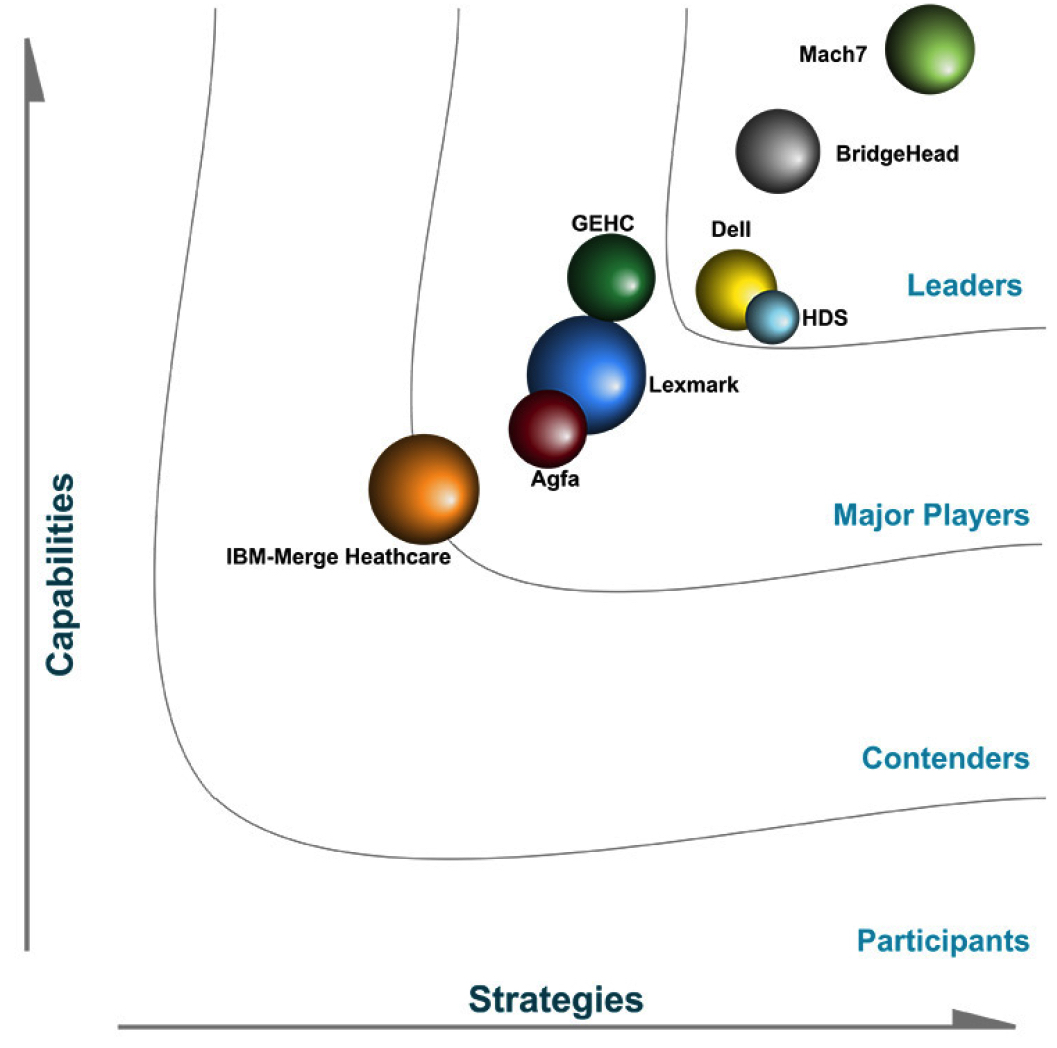

Leaders of Healthcare Neutral and Application-Independent Clinical Archive Unstructured Data Platforms – IDC

Mach7, Bridgehead, Dell and HDS

This is a Press Release edited by StorageNewsletter.com on July 4, 2016 at 2:33 pmIDC MarketScape: U.S. Healthcare Provider Vendor-Neutral Archives/Application-Independent Clinical Archive for Integrated Care 2016 Vendor Assessment  Judy Hanover, research director, provider IT strategies, IDC Corp.

Judy Hanover, research director, provider IT strategies, IDC Corp.

This is marketscape excerpt features Bridgehead.

U.S. Healthcare Provider VNA/AICA Unstructured Data Platforms

for Integrated Care 2016 Vendor Assessment

IDC opinion

The U.S. healthcare provider IT market has experienced extreme growth and change since the introduction of accountable and value-based care, following the passage of the Patient Protection and Affordable Care Act (PPACA) of 2010.

As providers seek to optimize their operations under value-based care business models, the need to rationalize storage for medical images and accommodate the growing variety and volume of unstructured content being created in new, network-based healthcare organizations (HCOs) has become acute. The growing need for management of unstructured content – whether the requirements are for traditional archives or real-time access repositories, or a combination of these capabilities – has led to increased adoption of vendor-neutral archives (VNAs) to manage DICOM files as well as a second generation of more patient-centric technology, the application-independent clinical archive (AICA).

This IDC MarketScape focuses on VNA and AICA platforms that allow providers to manage and provide access to disparate types of unstructured content, among multiple departments, across the entire integrated delivery network (IDN), and between affiliated providers in the community. The platform approaches to VNA and AICA evaluated in this IDC MarketScape include VNA suppliers that are adding AICA capabilities, PACS/VNA suppliers that are adding AICA capabilities, and native AICA vendors that also support DICOM archiving/VNA functionality. As AICA is an emerging space, there is considerable variation among the platforms offered by the vendors covered in this study in terms of approaches, underlying technology, ease of use and implementation, product road map, available tools, licensing models, and analytics capabilities. The ability of platform suppliers to service customers and support their needs through technical support and account management also varies. With these considerations in mind, it is not surprising that the qualities defining today’s market share winners may not be those of future leaders.

This study is designed to offer healthcare providers guidance on which VNA and AICA platform vendors serving the industry are best suited for consideration when evaluating an initial investment in, replacement of, or enhancement to unstructured content management capabilities. The next generation of vendor-neutral archive technologies, AICA, has evolved as a strategy to support U.S. healthcare organizations moving to accountable delivery. AICA will support the needs of existing VNA users and systems while offering healthcare providers additional capabilities to address the challenges posed by the exponential growth of unstructured healthcare data and the deepening need for population health management (PHM) and the patient-centered medical home (PCMH) in new business models. The patient-centric AICA replaces the PACS-tethered VNA with a solution that meets the needs for new and integrated business models based on collaboration and evidence-based decision making in today’s health systems.

This IDC MarketScape, in addition to vetting customer references to verify vendor claims, considers other key criteria:

- Provider-oriented and patient-centric product design, approach, platform technology provider market knowledge, number of customers, and stability of the vendor

- Deployment capability, deployment options, availability of cloud-based subscriptions,architecture, time to market, and usability of the platform and associated tools

- Cost relative to value and ROI from products and approaches

- Breadth of functionality and functionality flexibility, agility, and self-service capabilities

IDC Marketscape Vendor Inclusion Criteria

IDC frequently has unique visibility into vendor selection processes within hospitals and health systems through its clients and contacts in the industry. To be considered for inclusion in this study, VNA and AICA platform suppliers must have been significantly evaluated for purchase within a recent deal with which IDC is familiar. Only VNA and AICA vendors were considered; while some convergence is seen in the market, enterprise content management (ECM) solutions that also manage DICOM-based content and images were excluded from this study. Further research and due diligence were then conducted to narrow the list of vendors to only those that had won deals and that IDC viewed as legitimate contenders for future deals within the healthcare provider space. Vendors and products are evaluated on the basis of their ability to serve the largest participants in the market, as well as the midmarket and smaller players.

The vendors and products selected for evaluation in this study are:

- Agfa

- BridgeHead

- Dell

- GE Healthcare (GEHC)

- Hitachi Data Systems

- IBM–Merge Healthcare

- Lexmark

- Mach7 Technologies

Essential Buyer Guidance

The VNA and AICA market is confusing to health IT buyers. It is difficult to classify many solutions and to separate the platform capability from the image archiving capability in many vertical supplier offerings. Buyers need to consider not only the platform – whether it is VNA or AICA – and its fit to their current business needs but also the agility and scalability when it comes to meeting the demand of future business model changes. Many buyers with existing relationships with PACS or storage vendors will find offerings from these vendors appealing and often lower cost when compared with independent vendors’ solutions. In cases where these solutions meet business needs and offer more interoperability with an existing set of proprietary products, it is important to explore these offerings. However, in the long run, the cost of migrating existing image archives to the platform will be significant, and buyers should evaluate platforms that support long-term business needs against those that offer cost or time-to-implement advantages in the short term, accordingly. Providers need to understand their need for platform and/or specific workload and workflow capabilities when making VNA and AICA platform purchasing decisions.

Providers should clearly articulate, quantify, and document the organization’s current archiving needs and future business goals to assess the organization’s ability to take on VNA and/or AICA. As accountable care initiatives advance, the ability to unite unstructured data from across the organization on a single platform, to make information available to more providers for sharing, and to leverage data to perform analytics and rationalize storage will be important success factors.

Additional buyer guidance includes:

- Carefully assess delivery model. Consider choosing offerings that are provided as software as a service (SaaS) to gain some of the advantages of the cloud. This will enable flexibility andagility as well as access to services from the supplier and can support collaboration with other departments and partner healthcare organizations on the platform. The cloud VNA and AICA offerings in this IDC MarketScape are offered by service providers that understand the constraints associated with handling HIPAA-protected data and the unique demands of healthcare compliance.

- Build policies for working with VNA and AICA. As the organization begins to leverage the archive’s content in its operations, more and more unstructured data will be discovered anduse will expand to include additional departments. Most full-scale AICA implementations begin with radiology but realize value from unexpected departments, like home care, where image sharing can help reduce read missions and lower the cost of care as well as increase patient satisfaction. Policies for managing expansion opportunities should be in place to allow prioritization and manage implementation time frames and integration. Hospitals and health systems should organize around resources, whether they are in individual departments or centralized, to enable effective utilization of VNA and AICA platforms.

- Seek out innovation. Accountable care is coming fast, and risk-based contracting is increasingly prevalent. As providers seek to best manage operations, processes, and costs to deal with these business challenges, sharing unstructured data including images across the health system is a core capability. Managing data sharing well, and adapting to change as it comes, requires innovation. Innovative suppliers that seek customer partners should be pursued to gain competitive advantage from VNA and/or AICA programs. Co-development and collaboration opportunities can help organizations gain a foothold in new platforms and capabilities and build a culture of innovation.

- Set key IT goals for VNA and ACIA. Most healthcare IT organizations implementing new VNA and AICA platforms experience strong adoption in the departments that initially implement the platform and experience interest from other departments as the products expand. The pace of business model change means that it can be hard to prioritize. IT departments should seek platforms that offer tools that will allow end users some component of self-service and seek to develop reusable tools that make the most of available data when building out sharing within the organization. To ensure that the organization captures value from new VNA and AICA platforms, planning the transition to the platforms and setting goals for delivery of follow-on capabilities should be part of the process.

- Continue experimentation and develop best practices related to archiving. Each provider IT organization will need to experiment to determine archiving approaches that are best suited to the business needs and the skills of staff and end users. The transition will take time, and organizations should allow for experimentation as best practices emerge.

- Connect unstructured data initiatives to other new technology investments. Image archives don’t deliver value on their own; they need to be used by stakeholders in the care process. VNA and AICA should be embraced as an extension of PACS, RIS, EHR, and perhaps even enterprise content management as well as other technology investments like mobile apps that leverage content in the archive. Ensure that users can dynamically access content via a self-service portal.

BridgeHead Software Profile

BridgeHead Software is headquartered in Ashtead, England, with its U.S. headquarters in Woburn, MA. HealthStore is BridgeHead’s Independent Clinical Archive (ICA), also referred to as its third-generation vendor-neutral archiving solution. HealthStore provides a healthcare content management solution that is both application independent and storage agnostic. HealthStore is a standards-based, modular solution built on top of BridgeHead’s Healthcare Data Management (HDM) Platform, which allows healthcare organizations to logically separate data from the applications that created it and the hardware technology on which it resides. This clinical and administrative content can then be managed independently and made available to users and applications across the healthcare enterprise. BridgeHead is also a longtime partner of MEDITECH offering unique backup and disaster recovery services for MEDITECH’s Healthcare Information System (HIS) including its Electronic Medical Record (EMR) system. In addition, BridgeHead also provides archiving capabilities to MEDITECH customers – all provided utilizing the same underlying HDM Platform. Globally, BridgeHead Software has deployed its HealthStore ICA at 504 healthcare sites, with 454 installations in North America, 65 of which are in the cloud. BridgeHead is also positioned as a leader in this IDC MarketScape.

Strengths

BridgeHead’s strength lies in its long history of operations in healthcare, its commitment to vendor neutrality and healthcare data standards, and its strong customer relationships. The origin of many customers were through its tight links with MEDITECH. However, the past few years have given BridgeHead a much broader customer base and the company has expanded its archiving, VNA, and AICA functionality accordingly. BridgeHead operates largely through third-party integrators and has a particularly strong MEDITECH channel, which fuels a well-funded R&D operation. Having said that, in the area of AICA, BridgeHead has a high-end user touch sales model through which it leads its channel to market.

Challenges

BridgeHead has been challenged to break out of its MEDITECH base and offer broader services to more healthcare organizations, but after several years of work, BridgeHead has started to see success. The company is also challenged to expand the use of the archive among its MEDITECH backup and disaster recovery customers – today, only one-third are estimated to utilize the archive.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter