WW Purpose-Built Backup Appliance Market Up 2.5% to $3.35 Billion in 2015

Increasing 4% in 4Q15 from 4Q14, EMC easy leader with more than 60%

This is a Press Release edited by StorageNewsletter.com on March 24, 2016 at 2:57 pmWorldwide purpose-built backup appliance (PBBA) factory revenues grew 4.1% year over year totaling $1.05 billion in the fourth quarter of 2015 (4Q15), according to the International Data Corporation‘s Worldwide Quarterly Purpose-Built Backup Appliance Tracker.

For the full year, factory revenue was up 2.5%, to $3.35 billion in 2015.

Total PBBA open systems factory revenue increased 6.0% year over year in 4Q15 with revenues totaling $958.2 million while the mainframe market experienced a decline of -12.8% for the same period.

Total worldwide PBBA capacity shipped for 4Q15 reached 1,160PB, an increase of 25.6% year over year, while annual capacity was up 23.1% to 3.30EB.

“Growth in the worldwide PBBA market remained strong in the fourth quarter, hitting the billion dollar mark for only the second time in any given quarter,” said Liz Conner, research manager, storage systems. “Despite the continued commoditization of storage hardware, PBBA systems vendors are adapting, putting greater emphasis on backup and deduplication software, meeting recovery objectives, the ability to tier to the cloud, and increased ease of use. The results are a more flexible and agile product that is helping to meet a wider range of data protection needs.”

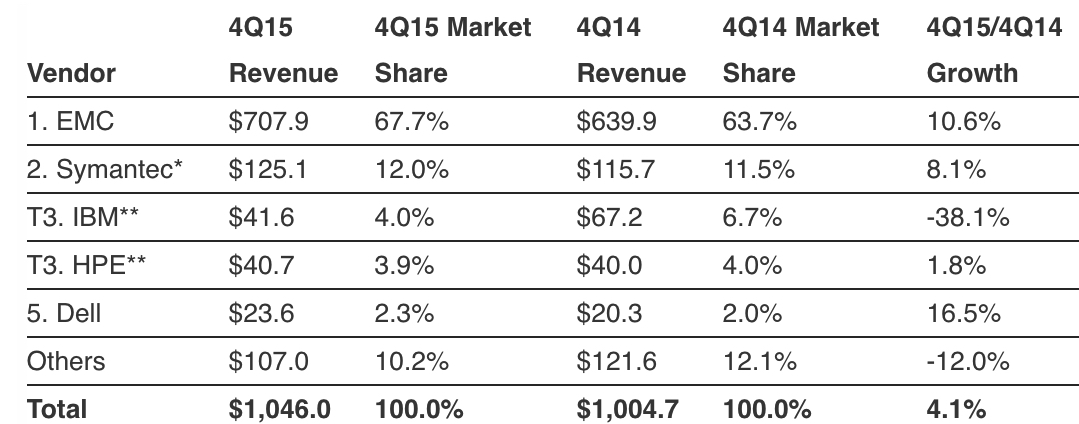

Total WW PBBA 4Q15 Results

EMC maintained its lead in the overall PBBA market with 67.7% revenue share in the fourth quarter, followed by Symantec with 12.0% share. IBM and HPE tied** for the third position with 4.0% and 3.9% market share, respectively. Dell moved into the number 5 PBBA vendor position with a 2.3% share of the worldwide market.

Top 5 Vendors, WW PBBA Factory Revenue, Market Share and Y/Y Growth, 4Q15

(revenue in $ million)

(Source: IDC Worldwide Purpose Built Backup Appliance Quarterly Tracker, March 23, 2016)

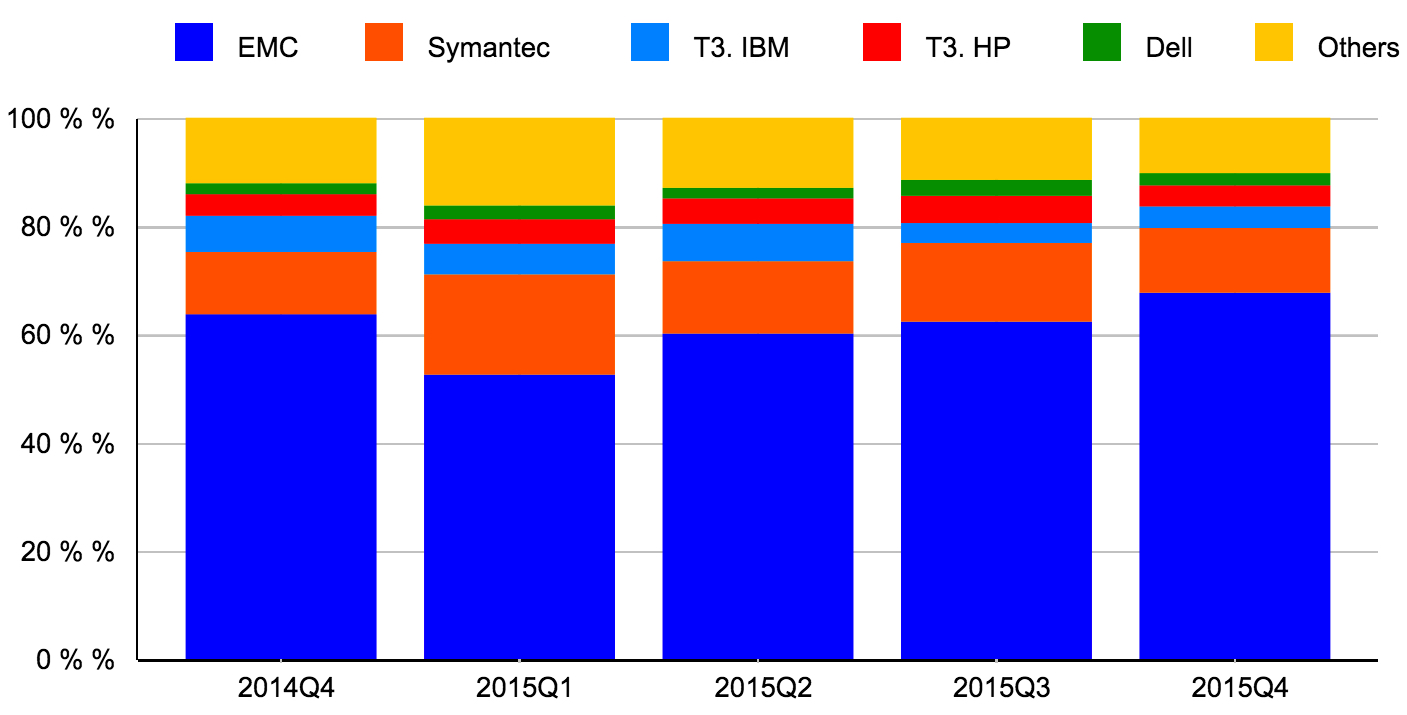

WW Total PBBA Market, Top 5 Vendors, 4Q14, 4Q15

(shares based on revenue)

(Source: IDC Worldwide Purpose Built Backup Appliance Quarterly Tracker, March 23, 2016)

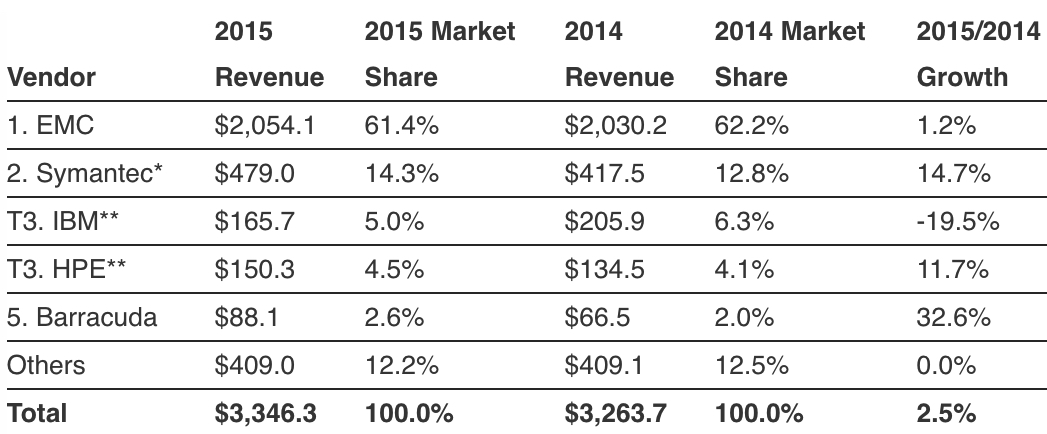

Total W PBBA 2015 Results

EMC maintained its lead in the overall PBBA market with 61.4% revenue share in 2015, followed by Symantec with 14.3% share. IBM and HPE tied** for the third position with 5.0% and 4.5% market share, respectively. Barracuda moved into the number 5 PBBA vendor position with a 2.6% share of the worldwide market.

Top 5 Vendors, WW PBBA Factory Revenue, Market Share, and Y/Y Growth, 2015

(revenue in $ million)

(Source: IDC Worldwide Purpose Built Backup Appliance Quarterly Tracker, March 19, 2015)

Notes:

* Symantec includes the Veritas business.

** IDC declares a statistical tie in the worldwide purpose-built backup appliance market when there is less than one% difference in the revenue share of two or more vendors.

Taxonomy Notes:

IDC defines a purpose-built backup appliance (PBBA) as a standalone disk-based solution that utilizes software, disk arrays, server engine(s), or nodes that are used for a target for backup data and specifically data coming from a backup application (e.g., NetWorker, NetBackup, TSM, and Backup Exec) or can be tightly integrated with the backup software to catalog, index, schedule, and perform data movement. The PBBA products are deployed in standalone configurations or as gateways. PBBA solutions deployed in a gateway configuration connect to and store backup data on general-purpose storage. Here, the gateway device is serving as the component that is purpose built solely for backup and not for supporting any other workload or application. Regardless of packaging (as an appliance or gateway), PBBAs can have multiple interfaces or protocols. Also, PBBAs often can provide and receive replication to or from remote sites and a secondary PBBA for the purpose of DR.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter