Emulex: Fiscal 2Q14 Financial Results

Storage connectivity products at $26 millIon, down 2% Q/Q

This is a Press Release edited by StorageNewsletter.com on January 31, 2014 at 3:03 pm| (in $ million) | 2Q13 | 2Q14 | 6 mo. 13 | 6 mo. 14 |

| Revenues | 122.1 | 123.0 | 241.4 | 237.8 |

| Growth | 1% | -1% | ||

| Net income (loss) | 5.6 | (4.0) | 6.2 | (7.7) |

Emulex Corporation announced earnings results for the second quarter of fiscal 2014, which ended on December 29, 2013.

Second Quarter Financial Highlights

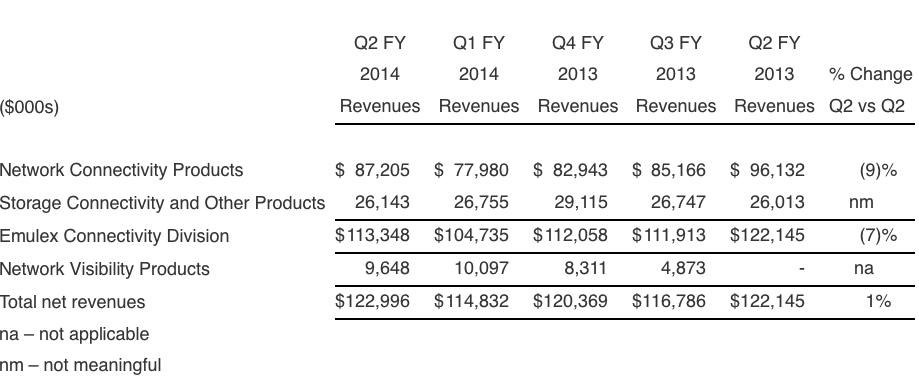

- Total net revenues of $123.0 million

- Network Connectivity Products (NCP) net revenues of $87.2 million, representing 71% of total net revenues

- Network Visibility Products (NVP), net revenues of $9.6 million, representing 8% of total net revenues

- Storage Connectivity and Other Products (SCOP) net revenues of $26.1 million, representing 21% of total net revenues

- Non-GAAP gross margins of 66% and GAAP gross margins of 59%

- Non-GAAP diluted earnings per share of $0.21

- GAAP loss per share of $0.05, which includes an approximately $0.09 impact related to our previously announced restructuring

- Cash, cash equivalents and investments at the end of the quarter of $198.7 million

- Raised $175 million through a convertible debt offering

- Announced a $200 million share repurchase program of which $100 million was transacted in Q2, consisting of $56 million of direct treasury stock purchases and $44 million paid for treasury stock repurchases under an accelerated stock buyback program which will conclude by May 2014

- Weighted share count of 88.6 million shares in the December quarter compared to 93.5 million in the first quarter

Second Quarter Business Highlights

- Implemented a three-part initiative to improve profitability and enhance shareholder value

- Expanded cost savings program to deliver $30 million in annual cost savings compared to the fiscal 2013 spending level in the connectivity business. The program includes a 15% workforce reduction and the closure of the Bolton, MA engineering facility by the end of fiscal 2014

- Announced a $200 million share repurchase program, of which $100 million is expected to be completed by the end of May 2014 primarily funded by completion of $175 million convertible debt offering due in 2018

- Received acceptances from Gary J. Daichendt, a former networking executive and current board member of ShoreTel and NCR, John A. Kelley, Jr., a former storage and telecom equipment CEO and current board member of Polycom, and Rahul N. Merchant, former chief information and innovation officer for the City of New York and current board member of Fair Isaac Corporation (FICO), to be seated as independent board members at our upcoming shareholders meeting on February 6, 2014

- Unveiled the next generation OneConnect 10/40GbE network adapter family, which represents the company’s first 40GbE network adapters and RDMA over Converged Ethernet (RoCE) capable CNAs, delivering increased server virtualization density, software-defined networking enablement and advanced functionality for hybrid cloud environments

- Delivered revenue shipments of the redesigned OCe11000R adapters based on the new XE4310R Ethernet controller

- Announced joint development with Brocade to deliver Gen 6 (32Gb) FC solutions, enabling increased network performance, higher scalability and improved reliability for the highly virtualized data center

- Announced a key customer reference with IRESS, a financial services organization, who is deploying the EndaceProbe Intelligent Network Recorder (INR) and the EndaceVision software suite to consolidate its network operations infrastructure, improve network performance and increase security monitoring capabilities in its data centers

- Expanded Gen 5 FC ecosystem partner certification for its LightPulse Gen 5 (16Gb) FC HBAs, including ATTO Technology, Bloombase, Imation, Permabit and Violin Memory

“With solid top line performance, I’m pleased to report that we once again exceeded the high-end of our earnings guidance, and have made significant progress on our three-part initiative to increase shareholder value,” commented Jeff Benck, president and CEO, Emulex. “I’m particularly proud that our team began shipping revenue units based upon our redesigned controller last quarter, and just last week, we introduced our next generation Ethernet adapter family, including the company’s first 40GbE and RDMA-capable adapters.”

“We’ve also added a wealth of experience to the company with the addition of Kyle Wescoat as CFO and the new independent director candidates, which will help the company as we continue our initiatives in support of enhanced profitability and shareholder value,” Benck concluded.

Business Outlook

For the third quarter of fiscal 2014, Emulex is forecasting total net revenues in the range of $110 – $114 million. The company expects non-GAAP earnings per diluted share of $0.14 – $0.17 in the third quarter. GAAP estimates for the third quarter reflect approximately $0.21 per diluted share in expected charges arising primarily from amortization of intangibles, stock-based compensation, the royalties, mitigation expenses and license fees associated with the Broadcom patent litigation, accretion of debt discount on convertible senior notes, and site closure and related restructuring costs, as well as the associated tax effects and the impact of our U.S. GAAP tax valuation allowance.

Comments

Abstracts the earnings call transcript:

Kyle Wescoat, CFO:

"Storage Connectivity and Other Products, or SCOP, consists of our bridges and back end connectivity products, baseboard management controllers and other miscellaneous products. In the second quarter, SCOP accounted for 21% of total revenues, coming in at $26 million, down approximately 2% from the first quarter."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter