WW Integrated Infrastructure Sales at $1.5 Billion in 2Q15, Up 15.5% Y/Y – IDC

Leaders in order: VCE, Cisco/NetApp, HP and EMC

This is a Press Release edited by StorageNewsletter.com on October 1, 2015 at 3:01 pmAccording to the International Data Corporation‘s Worldwide Quarterly Integrated Infrastructure and Platforms Tracker, the worldwide integrated infrastructure and platforms market increased revenue 1.7% year over year to $2.4 billion during 2Q15.

The market shipped 1,210PB of new storage capacity during the quarter, which was up 44.8% compared to the same period a year ago.

“We have a tale of two markets; integrated platforms is contracting while integrated infrastructure systems are growing rapidly,” said Kevin M. Permenter, senior research analyst, enterprise servers, IDC. “Organizations are leaning away from workload-specific platforms and toward general-purpose, multi-workload hardware solutions. We expect to see this trend continue through 2015.”

Integrated Platforms vs. Integrated Infrastructure

IDC distinguishes between two market segments: Integrated Platforms and Integrated Infrastructure. Integrated Platforms are integrated systems that are sold with additional pre-integrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools. Integrated Infrastructure systems are designed for general purpose, distributed workloads that are likely to have differing performance profiles. While integrated infrastructure is similar to integrated platforms in that it will leverage the same infrastructure building blocks, it is not optimized for a specific workload.

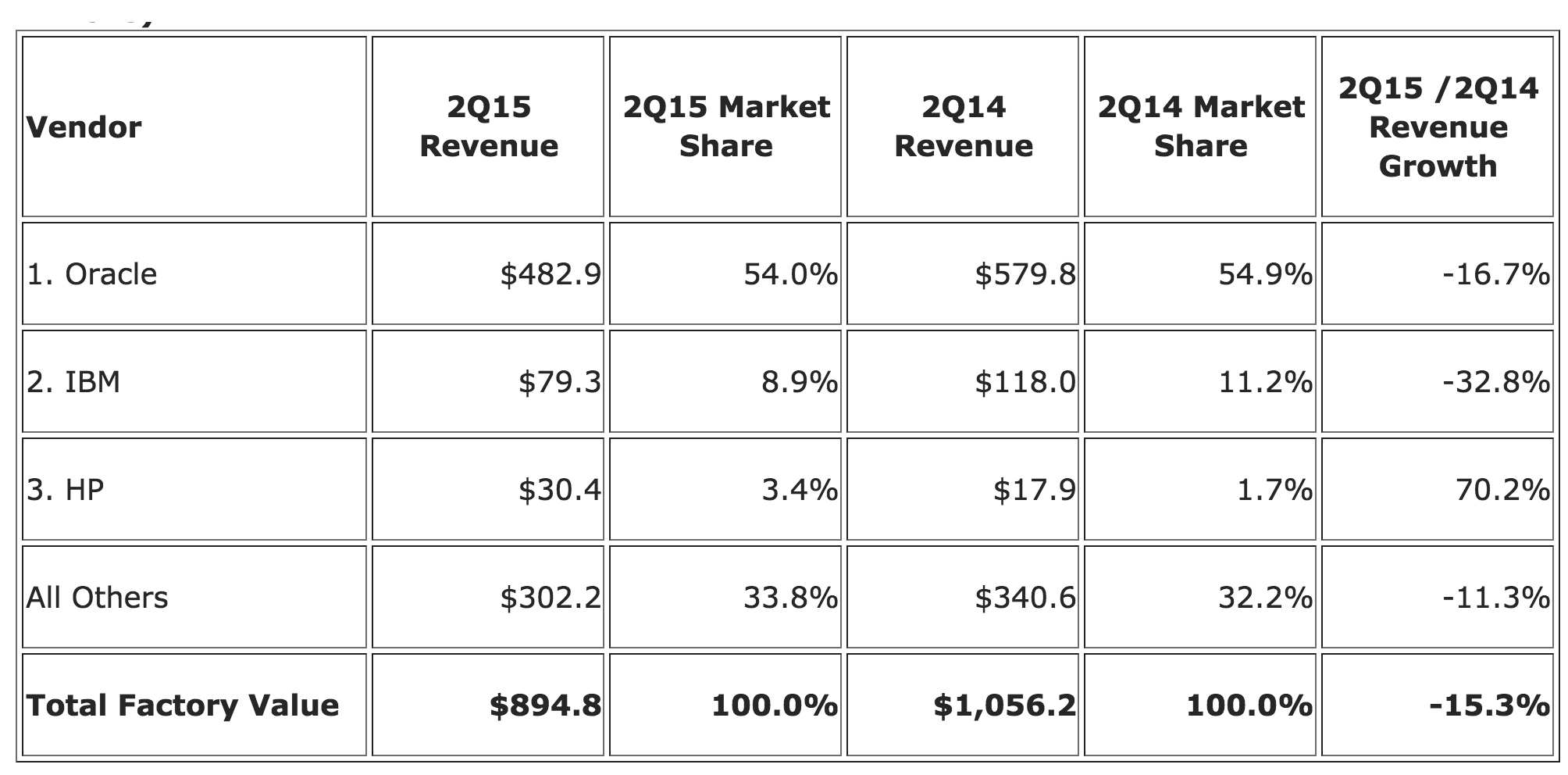

During 2Q15, the Integrated Platforms market generated revenues of $894.8 million, which represented a year-over-year decline of -15.3% and 36.6% of the total market value. Oracle was the largest supplier of Integrated Platform systems with $482.9 million in sales, or 54.0% share of the market segment.

Top 3 Vendors, WW Integrated Platforms, 2Q15

(revenue in million)

Top 3 Vendors, WW Integrated Platforms, Market Share, 2Q15 Vs. 2Q14 ![]()

(Source: IDC Worldwide Integrated Infrastructure and Platforms Tracker, September 24, 2015)

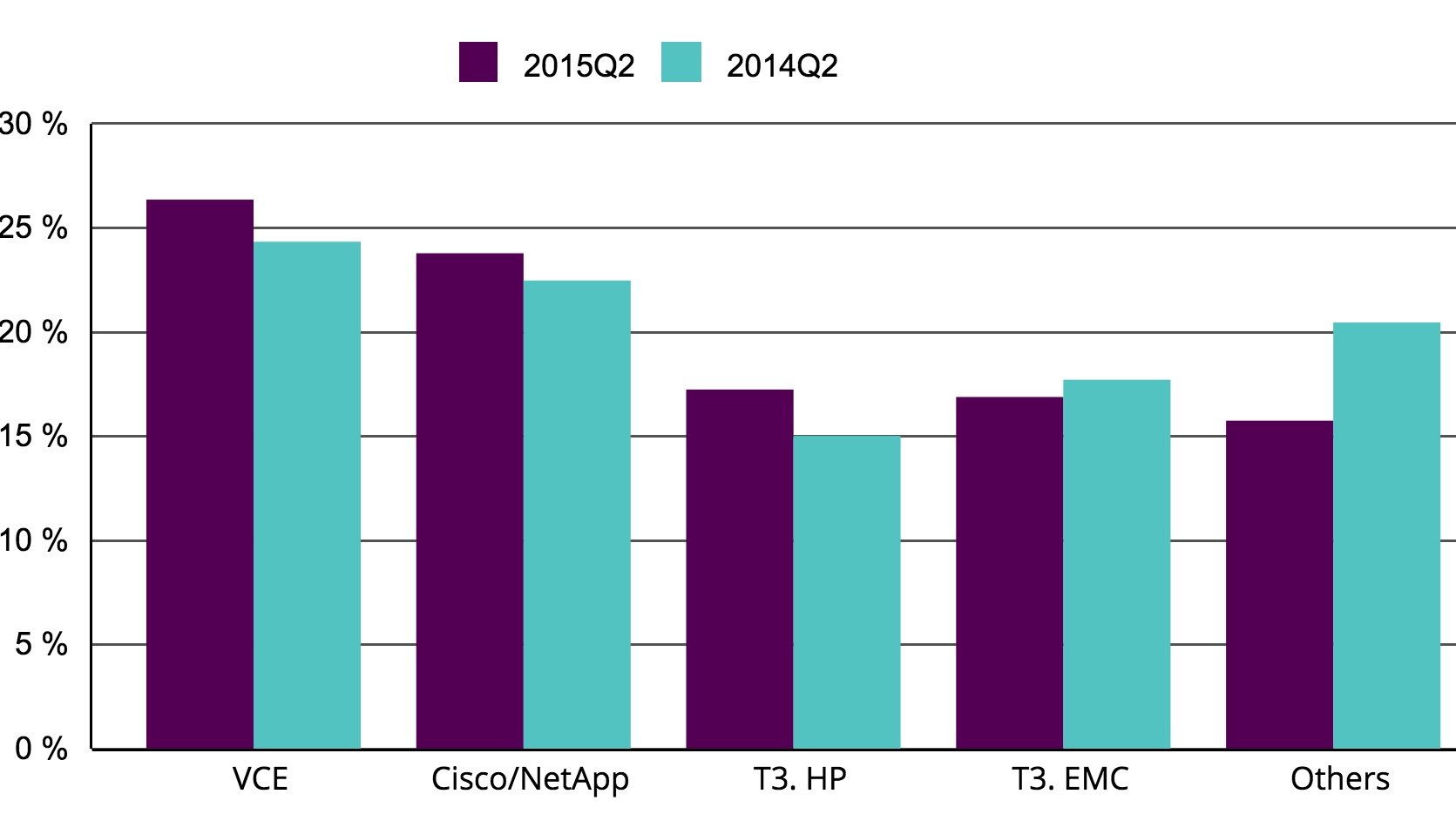

Integrated Infrastructure sales grew 15.5% year over year during the second quarter of 2015, generating more than $1.5 billion worth of sales. This amounted to 63.4% of the total market value. VCE was the top-ranked supplier of Integrated Infrastructure in the quarter, generating revenues of $409.4 million and capturing a 26.3% share of the market segment.

Top 5 Vendors, WW Integrated Infrastructure, 2Q15

(revenue in million)![]()

Top 5 Vendors, WW Integrated Infrastructure, 2Q15 Vs. 2Q14, Vendor Revenue Share

(Source: IDC Worldwide Integrated Infrastructure and Platforms Tracker, September 24, 2015)

* Note: IDC declares a statistical tie in the worldwide integrated infrastructure and platforms market when there is less than one percent difference in the revenue share of two or more vendors.

Taxonomy Notes:

IDC defines integrated infrastructure and platforms as pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software. Systems not sold with all four of these components are not counted within this tracker. Specific to management software, IDC includes embedded or integrated management and control software optimized for the auto discovery, provisioning and pooling of physical and virtual compute, storage and networking resources shipped as part of the core, standard integrated system.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter