Descent Continues for Worldwide Tape Market

LTO has monopoly.

This is a Press Release edited by StorageNewsletter.com on February 26, 2014 at 2:54 pmHere is the Executive Summary of Backup Tape Tracker for 4Q13 ($2,850) from analyst company Santa Clara Consulting Group.

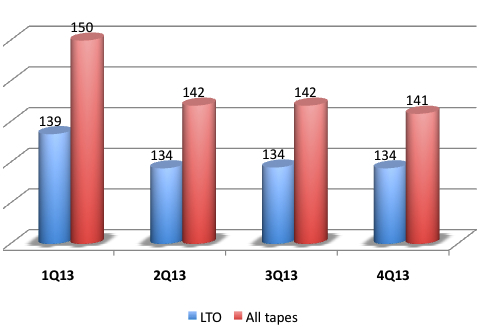

Backup tape cartridge sales amounted to $141.12 million in the fourth quarter of 2013.

LTO accounted for 95.2% of total with sales of $134.33 million.

The media market is expected to grow to $146.73 million in the next quarter.

Total LTO sales were slightly down at 4.9 million units in Q4. LTO-6 continued its ramp in the quarter accounting for 14% of units and 32% of dollars. LTO-5 was moderately down in the quarter. It accounted for 37% of unit sales and 31% of dollars. LTO-4 was down. It represented 35% of units and 26% of dollars. LTO-3 sales declined -17%. They accounted for 12% of volume and 9% of dollars. LTO-1 was down -24% and LTO-2 was off -17%. Combined, they accounted for 2% of units and 2% of dollars. HP led the LTO market with a 32% share. Fuji was the second largest supplier and IBM was third. Q1 LTO sales are expected to be moderately up. They will be supported by growth of LTO-6 and relatively steady volumes of LTO-5.

The DDS/DAT cartridge volume was off -18% to .33 million units in Q4. DAT-72 accounted for 41% of unit sales and 41% of the value of the segment. DAT-160 accounted for 37% of the value of the segment and DAT-320 sold 4%. HP led the DDS/DAT market with a 73% share. Segment dollar sales amounted to $4.63 million.

DLT-S cartridge sales amounted to .02 million units. HP led the segment. It was followed by Quantum and Maxell. DLT-S dollar sales are expected to be off to $0.90 million in Q1.

DLT-V sales were off at .01 million units. Their value was $0.22 million. DLT-VS1 cartridges accounted for 72% of units. Quantum led the segment with a 44% share. HP was second at 28%. Sales of DLT-V are expected to be lower in Q1.

AIT media supports its respective installed bases of drives. Total AIT cartridge volume in the quarter amounted to .01 million units. Sony was the sole supplier of the product.

Shipments of QIC cartridges in the quarter totaled .01 million units. Their value was $.45 million. Imation dominated the segment with a market share of 97%.

The 8mm metal particle cartridge amounted to .0003 million units worth $0.002 million. Sony led the segment with an 87% market share.

Tandberg Data supplied 8mm metal evaporated cartridges for its VXA and Mammoth drives. Sales were .0003 million units in the quarter.

Comments

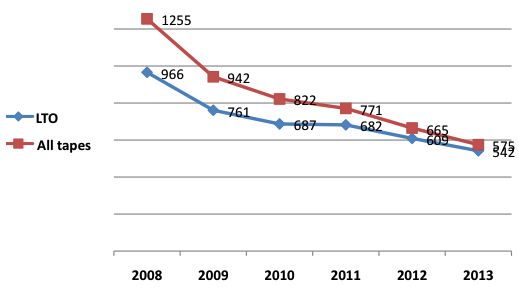

Here are two graphics proposed by StorageNewsletter.com based on the figures compiled by the Santa Clara Consulting Group for the last four quarters of 2013 and for the years from 2008 to 2013.

Two conclusions are obvious:

- the market of data tape cartridges never stopped to decline these past quarters and years and

- LTO has a monopoly in term of technology.

Note that the Santa Clara Consulting Group doesn't include in its statistics the high-end tape cartridges for mainframes but also for open systems from IBM and Oracle (StorageTek).

Tape cartridges revenue in $ million in 2013 per quarter

(Source: SCCG figures compiled by StorageNewsletter.com)

Tape cartridges revenue in $ million from 2008 to 2013 (Source: SCCG figures compiled by StorageNewsletter.com)

(Source: SCCG figures compiled by StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter