Brocade: Fiscal 2Q14 Financial Results

SAN revenue up 1% Y/Y, down 8% Q/Q

This is a Press Release edited by StorageNewsletter.com on May 23, 2014 at 3:00 pm| (in $ million) | 2Q13 | 2Q14 | 6 mo. 13 | 6 mo. 14 |

| Revenues | 538.8 | 536.9 | 1,128 | 1,101 |

| Growth | -0% | -3% | ||

| Net income (loss) | 46.9 | (13.7) | 25.7 | 67.2 |

Brocade Communication Systems, Inc. reported financial results for its second fiscal quarter ended May 3, 2014.

Brocade reported second quarter revenue of $537 million, flat year-over-year and down 5% quarter-over-quarter. The company reported a GAAP loss per share of $(0.03), compared with a profit of $0.10 per share in Q2 2013. The GAAP loss was due to an $83 million non-cash goodwill impairment charge associated with the strategic repositioning of the ADX product family. More information on this subject is provided in the highlights section below. Non-GAAP diluted EPS was $0.19, up from $0.17 in Q2 2013, principally due to higher gross margins and lower operating expenses.

“This was a solid quarter for Brocade in which our SANing (SAN) revenue grew year-over-year and our refocused IP Networking business made good progress in the quarter,” said Lloyd Carney, CEO, Brocade. “We see increasing customer interest in our software networking and Ethernet fabric technology as we drive innovation and disruption in data center networking. We are also pleased to report that our Board has approved the initiation of a quarterly cash dividend of $0.035 per share to be paid in Q3 2014.“

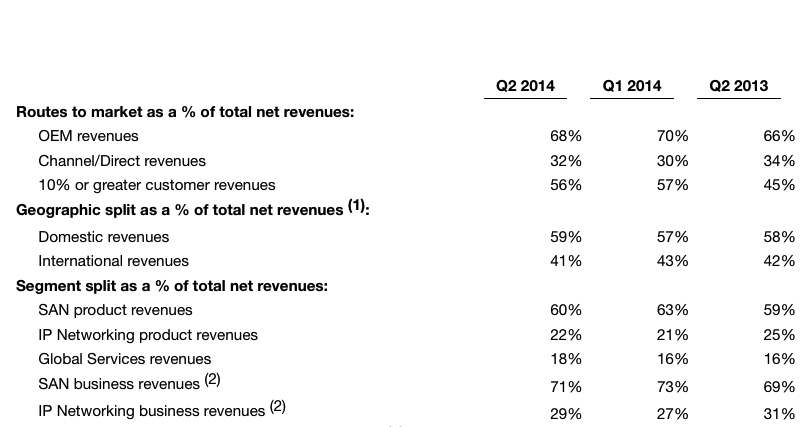

1) Revenues are attributed to geographic areas based on product delivery location. Since some OEM partners take delivery of Brocade products domestically and then ship internationally to their end-users, the percentage of international revenues based on end-user location would likely be higher.

2) SAN and IP Networking business revenues include product, support, and services revenues.

3) Business revenue by use category split is estimated based on the analysis of the information the company collects in its sales management system.

4)Data Center includes enterprise, service provider, and government data center revenues.

SAN business revenue, including products and services, was $379 million, up 1% year-over-year and down 8% sequentially. The year-over-year growth was primarily due to higher sales within the switch and embedded products as well as increased support revenue. The sequential decline was slightly better than expected in a seasonally soft quarter for many OEM partners of Brocade.

IP Networking business revenue, including products and services, was $157 million, down 4% year-over-year and up 3% sequentially. The year-over-year decline was due to lower sales to the U.S. Federal government, the divestiture of the network adapter business, and the change in the company’s wireless business strategy. The sequential increase was principally due to higher sales of Ethernet switching products as well as increased support revenue. During Q2 2014, an estimated 57% of IP Networking product revenue came from data center customers, up 7 pts year-over-year and down 2 pts sequentially. The estimated percentage of revenue coming from data center IP Networking customers may fluctuate quarter-to-quarter due to the timing of large data center customer transactions.

As part of the company’s previously communicated strategy to focus on the data center and other key technology segments, the company made a strategic shift during Q2 2014 to reduce investment in the hardware-based ADX products and to increase investment in the software-based ADX products for the Layer 4-7 market. As a result of this change in strategy, the company expects hardware-based ADX and related support revenue to be negatively impacted by $20 million to $40 million on an annualized basis compared with fiscal 2013 results. The company recognized a related $83 million non-cash goodwill impairment charge in Q2 2014.

The $83 million goodwill impairment charge is non-deductible for tax purposes resulting in the company’s effective GAAP tax provision rate being higher in Q2 2014. In addition, the effective GAAP and non-GAAP tax provision rates for Q2 2014 were higher than Q2 2013 due to the R&D tax credit that expired on December 31, 2013 and has not been extended by Congress.

The board of directors has initiated a quarterly cash dividend of $0.035 per share of the company’s common stock. The first dividend payment will be made on July 2, 2014 to stockholders of record as of the close of market on June 10, 2014. Future dividend payments are subject to review and approval by the board of directors.

Comments

Abstracts of the earnings call transcript:

Lloyd Carney, CEO:

"We express confidence in the stability and growth prospects of our SAN business, despite some prediction to the contrary. The fact is that, after normalizing for the sale of our network adapter business, our SAN business through the first six months of this fiscal year is flat with the same time period last year and was up 2% in the most recent quarter.

"Now, on the HBA, HBA revenue growth has never tracked with FC. HBA has always - FC torage always tracked server, and as severs become more and more virtualized, there has been requirement for less and less adaptor connectivity from those servers.

"So if you look at what has happened over the last three years, the HBA numbers have been falling off and fiber channel has been stable. And so it is not surprising to us that the HBA numbers are falling off. Remember, we decided to get out of the HBA business, because we realized that this is not a growth market for us. So there really isn't any correlation between the HBA adaptors and FC storage.

"The hottest segment of the storage right now is SSD array. And we never released with EMC, where we had a joint product portfolio release with the EMC on new SSD array. We have other release coming out with other partners. We did one with IBM actually. And so we are aligned with the new SSD array's coming from attritional part as well as from the new breed of SSD array vendors.

"So with 90% of the SSD array's being attached to FC and that being the hottest growth segment in storage, we expect to see over the next year that there is some residual effect for us, on us being connected to these arrays."

Daniel Fairfax, CFO:

"Our SAN revenue in the quarter saw strong performance in our switch and embedded product families.

"For Q3 '14, we expect SAN revenue to be down 2% to 5% due to the seasonal buying patterns of our OEMs. In addition, we consider potential disruption from ongoing business transitions within certain of our OEM partners. When adjusted for the sale of the network adapter business, we expect our SAN product revenue to be down 2% to up 1% year-over-year."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter