NAND Flash Memory Market Decelerating in 2H13

As Internet services trump local storage in smartphones and tablets.

This is a Press Release edited by StorageNewsletter.com on November 26, 2013 at 2:50 pmThe global NAND flash memory market is decelerating in the second half of the year as demand diminishes for local storage in smartphones and tablets, due in part to the rise of cloud-based services, according to IHS Inc.

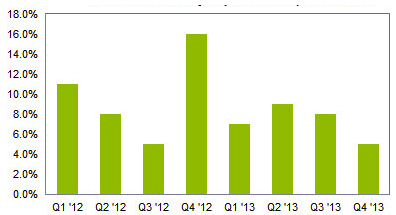

Nand Flash Quarterly Sequantial Bit Shipment Growth

(Source IHS, November 2013)

Preliminary estimates show that total NAND bit shipments were estimated to have grown 8% in the third quarter, down from 9% in the second quarter, according to a new Flash Dynamics brief from IHS.

For the year’s final quarter, NAND shipments will expand by an even lower 5%, down sharply from the 16% rise seen in the fourth quarter of 2012, as presented in the attached figure.

“The fast-growing season for flash memory appears to be running out of momentum as density growth levels off in many of the products that are leading users of NAND,” said Ryan Chien, storage systems analyst, IHS. “Moreover, few upcoming devices are expected to increase their NAND options, further dampening growth in the short term.”

Despite the second-half slowdown, the projected total for the NAND flash industry in 2013 will amount to 39 billion gigabytes of shipments and $24 billion in revenue-both industry records.

Cloud challenges

“Streaming media options and free cloud storage are diminishing the prospects for increased NAND usage in smartphones,” Chien said. “This is true for all three major mobile OSs-Apple’s iOS, Google’s Android and Microsoft’s Windows Phone. With less need to store data in local devices, the requirement for greater storage is reduced.”

Smartphones have memory issues

Another reason for slower NAND growth is that NAND use is limited in low-end smartphones that make up the fastest-growing part of the smartphone market. By keeping NAND use down, low-end smartphones can more easily control costs and maintain affordability.

Meanwhile, newly released flagship handsets from Apple, Samsung and Sony have not added larger density options compared to predecessor models.

Consumer indifference

Furthermore, consumer interest in recent years has been lukewarm in several NAND-heavy device categories like game consoles, PCs, e-readers and USB drives. And in media tablets, the rapid transition to lower-cost 7- and 8-inch sizes is squeezing product price points-and, therefore, flash densities.

NAND pricing jumps

Regardless of the slowdown in flash consumption, prices have actually risen considerably. A fire at South Korean memory supplier SK Hynix has caused it to shift some of its NAND capacity to DRAM. And even though the impact on NAND will be small and NAND bit production in the fourth quarter is still expected to increase, the possibility of supply challenges has catalyzed major component price hikes.

For instance, the IHS NAND price index-formulated to keep track of movements in NAND pricing over time-has jumped nearly 10% since the fire, signaling some nervousness in the market. As demand concerns start to weigh on the market, however, prices have drifted lower in recent weeks.

The relationship between DRAM and NAND continues to be important. DRAM figures prominently in various functions, from storing mapping tables in SSDs, to masking slower triple-level-cell NAND in the client SSDs of Samsung, to providing extra speed in enterprise flash caches for sequentializing write operations.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter