2013 Storage Hardware Segment Up 12% in U.S. B2B Channel Sales – NPD

EMC, HP, NetApp, IBM and Seagate five largest vendors

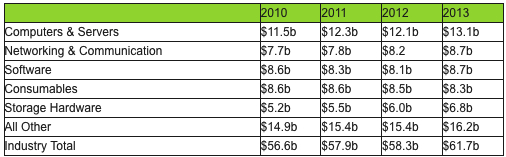

This is a Press Release edited by StorageNewsletter.com on February 10, 2014 at 2:50 pmFor the third consecutive year, U.S. B2B channel sales (sales through distributors and commercial resellers) increased, ending 2013 up nearly 6% at $61.7 billion, according to Distributor Track and Reseller Tracking Service from The NPD Group.

The impressive growth was the fastest sales increase since the end of the recession. Sales growth accelerated in the second half of the year peaking in fourth quarter with a 6.9% increase over the fourth quarter of 2012.

“B2B channel sales rebounded in 2013 after a weaker 2012 where we saw less than 1% growth,” said Stephen Baker, VP, industry analysis, NPD. “The belief that IT hardware is a declining business was dispelled as most of the significant hardware segments had positive sales results. The increasing demands for cloud and infrastructure services continue to positively impact distribution channels and should create increased hardware and software sales opportunities in the future.“

The top five categories accounted for 74% of sales; essentially unchanged over the last four years. Four of the five categories grew by more than 6% and every one of those improved sequentially over 2012’s growth rate. Outside of the largest product categories sales revenue was up 5.2 percent, a significant jump over 2012.

Top 5 U.S. B2B Categories Based on Revenue

(Source: The NPD Group/Distributor Track and Reseller Tracking Service)

Pre-configured desktop and notebook unit sales increased 9% and 23% respectively while Build-to-Order computers increased 19% to nearly 3 million units.

HP unit sales were flat on a year-over-year basis, Lenovo saw unit volumes jump 15% and the rest of the market, propelled by strong Chromebooks sales, had an almost 50% increase in unit sales. Server sales declined 9% in units and fell below $1 billion in annual revenue for the first time in more than four years.

Networking and communication devices continued to have steady revenue growth. Cisco was the largest supplier of networking gear to the channel capturing 57% revenue share. Among the top ten networking manufacturers Brocade and Juniper topped the list of fastest growing suppliers with revenue growth greater than 20% in 2013. Switches remain the largest category accounting for 31% of revenue, but units have been flat over the last four years while dollars increased nearly 7% in 2013 to $2.7 billion. Access points were the fastest growing major category with revenue up more than 21% and units increasing 18% from 2012.

Software sales rebounded after three years of decline. Business software increased 14% to more than $4.7 billion while OS sales grew by 11 percent. Security software grew just 2% and imaging software declined 13 percent. Microsoft, IBM and VMWare were the three largest software vendors in the channel accounting for 60% of revenue. Microsoft sales were up 12%, IBM’s sales grew 34% and VMWare increased 4% over 2012.

Storage hardware sales have been the fastest growing large segment in B2B channel sales since 2010 increasing 29% since then with a 12% increase in revenue in 2013. EMC, HP, NetApp, IBM and Seagate were the five largest vendors with EMC and NetApp each seeing double digit revenue growth. Sales were propelled by strong growth in SSD and NAS. SSD revenue increased 83% while units soared 95%. NAS revenue was up 33% over 2012. HDDs were the largest segment, with more than $2.5 billion in sales in 2013 and 14.9 million units sold.

“The outlook for 2014 appears strong for B2B sales channels,” said Baker. “Strong channel commitments from the major hardware OEMs combined with continued end-user demand for the latest hardware solutions should provide the B2B channels with growth similar to 2013 in the coming year.“

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter