eMMC to Remain Mainstream Format in 2014-2016 – DRAMeXchange

UFS to gain momentum in 2016

This is a Press Release edited by StorageNewsletter.com on December 2, 2013 at 2:46 pmAccording to DRAMeXchange, a research division of TrendForce Corp., eMMC 4.5 has replaced eMMC 4.41 on a massive scale since 2H13, becoming the main storage format used in smartphones and tablet PCs.

Judging from the product strategies employed by eMMC vendors and AP chip manufacturers, it is predicted that eMMC 5.0 products will begin entering a heightened production phase in 2H14.

For UFS, the format is not expected to gain much ground until 2016.

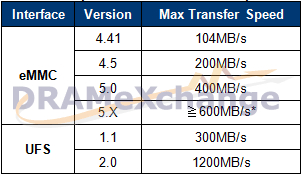

The biggest difference between eMMC 4.5 and eMMC 4.41 lies in their maximum transfer speeds, which is approximately 200MB/s and 104MB/s, respectively. In addition to fully utilizing NAND flash functions such as ONFI/Toggle, eMMC 4.5 is also capable of supporting higher R/W speeds in smartphones and tablets.

The majority of the NAND flash manufacturers of eMMC 4.5 products did not design-in for next-gen smartphone and tablet products until 1Q13. As such, eMMC 4.5 will only replace eMMC 4.41 as the market mainstream as smartphone/tablet OEMs begin promoting their new devices throughout 2H13.

In 2H13, major eMMC vendors have begun delivering samples of 1X nm class eMMC 5.0 products to their clients. Looking at the product development plans of the smatphone and tablet AP chip manufacturers, it appears certain that eMMC 5.0 will be the successor to eMMC 4.5.

Originally believed to have a shot at emerging throughout 2014-2015, TrendForce predicts that the UFS format will have to wait until at least 2016 before having a chance to compete with eMMC in the high-end smartphone and tablet markets.

The reasons for this are outlined below:

1. Product Efficiency Considerations

The fastest transfer speed for eMMC 5.0 is approximately 400MB/s, which is twice the rate offered by eMMC 4.5. For the two major types of UFS interfaces, UFS 1.1 and UFS 2.0, the maximum transfer speed is 300MB/s and 1200MB/s, respectively. The effectiveness of eMMC 5.0, as the numbers clearly demonstrate, falls between that of the UFS 1.1 and UFS 2.0 formats. Nonetheless, eMMC 5.0 was able to get a head start in the market, given its superior speed over UFS 1.1 and the fact that JEDEC took longer to announce the specs format for UFS 2.0 than for eMMC 5.0. In an attempt to not let UFS 2.0 get too far ahead in terms of speed, JEDEC is taking notable steps to develop the specifications for the eMMC 5.X format.

TrendForce believes that the format’s speed will end up being at least 600MB/s, and that the competition between UFS 2.0 and eMMC 5.X will be intense in the future periods.

Comparison of Max Transfer Speeds for eMMC and UFS

Notes: figures based on TrendForce’s estimations; JDEC specs not yet finalized

(Source of data: JEDEC, data organized by TrendForce)

2. AP Chip Consideration

The format preferences held by AP chip manufacturers such as Qualcomm, nVidia, MTK, and Samsung all play a crucial role in determining whether smartphone and tablet manufacturers choose the eMMC or UFS interface. Aside from Samsung’s 5420 and Qualcomm’s 8084 chips, both of which are likely to support the eMMC 5.0 and UFS 1.1 formats upon their release in 2014, other manufacturers are expected to stick to the eMMC 5.0 interface.

TrendForce’s current research suggests that Samsung will be the only eMMC supplier to promote UFS 1.1 products in 2014, and that the other suppliers will pass over UFS 1.1 in favor of waiting for the upgraded, more advanced UFS 2.0 format.

Considering the fact that UFS is completely different from eMMC in terms of overall structure and design, it is worth mentioning, also, that the former’s development phase will inevitably take a long time for manufacturers, whether it is for the AP chips or flash controller chips. All in all, given that the vendors for UFS 1.1 products are limited, that the format’s effectiveness is less impressive than that of eMMC 5.0, and that its design can be relatively difficult to implement, eMMC 5.0 is likely to remain the go-to format for the majority of the AP chip manufacturers.

TrendForce believes 2015 will be the earliest year during which AP chip manufacturers will eventually begin supporting the UFS 2.0 format.

3. Cost Consideration

While the speed of UFS 2.0 is able to easily exceed 1,000MB/s, its development cost (especially for the controller IC part) is noticeably high when compared to the eMMC 5.X interface. With the innovation in the high-end smartphone space slowing down and the low cost and mid-ranged market sectors expanding at a rapid pace, UFS 2.0 is likely to only be competitive against eMMC 5.X in the high-end markets. In the short run, the former is not likely to become mainstream within the industry.

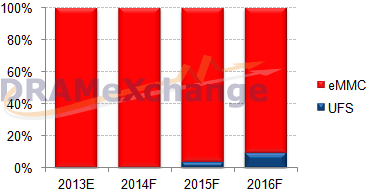

Taking into account all of the three aforementioned factors – product efficiency, AP chip manufacturer preferences, and cost -, TrendForce projects that the UFS format may only be able to compete against eMMC following the release of UFS 2.0, and that the competition will be mostly concentrated in the high-end smartphone and tablet markets. For now, eMMC will remain the market mainstream in the mid-to-low end market sectors. The proportion of shipments that is expected be accounted for by UFS products in 2016 is approximately 10%.

UFS and eMMC shipment proportion estimations

(Source: DRAMeXchange, November 2013)

The major suppliers of eMMC products – for example, Samsung, SK Hynix, Sandisk, Toshiba, Micron, and KSI- represent roughly 95% of the market, and are known to employ different types of product strategies.

With regard to the eMMC 5.0 products, Samsung, Toshiba, and Sandisk are all known for producing their controller chips in-house, while companies such as Micron and SK Hynix generally choose to outsource their production to third party manufacturers (despite their supposed interest in eventually creating in-house controller chips).

SMI and Phison are currently the two more well known manufacturers in the eMMC controller IC design and outsourcing business.

In addition to these two companies, Alcor, Marvell, Solid State System, Skymedi, and StorArt also provide similar services, and are hoping to eventually grab a larger chunk of the market.

With competitive pressure arising from Samsung’s TLC eMMC, TrendForce believes that the aforementioned controller IC chip manufacturers will attempt to provide TLC eMMC controller chip solutions in 2014 as a means to seize further opportunities in the eMMC vendor supply chain.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter