Cypress and Spansion to Merge – Objective Analysis

$1.6 billion price for NOR flash maker

This is a Press Release edited by StorageNewsletter.com on December 2, 2014 at 3:00 pm This artice was written by Jim Handy, analyst at Objective Analysis (with the help of Tom Starnes)

This artice was written by Jim Handy, analyst at Objective Analysis (with the help of Tom Starnes)

Cypress Semiconductor and Spansion plan to merge in a move the companies call an all-stock, tax-free transaction valued at approximately $4 billion.

Cypress will be trading 2.457 Cypress shares for each Spansion share, resulting in a purchase price of roughly $1.6 billion. The transaction has been unanimously approved by the boards of both companies, and is expected to close in the second quarter of 2015, pending approval by Cypress and Spansion stockholders and review by regulators in the U.S., Germany, and China.

Cypress CEO T.J. Rodgers will be CEO of the combined firm with Spansion’s chairman Ray Bingham will continue as non-executive chairman.

The new company, to be called Cypress Semiconductor Corporation, will have annual revenues of more than $2 billion. The combination is expected to create annual synergies of $135 million “achievable over three years“. The merger will be accretive to non-GAAP earnings within the first full year after the close, and Cypress plans to continue payments of its $0.11 quarterly dividend.

Cypress points out that it is the leading producer of SRAMs, and that Spansion is the leading NOR flash provider,

Cypress CEO Rodgers says that the combined company “will be a leading provider of embedded MCUs,” and will have “synergy in virtually every area of our enterprises.”

Who Are These Companies?

Cypress is a maker of programmable mixed-signal microcontrollers (MCUs) and claims leadership in USB controllers, SRAM, and nonvolatile RAMs, a small but rapidly-growing market. The company calls itself the “world leader in capacitive user interface solutions” which are used in touchscreens and trackpads for PCs and peripherals.

Spansion is a manufacturer of flash memory, MCUs, analog and mixed-signal ICs. The company was spun out of a flash memory joint venture of AMD and Fujitsu in 2003. In 2010 Spansion emerged from bankruptcy proceedings as a much more tightly-focused NOR flash provider. In 2013 Spansion acquired Fujitsu’s MCU business

NOR and SRAM – Two Similar Markets

One striking feature of this transaction is the similarity of the NOR flash and SRAM markets. Both are comprised of a broad offering of diverse products, none of which sells in the kind of high unit volumes typical of DRAM or NAND flash. This allows the two companies to win designs at the engineer’s desk, rather than in purchase negotiations, allowing prices to stay firm and profits to remain healthy. Typically a system will continue to use the original part for its entire life cycle.

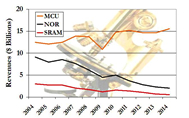

Unfortunately, the two markets also share the fact that they are in decline, with revenues decreasing steadily year after year. This is quite clear in the graph below – the two lower lines represent NOR flash and SRAM revenues for the past ten years, with a projection for 2014. This decline has driven Cypress and Spansion to find other markets to pursue in order to increase their revenues.

Annual market revenue SRAM, NOR flash, and microcontrollers

Synergies in MCUs

Both Cypress and Spansion have expanded into the MCU marketplace, which is crowded but growing, as can be seen in the chart, in stark contrast to the declining revenues of SRAM and NOR flash. The two companies’ product lines overlap very little, helping with the merger’s synergies, although the architectures of most offerings differ from each other, with different instruction sets, which will make design support more cumbersome. If the company can constrain the number of architectures over time it could conserve expensive resources.

In microcontrollers, the two companies have non-overlapping products. Cypress brings unique programmable gate-array and custom analog building blocks to ARM processor cores giving customers greater integration capabilities than other vendors can offer. Cypress also has old 8051 8-bit MCUs. Spansion recently expanded Fujitsu’s MCUs with a more powerful ARM architecture and has a number of MCUs with historical architectures. Spansion and Cypress rightfully pointed out that their MCU products have success in different end-equipment applications and even different geographic regions. As a single company, some good bleed-over should be seen expanding those markets.

The sales and marketing organizations used to sell MCUs require more technical depth, but are similar to those necessary for SRAM and NOR flash, utilizing field technical support and distribution more than those used to sell commodity products like DRAMs and NAND flash.

Complementary IP Portfolios

In 2007 Spansion acquired Saifun Semiconductor, creating for itself a very strong position in charge trap flash. The company claims 5,600 patents in its portfolio. Cypress acquired Simtek/AgigA in 2008 to garner a strong position in SONOS, a similar technology, and has 2,000 patents. The combined company will hold a very strong IP position in charge trapping memory technologies, which are required for the production of 3D NAND flash, the future of all NAND.

Although some NAND makers have already been licensed, others have not, and both companies have indicated a desire to license all makers with this technology.

The NAND flash market is poised to grow to $40 billion or larger by 2017. Even if the combined company nets only 1% of revenues in royalty payments it will enjoy a very significant income of $400 million that will flow straight to the bottom line.

Overall, a Good, but not a Great Deal

Although this merger shows a lot of strength, and complementary products, Objective Analysis does not view it as one with extraordinary synergies. Both companies are well positioned in their own memory markets, and both are poised to grow into microcontrollers, but the move to take market share away from larger MCU players will be a tough battle and may drag on for a number of years.

What we are most keen on is the very strong IP position in technologies that will be critical to 3D NAND flash, which is just around the corner. We believe that this will provide important cash to the combined company that it can use to further its goals in newer markets. We expect to see a solid revenue stream for the next several years that will give the new Cypress the strength to compete in new markets and to expand revenues despite the declining revenues of the SRAM and NOR flash markets.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter