SSD Shipments Grew Modestly (2%) in 4Q13 to 17 Million – Trendfocus

Average capacity up 15% sequentially to 179GB

This is a Press Release edited by StorageNewsletter.com on March 3, 2014 at 2:59 pmHere is a small abstract of Trendfocus, Inc.‘s NAND/SSD Information Service CQ4 2013 Quarterly Report and Long-Term Forecast (32 pages)

Total SSD shipments grew modestly in CQ4 to 17 million units – average capacity grew over 15% sequentially to 179GB.

SSD exabytes rose 17% to 3.008.

Stand-alone SSD average capacity increased 17% from the prior quarter to 204GB.

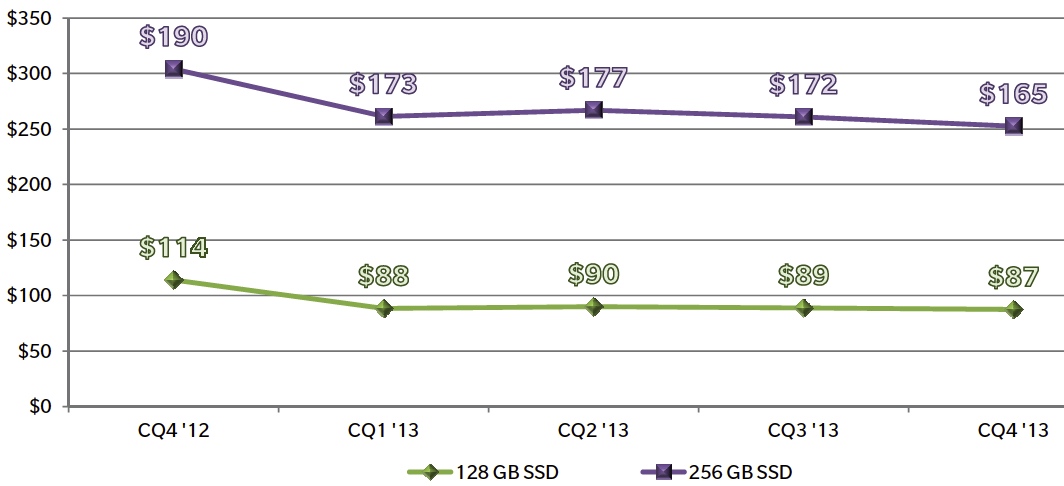

Average price of 128GB and 256GB stand-alone SSDs declined marginally in CQ4.

Historical 128GB SSD and 256GB SSD Average Price

(Source: Trendfocus, February 24, 2024)

Enterprise SATA SSDs, used mainly in servers continued to dominate this space with nearly 80% share in CQ4.

NAND output (GB equivalent) rose 9% in CQ4 due to robust demand from SSDs, tablets, and phones.

SanDisk/Toshiba and Samsung produced over two-thirds of all NAND in CQ4.

SSD Market

In CQ4 ’13, the total SSD market increased only 1.6% sequentially, due to continued weak demand for notebook PCs. For 2013, total SSD shipments surpassed 60 million, up a sharp 60% from 2014. Over the long-term forecast, a richening mix will drive a 5-year exabyte CAGR of 31.2% through 2018.

Notebook PC attach rate for SSDs was 9% in 2013 (stand-alone SSDs shipped in place of an HDD ex-factory) and the Trendfocus forecast projects the attach rate to triple by 2018. Enterprise SSDs will continue to be dominated by SATA models for low-cost acceleration in hyperscale applications. SAS will maintain strong presence in networked storage applications, while PCIe will undergo several transitions in form factors and interfaces that will help to drive adoption in the coming years.

- Samsung continues to lead the market in total SSD units, with 29.4% share in CQ4 ’13.

- Intel leads the enterprise SSD market due to its strong position in enterprise SATA.

- HGST holds onto a majority of the enterprise SAS SSD market, with >50% share.

- Fusion-io and LSI dominate the nascent enterprise PCIe market and are reported in the ‘others’ category.

Further details and forecasts on the NAND/SSD market are available from Trendfocus.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter