All M&As (73) in 2013

Same number in 2012: top ones are ...

By Jean Jacques Maleval | January 3, 2014 at 3:01 pmSince more than a decade we analyze the merger and acquisition trends in the worldwide storage industry, which has allowed us the proper perspective from which to gauge the evolution over time.

In 2006, there was a record of 104 M&As. Compared to 2012, the movement was stabilizing in 2013 with 73 deals, exactly the same number.

Storage is a big part of M&As. Per comparison, according to Thomson Reuters & National Venture Capital Association for all activities in USA (not only IT), there was 377 M&A deals in 2013 including 90 with disclosed values for a total of $14.5 billion or an average of $161 million.

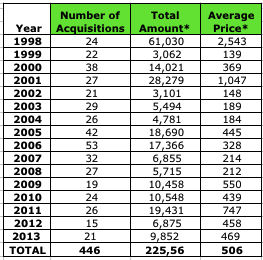

NUMBER OF ACQUISITIONS SINCE 1998 IN WW STORAGE INDUSTRY

| Year | ≠ |

| 1998 | 48 |

| 1999 | 59 |

| 2000 | 61 |

| 2001 | 64 |

| 2002 | 45 |

| 2003 | 54 |

| 2004 | 51 |

| 2005 | 75 |

| 2006 | 104 |

| 2007 | 90 |

| 2008 | 73 |

| 2009 | 50 |

| 2010 | 71 |

| 2011 | 62 |

| 2012 | 75 |

| 2013 | 74 |

(Source: StorageNewsletter.com)

Last year there was an enormous acquisition to be confirmed, LSI being bought by Avago Technologies for as much as $6.6 billion. This amount is not far from the total amount spent in 2012 ($6.9 million) for all the 73 acquisitions in 2013. It represents two thirds of all the 2013 deals. Behind that, number two is only $685 million, the sum paid by Western Digital to get Virident Systems. Iron Mountain records seven relatively small acquisitions last year, followed by Western Digital with four.

Historically, EMC is the most voracious in the industry with 73 acquisitions since 1994, but is much quieter these past years. It acquired 23 companies in 2007 only, just two in 2011, three in 2012 and three in 2013. Other storage giants were even quieter. No deal at all realized by Dell, HP, IBM and HDS, one by SanDisk and Seagate, just a small one by NetApp,.

With these 73 deals, EMC is largely in front of Veritas Software added to Symantec with a total of 35 acquisitions, Seagate (including Seagate Software) 29, Iron Mountain 25, IBM 19, LSI 17, Dell 17, Xyratex 16, HP 15. Only 12 for NetApp.

TOTAL AMOUNT OF ACQUISITIONS SINCE 1998

(here we include only the acquisitions when the price is known)

* in $ million

(Source: StorageNewsletter.com)

Looking at the total amount spent by the buyers – when the price of the acquisition has been revealed -, it was $9.9 billion in 2013 for an average of $469 million per deal. But be cautious about this average price because it only concerns 21 of the 73 M&As last year. When the amount of the deal is not revealed, it’s generally a small figure. It’s notably the case for big companies when they estimated that an acquisition has no significant impact on their global financial figures.

One year ago we predicted a more productive 2013 year but finally the number of acquisitions was the same in 2012 and 2013. And now our bet is around the same number (73) this year. The consolidation in the industry will continue because some publicly-traded companies are in bad shape and there are too many storage start-ups trying to survive with the only goal to be acquired or die.

Furthermore a trend is not going to stop: storage giants invent about nothing in new killing storage technologies and prefer to buy them by acquiring start-ups. It’s less expansive than investing in their own R&D.

We will probably continue to see several M&As in the channel market as usual (7 in 2013), and especially in online backup (7) and around SSD (8) as there are too many companies in these two activities. Wait also for some deals in big data.

More than $1 billion M&As

in the history of the storage industry

(only one in 2013)

2001: Compaq by HP, $25,000 million

2005: Veritas by Symantec, $11,000 million

2011: Autonomy by HP, $10,300 million

1998: Digital Equipment by Compaq, $9,600 million

2009: Sun by Oracle, $7,400 million

2013: LSI by Avago technologies, $6.600 million

2011: Hitachi GST by WD, $4,300 million

2005: StorageTek by Sun, $4,100 million

2000: Sterling Software by CA, $4,000 million

2000: Seagate by Suez Acquisition, $4,000 million

2006: Agere by LSI, $4,000 million

2008: Foundry Networks by Brocade, $2,600 million

2012: Elpida by Micron Technology, $2,500 million

2012: Quest Software by Dell, $2,400 million

2010: 3par by HP, $2,350 million

2010: Isilon by EMC, $2,250 million

2009: Data Domain by EMC, $2,200 million

2006: RSA by EMC, $2,100 million

2002: IBM HDD by Hitachi, $2,050 million

2000: Cobalt Networks by Sun, $2,000 million

2004: Kroll by Marsh & McLennan Companies, $1,900 million

2006: Maxtor by Seagate, $1,900 million

2000: Ancor Communications by QLogic, $1,700 million

1998: Seagate Software by Veritas, $1,600 million

2006: FileNet by IBM, $1,600 million

2006: msystems by SanDisk, $1,500 million

2007: EqualLogic by Dell, $1,400 million

2011: Samsung HDD by Seagate, $1,375 million

2000: Quantum HDD by Maxtor, $1,300 million

2003: Legato by EMC, $1,300 million

2010: Numonyx by Micron, $1,270 million

1996: Cheyenne by CA, $1,200 million

2010: Division 5 Technology by Max Stiegemeier (GCF), $1,200 million

1999: Data General by EMC, $1,100 million

1995: Conner Peripherals by Seagate, $1,040 million

(Source: StorageNewsletter.com)

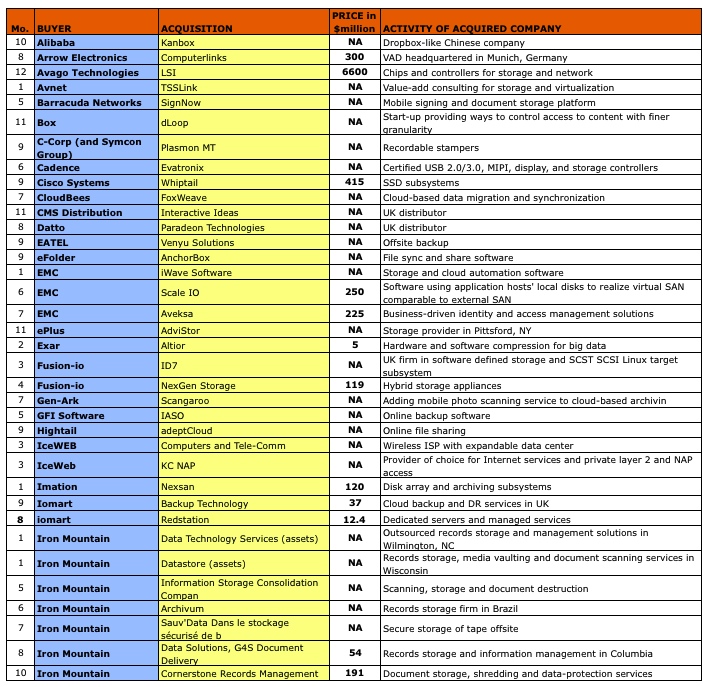

WHO BOUGHT WHOM IN 2013

(Source: StorageNewsletter.com)

(Source: StorageNewsletter.com)

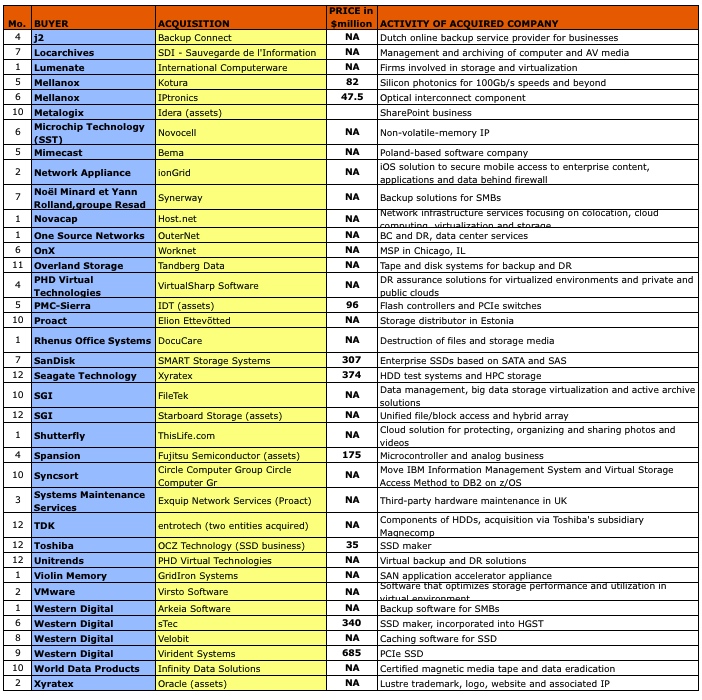

WHO BOUGHT WHOM IN 2013 (continued)

(Source: StorageNewsletter.com)

(Source: StorageNewsletter.com)

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter