32% Y/Y Growth in 2014 for Flash/Hybrid Arrays in EMEA – IDC

Total value already at $2.9 billion in 2014 for 3.53EB global capacity

This is a Press Release edited by StorageNewsletter.com on February 3, 2015 at 3:06 pmFlash storage is one of the disruptive technologies that are changing the game in the European storage market.

Even though it is a relatively new technology and many vendors have only entered the European market in the past 12-18 months, customer adoption is already soaring, according to a forthcoming special study from International Data Corporation, EMEA All-Flash Array and Hybrid Flash Array 2014-2018 Forecast and 1H14 Vendor Shares (42 pages, $25,000).

Performance-hungry workloads like virtual infrastructures and databases in particular are being deployed on flash systems and demand for flash systems continues to grow, the study shows.

Despite this being a relatively new storage market segment, the external flash storage market in EMEA is expected to reach a total value of $2.9 billion in 2014, showing year-on-year growth of 32%.

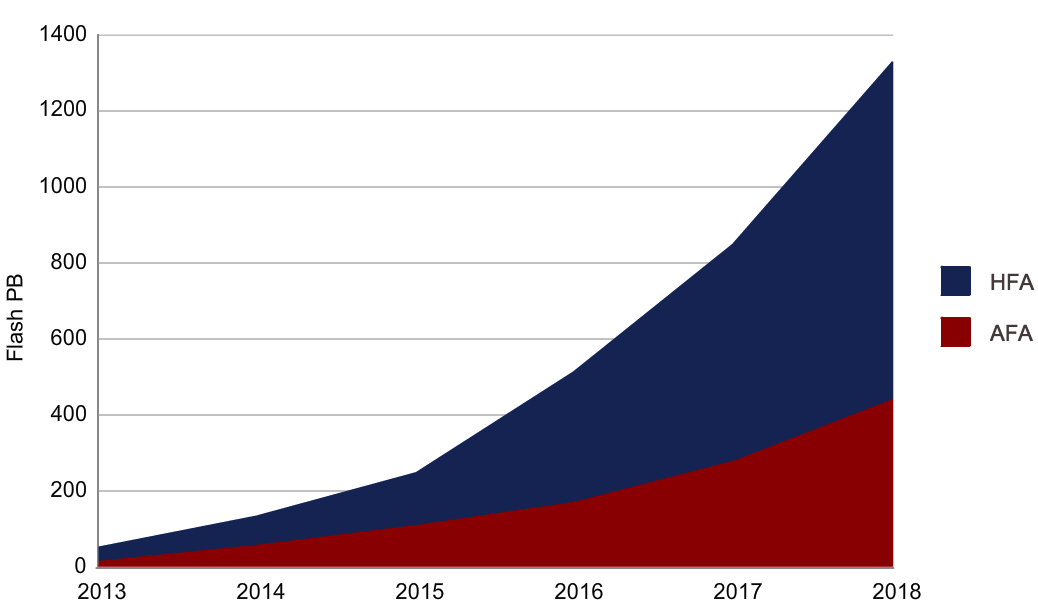

EMEA Flash Capacity Forecast

(Source: IDC EMEA All-Flash Array and Hybrid Flash Array 2014-2018)

The total capacity shipped with flash-powered arrays is expected to hit 3.53EB in 2014.

Flash-powered arrays can be divided into two groups. Hybrid flash arrays (HFAs) are the main category in the market, given their ability to reach an almost comparable performance with an all-flash system, but with considerably lower $/GB. All-flash array (AFA) systems, although posting impressive 302% year-on-year growth in user value in 2014, remain a single-point solution in the datacenter, with broader adoption hindered by the still high $/GB price gap compared with spinning media.

Western Europe accounted for roughly 75% of total EMEA flash market value in 2014, with adoption spreading from the UK to Germany, France, the Nordics, and Benelux, traditionally first adopters of new technologies, with Southern European countries following closely.

Central and Eastern Europe, the Middle East, and Africa (CEMA) follows suit with Western Europe in terms of HFA penetration in EMEA with the highest adoption seen in Russia, South Africa, Israel, and the Gulf countries. AFA demand is still very nascent in the emerging markets, with significant growth potential mostly from the Middle East subregion.

“European organizations have quickly adopted flash storage systems for their performance-sensitive workloads,” said Silvia Cosso, Western European storage analyst at IDC. “Now that all the major vendors have flash-powered arrays in their portfolio, and start-ups continue to push AFA into the market, competitive differentiation will come from data management capabilities and price. Future penetration of flash in the datacenter is dependent on how quickly the $/GB value will continue to decline.“

Forecasts

The flash storage systems market is a fast-growing segment of the EMEA storage systems market. IDC forecasts that total flash-optimized market value will grow at 15% CAGR from 2013 through 2018.

The AFA market alone is expected to show an impressive 58% CAGR during the same forecast period, and will account for about 15% of EMEA’s total flash market by 2018. Growth is mainly fuelled by a drop in flash $/GB value, which is expected to fall by more than 70% from 2014 to 2018, as well as mainstream acceptance of flash systems for a broader range of workloads.

“HFA systems will still play a leading role in the EMEA market, with all tier 1 applications and some of the tier 2 switching to hybrid by 2018,” said Marina Kostova, CEMA storage analyst, IDC. “However, in the longer term, the general-purpose workloads are expected to move to AFA, thanks to likely future advancements in non-volatile flash memory and the falling cost of raw flash prices. Spinning media will not be entirely displaced from the datacenter, however, and will mainly be confined to backup environments and cold storage.”

Companies Covered:

Nimble Storage, Inc., EMC Corporation, Kaminario, Inc., Violin Memory, Inc., SolidFire, Inc., IBM Corp., Hitachi, Ltd., NetApp, Inc., Hewlett-Packard Company, Pure Storage, Inc.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter