EMC: Fiscal 4Q13 Financial Results

Historical record quarter and year in storage

This is a Press Release edited by StorageNewsletter.com on January 30, 2014 at 2:58 pm| (in $ million) | 4Q13 | 4Q14 | FY13 | FY14 |

| Revenue | 6,030 | 6,682 | 21,714 | 23,222 |

| Growth | 11% | 7% | ||

| Net income (loss) | 870 | 1,022 | 2,733 | 2,889 |

EMC Corporation reported fourth-quarter and full-year 2013 financial results.

Highlights

- Q4 revenue growth up 11% year over year

- Q4 GAAP EPS and non-GAAP EPS growth up 23% and 11% year over year, respectively

- Double-digit year-over-year revenue growth across U.S., EMEA and Latin America, with strong revenue growth from BRIC+13 markets

- Q4 revenue from the Emerging Storage business up 73% year over year

- Strong year-over-year increase in operating and free cash flow

Fourth-quarter revenue was $6.7 billion, an increase of 11% compared with the year-ago quarter.

Fourth-quarter GAAP net income attributable to EMC increased 17% year over year to $1.0 billion. Fourth-quarter GAAP earnings per weighted average diluted share increased 23% year over year to $0.48. Non-GAAP1 net income attributable to EMC was $1.3 billion, an increase of 7% compared with the year-ago quarter. Fourth-quarter non-GAAP earnings per weighted average diluted share were $0.60, an increase of 11% year over year.

Full-year 2013 revenue was $23.2 billion, an increase of 7% year over year. This result was highlighted by 5% year-over-year revenue growth for EMC’s Information Infrastructure business, and 15% year-over-year revenue growth each for VMware and Pivotal.

GAAP net income attributable to EMC for 2013 increased 6% year over year to $2.9 billion, and GAAP earnings per weighted average diluted share were $1.33, up 8% year over year. Non-GAAP net income attributable to EMC for 2013 was $3.9 billion, an increase of 4% year over year, and non-GAAP earnings per weighted average diluted share were $1.80, an increase of 6% year over year.

For 2013, the company generated operating cash flow of $6.9 billion and free cash flow of $5.5 billion, increases of 11% and 10% year over year, respectively.

The company ended the year with $17.6 billion in cash and investments.

Joe Tucci, EMC chairman and CEO, said: “Our fourth-quarter results are further evidence that our federation strategy across EMC Information Infrastructure, VMware and Pivotal is on target. There’s no doubt that the move from the second platform to the third platform of IT, underpinned by the mega trends of mobile, cloud, big data and social, is having a profound impact on business and transforming the way we work and live. Customers and partners have these transformations in their sights and are embracing EMC’s vision, strategy and best-of-breed portfolio to capitalize on them.”

David Goulden, CEO of EMC information infrastructure and EMC’s CFO, said: “Despite 2013 IT spend growth that was lower than we expected, EMC achieved strong revenue and profit growth. This outperformance relative to our industry speaks to the power of the EMC portfolio, solid operational and financial model and consistent execution against our strategy. We entered 2014 exceptionally well positioned to grow faster this year than our IT spending growth projection while also gaining share in the markets we serve.”

Fourth-Quarter Highlights

For the fourth quarter, Information Storage business accelerated revenue growth to 10% year over year. Emerging Storage business accelerated revenue to 73% year over year, propelled by the very successful launch of XtremIO and continued strong growth of Isilon, Atmos and VPLEX products. The company’s Unified and Backup Recovery business increased revenue 11% year over year, benefitting from the recent product launches of the next-generation VNX and Data Domain product lines. Revenue from high-end storage business returned to growth in the fourth quarter as customers continued to turn to the company’s VMAX family. Revenue growth from RSA Information Security business and Information Intelligence business accelerated to 17% and 3% year over year, respectively.

VCE had an excellent fourth quarter as demand for Vblock systems showed strong year-over-year growth. VSPEX reference architecture portfolio continued to extend its market leadership with rapid adoption and increasing popularity among customers and partners. Additionally, Cloud Service Provider Partner program continued in the quarter as the company’s fastest-growing vertical market segment.

In the fourth quarter, VMware continued to excel because it is positioned to help customers move from the client-server era to the mobile-cloud era of computing. As VMware helps customers bridge to this new world and lays the foundation for the build out of the software-defined data center, it is enabling them to achieve new levels of efficiency, control and agility.

Pivotal continued to make progress during the quarter. In the nine months since its formation, it has met the objectives it set out to accomplish in 2013: meeting its financial goals, establishing a strong executive leadership team and launching Pivotal One, a comprehensive, multi-cloud Enterprise PaaS comprised of a set of application and data services that run on top of Pivotal CF, the enterprise distribution of the Cloud Foundry platform.

Consolidated fourth-quarter revenue from the United States increased 11% year over year to $3.5 billion, representing 52% of consolidated fourth-quarter revenue. Revenue from business operations outside of the United States increased 11% year over year to $3.2 billion and represented 48% of consolidated fourth-quarter revenue. Within this, on a year-over-year basis, revenue from EMEA region grew 15%, revenue from AsiaPac and Japan region increased 1%, and revenue from Latin America region grew 12%. Revenue from EBRIC+13 markets increased 17% year over year.

Business Outlook

- Consolidated revenues are expected to be $24.5 billion for 2014. Consolidated revenues for the three months ended March 31, 2014 are expected to be 22% of the full-year revenue.

- Consolidated GAAP operating income is expected to be 18% of revenues for 2014 and consolidated non-GAAP7 operating income is expected to be 25% of revenues for 2014.

- Consolidated GAAP earnings per weighted average diluted share are expected to be $1.38 for 2014 and consolidated non-GAAP earnings per weighted average diluted share are expected to be $1.95 for 2014.

- Consolidated GAAP earnings per weighted average diluted share are expected to be $0.19 for the three months ended March 31, 2014 and consolidated non-GAAP earnings per weighted average diluted share are expected to be $0.35 for the three months ended March 31, 2014.

- The consolidated GAAP income tax rate is expected to be 23% for 2014 and the consolidated non-GAAP7 income tax rate is expected to be 23.5% for 2014. This assumes that the U.S. R&D tax credit for 2014 is extended in the fourth quarter 2014.

- The weighted average outstanding diluted shares are expected to be 2.06 billion for 2014.

- EMC expects to repurchase an aggregate of $2.0 billion of the company’s common stock in 2014.

Comments

First note the last three months of the year are generally the best quarter for EMC and many IT vendors as end users need to spend what remains of their yearly budget before the following year.

Anyway, the growth of the storage business of the giant company is not skyrocking but impressive. No doubt that EMC continues to be the leader of the worldwide storage industry with global revenue of $16,1 billion in 2013, a record for the company, but increasing only 4% from 2012.

In storage software and hardware, it leads the pack since 2004 without interruption, WD continuing to be number two with $15.5 billion for its last fiscal year ended June 2013 and followed by Seagate declining at $14.4 billion for the same period, both of them in storage but essentially in HDDs.

The most successful current storage business of EMC is its Emerging Storage with revenue up 73% Y/Y, propelled by the launch of all-flash subsystem XtremIO in 4Q13 and the growth of Isilon, Atmos and VPLEX products.

The company's Unified and Backup Recovery business increased revenue 11% yearly, benefitting from the recent launches of the next-generation VNX and Data Domain products. Over 70% of these next-gen VNX are shipped with flash in the quarter compared with 50% on the previous generation.

Even revenue from EMC's high-end storage business (VMAX) returned to growth in 4Q13, up 2% for the year.

VCE also had an excellent fourth quarter.

David Goulden, CEO of EMC Information Infrastructure and EMC's CFO, commented: "Storage services gross margins were impacted by higher field service costs compared with Q4 of last year. While this was a headwind to most of 2013 because we expect a similar level of activity this year, the year-on-year impact to storage services margins should be neutral in 2014."

Also commenting EMC results by email,George Teixeira, CEO, DataCore, notes the pitfalls currently facing EMC as it relates to their storage and software-defined storage businesses.

Lower 6% growth revenue is expected for 2014 compared to 7% in 2013 for the global company, and only 3% for storage.

To read the earning call transcript

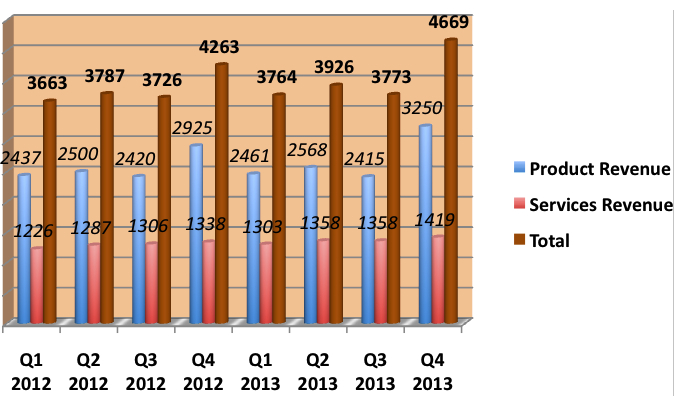

EMC storage revenue for the quarter

(in $ million)

| 4Q12 | 4Q13 | Growth | |

| product revenue | 2,925 | 3,250 | 11% |

| service revenue | 1,338 | 1,419 | 6% |

| total | 4,263 | 4,669 | 10% |

EMC storage revenue for the year

(in $ million)

| 2012 | 2013 | Growth | |

| product revenue | 10,283 | 10,694 | 4% |

| service revenue | 5,157 | 5,438 | 5% |

| total | 15,440 | 16,132 | 4% |

| gross profit | 8,860 (57.4%) | 9,082 (56.3%) | 3% |

Revenue of parts of EMC information infrastructure

(in $ billion)

| 4Q13 | Y/Y growth | 2013 | Y/Y growth | |

| high end | 1.28 | 1% | 4.74 | 2% |

| unified and backup/recovery | 1.87 | 11% | 6.21 | 4% |

| emerging storage | 0.56 | 73% | 1.48 | 54% |

| storage (other and PS) | 0.96 | -2% | 3.70 | 4% |

Two years of quarterly storage revenue

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter