Seagate: Fiscal 1Q14 Financial Results

In parallel with WD

This is a Press Release edited by StorageNewsletter.com on October 30, 2013 at 2:42 pm| (in $ million) | 1Q13 | 1Q14 |

| Revenue | 3,732 | 3,489 |

| Growth | -7% | |

| Net income (loss) |

582 | 427 |

Seagate Technology plc reported financial results for the first quarter of fiscal year 2014 ended September 27, 2013.

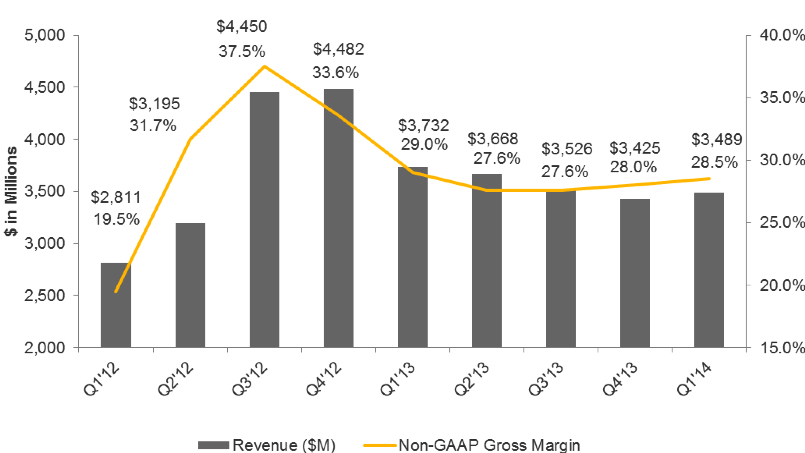

During the first quarter, the company reported revenue of approximately $3.5 billion, gross margin of 28.0%, net income of $427 million and diluted earnings per share of $1.16.

On a non-GAAP basis, which excludes the net impact of certain items, it reported gross margin of 28.5%, net income of $473 million and diluted earnings per share of $1.29.

During the first quarter, the company generated approximately $682 million in operating cash flow, paid cash dividends of $135 million and repurchased 4 million ordinary shares for approximately $182 million. There were 359 million ordinary shares issued and outstanding as of the end of the quarter.

Subsequent to the first quarter, the company repurchased 32.7 million ordinary shares from Samsung Electronics Co., Ltd. for approximately $1.5 billion.

“The solid financial results we achieved this quarter reflect the ongoing execution of our business model,” said Steve Luczo, Seagate’s chairman and CEO. “While the challenges of technology transitions and macro uncertainty are driving us to manage our business conservatively, we remain focused on the fact that the demand for EBs of storage continues to increase. We continue to invest in our market-leading storage technology portfolio to enable cloud, mobile and open source storage advancement as we believe these market trends represent new and significant opportunities for Seagate.”

Quarterly Cash Dividend

The board of directors has approved an increase in the quarterly cash dividend of $0.05 from $0.38 per share in the previous quarter to $0.43 per share this quarter, an increase of approximately 13%. This dividend will be payable on November 26, 2013 to shareholders of record as of the close of business on November 12, 2013. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Comments

The figures of Seagate and WD, running in parallel, are comparable for their respective 1FQ14, with a slight advantage to the second one remaining the leader of the HDD industry:

| in million | Seagate | WD |

| Revenue | $3,489 (-7% Y/Y) | $3,804 (-6% Y/Y) |

| Net income | $427 | $495 |

| HDD shipped | 55.7 | 62.6 |

Also Seagate announced the shipping of over one million solid state hybrid drives and did over $100 million of solid stake related storage in the quarter.

Units shipped by Seagate by market (in million)

Also Seagate announced the shipping of over one million solid state hybrid drives and did over $100 million of solid stake related storage in the quarter.

Units shipped by Seagate by market (in million)

| Enterprise | Client Compute | ClientNon Compute | ExabyteShipped | AverageGB/drive | |

| 1Q12 | 6.9 | 33.3 | 10.5 | 32.2 | 634 |

| 2Q12 | 6.4 | 32.7 | 7.8 | 30.6 | 653 |

| 3Q12 | 7.4 | 43.8 | 9.5 | 41.2 | 679 |

| 4Q12 | 8.5 | 46.3 | 11.2 | 45.6 | 692 |

| 1Q13 | 6.3 | 40.7 | 11.0 | 43.3 | 733 |

| 2Q13 | 7.3 | 39.2 | 11.7 | 47.9 | 826 |

| 3Q13 | 7.5 | 36.6 | 11.6 | 47.1 | 849 |

| 4Q13 | 8.2 | 34.7 | 10.9 | 46.5 | 863 |

| 1Q14 | 8.1 | 36.3 | 11.3 | 48.7 | 875 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter