Not so Good Quarterly Results for Western Digital

Worst for Fusion-io, LSI, Mellanox, QLogic, Silicon Motion, Symantec

This is a Press Release edited by StorageNewsletter.com on October 28, 2013 at 1:50 pm| (in $ million) | 1Q13 | 1Q14 |

| Revenue | 4,035 | 3,804 |

| Growth | -6% | |

| Net income (loss) |

519 | 495 |

Western Digital Corp. reported revenue of $3.8 billion and net income of $495 million, or $2.05 per share for its first fiscal quarter ended Sept. 27, 2013.

On a non-GAAP basis, net income was $514 million or $2.12 per share.

Non-GAAP net income for the first quarter fiscal 2014 consists of GAAP net income of $495 million plus $47 million of amortization of intangibles related to the acquisitions of HGST, sTec and VeloBit, $13 million of charges related to litigation, $13 million for acquisition-related expenses and $11 million related to fixed asset impairment and other charges, offset by a gain of $65 million for a flood-related insurance recovery. Non-GAAP earnings per share of $2.12 for the first quarter is calculated by using the same 242 million diluted shares as is used for GAAP earnings per share. The tax effect of the non-GAAP charges was not material.

In the year-ago quarter, the company reported revenue of $4.0 billion, net income of $519 million, or $2.06 per share. Non-GAAP net income in the year-ago quarter was $594 million, or $2.36 per share.

Non-GAAP net income for the first quarter fiscal 2013 consists of GAAP net income of $519 million plus $49 million of amortization of intangibles related to the acquisition of HGST and $26 million related to employee termination benefits and other charges. Non-GAAP earnings per share of $2.36 for the first quarter is calculated by using the same 252 million diluted shares as is used for GAAP earnings per share. The tax effect of the non-GAAP charges was not material

The company generated $680 million in cash from operations during the September quarter, ending with total cash and cash equivalents of $4.9 billion. During the quarter, the company utilized $150 million to buy back 2.3 million shares of common stock. On Sept. 19, the company declared a $0.25 per common share dividend, which was paid on Oct. 15.

“We continued to perform well in the September quarter as we remained focused on delivering value to our customers through differentiated and innovative storage solutions in all of our served markets,” said Steve Milligan, president and CEO. “Our HGST and WD subsidiaries continued to execute very well. Outstanding linearity drove strong operating results, with gross margins above the midpoint of our model range and earnings per share well above the high end of our guidance. Longer term, we are very excited about our ability to enable the ongoing creation, storage and management of digital content by consumers and businesses.”

Comments

| Units in million | Enterprise | Desktop | Notebook | CE | Branded | Exabyte Shipped | Average GB/drive | ASP |

| 1Q12 | 2.4 | 21.6 | 19.6 | 7.1 | 7.1 | 36.7 | 634 | $46 |

| 2Q12 | 1.7 | 11.4 | 9.8 | 2.4 | 3.2 | 16.5 | 578 | $69 |

| 3Q12 | 3.6 | 16.0 | 18.1 | 3.6 | 2.9 | 25.7 | 581 | $68 |

| 4Q12 | 7.9 | 21.2 | 32.8 | 4.2 | 5.0 | 47.4 | 668 | $65 |

| 1Q13 | 6.0 | 16.8 | 25.9 | 8.0 | 5.8 | 44.3 | 708 | $62 |

| 2Q13 | 6.6 | 17.7 | 21.3 | 6.5 | 7.1 | 47.6 | 804 | $62 |

| 3Q13 | 7.2 | 18.4 | 21.5 | 6.5 | 6.5 | 48.4 | 807 | $61 |

| 4Q13 | 7.9 | 16.2 | 24.0 | 6.5 | 5.3 | 47.7 | 797 | $60 |

| 1Q14 | 7.8 | 17.3 | 22.9 | 6.5 | 6.1 | 50.8 | 811 | $58 |

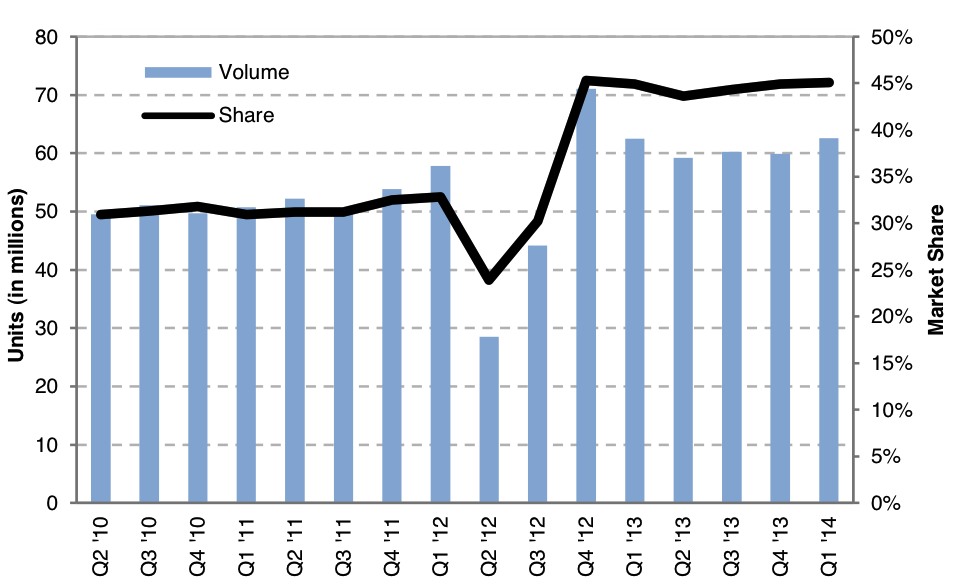

Western Digital shipped a total of 62.6 million drives for its most recent quarter, compared to 59.9 million in the former one, or a 4.5% sequential growth, but this figure was about identical (63.5 million) for the same three-month period one year ago. Revenue decreased 6% Y/Y because average selling price (ASP) was down yearly from $62 to $58 (also -6%). The manufacturer is not losing market share against rivals Seagate and Toshiba as the growth of the total available market (TAM) is flat and will continue to be flat next quarter, according to Western Digital's CEO, who adds: "Longer term, we remain excited about the opportunity to address the 34% annual growth in data that we are forecasting through 2020." Enterprise and notebook HDD shipments are down sequentially. It's flat for CE devices and increasing for desktop and branded devices. For the first time, Western Digital revealed a figure of its enterprise SSD revenue for 3CQ13: $106 million, up only 2%. It represents a mere 2.7% of global revenue. It's probably less than that for Seagate that never gave any figure on its SSD activity. The HDD leader expects revenue in the range of $3.775 billion to $3.875 billion next quarter, not a big jump. Milligan also said: "We are on track to launch our new 7-disk helium-based sealed-drive this quarter to a select group of customers." Volume and market share  To read the earnings call transcript

To read the earnings call transcript

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter