External Storage Market Recovers in 2Q14 for Central and Eastern Europe – IDC

In spite of slump in midrange segment

This is a Press Release edited by StorageNewsletter.com on October 10, 2014 at 2:47 pmDelayed large projects in Russia and revived activity of the SMB segment across Central and Eastern Europe (CEE) pushed external storage market value up 8.2% year on year to $244.38 million in the second quarter of 2014.

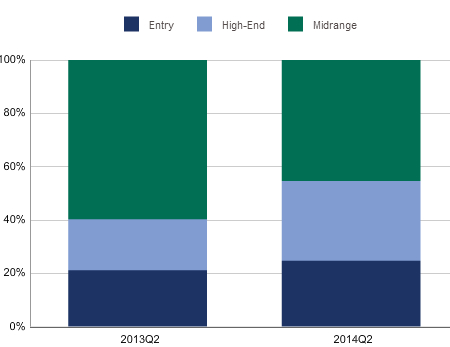

CEE External Storage Systems Market by Storage Class, 2Q14

The corresponding capacity soared, with growth of almost 50% to reach 212.5PB.

These results can be found in the Q2 2014 Europe, Middle East, and Africa (EMEA) Disk Storage Systems Quarterly Tracker, published by IDC Corp.

Improvement in Russia’s business climate, along with the resumption of projects in banks, telecommunications companies, and government entit

Most of the vendors had a very successful quarter with their high-end offerings (a trend contrary to EMEA developments), leading to a massive 152% increase of this segment in the country. The remaining CEE markets were dominated by entry-level solutions, as this space became more competitive, with new product launches, backup solutions targeted at small or remote offices, increased activity of smaller vendors, and improved partner coverage and programs. Midrange storage sales suffered almost across the entire region, due to seasonal effects and the availability of different storage technologies – such as traditional system-based, flash, software-defined storage, cloud, and converged – which left buyers somewhat confused by choice.

Dynamics among the top three CEE vendors were interesting, as HP had its best performance in almost three years, posting 57% annual value growth and almost catching EMC in terms of market share. HP’s sales across all storage classes increased, but the vendor benefited most from high-end XP orders in Russia.

Leading EMC and third-ranked IBM had their greatest success in the most affordable volume storage segment, resulting in an overall year-on-year market value decline.

NetApp was the second fastest-growing vendor on the external storage market, based on a 36.5% value increase over 2012, as well as being the only one to generate significant revenue with its midrange portfolio.

All other vendors recorded below-market-average growth, as customers refrained from investing in their primary midrange storage solutions.

“The CEE market is still disrupted by persistent economic and political challenges on the one hand, and plentiful storage options chipping away at the system-based storage’s share, on the other,” says Marina Kostova, storage systems analyst with IDC CEMA. “With the rising importance of as-a-service storage options, direct spending on storage hardware by enterprises was limited to cheap primary and backup storage, and refresh-cycle investments in datacenter infrastructure. However, IDC expects the growing demand for hybrid storage to give the midrange segment a boost in the second half of 2014.“

IDC’s Q2 2014 Europe, Middle East, and Africa (EMEA) Disk Storage Systems Quarterly Tracker delivers timely intelligence and a comprehensive database detailing changes and trends in the storage market. The tracker enables users to view data by volume, value, terabytes, country, year, quarter, vendor, product brand, model name, product category, topology, installation, protocol, OS, redundancy, storage class, and price band.

This data and analysis is included in the EMEA IT Infrastructure Hardware for Public and Private cloud 2011-2018 Forecast (IDC #CL01W, July 2014).

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter