3Q14 Indian External Storage Market Showing Signs of Recovery After Declining Three Quarters – IDC

Stood at $62 million though year-on-year was de-growth, with EMC leader.

This is a Press Release edited by StorageNewsletter.com on February 17, 2015 at 2:40 pmAccording to International Data Corporation‘s AsiaPac Quarterly Enterprise Storage Tracker, Q3 2014 India external storage market witnessed a double-digit quarter-on-quarter growth (in vendor revenue) and stood at $61.97 million though year-on-year was a de-growth.

Q3 2014 witnessed a recovery majorly due to some large multi-million dollar deals that were absent from last few quarters. The market is expected to revive in the coming quarters due to business favouring policies from government and large pending technology refreshes, though increased acceptability of cloud and need of infrastructure optimization across organizations are posing hiccups to the traditional storage market growth.

Optimization and productivity have become the key priorities across organizations resulting in increased adoption of technologies like virtualization, de-duplication, automatic tiering, compression and thin provisioning.

Flash storage is gaining foothold in Indian organizations, especially in verticals like communication and media, manufacturing, IT/ITeS and banking. Software-defined storage is also slowly gaining traction with majority of the OEMs gearing up with solution based approach to cater to this demand.

Communications and media, banking and professional services continued to be the dominant verticals while government and manufacturing verticals saw a decline as compared to Q2 2014. Retail (mostly e-commerce) and healthcare came out as the fastest growing verticals in Q3 2014 and the trend is likely to continue.

According to Dileep Nadimpalli, senior market analyst, storage, “Significant growth of both structured and unstructured data is seen due to various factors like increased acceptance of third platform, compliance, regulatory and other business needs, and that is driving the need for storage like never before.”

Gaurav Sharma, research manager, enterprise computing, enterprise infrastructure (India), says: “As India embarks on its digital journey and third platform adoption and acceptance rises, storage requirements have started to outpace the traditional planning processes. As the lines get blurred for the cloud based and on premise storage requirements; convergence, management layer and easy movement of data between the two will define the storage solutions, going forward.”

Major Vendors Analysis

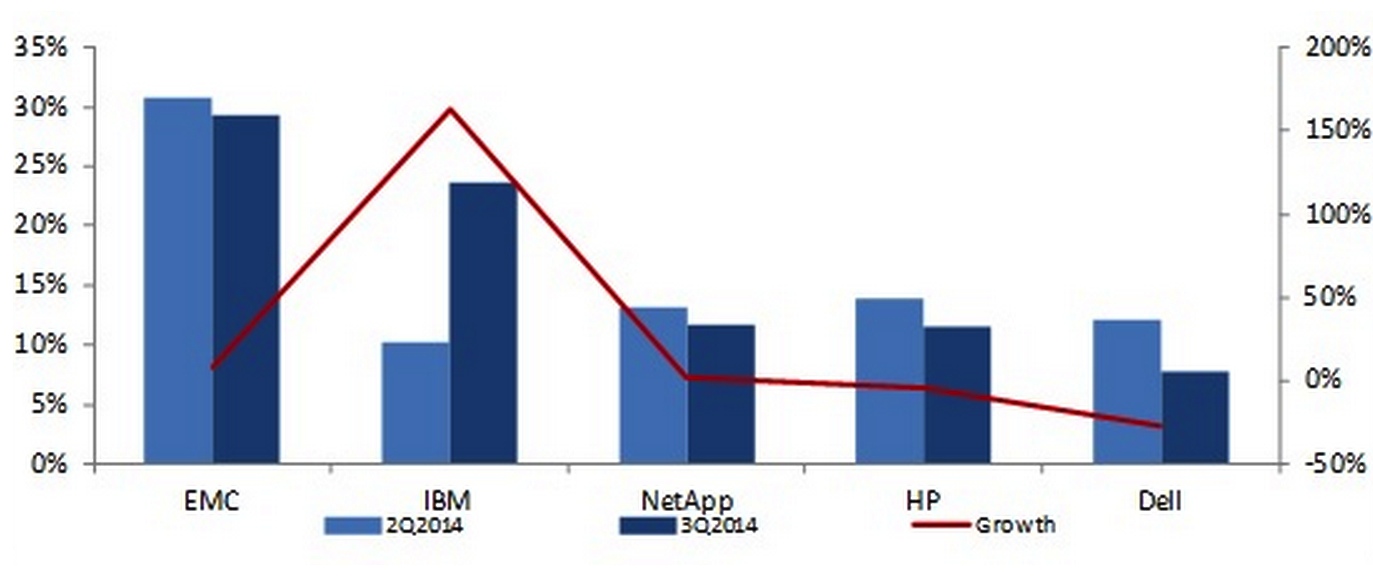

EMC continued to lead the market but its share dropped to 29% from 31% in Q3 2014 (quarter-on-quarter), whereas IBM displaced HP this quarter with a 24% market share. IBM saw a significant growth this quarter due to some large deals which helped them elevate to the 2nd spot from their 5th spot in Q2 2014.

India External Storage marker – Vendor Revenue Share and Growth

Q2 2014 Vs Q3 2014

(Source: External Storage Tracker Q3 2014)

IDC India Forecast

The external enterprise storage systems market is expected to grow in double digits in the coming quarters. Major investments are expected from banking, manufacturing, communication and media, and government verticals owing to a combination of refresh, investments in business outcome led technologies and capacity requirements.

Companies Covered: Dell Inc., EMC Corporation, IBM, NetApp, Inc., Hewlett-Packard Company

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter