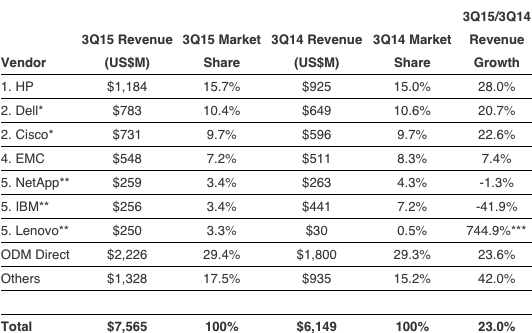

WW Cloud IT Infrastructure Spend Grows 23% Y/Y to $7.6 Billion in 3Q15 – IDC

1/ HP, 2/ Dell, 3/ Cisco, 4/ EMC, 5/ NetApp, 6/ IBM, 7/ Lenovo

This is a Press Release edited by StorageNewsletter.com on January 22, 2016 at 3:00 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of infrastructure products (server, storage, and Ethernet switch) for cloud IT, including public and private cloud, grew by 23.0% year over year to $7.6 billion in 3Q1).

The overall share of cloud IT infrastructure sales climbed to 33.8% in 3Q15, up from 28.7% a year ago. Revenue from infrastructure sales to private cloud grew by 18.8% to $2.9 billion, and to public cloud by 25.9% to $4.6 billion. In comparison, revenue in the traditional (non-cloud) IT infrastructure segment decreased by -3.2% year over year in the third quarter, with declines in all three technology segments (server, storage and Ethernet switch). All three technology markets showed strong year-over-year growth in both private and public cloud segments, with server experiencing the highest growth in private cloud at 24.3% and Ethernet switch with the highest growth in public cloud at 37.8%. Public cloud spending on storage grew 26.7% year on year.

“IDC continues to see healthy double-digit growth in cloud IT deployments in the market with an increasing preference for public cloud infrastructure,” said Kuba Stolarski, research director for computing hardware and platforms, IDC. “Customers are modernizing their infrastructures, having a progressively larger number of viable options for cloud deployments either on or off premises. These customers depend on a mix of as-a-service offerings and traditional infrastructure to help meet the IT transformation requirements of their organizations. As public cloud offerings continue to evolve and improve in reliability and security, customers are becoming more comfortable with the flexibility that they get by deploying certain workloads in these elastic environments.”

At the regional level, vendor revenues from cloud IT infrastructure sales grew fastest in Japan at 47.1% year over year, followed by AsiaPac (excluding Japan) at 35.3%, Western Europe at 22.1%, Canada at 22.0%, and the United States at 20.1%. Central and Eastern Europe declined at -10.2% year over year as the region continues to go through political and economic turmoil, which impacts overall IT spending.

Top 5 Corporate Family, WW Cloud IT Infrastructure Vendor Revenue, 3Q15

(in $ million, excludes double counting of storage and servers)

Notes:

- * Dell and Cisco both ranked number 2 in a statistical tie. IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is less than one% difference in the revenue share of two or more vendors.

- ** NetApp, IBM, and Lenovo all ranked number 5 in a statistical tie. IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is less than one% difference in the revenue share of two or more vendors.

- IBM’s divestiture of its x86 business to Lenovo on October 1, 2014 has a highly positive impact on year over year comparisons for Lenovo for 2Q15.

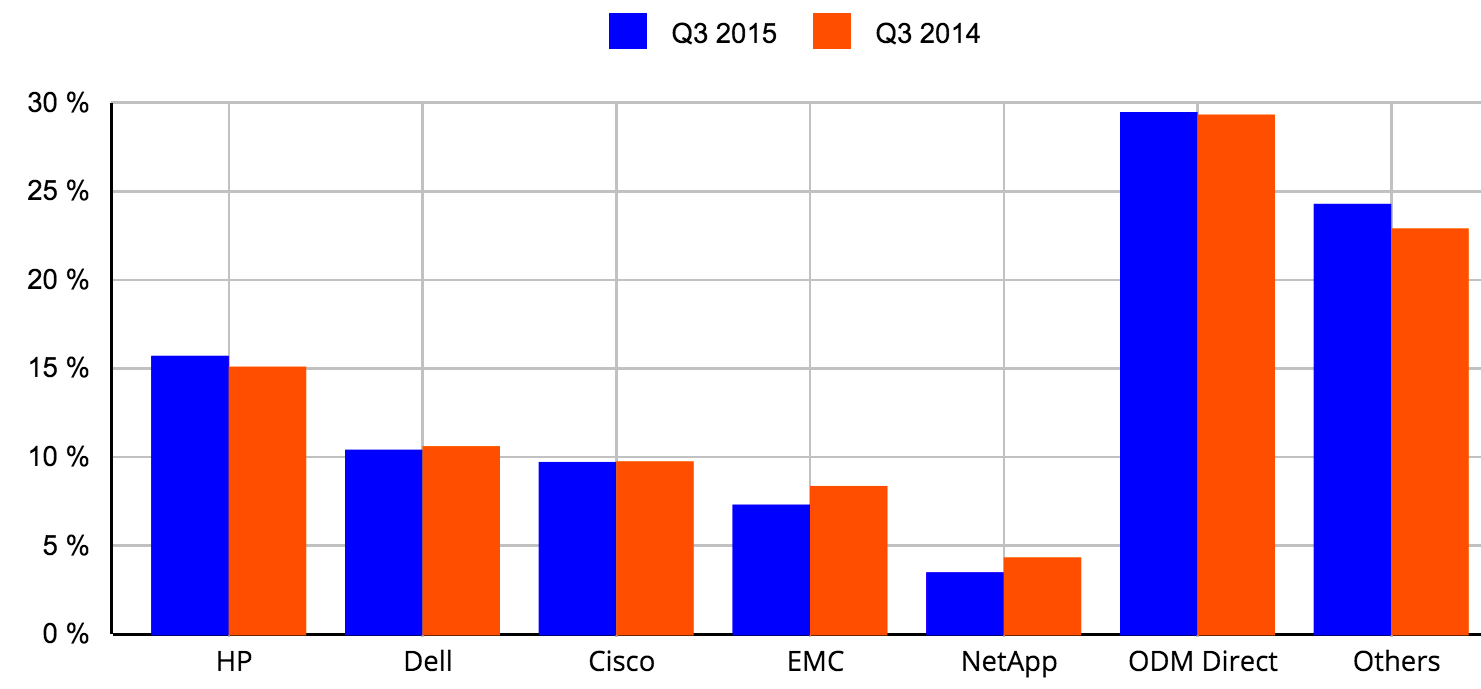

WW Cloud IT Infrastructure, Top 5 Cloud Vendors, 3Q14 vs. 3Q15

(shares based on vendor revnue)

(Source: IDC’s Worldwide Quarterly Cloud IT Infrastructure Tracker, January 2016)

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter