EMEA Integrated Infrastructure and Platform Revenue of $2.5 Billion for 2014 – IDC

300PB shipped in 4Q14

This is a Press Release edited by StorageNewsletter.com on April 7, 2015 at 3:10 pmThe integrated infrastructure and platforms market in Europe, the Middle East, and Africa (EMEA) grew 35% year over year in terms of vendor revenue to around $734.6 million in 4Q14 and achieved a yearly total of more than $2.5 billion in revenue in 2014, according to the International Data Corporation.

Shipments in the quarter reached close to 300PB of capacity, or around 9% of the total external storage capacity sold in EMEA in the same period, with an increase of more than 56% year over year.

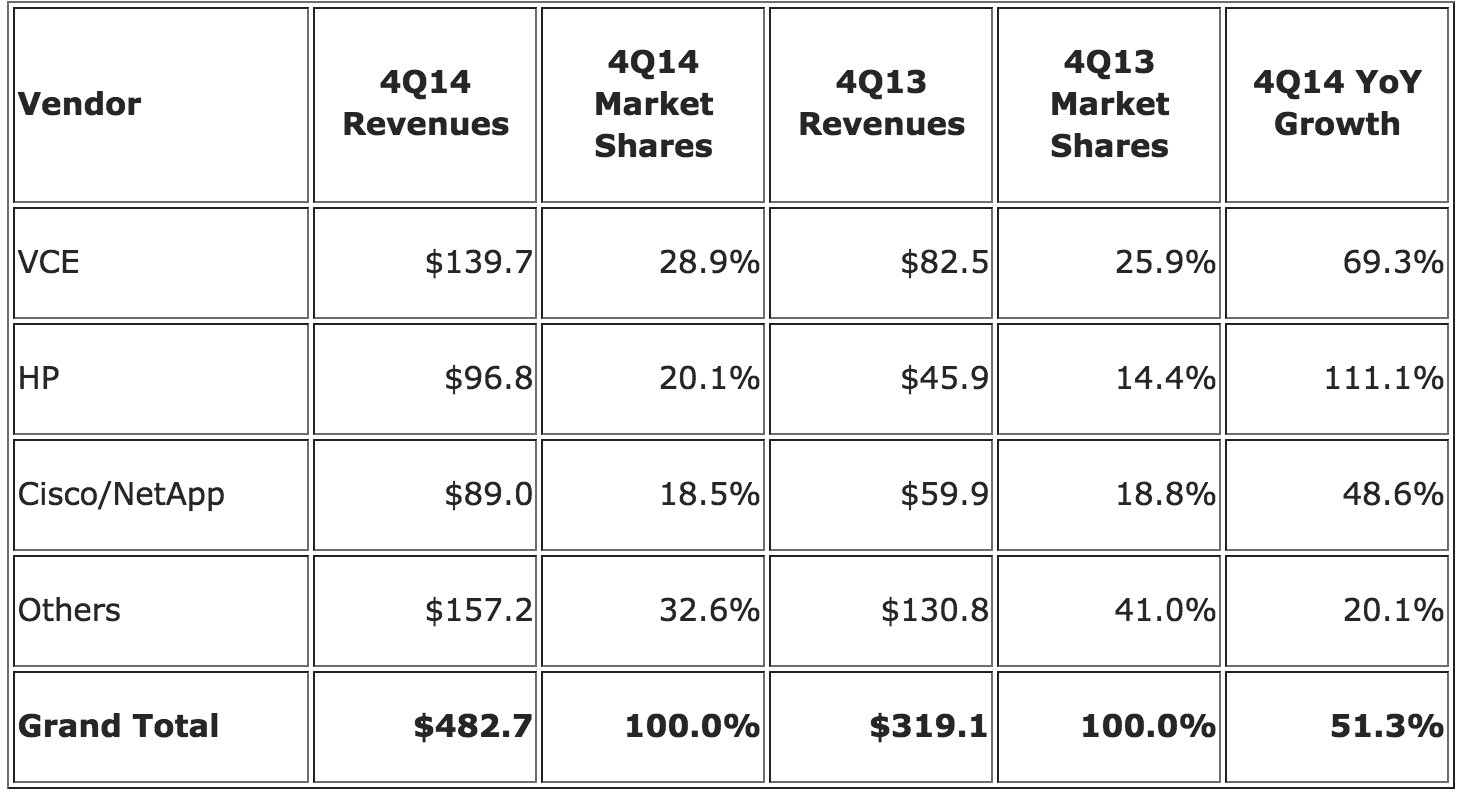

Top 3 Vendors, EMEA Integrated Infrastructure Systems Revenue, 4Q14

(in $ million)

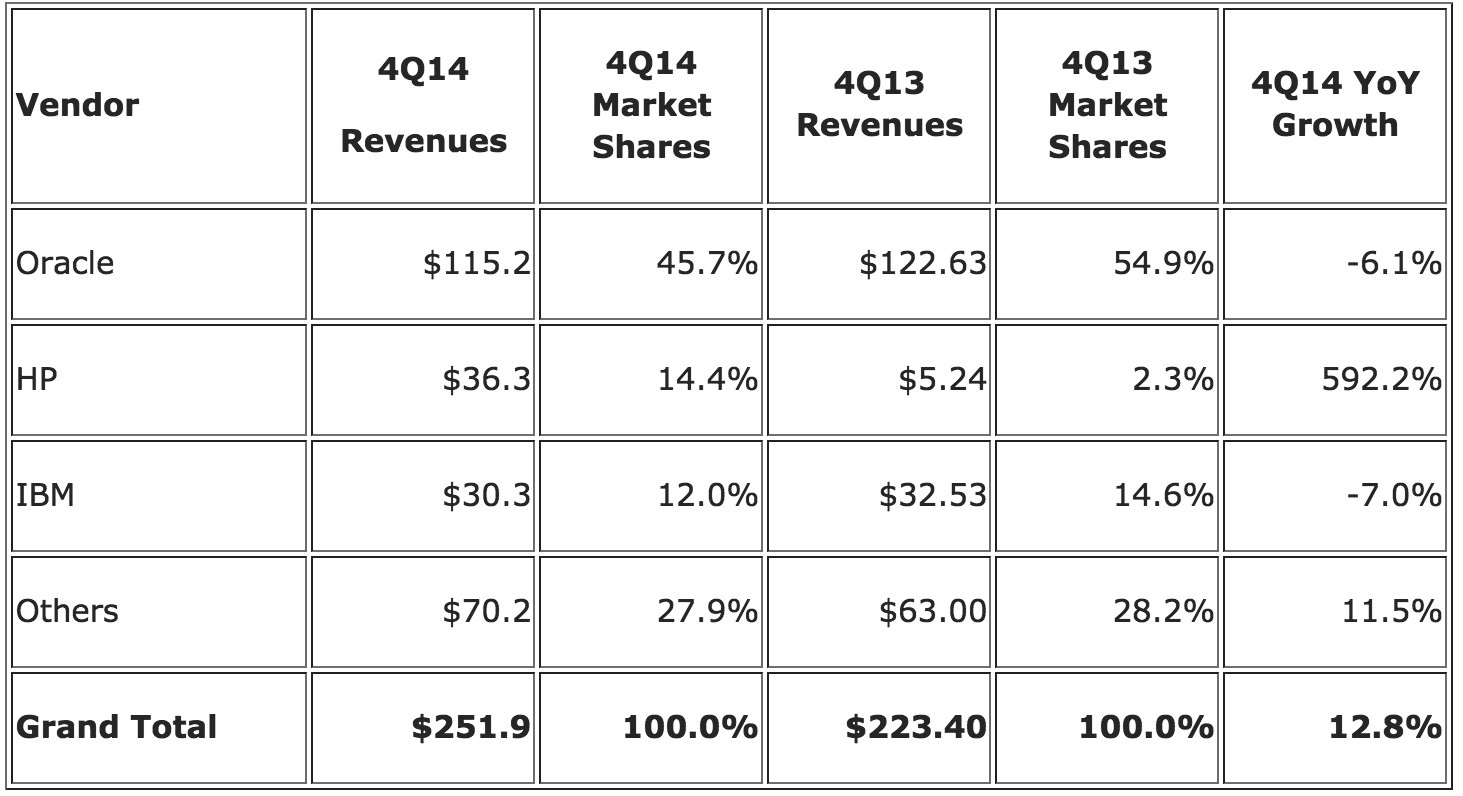

Top 3 Vendors, EMEA Integrated Platforms Revenue, 4Q14

(in $ million)

(Source: IDC’s EMEA Quarterly Integrated Infrastructure and Platforms Tracker, March 26, 2015)

Western Europe still accounted for more than 81% of revenues of the EMEA region; the UK and Germany being its largest markets. Beyond them, France, the Nordics, and Benelux have built a significant presence in the segment and a good uptake is also spreading to the southern countries of Western Europe. From the applications point of view, beside typical workloads such as VDI, database, and sharing tools, new workloads such as SAP HANA and Hadoop are increasingly run over integrated systems.

“Integrated systems have now become a major driver for the European infrastructure market, eliminating many management pain points of the modern datacenter, and the expected uptake in private and hybrid cloud will certainly fuel further growth,” said Silvia Cosso, senior research analyst with IDC’s EMEA storage team. “It is now time for the industry to address challenges such as the high price of acquisition, which prevents such systems from addressing the bulk of SMBs, as well as to eliminate the barriers to easier system scalability.“

Central and Eastern Europe, the Middle East, and Africa (CEMA) captured 19% of EMEA market value in 4Q14, down marginally over the previous quarter. The Middle East and Africa (MEA) continued to record the fastest growth in the EMEA region, expanding by 125% year over year and benefitting from infrastructure investments in Saudi Arabia and UAE. Central and Eastern Europe (CEE) also posted solid annual growth of 24%, mostly driven by demand in Russia.

“A growing number of organizations in CEMA are shifting their approach to infrastructure investments and adoption of integrated systems are seen as a practical solution to address efficiency and manageability challenges,” said Jiri Helebrand, IDC research manager, servers, systems and infrastructure solutions, CEMA.

Integrated infrastructure systems accounted for more than 66% of the total revenue generated in EMEA in 4Q14, driven by their lower price.

IDC defines integrated infrastructure and platforms as pre-integrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software at the point of sale.

IDC segments this market into two categories:

- Integrated platforms: systems sold with additional pre-integrated packaged software and customized system engineering optimized to enable functions such as application development software, databases, testing, and integration tools.

- Integrated infrastructure systems: leveraging the same infrastructure building blocks as integrated platforms but not optimized for a specific workload and designed for general-purpose, distributed workloads instead.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter