ TB devices crossed the 30% mark for the first time, accounting for 33.3% of all shipments in the quarter.

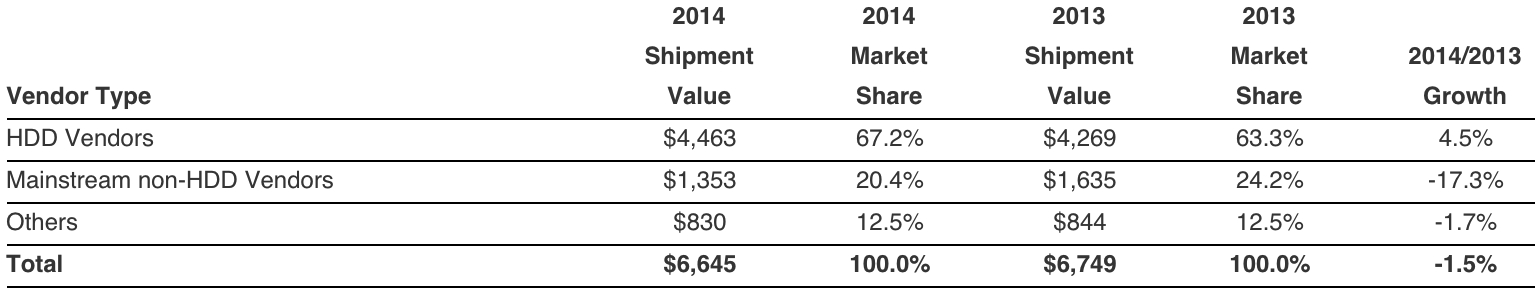

Worldwide Personal and Entry-Level Storage Shipment Value,

Market Share, and Year-Over-Year Growth, 2014

(shipment value in $ million)

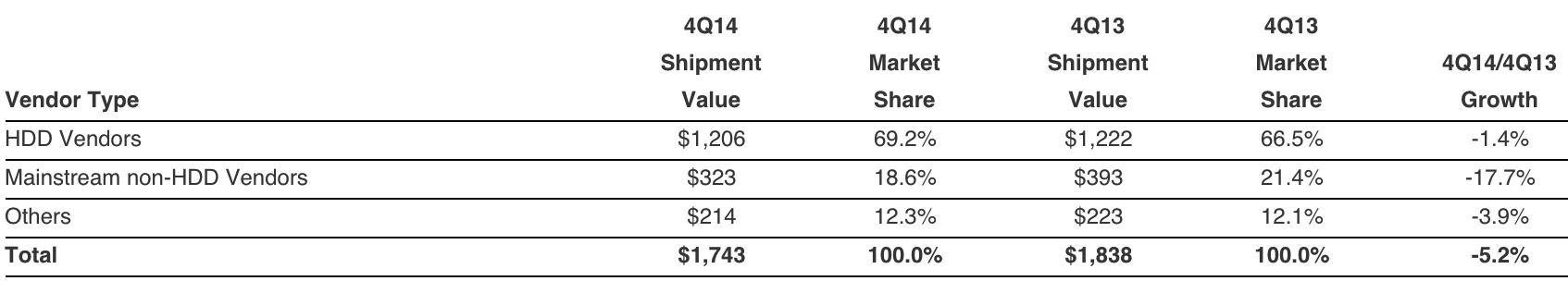

Worldwide Personal and Entry-Level Storage Shipment Value,

Market Share, and Year-Over-Year Growth, 4Q14

(shipment value in $ million)

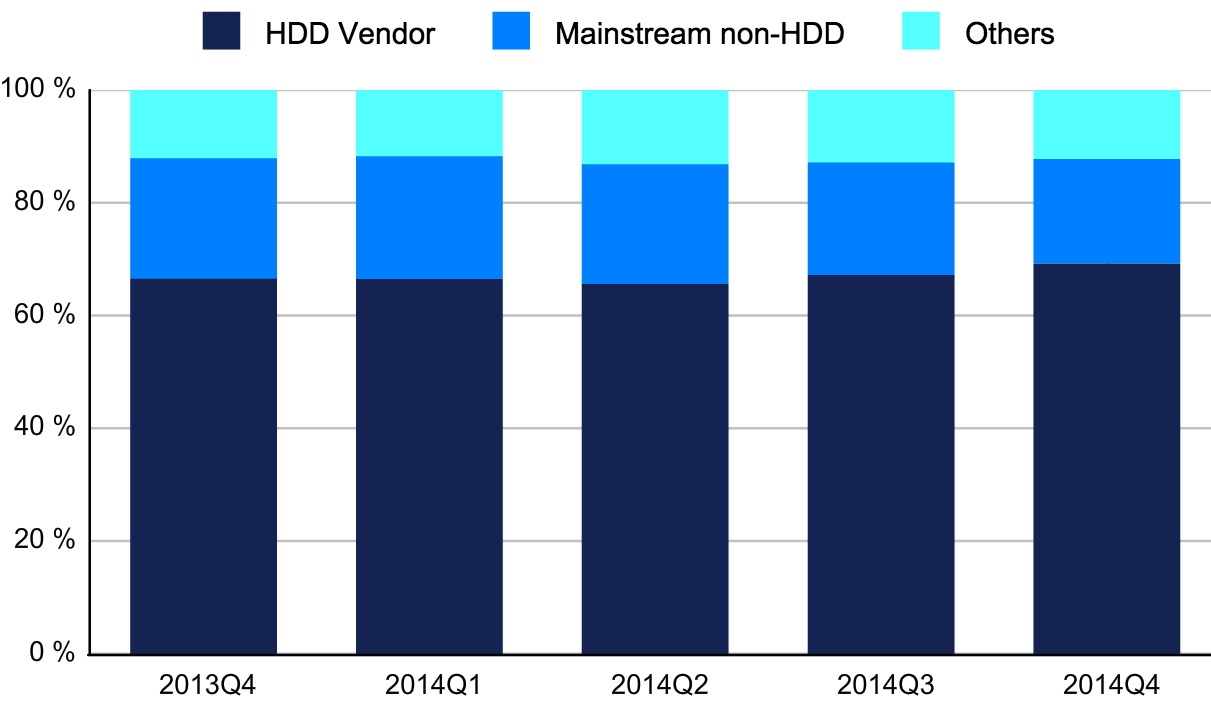

Worldwide Personal and Entry-Level Storage, Vendor Type, 4Q13-4Q14

(shares based on value)

(Source: IDC Worldwide Quarterly Personal and Entry Level Storage Tracker, February 2015)

Notes:

- The PELS market includes storage products and solutions with a single bay through twelve bay configurations that are manufactured and marketed for individuals, small offices/home offices, and small businesses.

- IDC defines Personal Storage as having 1-2 bays and Entry-Level Storage as having 3-12 bays.

- IDC defines an HDD vendor as a vendor who manufactures their own HDD, in addition to branded external storage.

- IDC defines a Mainstream non-HDD vendor as a major PELS vendor who does not manufacture its own HDDs.

- Data for the PELS market is reported for calendar periods.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter