Imation: Fiscal 2Q14 Financial Results

Another ugly quarter

This is a Press Release edited by StorageNewsletter.com on August 1, 2014 at 2:59 pm| (in $ million) | 2Q13 | 2Q14 | 6 mo. 13 | 6 mo. 14 |

| Revenues | 211.7 | 178.6 | 436.1 | 357.5 |

| Growth | -16% | -18% | ||

| Net income (loss) | (5.1) | (21.4) | (26.2) | (38.9) |

Imation Corp. released financial results for the second quarter ended June 30, 2014 that were in line with the company’s expectations.

Q2 Overview

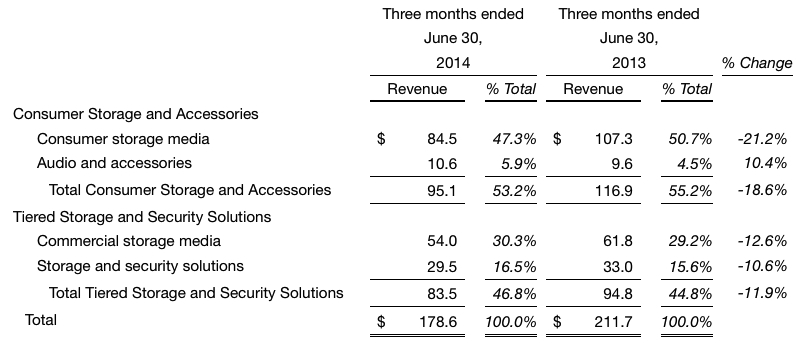

- For Q2 2014, Imation reported net revenue of $178.6 million, down 15.6% from Q2 2013.

- Gross margin for Q2 2014 was 19.0% versus 26.1% a year ago; Q2 2013’s results included a $13.6 million reversal of a European levy accrual, or 6.4 points of gross margin.

- Operating loss from continuing operations totaled $20.1 million in Q2 2014, with diluted loss per share of $0.48 from continuing operations, compared to breakeven operating results and diluted loss per share of $0.04 from continuing operations in Q2 2013. The company had a cash balance of $114.7 million as of June 30, 2014.

- On a sequential basis, net revenue and gross margin in Q2 2014 were essentially flat with Q1 2014’s performance. Within Imation’s Tiered Storage and Security Solutions (TSS) segment, the company’s Nexsan and IronKey product portfolios reported revenue increases over Q1 2014. TSS gross margins also rose sequentially. Within Consumer Storage and Accessories (CSA), Audio and Accessories Q2 2014 revenue grew 10.4% from Q2 2013 and also grew sequentially from Q1 2014.

Imation’s CEO Mark Lucas commented: “We are encouraged by the progress we saw in the second quarter of 2014. Overall, our total revenue decline rate moderated, and we again showed continued improvement in Imation’s expense levels. We still have a lot of work in front of us, but our growth businesses are gaining momentum, and market share in our legacy businesses remains stable.”

Business Segment Overview

TSS revenue decreased 11.9% in Q2 2014 from the prior year; gross margin was 18.9% compared with 21.7% a year ago. TSS gross margin rose sequentially to 18.9% in Q2 2014 from 18.3% in Q1 2014. Within TSS, Q2 2014 revenue for Storage Solutions and Mobile Security totaled $29.5 million, up from $27.5 million in Q1 2014.

Lucas said: “We are pleased that the key Imation Storage Solutions investments we have made in sales, products and service support and product enhancements led to sequential revenue growth for the Nexsan product line in all geographic regions. For example, we have expanded our channel partners by 25% and focused product development on the hybrid storage market, which is a high-growth sector within storage.“

“Further, we have excellent progress to report in Imation Mobile Security. In addition to two Fortune 100 companies approving us as a supplier of our IronKey Windows to Go product, we have more than 70 pilots under way for this mobile security solution. Imation has the only FIPS Level 3 Microsoft-certified product – a key differentiator in the federal government market, where we have relationships with over 50 agencies,” said Lucas. “Windows to Go, which Imation refers to as ‘PC on a Stick’, has the customer’s corporate Windows 8 OS on a secure flash drive with central management capability.”

In Consumer Storage and Accessories (CSA) segment, revenue decreased 18.6% in Q2 2014 from the prior year, due primarily to the expected secular declines in optical media products, partially offset by growth in audio and accessories. Gross margin of 19.0% was down from 30.2% in Q2 2013. However, as noted above, last year included the reversal of a European levy accrual that accounted for 11.6 points of gross margin in CSA.

Said Lucas: “In CSA, we are focused on introducing higher-margin products. To this end, we launched the new TDK Life on Record TREK wireless speaker in the quarter. Revenue in our audio and accessories category grew 10% over last year, with the TREK product line making strong contributions.“

Added Lucas: “As we look ahead to the second half of 2014, we expect to again see sequential revenue gains in Imation’s Storage Solutions and Mobile Security, as well as in our CSA Audio and Accessories. Although we anticipate decreases in Imation’s legacy tape and optical businesses, we are managing them well and they are solid cash generators.”

Detailed Q2 2014 Analysis

The following financial results are for continuing operations for the current and prior periods unless otherwise indicated.

Net revenue for Q2 2014 was $178.6 million, down 15.6% from Q2 2013, but flat with Q1 2014. Foreign currency exchange rates did not impact Q2 2014 revenue compared to Q2 2013.

Gross margin for Q2 2014 was 19.0%, down 7.1%age points from 26.1% in Q2 2013, but up slightly from Q1 2014’s level. Q2 2013 included a $13.6 million reversal of a European levy accrual, or 6.4 points of gross margin. CSA gross margin was 19.0%, down from 30.2% in Q2 2013 which included the benefit of the levy reversal, or 11.6 points of gross margin.

Selling, general and administrative (SG&A) expenses in Q2 2014 were $44.3 million, down $2.2 million compared with Q2 2013 expenses of $46.5 million. The company’s SG&A expense associated with its legacy business has decreased more than 25% from Q2 2012. These reductions have more than offset additional investments in Imation Storage Solutions.

R&D expenses in Q2 2014 were $4.5 million, up slightly from $4.3 million in Q2 2013, which reflects the company’s increased investment in higher-margin projects in TSS, partially offset by a reduction in legacy R&D spending.

Special items, primarily from previously announced restructuring programs, netted to $5.2 million of expense in Q2 2014 compared to $5.1 million in Q2 2013 (See Tables Five and Six).

Operating loss from continuing operations was $20.1 million in Q2 2014 compared with breakeven operating income in Q2 2013. Q2 2013 included the $13.6 million reversal of the European levy accrual.

Income tax benefit was $1.6 million in Q2 2014 compared with income tax provision of $1.1 million in Q2 2013. The benefit in Q2 2014 is primarily due to the mix of taxable income by country. The company maintains a valuation allowance related to its U.S. deferred tax assets and, therefore, no tax provision or benefit was recorded related to its U.S. results in either period.

Discontinued operations in Q2 2014 was a loss of $1.6 million compared with a loss of $3.3 million in Q2 2013. Discontinued operations includes both the results of the XtremeMac and Memorex consumer electronics businesses which were sold.

Loss per diluted share from continuing operations was $0.48 in Q2 2014 compared with a loss per diluted share of $0.04 in Q2 2013.

Cash and cash equivalents balance was $114.7 million as of June 30, 2014, down $11.5 million during the quarter due to the operating loss, which was partly offset by cash generated from working capital reductions.

The company repurchased 260,000 shares of common stock for $0.9 million during the quarter and, as of June 30, 2014, Imation had remaining authorization to repurchase up to 2.9 million additional shares.

Year-To-Date Summary

For the six months ended June 30, 2014, Imation reported net revenue of $357.5 million, down 18.0% compared with the same period last year, an operating loss from continuing operations of $36.2 million, including special items of $7.3 million, and a diluted loss per share from continuing operations of $0.89.

For the six months ended June 30, 2013, Imation reported net revenue of $436.1 million, an operating loss from continuing operations of $14.7 million, including special items of $9.3 million, and a diluted loss per share from continuing operations of $0.43 (See Tables Five and Six for non-GAAP measures).

Operating results for the six months ended June 30, 2013 include the second quarter reversal of an accrual of $13.6 million for copyright levies as a result of an Italian Court ruling.

Comments

We don't think anymore that Imation will return to the old golden years when it was a $2 billion company like in 2007. For the year 2014, it will be a miracle to surpass sales of $800 million and to be profitable. No future.

Imation tried to diversify since several years in RDX, disk subsystems (acquisition of Nexsan), security, and audio and accessories, but these new activities were far to compensate its legacy business (optical disc, tape) plunging drastically.

Even for this last quarter, revenue from storage and security solutions decreased 11% Y/Y.

Imation, now with 915 employees, needs more acquisitions to reverse its business model but cash and cash equivalents balance is declining, now at only $115 million, not enough to buy a successful start-up with the hope to boost revenue. The last chance could be to find a buyer, but which one and at which price?

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter