Entry-Level Storage Devices in EMEA Down 9% Y/Y in 1Q15 – IDC

6.7 million devices shipped

This is a Press Release edited by StorageNewsletter.com on June 10, 2015 at 2:58 pmResearch from International Data Corporation shows that 6.7 million personal and entry-level storage devices shipped in EMEA in 1Q15, a decline of 8.8% from a year ago.

IDC’s Worldwide Personal and Entry-Level Storage Tracker also shows that there was a decline in shipment values, by 14.7% to $512 million.

In the personal storage segment, HDD vendors continued to gain share and dominate the market. The 1TB-3TB capacity range accounted for 70.28% of the segment.

The affordability of personal storage and the facility to store data without any privacy/data breach or bandwidth concerns that end users encounter with some public cloud make personal storage devices the main source for consumers to store and manage their data, according to Jimena Sisa, senior research analyst, European storage research, IDC.

The entry-level segment used to be dominated by mainstream non-HDD vendors. In 1Q15, however, mainstream non-HDD vendors lost 26.7% unit share to HDD vendors, following the same pattern as in 2014. NAS products dominate this segment, with 96.6% market share in 1Q15.

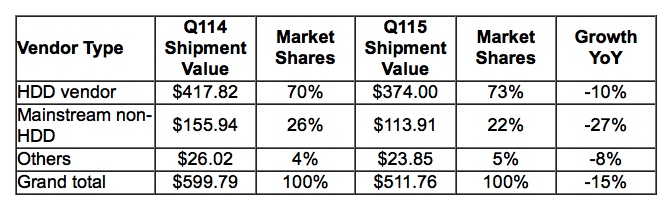

EMEA Personal and Entry-Level Storage Shipment Value,

Market Share, and Year-Over-Year Growth, 1Q15

(shipment value in $ million)

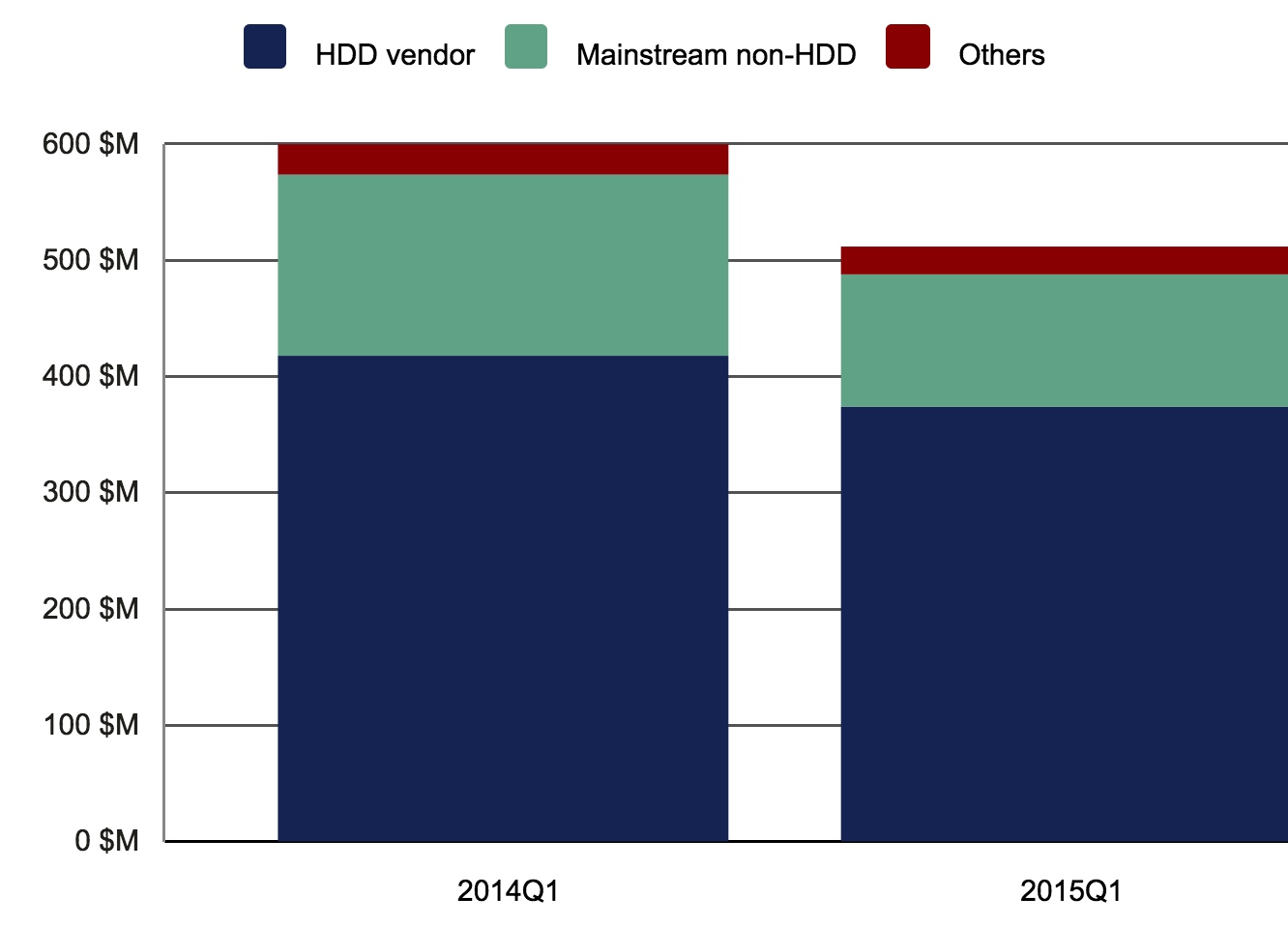

EMEA Personal and Entry Level Storage Market by Vendor Type, 1Q15

(revenue in $ million)

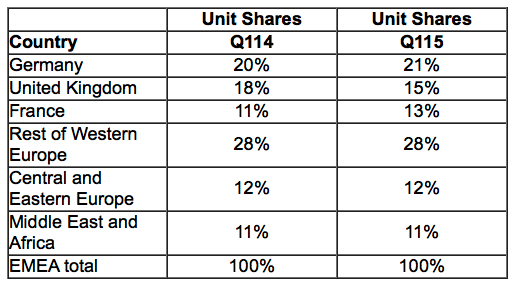

EMEA Personal and Entry-Level Storage Country Share, 1Q15

Notes:

- IDC defines personal storage as having 1-2 bays and entry-level storage as having 3-12 bays. HDD vendors are suppliers that manufacture their own HDD drives, in addition to branded external storage. IDC defines a mainstream non-HDD vendor as a major

- PELS vendor that does not manufacture its own HDD drives.

- Data for the PELS market is reported for calendar quarters. It includes vendor type, bays, capacity range, interface, and form factor.

- Major vendors covered in this IDC Tracker include Western Digital, Seagate, Toshiba, Buffalo Technology, D-Link, Netgear, and Lenovo/EMC (Iomega).

- EMEA PELS research covers 16 Western European countries, the Czech Republic, Poland, the Rest of Central Eastern Europe, South Africa, Turkey, the United Arab Emirates, and the Rest of Middle East and Africa.

Read also:

WW Personal and Entry Level Storage Market Declined in 1Q15 – IDC

6.4% year over year and 13.6% sequentially

2015.05.19 | Press Release

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter