WW Personal and Entry Level Storage Market Declined in 1Q15 – IDC

6.4% year over year and 13.6% sequentially

This is a Press Release edited by StorageNewsletter.com on May 19, 2015 at 2:54 pmWorldwide personal and entry-level storage (PELS) shipments declined by -6.4% year over year and -13.6% sequentially, finishing 1Q15 with 17.6 million units, according to the International Data Corporation‘s Worldwide Personal and Entry Level Storage Tracker.

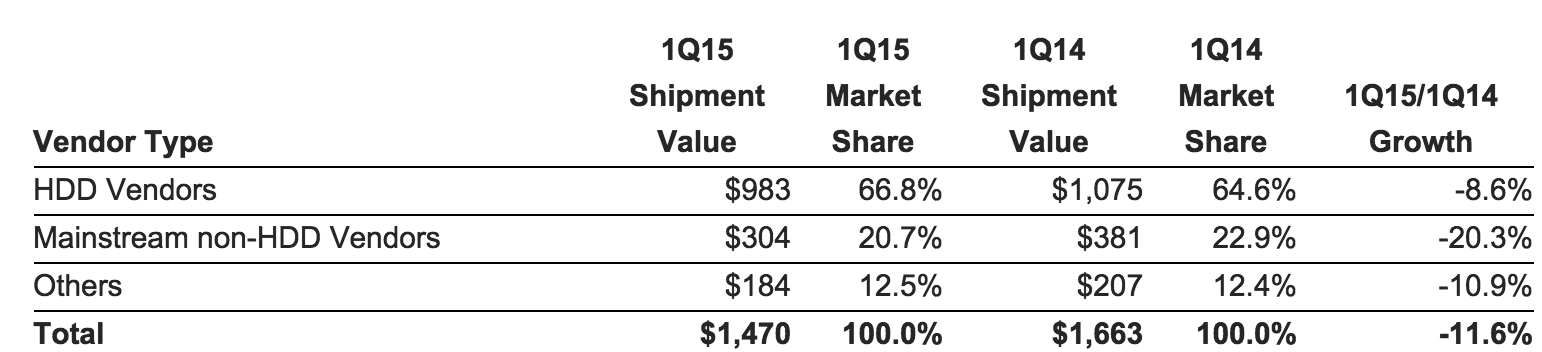

Shipment values declined along with unit shipments, down -11.6% from a year ago to $1.5 billion.

“Broadly speaking, the size of this market has changed little over the past two and a half years. This is partly due to competition from public cloud offerings and partly due to a fundamental shift of media consumption preferences,” said Jingwen Li, research analyst, storage systems. “It’s important to note, however, that there are still untapped growth opportunities within this market. Personal and entry level NAS, for example, would benefit greatly from an increased level of marketing programs focused on building awareness.”

Market Highlights

Dual interface products grew at a significant rate of 56.7% year over year, albeit off a small base. USB/Thunderbolt and USB/WiFi offerings contributed most of the growth of this category and continued to benefit from a shift away from eSATA, FireWire, and Thunderbolt-only offerings.

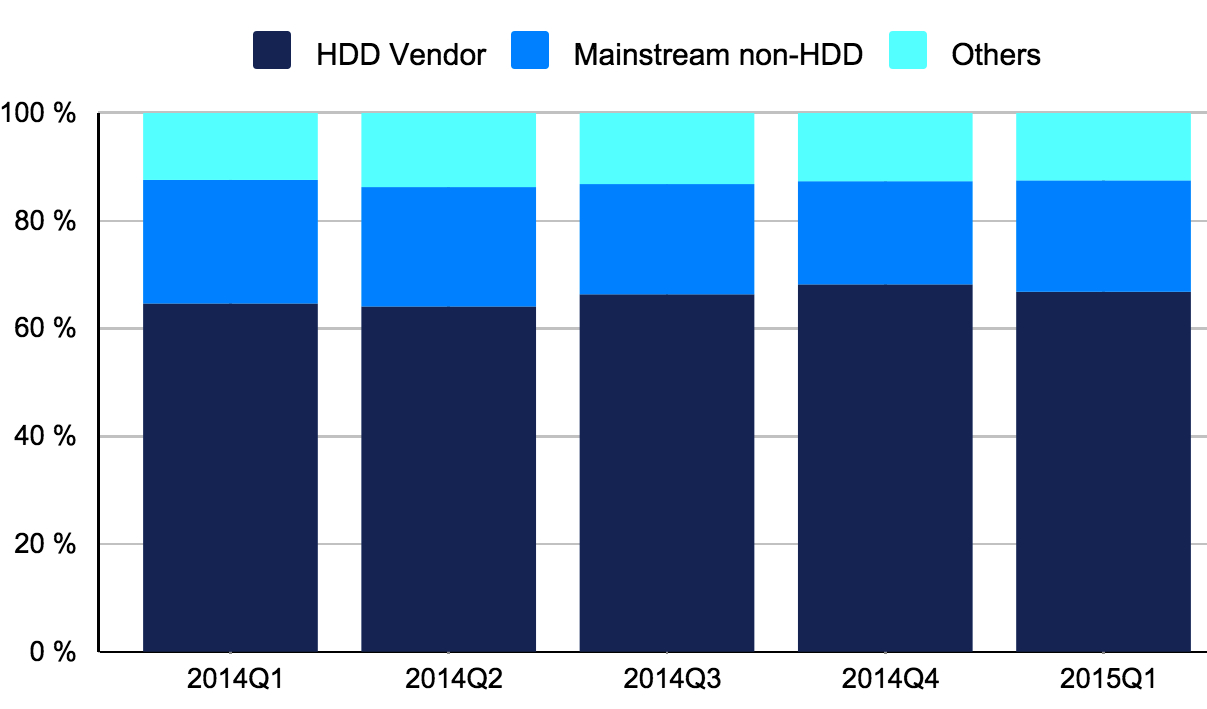

For the first quarter of 2015, HDD vendors continued to increase their share in total PELS units shipped, gaining 0.8 percentage point year over year to grow to 78.8% market share. Mainstream non-HDD vendors dominated the entry-level storage segment, but lost market share to HDD vendors. In 1Q15, HDD vendors gained 13.2 percentage points from a year ago to represent 23.2% of the entry-level storage market.

Worldwide Personal and Entry-Level Storage

Shipment Value, Market Share, and Year-Over-Year Growth, First Quarter 2015

(shipment value in million)

(Source: IDC Worldwide Quarterly Personal and Entry Level Storage Tracker, May 2015)

Notes:

- The PELS market includes storage products and solutions with a single bay through twelve bay configurations that are manufactured and marketed for individuals, small offices/home offices, and small businesses.

- IDC defines Personal Storage as having 1-2 bays and entry-level storage as having 3-12 bays.

- IDC defines an HDD vendor as a vendor who manufactures its own HDD drive, in addition to branded external storage.

- IDC defines a mainstream non-HDD vendor as a major PELS vendor that does not manufacture its own HDDs.

- Data for the PELS market is reported for calendar periods.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter