NAND Memory Revenue Rose 28% to $25.8 Billion in 2013 – IHS

eMMC up 49%

This is a Press Release edited by StorageNewsletter.com on February 28, 2014 at 2:56 pmThe global memory market presented a vivid picture of contrast last year given the wildly divergent fortunes of its two main segments, with spritely NAND offset by the sobering continued downturn of beleaguered NOR flash, according to a report from IHS Technology.

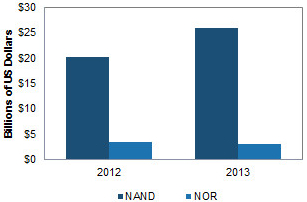

Global Flash Memory Revenue

(Source: IHS Technology, February 2014)

On the one hand, the NAND product known as embedded multimedia card (eMMC) enjoyed record shipments in 2013 of more than 1 billion units, up a hefty 49% from 687 million in 2012.

NAND revenue rose 28% to $25.8 billion.

In comparison, NOR shipments last year fell 10% to 606 million units, with revenue down 15% to approximately $3.0 billion.

The overall flash market in 2013 was worth $28.8 billion, up from $23.7 billion a year earlier.

“The key driver to NAND lies in its proliferating use for mobile consumer electronics, exemplified by the memory’s increasingly widespread application in devices like smartphones, tablets and notebook PCs,” said Michael Yang, senior principal analyst for memory and storage, IHS. “Meanwhile, NOR’s once-broad portfolio of applications in low-end mobile handsets and desktop PCs has mostly matured, and its next killer market has yet to manifest.”

These findings are contained in the report, Mobile & Embedded Memory Tracker – Q4 2013, from the Semiconductors & Components service of IHS.

NAND eMMC achieves milestone

NAND memory, in the form of either raw NAND or eMMC, is now the standard memory used for most smartphones. The only exception is Apple’s iPhone, which uses its own managed NAND memory product.

The evolution of eMMC, in particular, has been rapid, with nearly annual enhancements to performance. As an economical choice for greater flash-memory densities, eMMC has become viable in high-end markets like smartphones and tablets, in which high-density storage capacity is required along with low-power consumption and a small footprint.

Embedded NAND’s utility has also now carried over from smartphones in its early use, to tablets. Last year, eMMC was the standard memory configuration for a vast majority of tablets, the only exception being the Surface Pro from Microsoft, which employs a SATA-interface SSD.

“The billion-unit shipment level of eMMC last year is a milestone,” Yang remarked. “And the product shows the way forward for managed NAND solutions by its deft handling of error correction and enhanced reliability at the solution level.”

The rise of eMMC has also bred a new cast of suppliers. While Samsung remains dominant, players like SK Hynix, SanDisk and Toshiba are fiercely competitive and poised to gain ground.

The eMMC space, however, could see challenges this year. With growth slowing in the smartphone and tablet markets, there could be a possible oversupply of the memory type, in the process also leading to a possible large drop in eMMC ASPs.

NOR’s sad tale of decline

The steady decline of the NOR flash market began in 2007 and hasn’t stopped since. At its peak, the NOR market exceeded $9 billion a year and last hit $8 billion back in 2006-a far cry from its current numbers.

The NOR picture is also complicated by the contrasting outlook for its two sub-segments. Parallel NOR, long used in computers for boot-code execution or serving as a storage medium for entry-level cellphones, will see its run in wireless devices come to an end sometime next year. Parallel NOR will continue to be used in high-level industrial, medical, networking and military applications, but its exit from wireless will be a blow.

Meanwhile, serial peripheral interface (SPI) NOR, rival to parallel NOR, will go on to wider use in both wireless and consumer devices. SPI NOR’s relative simplicity in design and low manufacturing cost will prove appealing, and the memory will be especially attractive to manufacturers of low-cost cellphones that need to keep a lid on expenses.

The shift from parallel to SPI NOR has also impacted their respective suppliers. Micron Technology and Spansion, the foremost producers of parallel NOR, now also have SPI offerings. However, both companies have been at pains to differentiate their SPI product from the rest of the pack, in order to stave off the aggressive penetration of other SPI NOR suppliers such as Macronix, Winbond Electronics and GigaDevice.

The ongoing growth of SPI NOR will help offset a shrinking parallel NOR market, but the industry would be healthier if consolidation took place and reduced the number of players to four, IHS believes. There are five suppliers at present that command 75% of the market, along with a spattering of smaller producers that make up the rest of the market.

Even so, there are no quick fixes, with the largest NOR applications disappearing or on their way out, and new deployments like automotive NOR still facing an uphill climb.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter