Data Loss and Downtime Cost Enterprises $1.7 Trillion Per Year – Vanson Bourne/EMC

Up 400% over last two years

This is a Press Release edited by StorageNewsletter.com on December 4, 2014 at 2:42 pmEMC Corporation announced the findings of a data protection study that reveals that data loss and downtime cost enterprises $1.7 trillion in the last twelve months, or the equivalent of nearly 50% of Germany’s GDP.

Data loss is up by 400% since 2012 while, surprisingly, 71% of organizations are still not fully confident in their ability to recover after a disruption.

EMC Global Data Protection Index, conducted by Vanson Bourne, surveyed 3,300 IT decision makers from mid-size to enterprise businesses across 24 countries.

Impact of Data Loss and Downtime

The good news is that the number of data loss incidents is decreasing overall. However, the volume of data lost during an incident is growing exponentially:

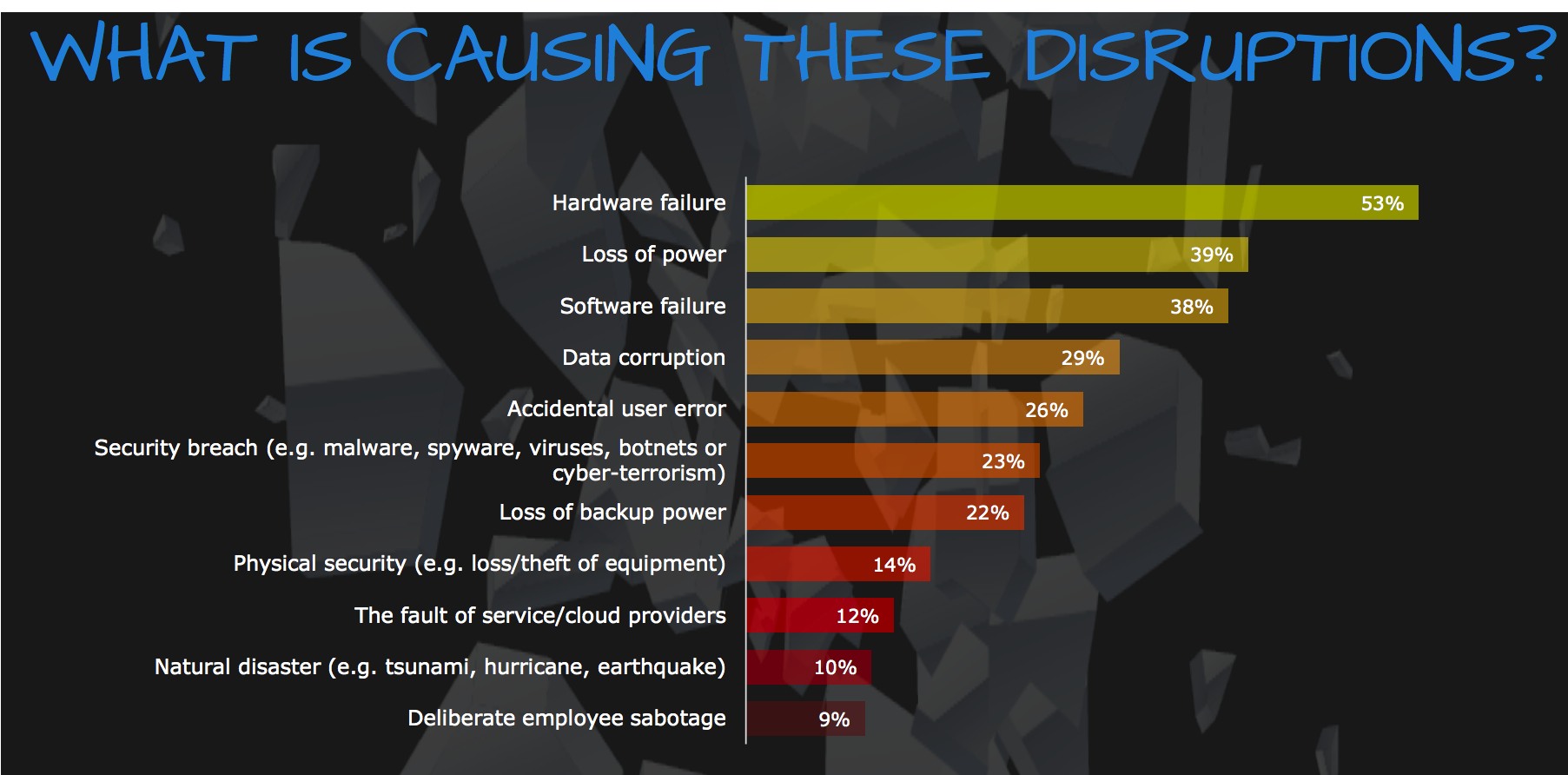

- 64% of enterprises surveyed experienced data loss or downtime in the last 12 months

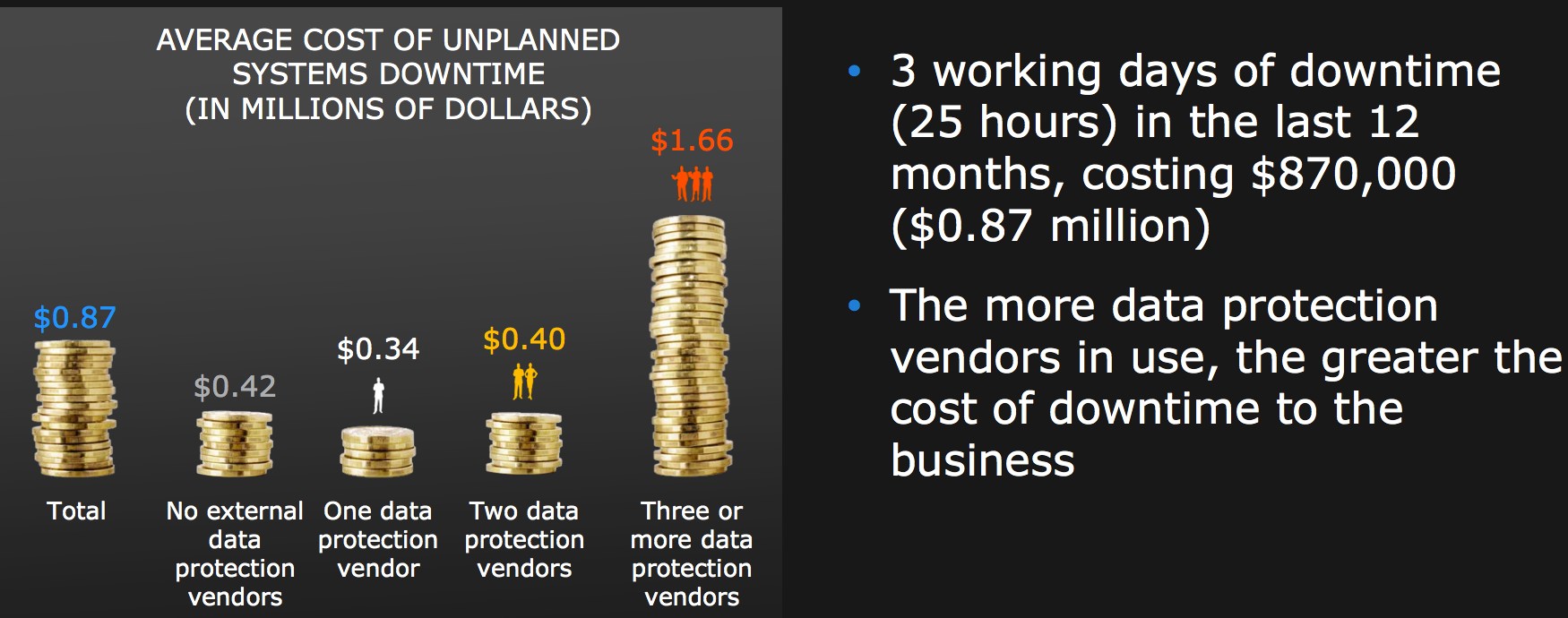

- The average business experienced more than three working days (25 hours) of unexpected downtime in the last 12 months

- Other commercial consequences of disruptions were loss of revenue (36%) and delays to product development (34%)

New Wave of Data Protection Challenges

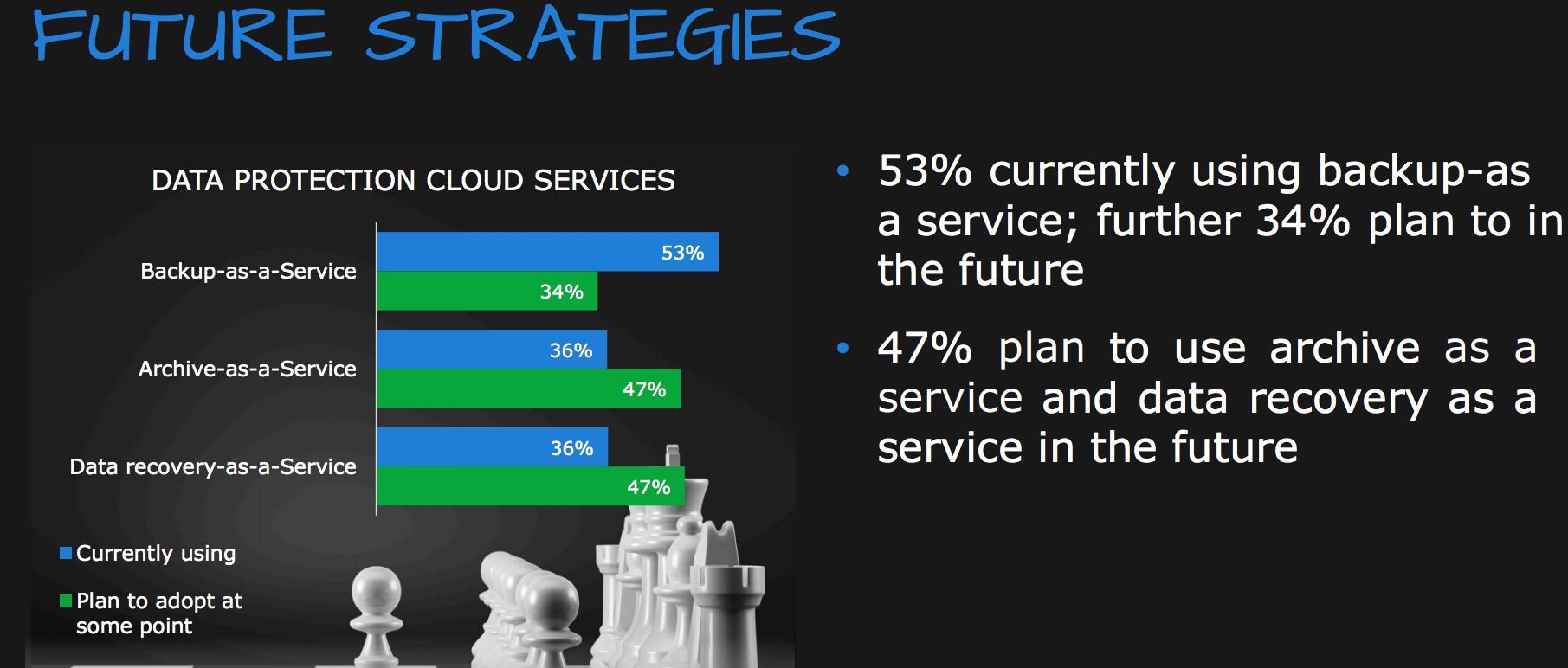

Business trends, such as big data, mobile and hybrid cloud, create new challenges for data protection:

- 51% of businesses lack a DR plan for any of these environments and just 6% have a plan for all three

- In fact, 62% rated big data, mobile and hybrid cloud as ‘difficult’ to protect

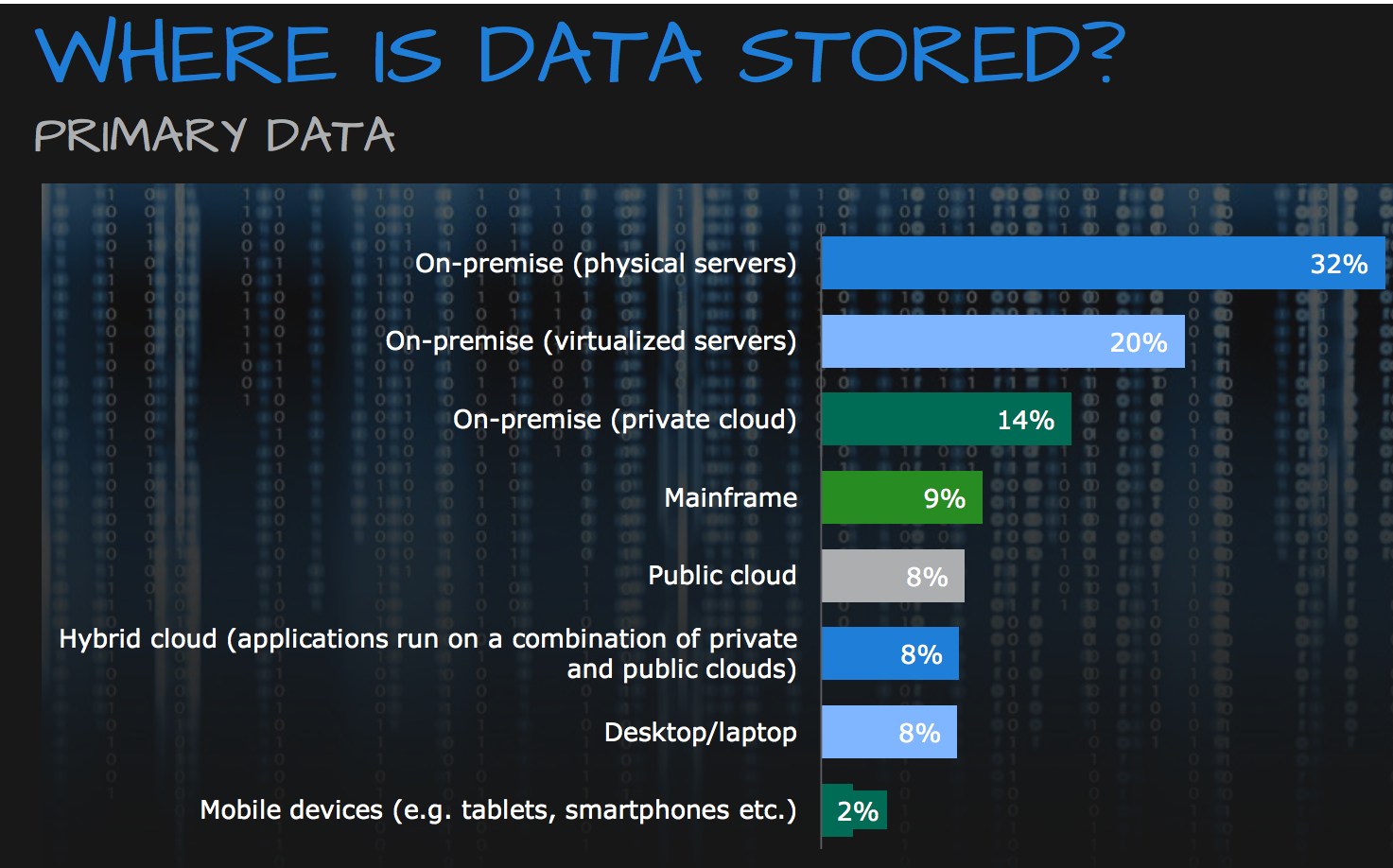

- With 30% of all primary data located in some form of cloud storage, this could result in substantial loss

The Protection Paradox

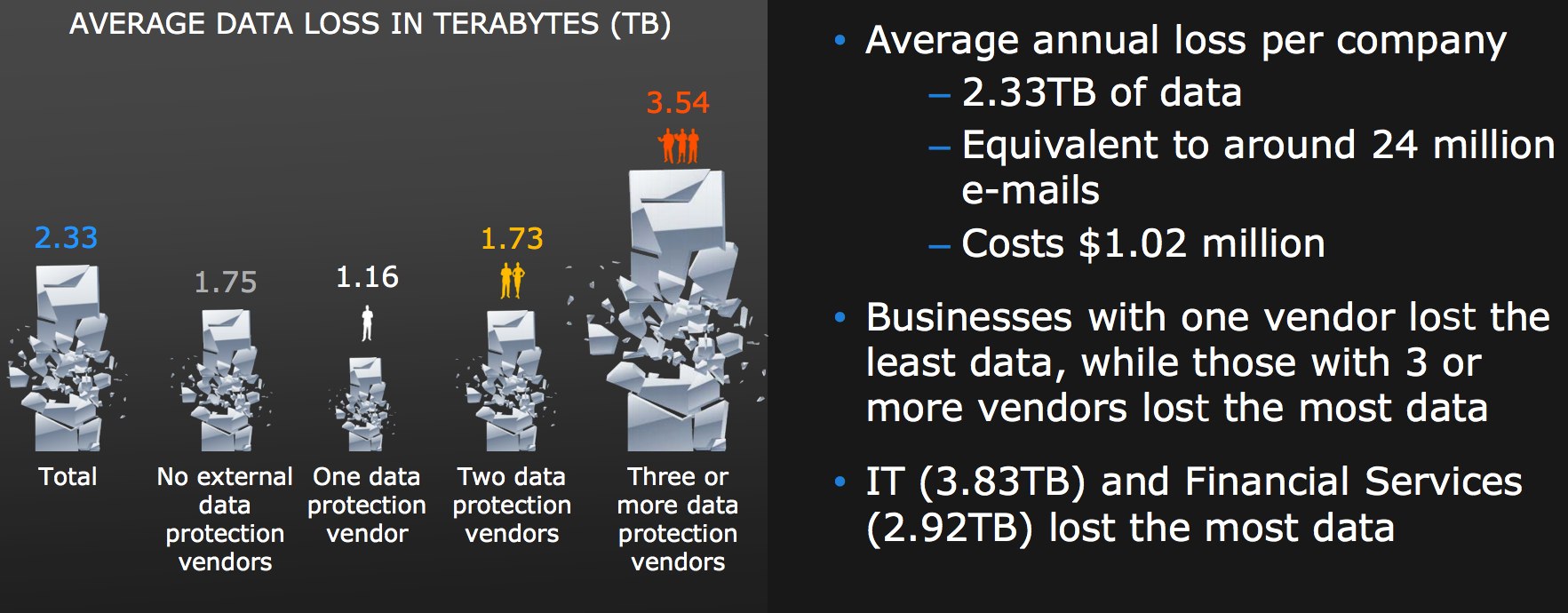

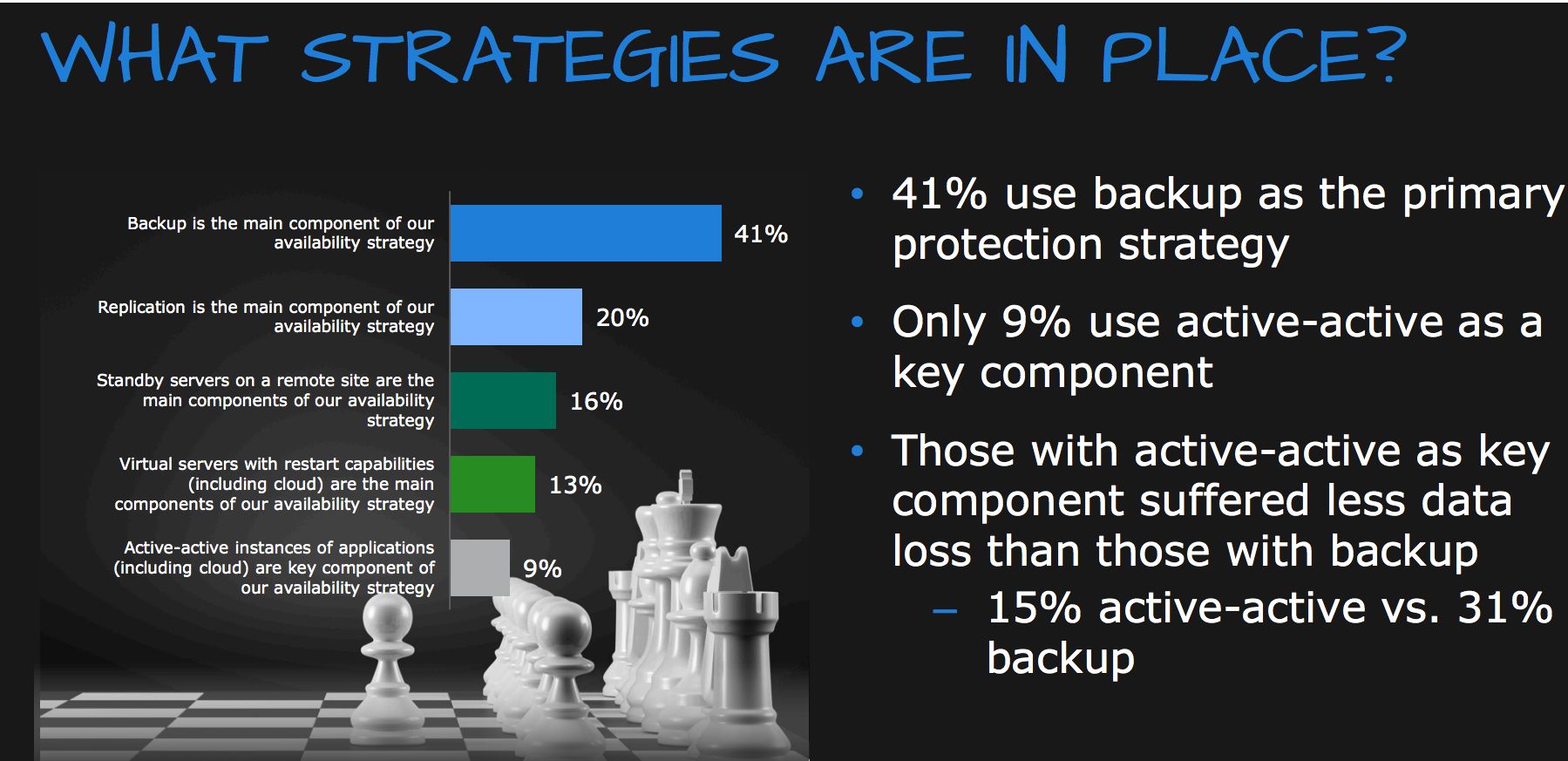

Adopting advanced data protection technologies decreases the likelihood of disruption. And, many companies turn to multiple IT vendors to solve their data protection challenges. However, a siloed approach to deploying these can increase risks:

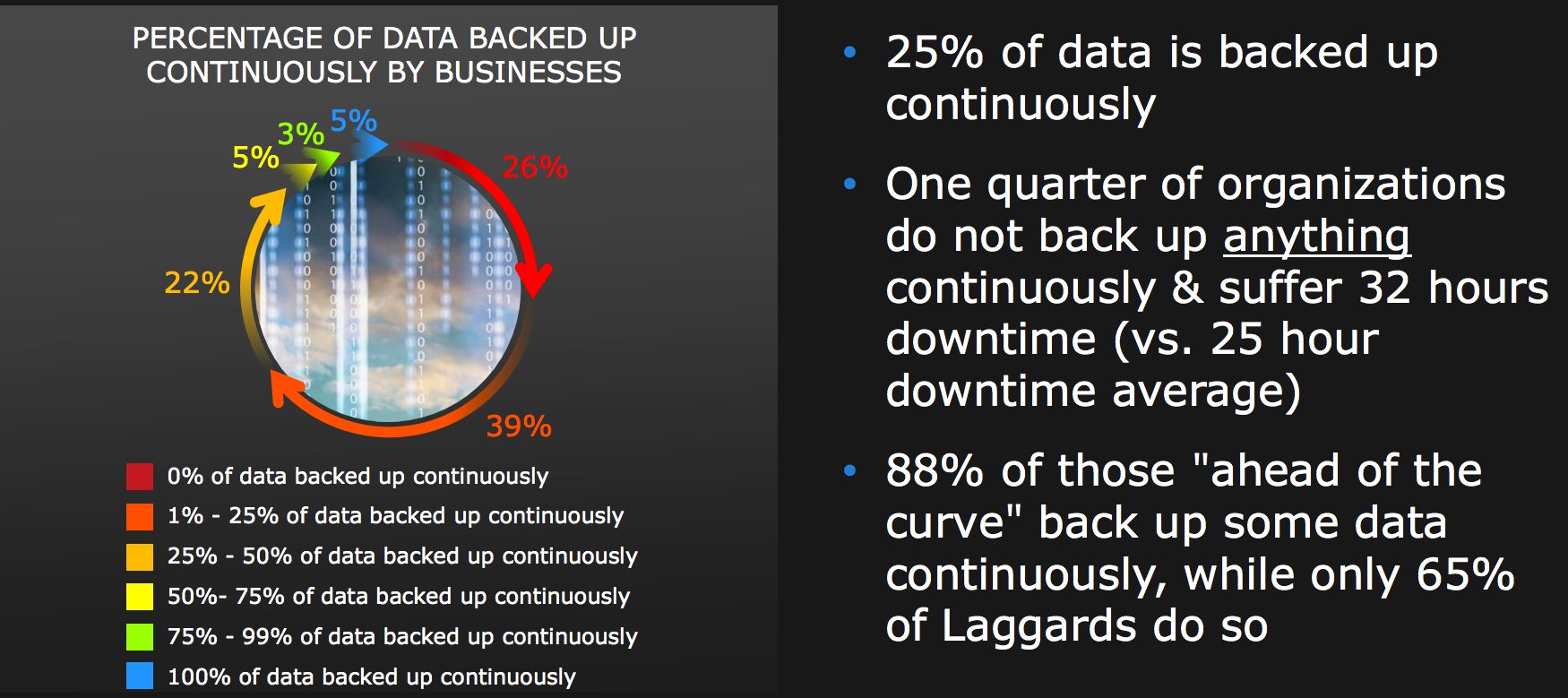

- Enterprises that have not deployed a continuous availability strategy were twice as likely to suffer data loss as those that had.

- Businesses using three or more vendors to supply data protection solutions lost three times as much data as those who unified their data protection strategy around a single vendor

- Those enterprises with three vendors were also likely to spend an average of $3 million more on their data protection infrastructure compared to those with just one

The Maturity Matrix

EMC Data Protection Index survey participants were awarded points based on their responses, ranking their data protection maturity in one of four categories:

- The vast majority – 87% – of businesses rank in the bottom two categories for data protection maturity

- Globally 13% rank ahead of the curve, with 11% classed as Adopters and 2% considered Leaders

- China has the greatest number of companies ahead of the curve (30%) and the UAE the least (0%)

- Very large enterprises of more than 5,000 employees were twice as likely (24%) to be ahead of the curve than smaller enterprises of 250-449 employees (12%); companies in the U.S. and The Netherlands were the greatest vanguards outside of AsiaPac and Japan (at 20% and 21% respectively)

“This research highlights the enormous monetary impact of unplanned downtime and data loss to businesses everywhere. With 62% of IT decision-makers interviewed feeling challenged to protect hybrid cloud, big data and mobile, it’s understandable that almost all of them lack the confidence that data protection will be able to meet future business challenges. We hope the global data protection index will prompt IT leaders to pause and reevaluate whether their current data protection solutions are in alignment with today’s business requirements as well as their long term goals,” said Guy Churchward, president, EMC core technologies

Methodology

Research carried out independently by Vanson Bourne between August and September 2014. Respondents were IT decision makers within organizations employing over 250 people. There were a total of 3,300 respondents from 24 countries. 200 respondents each in the USA, UK, France and Germany and 125 respondents each in Canada, Mexico, Brazil, Russia, South Africa, Turkey, UAE, Italy, Switzerland, The Netherlands, Australia, Japan, China, Korea, India, Singapore, Hong Kong, The Philippines, Thailand and Indonesia.

To create the maturity curve, IT decision-makers were asked specific questions relating to their backup and recovery experience, strategy and infrastructure. Each section was scored out of 64 to give an overall maturity rating. This score was then multiplied by a scaling factor to normalize the curve and give a total score out of 100 points. Once scored, these IT decision-makers were divided into four even segments from a low to high score; Laggards (scoring 1-25), Evaluators (scoring 26-50), Adopters (scoring 51-75) and Leaders (scoring 76-100).

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter