Imation: Fiscal 1Q14 Financial Results

Continuing to plunge and selling XtremeMac business

This is a Press Release edited by StorageNewsletter.com on May 1, 2014 at 3:00 pm| (in $ million) | 1Q13 | 1Q14 |

| Revenue | 224.4 | 178.9 |

| Growth | -20% | |

| Net income (loss) |

(21.1) | (17.5) |

Imation Corp. released financial results for the first quarter ended March 31, 2014.

The company also announced that it has closed on the sale of its XtremeMac business and continues to execute on its strategic transformation.

Q1 Overview

For the first quarter of 2014, Imation reported net revenue of $178.9 million, down 20.3% from Q1 2013, an operating loss from continuing operations of $16.1 million, including special charges of $2.1 million, diluted loss per share from continuing operations of $0.41 and a cash balance of $126.2 million.

Imation’s CEO Mark Lucas commented: “In 2011, we embarked on a strategic transformation to leverage Imation’s roots in storage to become a major player in higher-growth, higher-margin industry segments. Since then, we have exited two low-margin consumer electronics businesses, acquired Nexsan and built a mobile security portfolio. We have done this with urgency, since approximately 65% of our volume is in declining businesses.

“During the first quarter of 2014, we continued to build for the future, and our results were in line with our overall expectations. Performance in our Consumer Storage and Accessories segment came in stronger than anticipated, with our Tiered Storage and Security Solutions segment a bit soft. As our growth investments in sales and channel resources and new products take root, and as the sluggish IT environment improves, we expect our revenues in this segment to increase. Nexsan participates in a very attractive market. Hybrid storage has a 21% growth rate and is on a trajectory to become 45% of the external storage market by 2017. We are confident we are on the right course for long-term growth.”

Lucas continued: “From an operations perspective, we are pleased with both our working capital and cash management efforts. Our effective cost controls led to a drop of almost $6 million in SG&A expenses, and we will continue to rigorously monitor our cost structure going forward.”

Sale of Non-Core Business

On January 31, 2014, Imation completed the sale of its XtremeMac consumer electronics business which, along with the sale of the Memorex consumer electronics business in the fourth quarter of 2013, completes the company’s effort to divest its lower-margin, non-core consumer electronics businesses.

According to Lucas, “These divestitures are important because narrowing our focus has been a key objective for Imation, so we can concentrate our resources on the opportunities offering the best potential for long-term growth and profitability.”

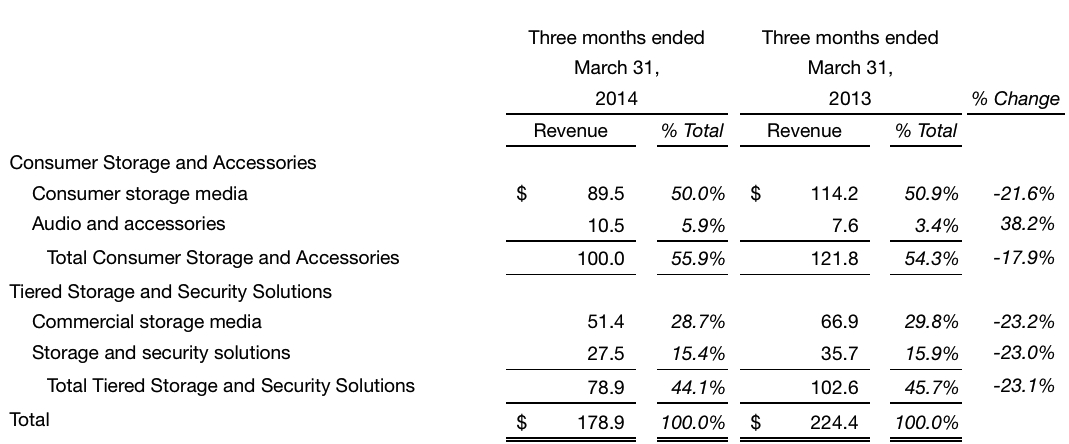

Business Segment Overview

Imation’s Consumer Storage and Accessories (CSA) revenue decreased 17.9% in Q1 2014 from the prior year, due primarily to the ongoing secular declines in optical media products. Gross margin of 19.3% increased 1.6 percentage points from the prior year with margins improving in all major product categories.

“As we have noted previously, the CSA segment is evolving as the optical market progresses through its life cycle with corresponding, anticipated revenue declines. Our strategic transformation is designed to lessen our reliance on Imation’s legacy media businesses. We are introducing differentiated new products throughout 2014 into the retail channel. A key Q1 highlight for the CSA segment was solid growth in our TDK Life on Record audio and accessories portfolio, driving 38% overall growth in that product category versus last year. Additionally, we introduced the 2-in-1 Micro USB Flash Drive for Android devices that allows users to conveniently move and store photos and videos,” said Lucas.

Imation’s Tiered Storage and Security Solutions (TSS) revenue decreased 23.1% in Q1 2014 from the prior year. TSS gross margin was 18.3% versus 22.0% a year ago, due chiefly to lower revenue levels. TSS’ performance is expected to strengthen as the sluggish IT spending environment improves and as the benefits of Imation’s growth investments begin to take hold.

Lucas said: “Since our acquisition of Nexsan, we have expanded our footprint within high capacity storage markets and have successfully entered the hybrid storage market with our NST line of hybrid storage solutions. By using an architecture that optimizes flash technologies for caching and storage performance, NST is broadening our market reach into the data center by addressing mixed-application workloads in a cost-effective and scalable way. Imation’s breadth of hybrid storage solutions and the new capabilities to come, position us well for growth in this storage market segment.”

“Within our mobile Security Group, we are also very encouraged by the marketplace response to our IronKey Workspace, Microsoft Certified Windows to Go line. This product is the equivalent of a ‘PC on a Stick’ having the entire Windows 8 OS and corporate image on a secure flash drive along with central management services for IT departments to control, manage and secure access and data. Imation has recently been chosen as a supplier by a Fortune 100 company due to the product’s security, durability and speed. Further, this mobile security offering is prevailing in the product evaluation stage with many other large global companies and governmental agencies around the world,” Lucas concluded.

Detailed Q1 2014 Analysis

As a result of the XtremeMac and Memorex consumer electronics divestitures which occurred on January 31, 2014 and October 15, 2013, respectively, the financial results for those operations are presented as discontinued operations. The following financial results are for continuing operations for the current and prior periods unless otherwise indicated.

Net revenue for Q1 2014 was $178.9 million, down 20.3% from Q1 2013. From a segment perspective, TSS and CSA declined 23.1% and 17.9%, respectively. Foreign currency exchange rates negatively impacted Q1 2014 revenues by 3% compared to Q1 2013.

Gross margin for Q1 2014 was 18.8%, flat with Q1 2013. Gross margin in Q1 2013 included inventory write offs of $2.1 million, which were part of the company’s restructuring program. CSA gross margin was 19.3 percent, up from 17.7% in Q1 2013 driven by improvements in all major product categories. TSS gross margin for Q1 2013 was 18.3 percent, down from 22.0% in Q1 2013 primarily stemming from lower revenue levels.

Selling, general and administrative expenses in Q1 2014 were $43.4 million, down $5.9 million compared with Q1 2013 expenses of $49.3 million due to the company’s continued cost reduction efforts.

R&D expenses in Q1 2014 were $4.3 million, down from $5.4 million in Q1 2013. The company has reduced legacy R&D spending while increasing investment in higher-margin projects in TSS, primarily through the Nexsan acquisition.

Special items netted to $2.1 million of expense in Q1 2014 compared to special charges of $4.2 million in Q1 2013, which included inventory write offs of $2.1 million, as discussed above.

Operating loss was $16.1 million in Q1 2014 compared with an operating loss of $14.7 million in Q1 2013. Excluding the impact of special charges described above, adjusted operating loss would have been $14.0 million in Q1 2014 compared with adjusted operating loss on the same basis of $10.5 million in Q1 2013 (See Tables Five and Six for non-GAAP measures).

Income tax provision was $0.0 million in Q1 2014 compared with income tax provision of $0.4 million in Q1 2013. The company maintains a valuation allowance related to its U.S. deferred tax assets and, therefore, no tax provision or benefit was recorded related to its U.S. results in either period.

Discontinued operations loss in Q1 2014 totaled $0.7 million (after-tax) compared with a loss of $5.5 million in Q1 2013. Discontinued operations includes both the results of the XtremeMac and Memorex consumer electronics businesses which have both been sold as noted above.

Loss per diluted share from continuing operations was $0.41 in Q1 2014 compared with a loss per diluted share of $0.39 in Q1 2013. Excluding the impact of special items, adjusted loss per diluted share would have been $0.36 in Q1 2014 compared with a loss per diluted share of $0.31 in Q1 2013.

Cash and cash equivalents balance was $126.2 million as of March 31, 2014, down $6.4 million during the quarter as seasonal compensation and rebate payments were partially offset by improvements in working capital.

Comments

Abstracts of the earnings call transcript:

Mark Lucas, president and CEO:

"During Q1, we reduced SG&A by almost $6 million and rigorous cost management is now part of our everyday stated operating procedure and it will continue.

" (...) since we purchased Nexsan just a year ago we have started investing in sales and channel initiatives. Specifically in this first quarter, we hired over 30 new sales engineering and support professionals including new sales management in key geographies.

"So we have a lot going on to build for the future Imation."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter