Storage Start-Ups in 2014

Historical record for just one financial round: $900 million for ...

By Jean Jacques Maleval | March 3, 2015 at 3:00 pmA fact completely dominated the market of storage start-ups in 2014: the monster unique financial round of $900 million received by Cloudera, in in enterprise analytic data management powered by Apache Hadoop. That the highest amount historically for a round in the storage industry. More than that, no start-up ever got more than that in total investment, all rounds included. Last year top round was $150 million for Pure Storage, $100 million for Box in 2013.

Hadoop is one of the most exciting IT technology today, another proof being the successful IPO of Hortonworks in December 2014.

This Clouderra’s financing round includes the previously-announced $160 million of funding from T. Rowe Price and three public market investors, Google Ventures, and an affiliate of MSD Capital, L.P., the private investment arm of Michael Dell and his family, and a significant $740 million equity investment by Intel that gives them 18% share of Cloudera.

Also the global sum received by Cloudera up to now, 1,041 million, was never reached by any other start-ups. Former record was $544 million by Pillar Data then acquired by Oracle in 2011.

Of course this exceptional round had a big impact on our comments below for 2014.

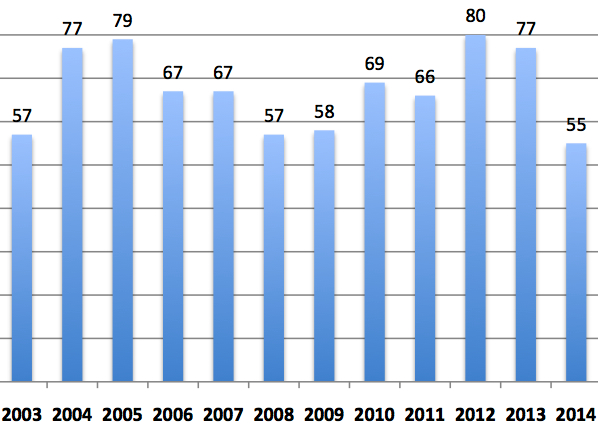

In 2014 we counted 55 investment rounds initiated by storage start-ups, a small number.

It was 77 in 2013 and an historicaal record of 80 in 2012. This decrease is not really bad news for storage, still one of the most dynamic sectors in the IT industry, continuing to be appreciated by VCs that dream of what got some of them following the acquisitions of firms like 3par, Data Domain and Isilon few years ago at more than $2 billion, or few successful IPOs.

But the investors in these latter three start-ups were lucky as generally most of them have to invest in several new ventures to finally win the jackpot.

NUMBER OF FINANCIAL ROUNDS SINCE 2003

(Source: StorageNewsletter.com)

(Source: StorageNewsletter.com)

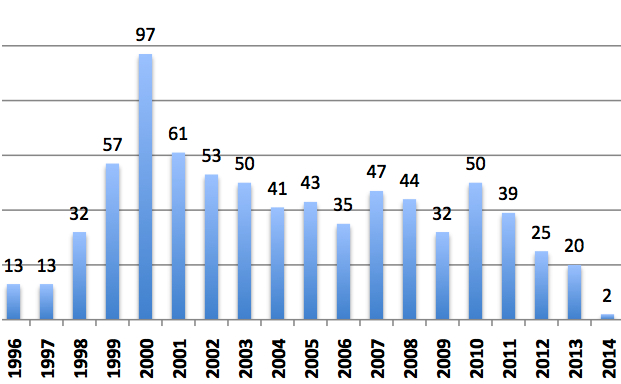

Fewer New Start-Ups

More worrying is the reduced number of start-ups founded since the heydeys of 2000 when 97 new entities sprang up in a single year. We were only able to turn up 2 new firms launched last year vs. 20 in 2013 and 25 in 2012, while these figures will go up as more of them, operating in stealth mode, will come to light.

For example, we found 5 born in 2013 at the same time last year, this figure being increased by 15 discovered later.

NUMBER OF STORAGE START-UPS LAUNCHED EACH YEAR SINCE 1996

(when the born year is known)

(Source: StorageNewsletter.com)

(Source: StorageNewsletter.com)

How Much Do They Raise?

The number of financial rounds in 2014, 55, represented the lowest number since 2003, but some were impressive (see below), with big winner Cloudera but also Pure Storage and Nutanix at more than $200 million. Note that Pure Storage got in fact $225 million and $60 million in secondary funding deal in 2014. Nutanix also received two rounds in 2014, $101 million and $140 million.

LARGEST FINANCIAL ROUNDS IN 2014

(at $70 million and more)

| Company | in $million |

| Cloudera | 900 |

| Pure Storage* | 285 |

| Nutanix* | 241 |

| Box | 150 |

| MapR Technologies | 110 |

| Actifio | 100 |

| Hortonworks | 100 |

| SolidFire | 82 |

| Tintri | 75 |

| Spin Transfer Technologies | 70 |

* in two rounds

(Source: StorageNewsletter.com)

Record Year in Financial Funding

2014 was not another record year in the global amount received by storage start-ups considering here only the sums revealed by the companies: $2,660 billion invested, compared to $1,526 billion in 2013 or up 74% . In parallel, the average amount per round continues to increase, also since 2009, reaching , but here booming yearly 164%.

But these impressive growing figures are the resuts of the exceptional $900 million round of Cloudera.Without it, 2014 lobal amount received by storage start-ups will be up only 15% and average amount per round $35 million up 78%.

Investors put more money in fewer start-ups and consequently in fewer rounds, like in 2013.

These past twelve years, VCs have put $17.8 billion in storage start-ups. This amount is much higher than the total figure in the table below ($13.5 billion adding all rounds) because, for several firms, we got the total invested but not the details per round.

On average, a company got historically $38.4 million in total funding, the average per round being $18.5 million.

* in $ million

(Source: StorageNewsletter.com)

The activity more appreciated by VCs in 2014 were Haddop, software-defined storage, SSD systems and hyperconverged insfrastructure.

PER ACTIVITY AMONG CURRENT ALIVE START-UPS

| Activity | % |

| Software | 45% |

| Hardware | 28% |

| SSP | 16% |

| Connection0 | 6% |

| Fundamental technology | 4% |

| Security | 2% |

| TOTAL | 100% |

(Source: StorageNewsletter.com)

Where Are They Going?

The last thing we looked at was what becomes of all these storage start-ups after we identify and count them. The conclusion is not really reassuring, a reminder that investment in these sorts of companies is in fact highly risky.

On all start-ups identified, only 3% eventually go public, and thus allow investors more than just to recoup their original stake. The same is generally true for the 28% that find buyers, although the asking price is not always greater than the total of all sunk investments. It is, in any case, the emergency exit that many companies are seeking. Meanwhile, another 19% just vanish off the map – doors closed.

50% of all start-ups of them remain in a holding pattern, still a start-up, still nursing the secret hope of an offer from a storage giant seeking to fill-in a missing technology.

WHAT HAPPENED TO THEM SINCE 1978

(out of a total 846 start-ups)

| Became public | 28 | 3% |

| Sold | 238 | 28% |

| Closed | 158 | 19% |

| Remaining start-ups | 423 | 50% |

| TOTAL | 847 | 100% |

(Source: StorageNewsletter.com)

16 start-ups did find buyers in 2014 and 11 in 2013, the biggest deal last year being Fusion-io acquired by SanDisk for $1.1 billion aand Virident by Western Digital for $685 million two years ago

There was only one IPO in 2014 (3 in 2013): Hortonworks, getting $163 million after $110 million invested in the company. The stock exchange does not find big interest in storage

Few start-ups are going to file for IPO this year. Box already did it. Somes names are rumored: Actifio, Nutanix, Pure Storage, Tintri or SolidFire.

IPOs IN STORAGE INDUSTRY

| Company | IPO year | Amount raised* | Total funding* |

| Silicon Storage Technology |

1995 | 15 | NA |

| StorageNetworks | 2000 | 260 | 205 |

| BakBone | 2000 | NA | NA |

| McData | 2000 | 350 | NA |

| STEC | 2000 | 65 | NA |

| FalconStor** | 2001 | NA | 33 |

| Xyratex | 2004 | 48 | NA |

| Rackable Systems | 2005 | 75 | 21 |

| CommVault | 2006 | 161 | 75 |

| Double-Take | 2006 | 55 | 70 |

| Isilon | 2006 | 108 | 69 |

| Riverbed | 2006 | 86 | 38 |

| 3PAR | 2007 | 95 | 183 |

| Compellent | 2007 | 85 | 53 |

| Data Domain | 2007 | 111 | 41 |

| Mellanox | 2007 | 102 | 89 |

| Netezza | 2007 | 124 | 68 |

| Voltaire | 2007 | 47 | 75 |

| Rackspace Hostings | 2008 | 145 | NA |

| OCZ Technology | 2010 | 101 | NA |

| Carbonite | 2011 | 62.5 | 67 |

| Fusion-io | 2011 | 223 | 112 |

| JCY International | 2011 | 238 | NA |

| Parade Technologies | 2011 | 34 | 21.5 |

| Violin Memory | 2013 | 162 | 186 |

| Nimble Storage | 2013 | 168 | 99 |

| Barracuda Networks | 2013 | 75 | 40 |

| Hortonworks | 2014 | 110 | 173 |

| Average of known figures | 117 | 85.0 |

* in $ million

** became public via a merger with Network Peripherals

(Source: StorageNewsletter.com)

NEW START-UPS (known thus far) BORN IN 2013

| Company | Activity and comments |

| ClearSky Data (Boston, MA) | in stealth mode |

| Cloud Guys (Ville d’Avray, France) | Lima appliance for personal cloud storage |

| CNEX Labs (San Jose, CA) | in stealth mode; apparently in PCIe NVMe for SSD |

| Cohesity (Santa Clara, CA) | in stealh mode |

| Datrium Storage | alternative to virtualized storage, in stealth mode |

| Elastifile (San Jose, CA) | software-defined storage solution for all-flash, distributed file, object, and block store and serving as enterprise scale out primary storage; also in Herzliya, Israel |

| Igneous Systems (Seattle, WA) | builds, maintains and scales enterprise data center infrastructures; in stealth mode |

| Long Access (Athens, Greece) | secure personal cloud archiving |

| Nextbit Systems (San Francisco, CA) | mobile data backup and sync technology |

| NVMdurance (Limerick, Ireland) | software for NAND flash endurance; also in San Jose, CA |

| NxGn Data (Irvine, CA) | SSDs based on own controller |

| Parsec Labs (Minneapolis, MN) | storage virtualization for NAS |

| Primary Data (Palo Alto, CA) | software-defined storage; merged with Tonian Systems in 2013; in stealth mode; office in Israel |

| Quobyte (Boston, MA) | software-defined storage system running on commodity Linux servers; R&D in Berlin Germany; seven-figure Euro financing in 2014 |

| Seeq (Seattle, WA) | big data technologies to manufacturing and operational industrial process data |

| SoftNAS (Houston, TX) | cloud storage OS |

| Stratoscale (Herzliya Pituach, Israel) | hyper convergence virtualization compute and storage software; probably born in 2013 |

| StreamNation (Lëtzebuerg, Luxembourg) | photo and viedo online backup; acquired Picturelife in 2015 |

| ThinAir Labs (Palo Alto, CA) | programmable virtual storage platform; in stealth mode |

| Verselus (Pleasanton, CA) | HDD and SSD manufacturing processes; several employees coming from Xyratex |

(Source: StorageNewsletter.com)

NEW START-UPS (known thus far) BORN IN 2014

| Company | Activity and comments |

| Nano-Meta Technologies (West Lafayette, IN) | plasmonics to advance optical technology; parent company of Photonic Nano-Meta Technologies LLC, Russian Skolkovo-affiliated subsidiary |

| Xitore (Orange County, CA) | new way of solid state storage increasing bandwidth, reducing latency; formerly eXtreme Data Storage; in stealth mode |

(Source: StorageNewsletter.com)

ALL 55 FINANCIAL ROUNDS IN 2014

| NAME (HQ) | BORN IN | 2014 FUNDING | TOTAL FUNDING | ACTIVITY/COMMENTS |

| Actifio (Weston, MA) | 2009 | 100 | 207.5 | solution for data protection, DR and BC |

| Amplidata (Lochristi, Belgium) | 2008 | 21 | 43 | RAID by storing data across a selection of disks; also in Milpiltas, CA; two rounds in 2010, $2.5 million and then $6 million; $11 million round in 2014 and $10 million investment of Western Digital Capital |

| Avere Systems (Pittsburgh, PA) | 2008 | 20 | 72 | tiered NAS appliances |

| Box (Palo Alto, CA) | 2005 | 150 | 554.5 | online storage on the Web; partners with Dell; files IPO in 2015 getting $175 million |

| ClearSky Data (Boston, MA) | 2013 | 12 | 12 | in stealth mode |

| Cloud Guys (Ville d’Avray, France) | 2013 | 2.5 | 3.7 | Lima appliance for personal cloud storage |

| Cloudera (Palo Alto, CA) | 2008 | 900 | 1,041 | Apache Hadoop-based platform |

| Cloudian (Foster City, CA) | 24 | 44 | cloud storage platform; formerly Gemini Mobile Technlologies | |

| CloudPhysics (Mountain View, CA) | 2011 | 15 | 27.5 | datacenter analytics services for virtualized infrastructures |

| CNEX Labs (San Jose, CA) | 2013 | 37 | 37 | in stealth mode; apparently in PCIe NVMe for SSD |

| Crossbar (Santa Clara, CA) | 2008 | 25 | 50 | RRAM non-volatile memory competing with flash and DRAM |

| CTERA Networks (Petach Tikva, Israel) | 2008 | 25 | 45 | Cloud Attached Storage grouping small NAS into single appliance; also in NYC |

| DataGravity (Nashua, NH) | 2012 | 50 | 92 | data-aware storage platform that tracks data access and analyzes data; launched by EqualLogic veterans |

| DigitalOcean (New York, NY) | 2011 | 37.2 | 40.4 | SSD powered cloud |

| Druva Software (Pune, India) | 2007 | 25 | 67 | continuous data availability and de-dupe backup software for laptops |

| Elastifile (San Jose, CA) | 2013 | 8 | 8 | software-defined storage solution for all-flash, distributed file, object, and block store and sering as enterprise scale out primary storage; also in Herzliya, Israel |

| Evtron (St. Louis, MO) | 2012 | 0.8 | 1.5 | high-density storage platform |

| Formation Data Systems (Fremont, CA) | 2012 | c | 24.2 | software for enterprise converged platform |

| Gridstore (Mountain View, CA) | 2007 | 11 | 26 | NAS grid solution; originated in Dublin, Ireland |

| Hive Cloiud (San Francisco, CA) | 0.5 | 0.5 | social network for file sharing; born in 2014? | |

| Hortonworks (Palo Alto, CA) | 2011 | 100 | NA | develops, distributes and supports open source Apache Hadoop data platform; acquired XA Secure in 2014 |

| Igneous Systems (Seattle, WA) | 2013 | 23.6 | 26.6 | build, maintain and scale enterprise data center infrastructures; in stealth mode |

| Infrascale (El Secundo, CA) | 2006 | 16.3 | 29.3 | cloud backup and archive, disaster recovery, and file sharing with military-grade security; acquired Eversync in 2014 |

| ioSafe (Auburn, CA) | 2005 | 2.5 | NA | fire resistant and waterproof D2D backup appliance |

| IzumoBASE (Tokyo, Japan) | 2012 | 1.4 | NA | software-defined storage, investment from Global Brain in 2014 |

| Kaminario (Newton, MA) | 2008 | 53 | 143 | all-flash arrays; R&D in Israel |

| Load DynamiX (Santa Clara, CA) | 2008 | 12 | NA | storage infrastructure performance validation; formerly SwiftTest |

| Long Access (Athens, Greece) | 2013 | 0.36 | 0.51 | secure personal cloud archiving |

| MapR Technologies (San Jose, CA)) | 2009 | 110 | 169 | distribution for Apache Hadoop for data protection and business continuity; R&D in India |

| Maxta (Sunnyvale, CA) | 2009 | 25 | 35 | Software defined storage platform |

| Memblaze Technology (Beiijng , China) | 2010 | 20 | NA | SSDs |

| Nasuni (Natick, MA) | 2009 | 10 | 53 | secure cloud storage; founded by former executives of Archivas |

| nCrypted Cloud (Boston, MA) | 2012 | 5 | NA | secure cloud storage |

| Nextbit Systems (San Francisco, CA) | 2013 | 18 | 18 | mobile data backup and sync technology |

| Numvision (Paris, France) | 2009 | 0.5 | NA | software to sync files on cloud; financial round in 2013 |

| Nutanix (Santa Clara, CA) | 2009 | 241 | 312 | cloud computing and virtualization |

| NVMdurance (Limerick, Ireland) | 2013 | 0.8 | 1.1 | software for NAND flash endurance; also in San Jose, CA |

| Odysee (San Francisco, CA) | 2011 | 0.75 | NA | online storage of videos and photos |

| ownCloud (Lexington, MA) | 2011 | 6.3 | 3.75 | open source file sharing |

| Pivot3 (Austin, TX) | 2003 | 12 | 126.5 | RAID Across Independent Gigabit Ethernet (RAIGE) for video surveillance |

| Pluribus Networks (Palo Alto, CA) | 2010 | 35 | 95 | distributed network hypervisor OS, converging compute, network, storage and virtualization |

| Primary Data (Palo Alto, CA) | 2013 | 13 | NA | software-defined storage; merged with Tonian Systems in 2013; in stealth mode; office in Israel |

| Pure Storage (Mountain View, CA) | 2009 | 285 | 470 | all-flash storage arrays |

| Reduxio (San Bruno, CA) | 2012 | 15 | 27 | enterprise hybrid storage with 1-second data recovery, in-line in-memory deduplication and compression and block-level tiering; also in Petach Tikvah, Israel |

| RzoFS (Fizians SAS) (Nantes, France) | 2010 | 1 | NA | software scale-out NAS file system |

| SolidFire (Boulder, CO) | 2010 | 82 | 150 | all-SSD storage system |

| Sonian (Dedham, MA) | 2006 | 8 | 36.2 | SaaS hosted archive solution with grid computing infrastructure technologies; acquired Webroot’s email archiving business in 2012 |

| Spin Transfer Technologies (Boston, MA) | 2007 | 70 | 106 | orthogonal spin transfer magnetoresistive random access memory technology; subsidiary of Allied Minds |

| StarWind Software (Wakefield, MA) | 2003 | 3.25 | 6.25 | iSCSI SAN and storage virtualization software; spin-off from Rocket Division |

| Storage Made Easy (Sutton, UK) | 2008 | 1 | 2.5 | secure private enterprise file sharing and synchronization; wholly-owned by Vehera Ltd.; formerly SMEStorage |

| Stratoscale (Herzliya Pituach, Israel) | 2013 | 32 | 42 | hyper convergence virtualization compute and storage software; probably born in 2013 |

| Streem (San Francisco, CA) | 0.875 | NA | unlimited cloud storage and media streaming service; Y Combinator | |

| SwiftStack (San Francisco, CA) | 2011 | 16 | 23.6 | software-defined storage for object storage |

| Tintri (Mountain View, CA) | 2008 | 75 | 135 | purpose-built SSD storage system for virtual machines |

| Zerto (Boston, MA) | 2009 | 26 | 60.2 | hypervisor-based replication for enterprise; also in Herzliya, Israel |

Note: Funding in $ million

(Source: StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter