Cloud Environments Accounted for Third of WW Spending on Enterprise IT Infrastructure in 2015 – IDC

Led by growth of public cloud datacenters

This is a Press Release edited by StorageNewsletter.com on February 2, 2016 at 2:59 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, total spending on IT infrastructure products for deployment in cloud environments will increase by 24.6% in 2015 to reach $32.8 billion.

This amount includes spending on servers, storage (excluding double counting between storage and server), and Ethernet switch products.

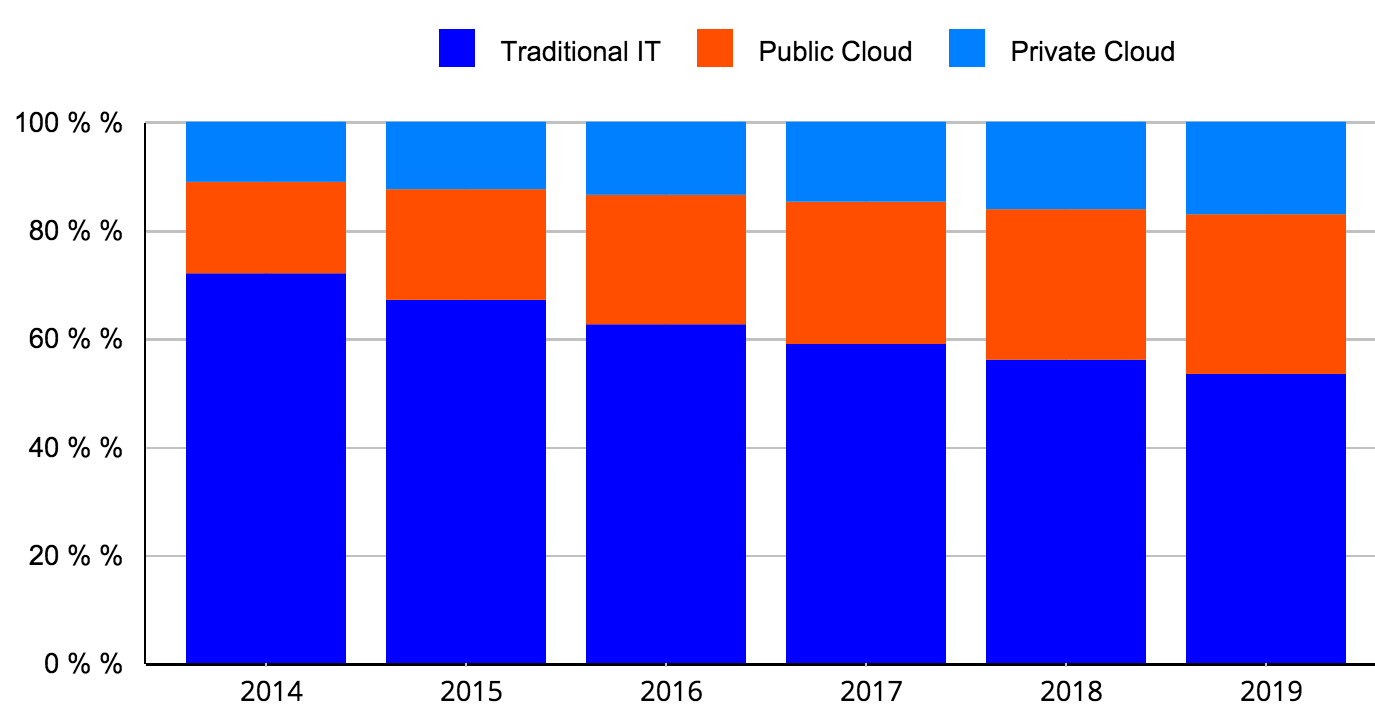

Spending on cloud IT infrastructure will grow from 28% of overall spending on enterprise IT infrastructure in 2014 to 32.9% in 2015. In comparison, spending on IT infrastructure deployed in traditional, non-cloud, environments will decline -1.1% in 2015. At $67 billion it will remain the largest segment of the market. Spending on private cloud IT infrastructure will grow by 19.1% year over year to $12.4 billion, while spending on public cloud IT infrastructure will increase 28.2% year over year in 2015 to $20.4 billion.

Central and Eastern Europe remains the only region where spending on cloud IT infrastructure is expected to decline in 2015. In most other regions, spending on cloud IT infrastructure will grow at double-digit rates. For all three technologies – server, storage and Ethernet switch – growth in spending will exceed 20%; spending on servers will grow at the highest rate, 26.7%.

For the five-year forecast period, IDC expects that spending on IT infrastructure for cloud environments will grow at a CAGR of 15.5% and will reach $54.3 billion by 2019, accounting for 46.6% of the total spending on enterprise IT infrastructure. Spending on non-cloud IT infrastructure will decline at a-1.7% CAGR during the same period. Within the cloud segment, spending on public and private cloud IT infrastructure will grow at 16.6% and 13.8% CAGRs respectively. In 2019, IDC expects service providers will spend $34.4 billion on IT infrastructure for delivering public cloud services, while spending on private cloud IT infrastructure will reach $19.9 billion.

WW Quarterly Cloud IT Infrastructure Market Forecast by Deployment Type 2014-2019

(shares based on value)

“The growing sophistication and reliability of cloud services continue to drive increasing demand for public and private cloud offerings,” said Natalya Yezhkova, research director, storage systems. “End users find that through utilization of multiple deployment models, including public cloud, on-premises and off-premises private cloud, and traditional IT infrastructure, they can achieve flexibility and agility tuned to the requirements of various legacy and next-gen workloads and applications.”

Worldwide Quarterly cloud IT Infrastructure Tracker is designed to provide clients with a better understanding of what portion of the server, disk storage systems, and networking hardware markets are being deployed in cloud environments. This Tracker breaks out vendors’ revenue by the hardware technology market into public and private cloud environments for historical data and also provides a five-year forecast by technology market.

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter