Flash Drives Growth of EMEA External Disk Sytems in 3Q14 – IDC

Total market value up by 1.3% Y/Y

This is a Press Release edited by StorageNewsletter.com on December 26, 2014 at 2:27 pmThe external disk storage sytems market value in Europe, the Middle East, and Africa (EMEA) was up by 1.3% year over year in terms of user value, according to the EMEA Quarterly Disk Storage Systems Tracker from International Data Corporation (IDC).

The positive result has been driven by a vibrant market in MEA and a rather flat, but still buoyant, Western Europe that more than compensated for a declining CEE performance. A 24% drop in the $/GB rate brought the total external capacity in EMEA to just shy of 2.75EB, with a yearly growth of 32%.

Sales of external storage were driven by healthy growth in the mid-range and entry-level segments, while high-end arrays fell for the sixth quarter in a row (although resulting slightly positive in Western Europe alone). A widening adoption of flash has greatly contributed to the positive performance of the quarter, as the EMEA Flash Storage Special Report just carried out by IDC has discovered.

Besides external storage, growth came also from the original design manufacturer (ODM) sector that IDC has broken out this quarter with data back to 2008 (including the likes of Gigabyte, Inventec, Mitac, Quanta, Wiwynn and others). In 3Q14, the category accounted for more than 20% of EMEA capacity and about 5% of total storage revenue.

Western Europe

Western Europe had a flat third-quarter performance, in which the weakness of major markets such as the UK, France, and the Nordics has taken its toll. However, good performances in Germany, Benelux, and Switzerland as well as the strong growth in Italy (mainly thanks to deals on the IBM side), counteracted the negative effect.

“Flash-powered arrays were the main growth contributors in the quarter, with hybrid solutions now becoming mainstream in the tier 1 storage environment and AFA arrays still experiencing exponential Y/Y growth,” said Silvia Cosso, Western Europe storage analyst, IDC. “This translated into good performance above all in the high midrange space, also bringing a positive note for the high-end, which resumed shy growth following a string of disappointing quarters.”

CEMA

Results were reversed over the previous quarter, with the Middle East and Africa (MEA) registering a stable annual increase (+9.3%), negating the 1.9% decline in Central and Eastern Europe (CEE), for overall growth in Central and Eastern Europe, Middle East, and Africa (CEMA) of 4.0%.

There was massive adoption of entry-level storage solutions in CEE, supported by the efforts of the majority of vendors, demonstrating double and triple-digit growth. Data center infrastructure upgrades also boosted the high-end storage class, though due to IBM’s and EMC’s inability to repeat their results from previous quarters, sales in this submarket dropped year on year.

“CEE demonstrates polarized spending behavior, with SMBs focusing on entry-level storage arrays while very large organizations, government and service providers relied on high-end solutions to satisfy their datacenters’ requirements,” said Marina Kostova, storage systems analyst, IDC CEMA. “IDC expects this trend to continue in the short term before customers rediscover the potential of midrange solutions.“

The storage market in MEA resumed its steady growth, with exploding entry-level storage systems sales (+44.5% Y/Y) and confirming the success of the mid-range class (making it the IDC region with the highest adoption of midrange storage) owing to flash optimization and other advanced technologies, as well as the expansion of niche players in the Middle East in particular. Most countries ended the quarter with double-digit growth compared to the same period in 2013.

Vendor Highlights

Although there were no major reshuffles this quarter, there has also been mixed performance across the top-ranked vendors as well as across subregions.

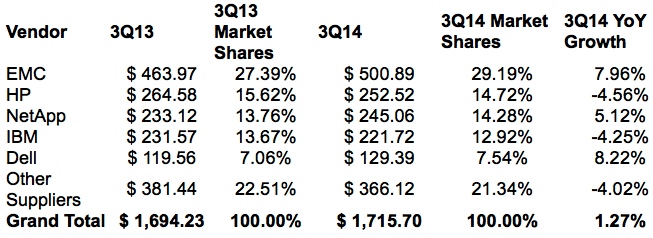

Top 5 Vendors, EMEA External Disk Storage Systems Value

(in $ million)

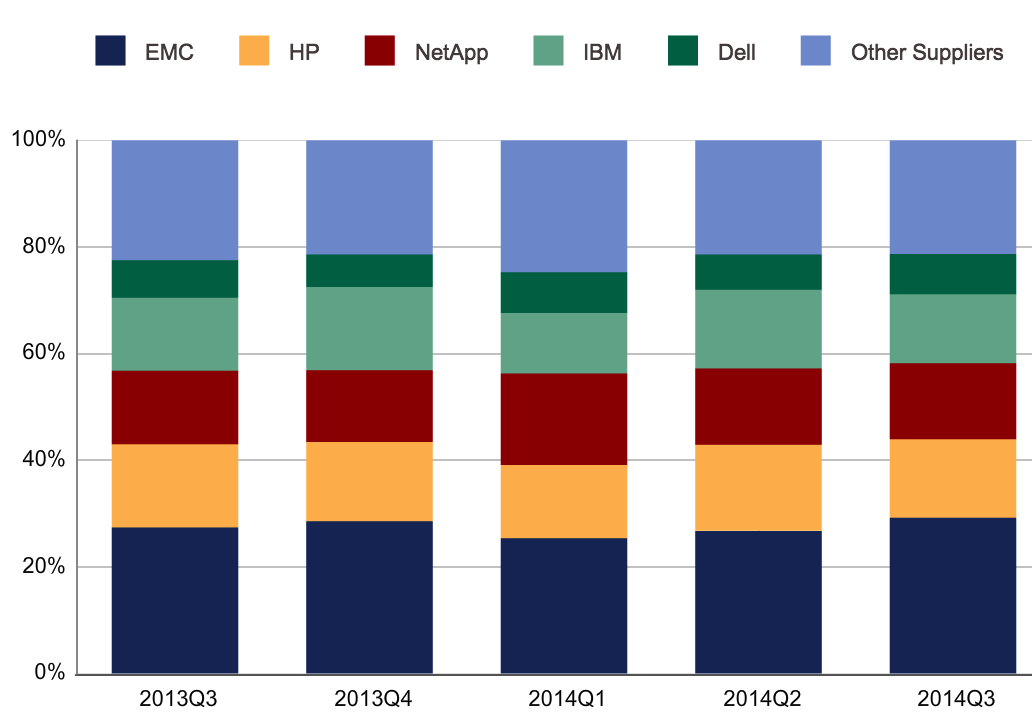

Top 5 Vendors, EMEA External Disk Storage Systems

(Value Market Share)

(Source: IDC EMEA Quarterly Disk Storage Systems Tracker, 2014)

EMC

Positive sales in the mid-range space and backup environment (mainly VNX and Data Domain), helped EMC strengthen its lead in EMEA by almost two percentage points compared to a year ago. However, the company is still subject to declining sales in the high end, where not even the strong uptake of XtremIO (EMC’s AFA array) managed to negate falling sales of Vmax. EMC’s growth was felt in every subregion, but it was especially marked in MEA.

HP

Positive 3PAR and MSA sales (the latter gaining momentum thanks to the recent addition of SSD and some feature enhancements) did not make up for declining sales in the backup and virtualization environments (namely StoreOnce and StorVirtual families). A negative performance across every subregion resulted in the erosion of HP’s shares in EMEA.

NetApp

Strong sales in its AFA range as well as a good performance in the CEMA region, stemming from deals in defense, finance, and oil and gas, and a redesign of the channel program, helped NetApp distance IBM in its third position compared to a year ago.

IBM

Strong sales in some Western European countries (notably Italy, second only to Germany in terms of quarterly revenues for the company) partly counteracted a disappointing quarter for IBM, which declined heavily in the CEE region, losing positions in both government and the corporate sector. Strong growth in the Storwize and FlashSystem ranges weren’t able to make up for the losses in DS8000.

Dell

Channel incentive and training programs contributed to strong sales in CEE and in Western Europe, mainly driven by the flash-optimized EqualLogic and the refreshed PowerVault families, made Dell the fastest growing among the top incumbent vendors.

Taxonomy Notes:

- IDC defines a disk storage system as a set of storage elements, including controllers, cables, and (in some instances) HBAs, associated with three or more disks. A system may be located outside of or within a server cabinet and the average cost of the disk storage systems does not include infrastructure storage hardware (i.e. switches) and non-bundled storage software.

- The information in this quantitative study is based on a branded view of the disk storage systems sale. Revenue associated with the products to the end user is attributed to the seller (brand) of the product, not the manufacturer. OEM sales are not included in this study.

IDC’s EMEA Quarterly Disk Storage Systems Tracker is a quantitative tool for analyzing the Europe, Middle East, and Africa disk storage market on a quarterly basis. The tracker includes quarterly shipments and revenues (both customer and factory), terabytes, $/GB, GB/unit, and average selling value. Each criterion can be segmented by product category, installation base, OS, vendor, product brand, model name and region.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter