WW Disk Storage Vendor Revenue Up 1.4% in 2013 – Gartner

NetApp, HP and Fujitsu +6%, Oracle -30%

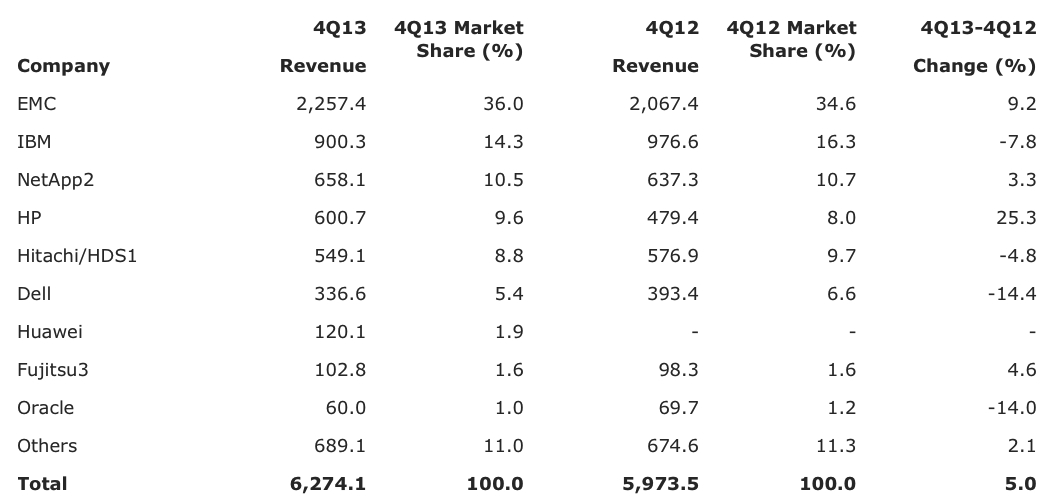

This is a Press Release edited by StorageNewsletter.com on March 20, 2014 at 2:39 pmWorldwide external controller-based (ECB) disk storage vendor revenue totaled $6.3 billion in the fourth quarter of 2013, a 5% increase from revenue of $6.0 billion in the fourth quarter of 2012, according to Gartner, Inc.‘s report Quarterly Statistics: Disk Array Storage, All Regions, All Countries, 4Q13 Update.

All regions except Japan posted revenue increases, with AsiaPac growing the fastest, at 15.5%. Revenue for block ECB storage increased 1.2%, and network-attached storage grew 14.9%.

“Following an abysmal third quarter, the fourth quarter of 2013 returned to growth. Driven by pent-up demand and the year-end budget flush phenomenon, the market overcame a fragile global economy and grew a strong five% over the same period in 2012,” said Roger Cox, research VP, Gartner.

While Fujitsu and NetApp had year over year revenue gains, only two vendors – EMC and HP – beat the year-over-year market growth rate in the fourth quarter. Propelled by broad acceptance of the HP 3PAR StoreServ and the StoreOnce disk-based backup platforms, HP led all surveyed vendors in year-over-year revenue growth. Beyond its broad ECB disk storage portfolio, EMC benefited from the success of its VNX and Data Domain product refresh offerings. The increasing traction of NetApp’s Clustered Data ONTAP OS within its installed base, as well as an alternative to competing solutions, is enabling NetApp to achieve above-market results. Fujitsu continues to make gains in the EMEA region and has a strong showing in its home country, Japan.

WW ECB Disk Storage Vendor Revenue Estimates for 4Q13

($ million)

(Source: Gartner, March 2014)

1: Hitachi/HDS revenue excludes OEM revenue from HP.

2: NetApp revenue excludes ONTAP OEM revenue from IBM and Engenio OEM revenue.

3: Fujitsu’s branded revenue does not include products sold under the EMC and NetApp brands.

Dell, IBM and Oracle continue to underperform the market and lose share. Although the Dell Compellent offering is producing year-over-year revenue increases, these gains are insufficient to offset the decline in other members of its ECB disk storage portfolio. In addition, Dell may be suffering from organizational and structural issues associated with its leveraged buyout that are hampering sales. IBM’s strategy of emphasizing its IP-based disk storage products is gaining traction but is not yet strong enough to offset declines in technology sourced from NetApp. Even though Oracle’s ZFS Storage Appliance is a competitive offering from a technology perspective, Oracle’s declining revenue results are due to inadequate market coverage.

For the year, worldwide disk storage vendor revenue totaled $22.5 billion in 2013, a 1.4% increase from revenue of $22.2 billion in 2012. This anemic year-over-year growth, the lowest since the decline in 2009, reflects the influence of muddled global macroeconomies, particularly in North America, AsiaPac and EMEA. The culmination of the infrastructure build-out after the 2011 tsunami with the weakness of the yen contributed to Japan being the only region to experience an absolute year-over-year decline in vendor revenue.

Although pricing per terabyte continues to decline as expected, the ASP per unit increased 5.1% in 2013, signaling larger configurations.

Worldwide ECB Disk Storage Vendor Revenue Estimates for 2013

($ million)

(Source: Gartner, March 2014)

1: Hitachi/HDS revenue excludes OEM revenue from HP.

2: NetApp revenue excludes ONTAP OEM revenue from IBM and Engenio OEM revenue.

3: Fujitsu’s branded revenue does not include products sold under the EMC and NetApp brands.

Gartner ECB disk storage reports reflect vendor-branded hardware-only revenue, as well as hardware revenue associated with financial leases and managed services. Revenue from optional and separately priced storage software and SAN infrastructure components is excluded.

Comments

We are sometimes surprised by some market reports. Here, for the external disk systems, Gartner and IDC do not have exactly the same definition but there are small differences. Comparing the respective results of the recognized analysts of the two firms from 4Q12 to 4Q13 (see below), their figures are globally in accordance, but really surprising concerning one of the top 5 storage companies, HP.

Between the two periods IDC records 6.5% growth in revenue, and, on its side, Gartner registers 25.3% even if both of them evaluates HP's worldwide market share with the same figure, 9.6% for 4Q13.

OK, HP had a nice 4Q13 compared to 4Q12 for both analyst firms, but it was good one for IDC and exceptional one for Gartner. Who is right?

Market share of WW external disk systems revenue for IDC and Gartner for 4Q13

| for IDC | for IDC | for Gartner | for Gartner | ||

| Rank | Vendors | 4Q13 share | 4Q12/4Q13 growth | 4Q13 share | 4Q12/4Q13 growth |

| 1 | EMC | 32.9% | 9.9% | 36.0% | 9.2% |

| 2 | IBM | 13.0% | -10.6% | 14.3% | -7.8% |

| 3 | NetApp | 11.5% | 1.5% | 10.5% | 3.3% |

| 4 | HP | 9.6% | 6.5% | 9.6% | 25.3% |

| 5 | Hitachi | 8.1% | -5.6% | 8.9% | -6.6% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter