Cease Fire in HDD Vs. SSD Price War – PriceG2

Both sides pause to make profit.

This is a Press Release edited by StorageNewsletter.com on November 19, 2013 at 2:48 pm2013 will be remembered where SSD pricing took a new direction – flat.

In previous years PriceG2, a market research and consulting firm with expertise in SSD, HDD, NAS, USB flash drives, and memory cards, observed SSD pricing falling at a linear rate.

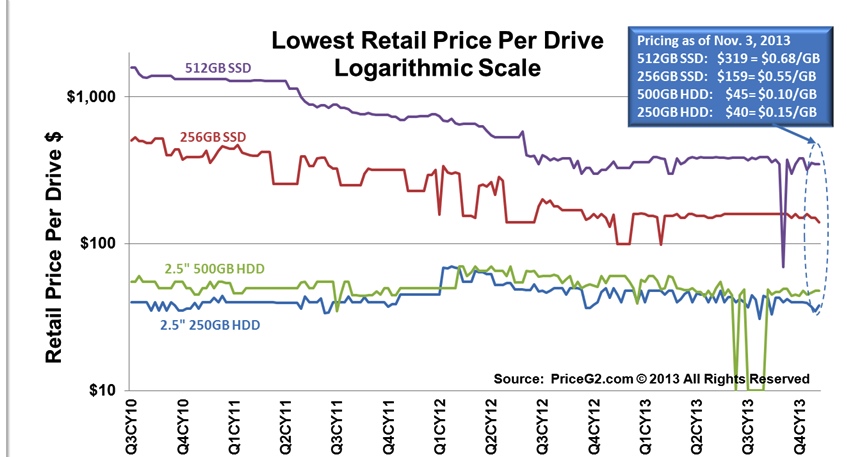

The 512GB SSD drive is a great example. From July 2010, until December 2012, the lowest retail price for the 512GB SSD in the U.S. was dropping at a linear rate of y = -9.95x + 1488.2 with an amazing R_ = 95%. The slope of the line changed in December 2012, however, and pricing has been overall flat throughout 2013 (with exception of short term specials).

HDD pricing has drifted down some in 2013, but that must be qualified by stating that throughout most of the year, retail HDD prices were still above the every day levels before the October 2011 floods in Thailand that temporarily disrupted factories and the supply chain.

HDD pricing has drifted down some in 2013, but that must be qualified by stating that throughout most of the year, retail HDD prices were still above the every day levels before the October 2011 floods in Thailand that temporarily disrupted factories and the supply chain.

Stocks at 52-Week Highs

HDD and SSD manufacturer stocks are currently trading near their 52-week highs including Seagate, Western Digital, SanDisk, and Micron.

Here’s an insightful quote from a quarterly earnings call earlier this year: “Our cost per gigabyte declined 5% sequentially and 21% year-over-year,” Judy Bruner, CFO, SanDisk (July 17, 2013).

Combining SanDisks’s declining costs with flat industry prices, creates an environment to increase gross margins. HDD manufacturers similarly have a religion to reduce costs each quarter regardless of what market pricing is doing.

Battle Lines Are Redrawn

The battle of HDD vs. SSD avoided head-to-head combat in 2013, but instead a battle by proxy ensued. Consumer computing preferences for tablets displaced sales that might otherwise have gone to notebook PCs.

For example, a consumer’s purchase of a tablet PC with a 64GB SSD inside replaced a notebook PC with a 500GB HDD inside. “Make it up on the other side?” refers to the possibility that since consumers are buying tablet PCs with only a fraction of the storage that notebook PCs have, that consumers will quickly run out and need to replace all 500GB in a HDD based cloud storage data center. True? Yes and no. HDD manufacturers have seen an increase in their unit shipments of enterprise drives in recent quarters. However, CIOs in charge of data centers are pursuing initiatives of content de-duplication, data compression, and only buying storage capacity needed to sustain operations may equate to a less than a 1:1 transition of former notebook PC’s HDD storage to cloud data centers as consumers buy more tablet PCs.

What to Expect in 2014

The HDD industry has consolidated down to three suppliers: Seagate, Toshiba, and Western Digital. From the Thailand floods of 2011, HDD manufacturers learned that the purchase orders still come in, even when prices are high. Seagate and Western Digital may be near critical mass in terms of how much market share they can gain from the other.

Indeed, Seagate’s chairman and CEO Steve Luczo said in their earnings call on October 28, 2013, that his company is focused on “quality of share,” interpreted as seeking market share that also comes with the highest gross margins.

SSD manufacturers are nearing a technology transition from planar NAND to 3D NAND geometries, but this may not be influential in 2014. SanDisk has gone on record as saying they target pilot production of BiCS NAND in 2015 and volume ramp of product in 2016. In the meantime, SanDisk plans on two more generations, 1Y and 1Z, reductions in geometry.

Micron has a more aggressive introduction of 3D with samples scheduled for the first quarter of 2014, and a slow ramp up by the end of 2014.

With HDD and SSD manufacturers enjoying profits now, and with evolutionary (not revolutionary) technology dominating NAND Flash/SSD factory outputs, continuity of overall flat pricing in both HDD and SSD industries is likely in 2014.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter