Start-Up Profile: SolidFire

in all-SSD scale-out storage solution large enterprises

By Jean Jacques Maleval | September 25, 2015 at 3:10 pmName

SolidFire, Inc.

Headquarters

Boulder, CO; offices in UK (European HQs), France, Germany, Singapore, Australia, South Korea and Japan

Founded in

December 2009

Financial funding

Total of $150 million including:

- 37 million including two rounds at $11 million (A) and $25 million (B) in 2011

- $31 million (C) in 2013

- $82 million (D) in 2014

Samsung is an an investor with NEA, Valhalla Partners, Novak Biddle, Greenspring Associates as well as Frank Slootman former CEO of Data Domain.

Main executives

Most of them from HP (LeftHand Networks and 3par)

Dave Wright, founder and CEO: He left Stanford in 1998 to help start GameSpy Industries, in online videogame media leading a team that created a backend infrastructure powering thousands of games and millions of gamers. GameSpy merged with IGN Entertainment in 2004. He served as chief architect for IGN and lead technology integration with FIM / MySpace after IGN was acquired by NewsCorp in 2005. In 2007 he founded Jungle Disk, in cloud-based storage and backup solutions for consumers and businesses, acquired by Rackspace in 2008 where he worked with the cloud division.

Dave Wright, founder and CEO: He left Stanford in 1998 to help start GameSpy Industries, in online videogame media leading a team that created a backend infrastructure powering thousands of games and millions of gamers. GameSpy merged with IGN Entertainment in 2004. He served as chief architect for IGN and lead technology integration with FIM / MySpace after IGN was acquired by NewsCorp in 2005. In 2007 he founded Jungle Disk, in cloud-based storage and backup solutions for consumers and businesses, acquired by Rackspace in 2008 where he worked with the cloud division.

- RJ Weigel, president: He served as VP for Americas global accounts, enterprise storage organization at HP. He came to this role through 3Par, where he served as WW VP of sales and field operations prior to acquisition by HP. Prior to that, he served as VP for the Central United States for NetApp. He also spent several years with Cisco.

John Hillyard, CFO: He most recently served as CFO of Datalogix, a digital media marketing company. Prior to that, he was the CFO of LeftHand. - James Whitemore, chief marketing officer: He most recently served as SVP of sales and marketing at West IP Communications, provider of technology-driven communications services, where he led the company’s Unified Communications-as-a-Services (UCaaS) business. Prior to that, he was EVP of sales and marketing at Smoothstone IP Communications and formerly was the chief marketing officer at Savvis and has held a variety of sales and marketing positions in Europe, Asia and the U.S. with Sun, IBM, StorageTek and Standard Telephones and Cables.

- Jay Prassl, VP marketing: He was employee number five at LeftHand, where he spent 10 years.

- Tim Pitcher, VP international: He was senior director of global account storage at HP after its acquisition of 3Par. Prior to that, he served for 8 years as area VP at NetApp.

- Daniel Berg, chief product officer: He joins from Avaya where he was VP R&D. Previously he was CTO at Skype after working at Sun, IBM and Honeywell.

- Brian McCloskey, VP of Americas sales: He served as senior director of enterprise East and Canada for the Isilon storage division at EMC. He started with Isilon in 2007. Prior to Isilon, he held various management, sales, and systems engineering roles at EMC and Data General.

- Adam Carter, VP of product management: He led product management at LeftHand, HP and VMware

- Dave Cahill, VP corporate development and strategy: He was founder of Diligence Technology Advisors, starting his career at EMC, being an early member of the Centera business unit.

- Jim Burglin, director of support and services: He built a support and services team for Scale Computing. He also helps LeftHand grow their base to over 3,000 customers and then worked one year at HP.

Among the board’s directors: Bill Chambers who was CEO of LeftHand division in the HP StorageWorks organization and Ron Bernal who was at the board of Data Domain (acquired by EMC), Drobo (acquired by Connected Data) and ProStor (acquired by Imation and Tandberg)

Number of employees

430Technology

All-SSD scale-out storage solution designed for large enterprisesProduct description

Clustered with industry-standard hardware and iSCSI, the flash array is scalable from a minimum of 4 up to 100 SF nodes reaching from 35TB (with data reduction) and 200,000 IO/s to 3.5PB and 7.5 million IO/s. The architecture can be compared with those of Cleversafe or Scality with several nodes on a 10GbE copper or fiber network but here with SSD and not HDD subsystems. The is no RAID, each data being copied twice on different nodes for redundancy. A drive failure can be repaires in five minutes.Solidfire uses de-dupe, compression for average of 4X data reduction, thin provisioning and 256-bit encryption-at-rest.

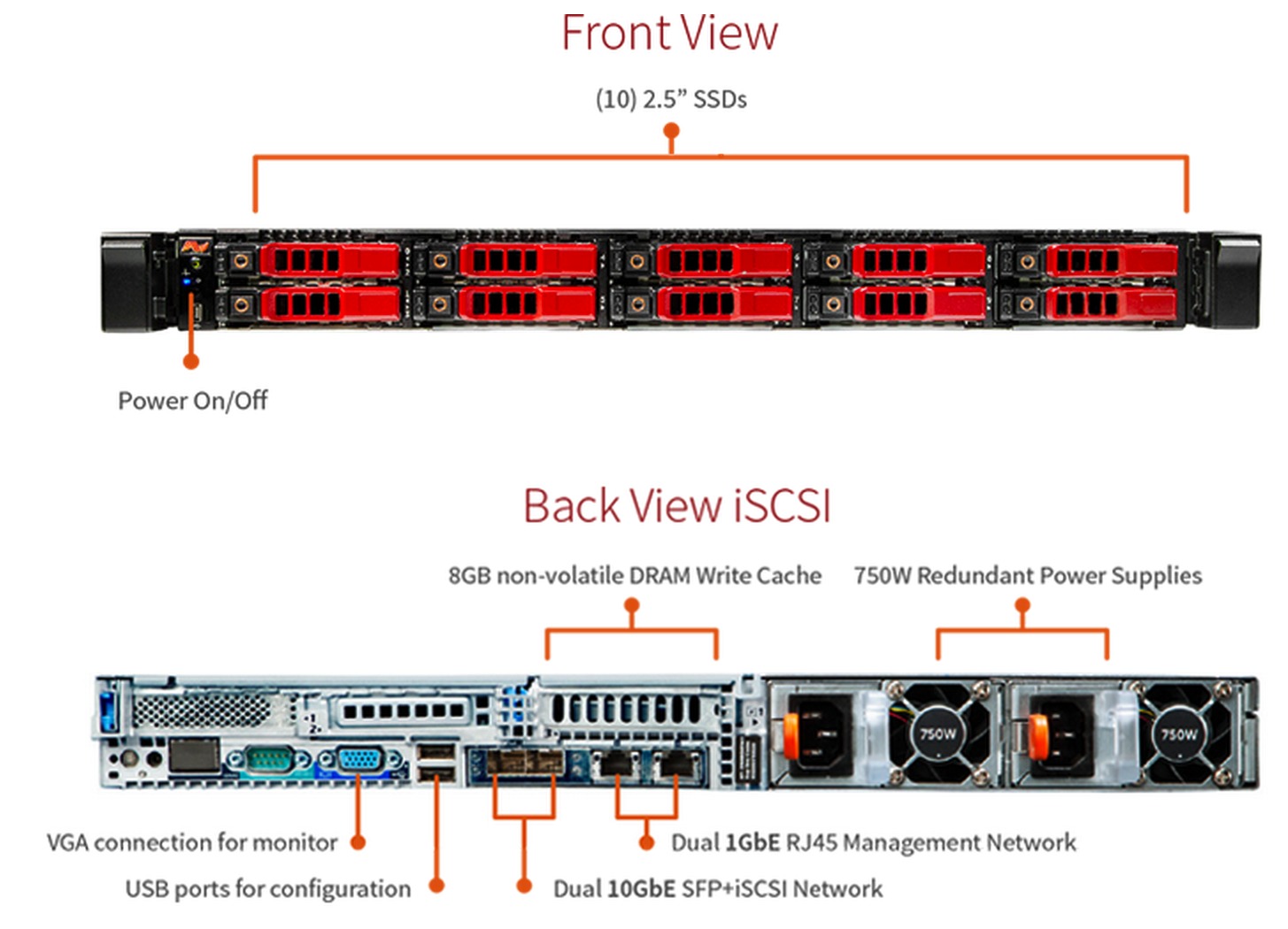

Each 1U node is a rack built with commodity products (Intel processor, 64GB to 256GB read cache, dual 10GbE connectors, two power supplies, ten 2.5-inch SATA SSDs from 240GB to 960GB).

There are three sources of SSDs: Intel, Samsung and SanDisk.

SoidFire has bought a lot of SSDs and here CEO David Wright gives these percentages on the reliability of flash units compared to HDDs:” Annual failure rate is 0.25% for SSDs and 2% to 3% for HDDs.”

Integration of the systems is available for VMware vCenter plug-in, VAAI, SRM, OpenStack driver, CloudStack plug-in, OnApp built-in SolidFire control, Microsoft VSS provider, PowerShell, VMware SRM/SRA and Microsoft PowerShell.

The software managing the system, a software-defined storage, is also being sold by SolidFire separately.

Roadmap

Flash for object storageReleased date of first product

November 2012Price range

Base model with four nodes with 35TB began at $100,000. Average price of customers’ first purchase is $240,000 with 80% of clints buying more the following year.Revenue and profitability

Sales were not revealed but Wright said that SolidFire is considered as “the number two company in flash arrays [behind Pure Storage] by analysts.” The firm has never been profitable but losses are going down.Distribution

Three fourth of the business is indirect, main distributors being Dell and Arrow in Europe≠ of customers

For Wright there are “Hundreds” (with “s” at the end) in 40 countries, with 20% outside USA last year and 50:50 split between enterprises and cloud service providersMain customers

CenturyLink, Coly, eBay, Fico, PayPal, SungardMain competitors

EMC, HP 3par, NetApp ad Pure StorageIPO

Wright thinks about it but does not give ant deadline. He is waiting about the result of the coming IPO of Pure Storage and to see when the market conditions will be favorable.Read also:

Start-Up’s Profile: SolidFire

In all-SSD storage system for large cloud environment

2013.02.19 | Press Release | [with our comments]

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter