Dot Hill: Fiscal 4Q13 Financial Results

First full year GAAP profitability since 2005, but share plunging 19%

This is a Press Release edited by StorageNewsletter.com on March 7, 2014 at 2:59 pm| (in $ million) | 4Q12 | 4Q13 | FY12 | FY13 |

| Revenue | 44.1 | 58.8 | 194.5 | 206.6 |

| Growth | 33% | 6% | ||

| Net income (loss) | (5.0) | 2.2 | (15.0) | 5.1 |

Dot Hill Systems Corp. reported financial results for the fourth quarter and year ended December 31, 2013.

2013 and Recent Operational Highlights

- Entered into several new OEM customer agreements including Acer Europe SA, CGG, Quantum, Supermicro and Teradata.

- Received five new patents bringing the total to 92 awarded.

- Provided the company’s largest customer with a first to market advantage in 16Gb FC, 12Gb SAS and 16Gb FC / 10GbE iSCSI converged interface entry level storage solutions.

- Expanded the breadth and depth of the company’s product line, introducing new reference platforms for OEM telecommunication customers.

“Against the backdrop of a storage industry that was generally flat in 2013, our results and our revenue growth are strong indicators of the inherent operating leverage in our business. It is now more evident that our vertical markets and midrange product efforts are really beginning to pay off,” stated Dana Kammersgard, CEO, Dot Hill. “More importantly, we are projecting even greater top line growth in 2014, given that several of our recently announced customers who did not contribute meaningfully in 2013 are expected to ramp this year. In some cases the ramps will likely be towards the second half of 2014 and accordingly we expect these customers will become foundational for strong revenue growth into 2015.”

Fourth Quarter 2013 GAAP Financial Detail (including discontinued operations)

- Net revenue was $58.8 million for the fourth quarter of 2013, compared to $44.1 million for the fourth quarter of 2012 and $52.6 million for the third quarter of 2013.

- Gross margin for the fourth quarter of 2013 was 30.2%, compared to 17.8% for the fourth quarter of 2012 and 32.1% for the third quarter of 2013.

- Operating expenses for the fourth quarter of 2013 were $15.7 million, compared to $12.6 million for the fourth quarter of 2012 and $15.0 million in the third quarter of 2013.

- Net income for the fourth quarter of 2013 was $2.2 million, or $0.04 per fully diluted share, compared to a net loss of $5.0 million, or ($0.09) per share, for the fourth quarter of 2012, and net income of $1.8 million, or $0.03 per fully diluted share, for the third quarter of 2013.

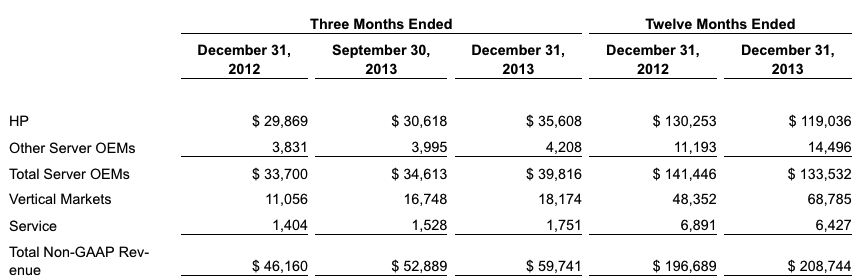

Unaudited non-GAAP revenue detail by market

(in thousands)

Fourth Quarter 2013 Non-GAAP Financial Detail

- Non-GAAP net revenue increased to $59.7 million compared to $46.2 million for the fourth quarter of 2012 and $52.9 million for the third quarter of 2013.

- Non-GAAP gross margin was 31.7%, compared to 28.3% for the fourth quarter of 2012 and 32.8% for the third quarter of 2013.

- Non-GAAP operating expenses were $14.8 million, as compared to $14.7 million for the fourth quarter of 2012 and $14.5 million in the third quarter of 2013.

- Non-GAAP net income was $4.2 million, or $0.07 per fully diluted share, as compared to a net loss of $2.0 million, or ($0.03) per share, for the fourth quarter of 2012, and net income of $2.8 million, or $0.05 per fully diluted share, for the third quarter of 2013.

Full Year 2013 GAAP Financial Detail (including discontinued operations)

- Net revenue was $206.6 million, compared to $194.9 million in 2012.

- Gross margin was 31.9%, compared to 23.7% in 2012.

- Operating expenses were $60.8 million, compared to $60.4 million in 2012.

- Net income was $5.1 million, or $0.09 per fully diluted share, compared to a net loss of $15.0 million, or ($0.26) per share for the full year of 2012.

Full-Year 2013 Non-GAAP Financial Detail

- Non-GAAP net revenue grew to $208.7 million, compared to $196.7 million in 2012.

- Non-GAAP gross margin was 32.8%, compared to 27.9% in 2012.

- Non-GAAP operating expenses were $57.8 million, compared to $57.8 million in 2012.

- Non-GAAP net income was $10.5 million, or $0.18 per fully diluted share, compared to a net loss of $3.7 million, or ($0.06) per share for the full year of 2012.

Balance Sheet and Cash

The company exited 2013 with cash and cash equivalents of $40.4 million, with $2.0 million in borrowings from its working capital line. This compares to $40.3 million at the end of 2012, with $2.8 million in borrowings, and $40.4 million at the end of the third quarter of 2013, with no borrowings.

First Quarter and Full Year 2014 Outlook

Non-GAAP net revenue and fully diluted earnings per share for the first quarter of 2014 are expected to be in the range of $47 million to $50 million and $0.00 to $0.01, respectively. Non-GAAP net revenue and earnings per fully diluted share for the full year 2014 are projected to be between $220 million and $255 million and $0.18 and $0.29, respectively.

“We are projecting continued strong vertical markets traction in 2014, while the server OEM business remains relatively flat, resulting in almost 14% aggregate revenue growth at the midpoint of our guidance range,” said Hanif Jamal, CFO, Dot Hill. “As we look out over our own internal planning horizon, we think that our compounded average annual growth rate in non-GAAP revenue should be 14-18% overall from a 2013 baseline, with the vertical markets business growing 40-50%.“

Comments

Abstracts the earnings call transcript:

Hanif Jamal, CFO:

"Our vertical markets business grew to $18.2 million or 8.5% sequentially and over 64% year-over-year. Our fourth quarter 2013 server OEM revenues of $39.8 million were up 15% sequentially and 18% year-over-year, primarily due to 16% and 19% sequential and year-over-year growth, respectively, in sales to our largest customer.

"In the fourth quarter, sales to this customer represented a little under 60% of total revenue compared to 58% and 65% in Q3 '13 and Q2 of '12, respectively.

"For 2014, We are projecting continued strong vertical markets growth and expect non-GAAP revenues from this segment to be between $90 million and $115 million, while our server OEM business is likely to remain relatively flat between $130 million and $140 million."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter