Seagate: Fiscal 3Q14 Financial Results

Lowest revenue since two years and a half

This is a Press Release edited by StorageNewsletter.com on April 30, 2014 at 2:42 pm| (in US$ million) | 3Q13 | 3Q14 | 9 mo. 13 | 9 mo. 14 |

| Revenues | 3,526 | 3,406 | 10,927 | 10,423 |

| Growth | -3% | -5% | ||

| Net income (loss) | 158.1 | 192.1 | 1,490 | 1,250 |

Seagate Technology plc reported financial results for the third quarter of fiscal year 2014 ended March 28, 2014.

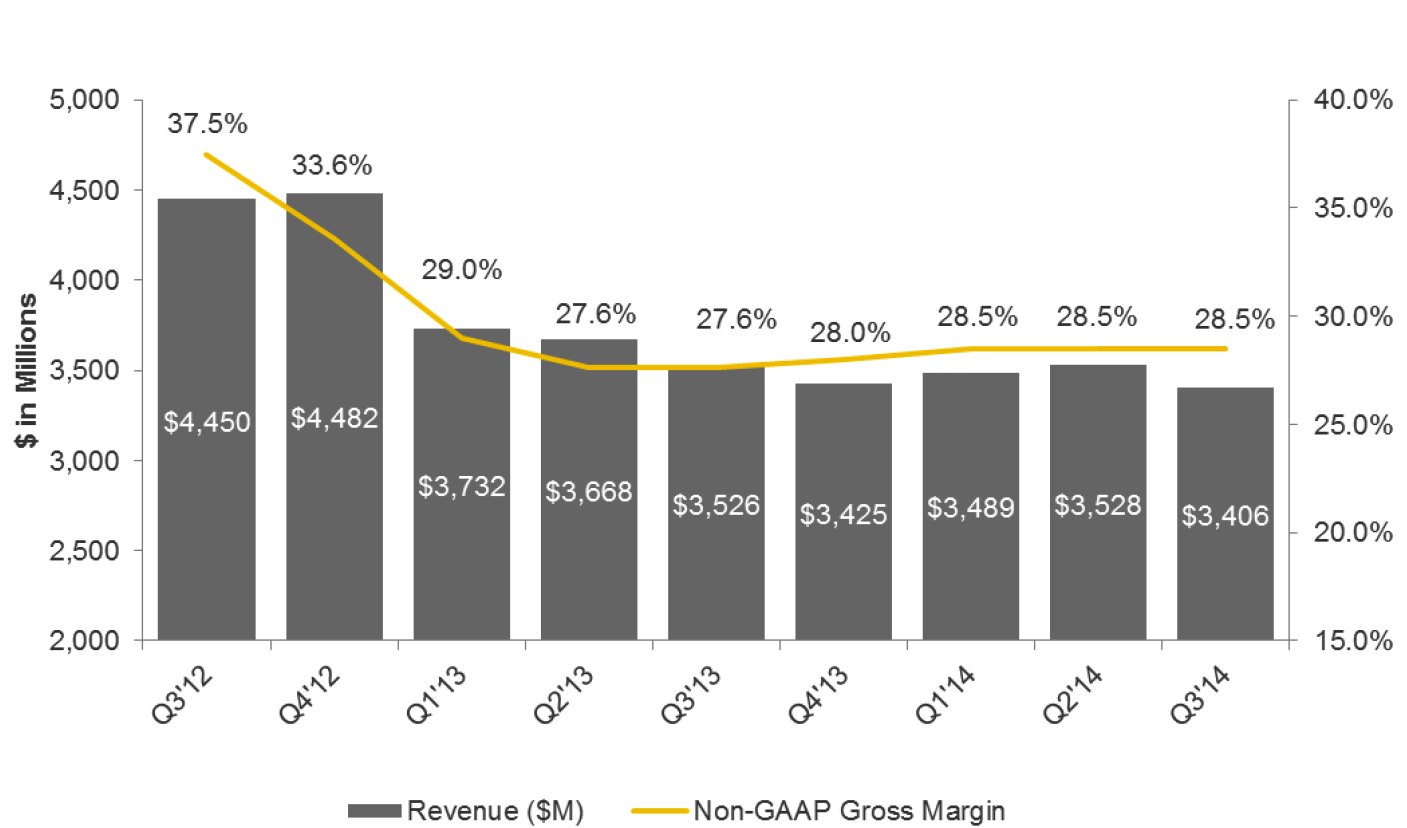

For the third quarter, the company reported revenue of approximately $3.4 billion, gross margin of 28.2%, net income of $395 million and diluted earnings per share of $1.17.

On a non-GAAP basis, which excludes the net impact of certain items, Seagate reported gross margin of 28.5%, net income of $453 million and diluted earnings per share of $1.34. For a detailed reconciliation of GAAP to non-GAAP results, see accompanying financial tables.

During the third quarter, the company generated approximately $443 million in operating cash flow, paid cash dividends of $140 million and repurchased 3.5 million ordinary shares for $184 million. There were 326 million ordinary shares issued and outstanding as of the end of the quarter.

Cash, cash equivalents, restricted cash, and short-term investments totaled approximately $2.3 billion at the end of the quarter.

“Seagate’s March quarter results reflect ongoing effective execution in a dynamic market environment,” said Steve Luczo, Seagate’s chairman and CEO. “We are positioning the company to lead in the evolving storage ecosystem by leveraging and investing in our market-leading product portfolio to enable shifts in the storage landscape in hyperscale, performance and mobility. In addition, we are maintaining our focus on operational discipline through conservative demand forecasting and supply management.”

Comments

$3.406 billion in revenue for the three-month period is the lowest figure for Seagate since two years and a half and its acquisition of Samsung HDD business, but with worldwide market share stable at around 40%.

Workforce also considerably decreased for the same period, from 57.520 to 51,099 people.

For the June quarter, Seagate is planning for revenues of only "at least $3.3 billion", including the recent closed acquisition of Xyratex adding "about $100 million" in revenue, a small amount as, for its last known financial quarter ended November 30, 2013, the UK company registered $185.3 million in sales.

Seagate's revenue and gross margin

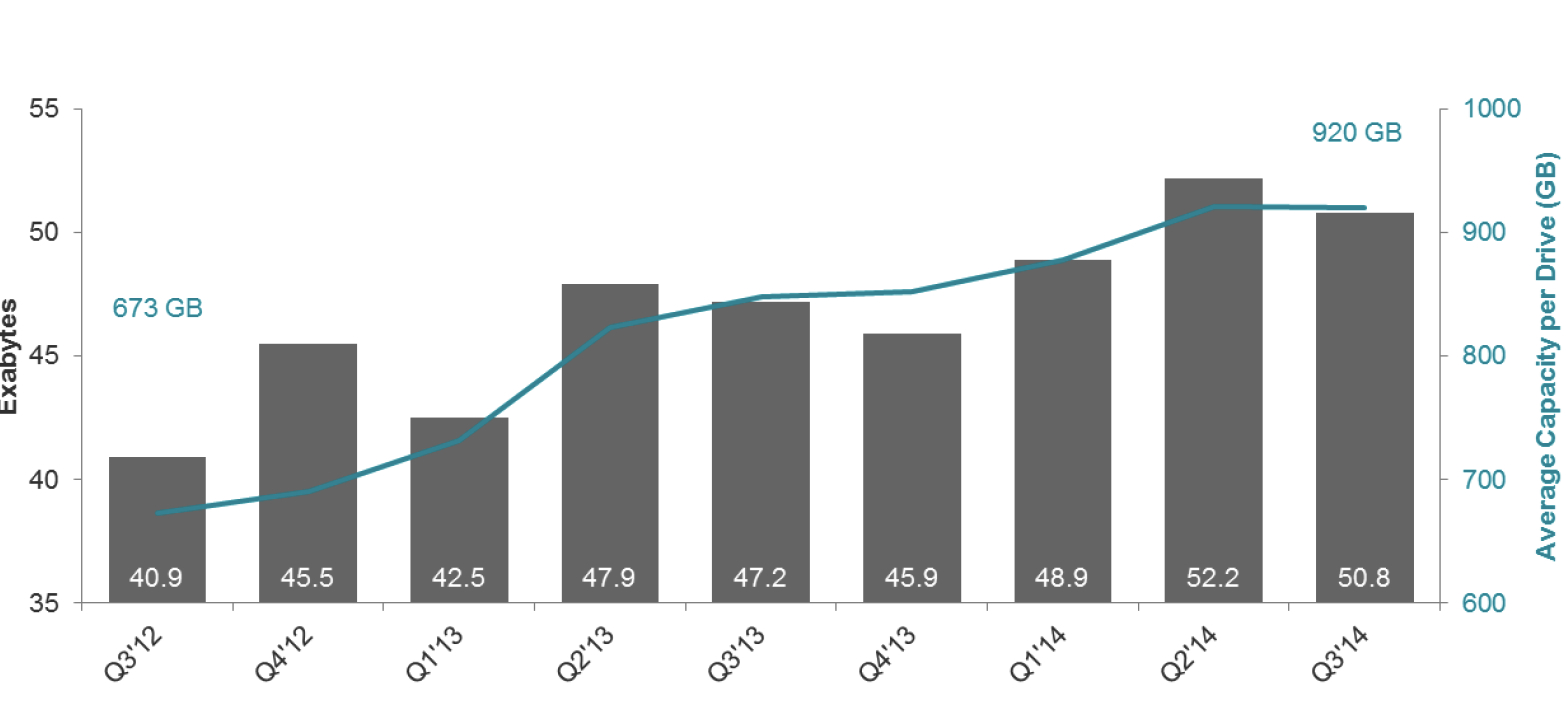

Storage shipments for the quarter grew 8% Y/Y and decreased 3% Q/Q to 50.8EB.

Average capacity per drive sold was 920GB compared to 922GB for the former quarter with ASP stable at $61.

Commenting on the results, Seagate's chairman and CEO Steve Luczo said:" Given the capacity points that we have to deliver over the next year, [we are] going from 6 to 8 to 10TB."

Exabytes shipped and average capacity per drive for Seagate

Shipments by type of HDDs for the quarter:

- Desktop: 19.8 million (39%)

- Notebook: 16.4 million (33%)

- Enterprise: 7.7 million (12%)

- CE: 5.4 million (11%)

- Branded: 5.9 million (4%)

- Total: 55.2 (100%)

The only segment growing Q/Q is desktop HDD.

By channel:

- OEM: 66%

- Distribution: 20%

- Retail: 14%

Luczo added: "Our June outlook assumes unit demand to be down a few points with negotiated pricing having been relatively benign. The outlook also assumes exabyte growth will be modest due to seasonality in the client and branded markets as well as due to a few specific temporal factors in the enterprise and nearline market this quarter. These factors include a few significant enterprise customers are absorbing in-house drive inventory and reducing disk drive purchases in the June quarter as they prepare for their new product introductions planned for the second half of the calendar year. And a number of cloud service providers have accelerated their time to deployment and have improved overall utilization and existing cloud infrastructures during the last three to four quarters, thereby absorbing their in-house drive inventory over the last two to three quarters. Based on current customer sentiment, we are planning for a stronger market demand in the second half of the calendar year as these entities deploy new build outs."

To read the earnings call transcript

Main competitor Western Digital will release its financial results for the third fiscal quarter ended March 28, 2014 today after the close of the market.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter