12 Hyperconverged Infrastructure Providers That Matter

Nutanix, SimpliVity and Pivot3 leaders in front of EMC, HPE, VMWare, etc.

This is a Press Release edited by StorageNewsletter.com on August 23, 2016 at 3:08 pmThe Forrester Wave: Hyperconverged Infrastructure (HCI), Q3 2016

The 12 Providers That Matter Most And How They Stack Up

(August 16, 2016)

by Richard Fichera and Naveen Chhabra with Glenn O’Donnell, Andrew Hewitt, and Diane Lynch, analysts at Forrester Research, Inc.

Forrester conducted product evaluations in May 2016 and interviewed 12 hyperconverged systems vendors and their references: Atlantis Computing, Cisco, EMC, Gridstore, HPE, Huawei, Nutanix, pivot3, Scale Computing, SimpliVity, Stratoscale, and VMware.

Hyperconvergence Is a Concept Whose Time Has Come

A flexible cloud computing model has proven central to nimble adaptation for quickly changing customer expectations. As I&O pros around the globe increasingly virtualize their infrastructure, operating ever-larger cloud-like infrastructures has gained a higher pro le. More virtualization has resulted in more complexity at a time when complexity is already excessive. In response to this growing problem, the first hyperconverged system emerged in 2011.(1) Hyperconverged platforms disrupt the traditional hardware infrastructure vendor landscape because they let customers build scalable virtualized infrastructure without requiring silo-focused expertise in areas such as storage and SAN management.

Forrester defines hyperconvergence as:

An approach to technology infrastructure that packages server, storage, and network functions into a modular unit and adds a software layer to discover, pool, and reconfigure assets across multiple units quickly and easily without the need for deep technology skills. These systems can be implemented either as software plus modular physical units or as a software overlay on top of existing infrastructure.

Legacy Hypervisor-Based Infrastructure Did Little to Hide Complexity

Legacy hypervisor-based infrastructure exposed too many underlying system details, unnecessarily adding to operational complexity. The routine task of adding capacity – particularly storage and compute capacity – became increasingly onerous, distracting I&O professionals from tasks that deliver more value to their companies’ BT agendas. Tech management professionals are demanding tighter management integration across virtualization and storage silos to boost the efficiency of their infrastructures to match customer demands.

Technology Must Obscure Complexity

to Help Protect People from Themselves

Complexity is inevitable, but it’s usually a self-inflicted issue. Infrastructure is typically designed with the best tools and design methodologies available at the time but often with unclear or missing information about future requirements. As these environments scale and change, the limitations of the underlying technology become more and more apparent, manifesting themselves as increasing complexity and instability. Complexity and instability have a tendency to become nonlinear as the number of non-isolated potential interactions between components increases. At the same time, a small minority of people who have profound technology expertise rooted in the current environment and are resistant to change sometimes complicate these legitimate aspects of complexity. The result is like a Frankenstein’s monster that turns on its creators. Even those with the deepest technical expertise will find themselves crushed under the weight of its complexity, and the business will suffer commensurately. Technology must protect us from ourselves.

Hyperconvergence Delivers on The Promise of Infrastructure-As-A-Service (IaaS)

The next wave of integrated systems, beyond the base level of converged hardware integration, is hyperconvergence, which installs a software-defined storage layer optimized for VM-aware operation on top of an integrated hardware and system software stack.(2) The earlier generation of converged infrastructure (CI) combined resources into single physical units, which was a great first step to truly unifying infrastructure. Hyperconvergence adds more flexibility by treating the entire pool of physical units as a unified virtual entity. With minimal administrative burden, you can morph this pool into more-flexible configurations and treat the storage as native objects in the virtualization abstraction layer. A fluid resource pool is central to the whole notion of cloud computing. If you wish to develop cloud-like services atop your infrastructure, hyperconverged systems represent a very promising platform. When you’re forced to manipulate individual components, the process is complex and fragile, even when cloud software automates it. Let the infrastructure itself produce the needed capabilities.

Forrester believes that a hyperconverged system must have all of the following:

- Integrated compute and storage resources. At the core of the hyperconverged value proposition is the simplicity of scaling the cluster, which in part derives from the co-provisioning of compute and storage resources in pre-integrated modules. In contrast, basic CI solutions bundle and pre-integrate discrete server and storage units. One glaring and immediate concern of potential users was that this pre-supposes that the ratio of compute and storage is fixed and that the vendor has guessed correctly.(3) Hyperconverged systems vendors have dealt with this in three ways: 1) they made well-informed assumptions with their initial set of offerings; 2) many of them offer modules with differing levels of compute and storage; and 3) some can access and federate external storage resources.(4)

- Software-defined storage. The core value of a hyperconverged system is the simplicity it brings to the management of VM storage. Hyperconverged systems must also provide a software abstraction of the federated storage of the physical nodes and present this storage to the hypervisor. For example, the Nutanix Distributed File system (NDFS) fulfills the storage aggregation and resiliency functionality. Storage functionality beyond this baseline requirement varies considerably, and such variations represent a major part of the current differentiation among vendors.

- Automatic discovery and configuration. The third leg of the hyperconverged concept is that

the hyperconverged system must be capable of discovering and adding a new resource to the environment with minimal operator interaction. While this is hard to quantify in terms of the number of required operator interactions or time investment, Forrester believes that a hyperconverged system should be able to add a new module with an additional 20TB to 100TB of storage in no more than 15 minutes of operator time and that none of the incumbent members of the cluster should require any administrative intervention. - Minimal management outside the hypervisor console. Management must be largely within the purview of the hypervisor console, enhanced further with APIs for integrating with other automation tools such as cloud management suites.(5) Other than initial setup, avoid manually managing such dynamic systems from the command line, as this method is costly and prone to errors. Local system management must be minimal, with extensive automation of required management tasks. Again, this is an area in which vendors will innovate and differentiate, but the basic requirement is to reduce the number of operator interventions.

Hyperconverged Systems Have a Broad Range of Use Cases

In short, any use case that demands rapid resource allocation will benefit from hyperconvergence. thus, we expect hyperconverged systems to become ubiquitous, fueling a rush to market by all technology vendors. Vet solutions carefully, as many will stretch the definition to gain traction.

Interviews with Forrester clients and systems vendors provided us with the following set of use cases where I&O pros can advantageously deploy hyperconverged systems:

- Virtual desktop infrastructure (VDI). Hyperconverged systems can offer a very efficient deployment platform. Embedded deduplication is a strong positive for the VDI use case,

and performance, system overhead, and efficiency of vendor deduplication algorithms vary. Deduplication is advantageous in many use cases but critical in VDI because of the high degree of replication of identical data in multiple desktop images. A VDI system with efficient deduplication may enjoy a 10-to-1 or greater advantage in storage efficiency over a non-deduplicated environment. For VDI, deduplication processing is generally not performance-intensive because the majority of the processing occurs only at the time of image generation and the reconstruction of the invoked image is less resource intensive.(6) - IaaS environments with large numbers of stored VM templates. This use case is similar to the VDI use case. The savings also come in the form of deduplicated storage for the large number of template files that you’ll use to build future images, as well as the stored images themselves.

- High-volume VM snapshotting. VM snapshots are an important element of a global DR/BC strategy, but generating these snapshots tends to cause storage requirements to balloon, and the replication of them to a remote location can strain network resources.(7) A hyperconverged system with embedded deduplication, whether immediate or deferred, can yield significant benefits in storage utilization and network load and can improve DR/BC options. Feedback from enterprise clients indicates that the existence of this capability will motivate clients and stakeholders to generate snapshots more often, so I&O professionals must be prepared. Nonetheless, illustrations of operational results showing a greater than tenfold savings in space convince us that the results will be positive for most customers.(8)

- General VM clusters. Independent of deduplication, hyperconverged systems provide an extremely cost-efficient way to deploy capacity for general-purpose IaaS environments. Contributing factors include reduced management overhead, rapid provisioning, and efficient management of a global federated storage resource at a low cost. This cost is at least competitive on a capital cost basis with a standard rack solution and homegrown integration. Even workloads where VMs have historically strained a bit, such as online transaction processing (OLTP), are readily addressable, as vendors have increased the number of node configurations available, including all- flash nodes offered by multiple vendors. Scalability of hyperconverged systems has escalated rapidly, as has the deployment of general-purpose enterprise workloads such as major independent software vendor (ISV) solutions and databases.(9)

- Analytics clusters. Early deployments of Hadoop and other analytics tools on hyperconverged systems indicate that ease of scalability and simplified storage management benefits far outweigh the drawback of losing control over physical resource placement across the systems, and Forrester expects to see a ramp in hyperconverged systems as an alternative to generic Hadoop clusters. Analytics is another workload where the availability of all-flash nodes will be a major plus.(10)

Hyperconverged Systems Evaluation Overview

To assess the state of the hyperconverged systems market and see how the vendors stack up against each other, Forrester evaluated the strengths and weaknesses of top hyperconverged systems vendors. After examining past research, user need assessments, and vendor and expert interviews, we developed a comprehensive set of evaluation criteria.

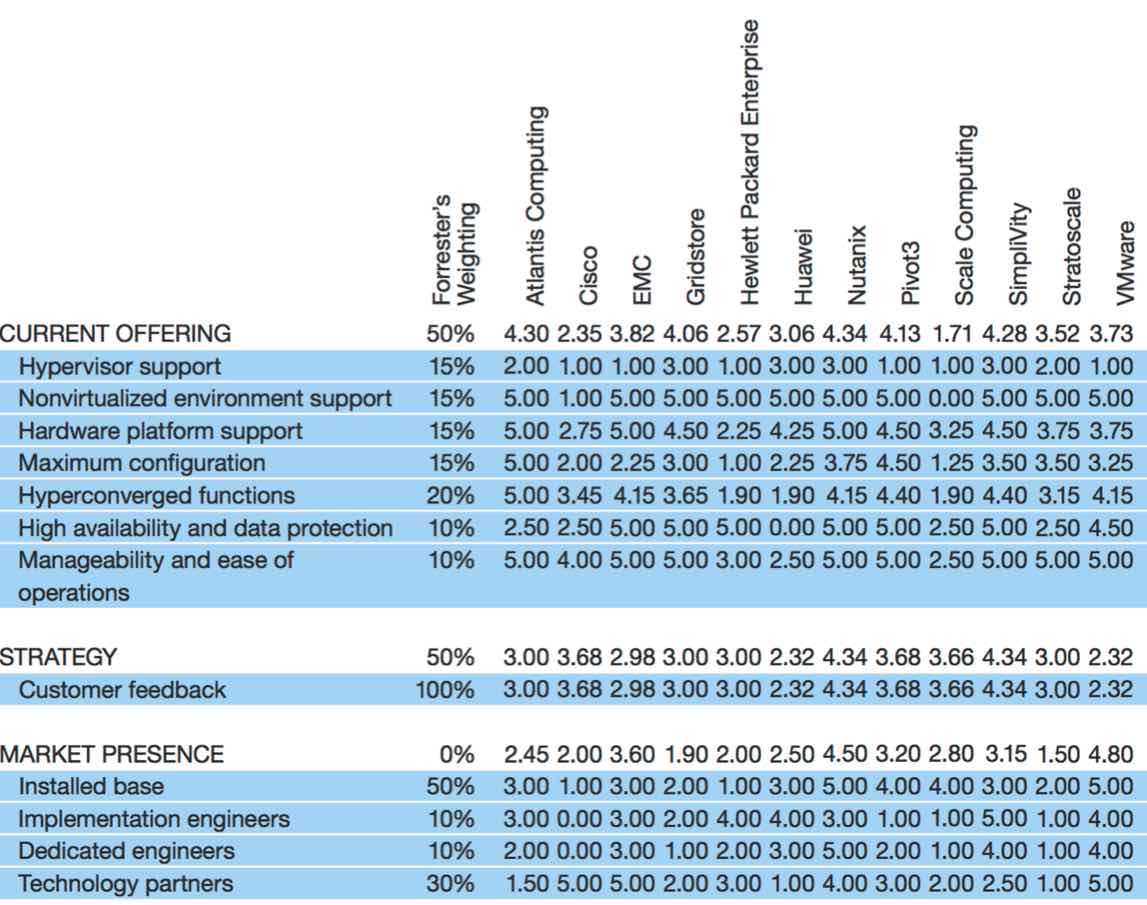

We evaluated vendors against 28 criteria,

which we grouped into three high-level categories:

- Current offering. We evaluated the capabilities of the current offerings according to our set of criteria.

- Strategy. We assessed each vendor’s strategic positioning as a factor of several evaluation criteria.

- Market presence. This category indicates the relative ranking of the vendors in terms of their customer installations and revenues. In cases where the vendor did not disclose, Forrester has made estimates.

Evaluated Vendors and Inclusion Criteria

Forrester included 12 vendors in the assessment: Atlantis Computing, Cisco, EMC, Gridstore, HPE, Huawei, Nutanix, Pivot3, Scale Computing, SimpliVity, Stratoscale, and VMware.

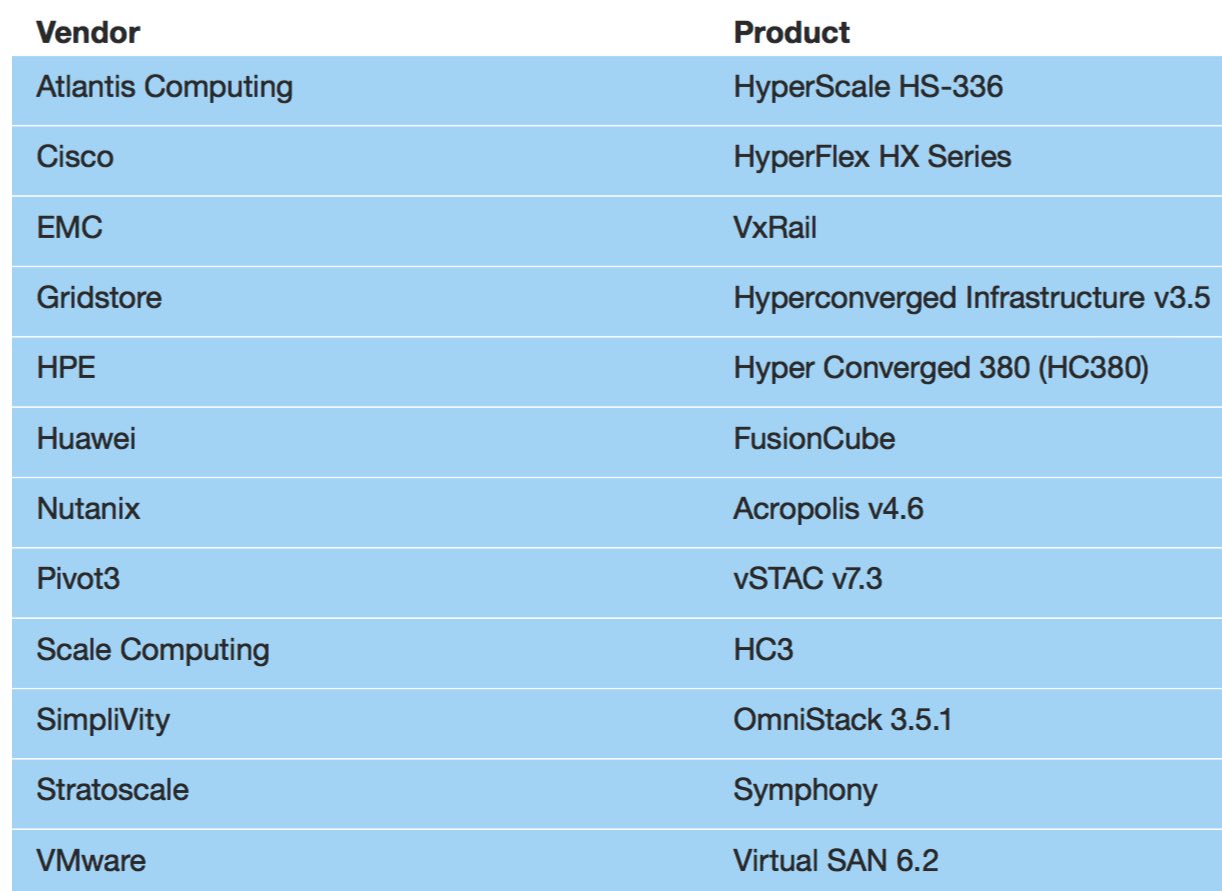

Each of these vendors has (see Figure 1):

- A hyperconverged product in availability. Forrester required that the evaluated product and version be available for general purchase, not in beta or restricted availability. The same policy applies for features and point upgrades – we have included only currently shipping features.

This stricture had significant effects on products that, while they have impressive technology roadmaps and might score much better in the future, don’t have the required features in production today. Many of the evaluated products are capable of running on multiple hardware platforms, and Forrester has evaluated only the software capabilities, or in the case of bundled appliances, the primary hardware/software combination. The existence of differences across multiple platforms was an evaluation criterion. - Referenceable customers. Forrester requires that vendors supply at least three reference customers. Forrester directly collected these evaluations.

- The ability to demonstrate the product. An integral part of the Forrester Wave evaluation process is a product demonstration, which we record for reference. We supply a script specifying a set of tasks to the vendors, and at a minimum, they must perform all the tasks in the script. the script for the hyperconverged vendors specified a series of critical operational tasks, including initial setup, creating a VM, setting up replication and data protection policies (if supported), adding capacity, and shutting down a node to prove the resiliency of the system. We encouraged vendors to show additional features beyond the required script.

- An offering that has drawn significant interest from Forrester clients. Forrester clients frequently mention the included vendors in inquiries and other forms of client interaction.

Figure 1 Evaluated Vendors: Vendor Information and Selection Criteria

Vendor selection criteria

Forrester defines hyperconverged infrastructure as an approach to technology infrastructure that packages server, storage, and network functions into a modular unit and adds a software layer to discover, pool, and reconfigure assets across multiple units quickly and easily without the need for deep technology skills. These systems can be implemented either as software plus modular physical units or as a software overlay on top of existing infrastructure.

For this product evaluation, all participants must have:

1. A hyperconverged software offering available for purchase by May 1, 2016. Pricing must be public.

2. At least three production references they can share with Forrester for evaluation.

3. The ability to demonstrate key aspects of the product’s functionality.

4. An offering that has drawn significant interest from Forrester clients.

Vendor profiles

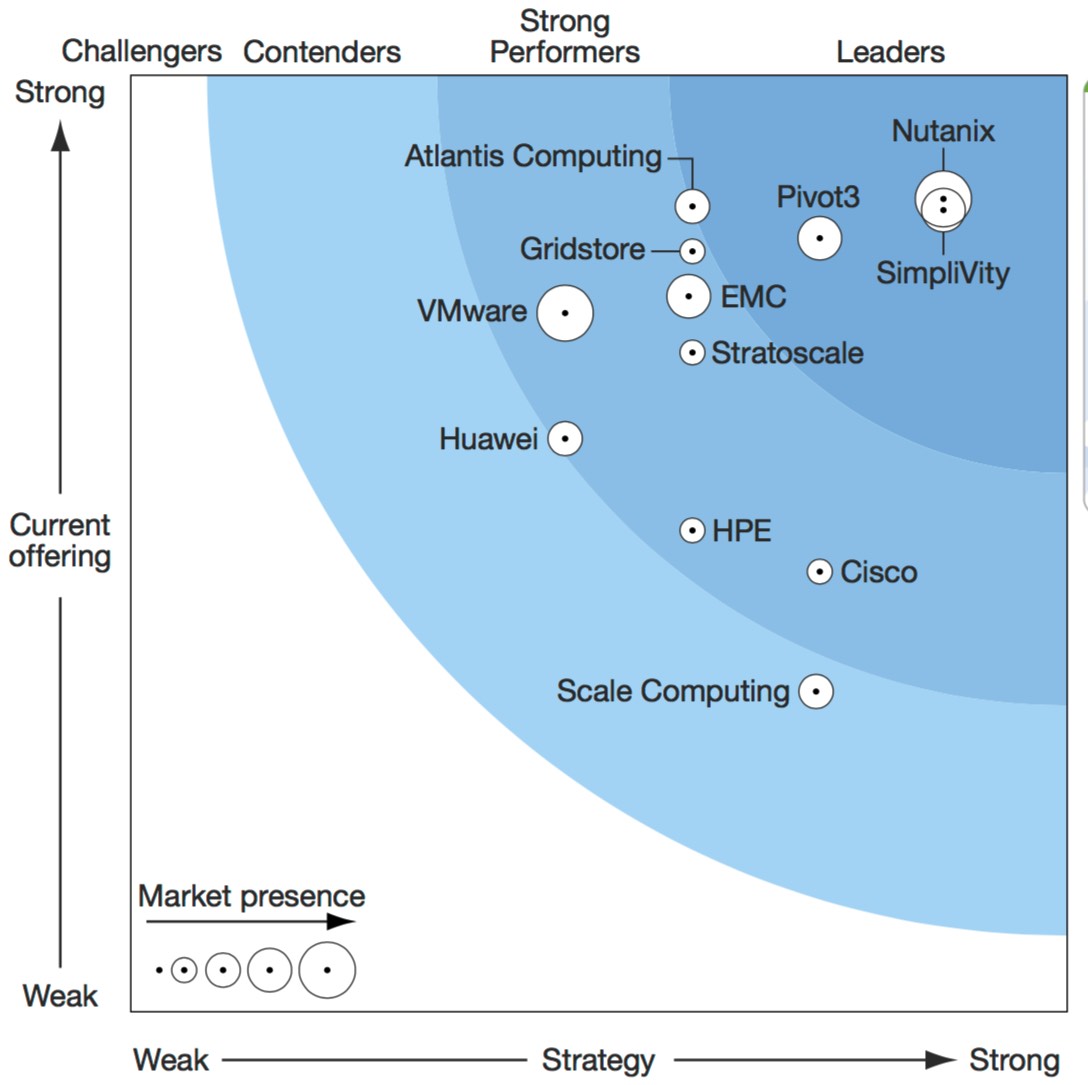

We intend this evaluation of the hyperconverged market to be a starting point only. We encourage clients to view detailed product evaluations and adapt criteria weightings to t their individual needs through the Forrester Wave excel-based vendor comparison tool (see Figure 2).

Figure 2 Forrester Wave: Hyperconverged Infrastructure (HCI), Q3 ’16

Figure 2 Forrester Wave: Hyperconverged Infrastructure (HCI), Q3 ’16 (Cont.)

All scores are based on a scale of 0 (weak) to 5 (strong).

Leaders

Nutanix

It is currently the largest supplier of integrated HCI appliances and widely credited with coining the term ‘hyperconverged’ at the time of its 2011 HCI introduction. Nutanix not only is the largest appliance vendor but also has the most customers in our evaluation (3,100-plus), has 1,800 employees, and operates in 80 countries. Nutanix also boasts some of the largest managed clusters, with more than 100 nodes in its largest customer clusters. Nutanix stands out in its ease of use, simplified management, and no-disruptive capacity. Its annual revenue run rate, estimated by Forrester at approximately $200 million, places it as the highest revenue contributor to the HCI ecosystem (VMware VSAN, while shipping more node licenses, probably does not generate as much revenue).

SimpliVity

It is targeting enterprise storage services and multisite environments through its Omnistack hyperconverged infrastructure offering. The Omnistack product, available as an integrated appliance based on a Cisco, Dell, or Lenovo server, offers a very rich set of global multisite data management functions anchored by an always-on global deduplication architecture. It includes a comprehensive set of backup, deduplication, snapshot, and clones with multisite data replication and DR capabilities along with WAN optimization. Omnistack clusters have more-modest scale limits than many other offerings, at a maximum of 24 nodes in a local cluster, but it compensates with its strong multisite capability. Cluster size has not affected deployment of Omnistack at large enterprise accounts. Maximum total raw storage in a set of linked clusters is in the order of 1.3PB.

Pivot3

It has been quietly shipping hyperconverged systems since 2007, before better-known vendors such as Nutanix and SimpliVity, and has accumulated more than 2,000 customers. Its historical customer base is in surveillance and media storage, leveraging the strength of its efficient and very scalable data protection technology (Pivot3 boasts one of the two largest hyperconverged storage clusters we found in our research). Because it has not focused on general enterprise environments, it’s been flying under the radar for some time. In the past 18 months, the company has made a concerted effort to sell outside of its historical strongholds, and in its most recent quarter, it reported that, for the first time, non-surveillance applications accounted for the majority of its sales. Despite its smaller size and visibility, Pivot3 is a strong candidate, especially if requirements include petabyte-scale storage, where its space-efficient data protection may reduce costs.

Strong Performers

Atlantis Computing

It has been selling storage software solutions since mid-2015, entering the HCI market with a solution based on aggressively priced midsize (up to 24TB) flash-based server nodes. Atlantis was one of the first vendors to answer concerns about data reduction efficiency by selling nodes based on their net effective capacity, with an underlying guarantee to add media if the system failed to deliver on its effective capacity. Atlantis sells through channels and currently supports hardware from Dell, HP, Lenovo, and Supermicro. Atlantis is a relative newcomer and has a small market footprint, but its overall capabilities give it a strong position in this Forrester Wave.

Gridstore

It is unique in its Microsoft specialization, currently supporting only Hyper-V and integration with Microsoft’s environment. The most recent version of Gridstore, V3.5, adds to this already tight integration with Windows server and system Center with support for Azure pack. Gridstore’s flash-based architecture allows independent scaling of its compute and storage resources and scales to multi-petabyte sizes and up to 64 compute and 256 storage nodes. One unique aspect of Gridstore’s solution is its quality-of-service capabilities, which allow the definition of multiple classes of VMs with guaranteed minimum and maximum I/O performance levels. As of the publication date of this Forrester Wave, Gridstore had rebranded itself as HyperGrid.

EMC

It has an extensive portfolio of hyperconverged solutions based on its own IP, open source code, and tightly coupled partner VMware. Its VMware-based VxRail appliances will constitute the bulk of its volume sales through direct and channel partners. VxRail is a combination of x86 servers, VMware VSAN software, and value-added EMC software for initial installation as well as ongoing management. EMC’s scale-up offering, VxRack (which we did not include in this Forrester Wave evaluation), is available in two distinct personalities, one based on open source hypervisors and EMC’s ScaleIO software and one based on VMware’s EVO:SDDC software stack, which bundles VSAN with additional software-defined networking and management tools. Taken as a whole, EMC is in a good position to participate in the industry-wide shift toward software-defined infrastructure environments.

Stratoscale

It proclaims an aggressive mission statement to “bring Amazon Web services (AWS)-like capabilities to the data center.” It’s one of the newest of the HCI vendors, was founded in 2013, and has a limited installed base as of the publication date of this evaluation. However, in this brief time, it has amassed a convincing set of early users. Stratoscale is built on a microservices-based distributed architecture and based extensively on open source, using a distributed version of the KVM hypervisor and ZFS file system services as its underpinnings. Although currently lacking some of the more advanced data services such as deduplication (favoring duplication avoidance technology instead) and compression, Stratoscale does appear to have one of the more advanced workload and data migration capabilities in our vendor group as well as integrated HA.

VMware

It sells its VSAN software-defined storage as a standalone product running on standard x86 server platforms. In addition, it sells through partners that embed VSAN in their own appliances. At the time of this evaluation, VMware claimed more than 4,000 customers for VSAN, which would make it the most widely deployed hyperconverged solution in the market, although we’ve had difficulty in ascertaining revenue due to the varied channels it takes to market. VSAN has rapidly added features over the three-year life of the product and now has a rich feature set, combined with its tight integration with the rest of the VMware stack. Although customers can build VSAN on top of any approved HCI components, most customers will use a VSAN-ready node that conforms to its specifications for CPU, memory, storage, and network configurations, but the specification is not exotic and is available from multiple hardware partners including Cisco, Dell, HPE, Lenovo, Quanta, Supermicro, and others, often with optional integration services.

Cisco

Despite a Cisco UCS ecosystem, multiple software-defined storage partnerships, and a strong relationship with SimpliVity, Cisco recently entered the HCI market with its own product, HyperFlex systems. Cisco bases HyperFlex systems on licensed software technology from Springpath, built on the foundation of Cisco UCS servers. HyperFlex offers the baseline functions required by most HCI customers, and the roadmap includes advanced data services and other features. A compensatory strength for HyperFlex is its deep integration with the Cisco UCS management architecture, which has been instrumental in propelling Cisco from zero to 52,000 server customers in seven years. HyperFlex is in the very early stages of its lifecycle, which affects Cisco’s rating in this evaluation. In the absence of data from Cisco, Forrester was unable to accurately estimate several of the market presence and strategy criteria. While this prediction is not a formal part of the Wave methodology, Forrester expects that, given the strong acceptance of Cisco’s underlying UCS platform, the market ramp for HyperFlex should be rapid.

Hewlett Packard Enterprise

It entered the HCI space in March with its new HC380, a solution based on an integration of several very mature existing elements, notably its own Proliant Dl380 server and its StoreVirtual IP SAN technology.(11) On top of this platform, HPE has added its OneView management software and new Grommet-based user experience for configuration and management of the HCI environment. Like Cisco, HPE’s product is in its early stages, and in the absence of data from HPE, Forrester is unable to properly estimate several of the market presence and strategy criteria, although HPE has thousands of StoreVirtual deployments. While this prediction is not a formal part of the Wave methodology, Forrester expects that, given HPE’s large installed base of enterprise customers and its almost certain intent to port its HCI solution to other platforms, HPE’s position in the HCI segment should improve quickly over time.

Huawei

It offers FusionCube, which supports different hypervisors: FusionSphere, KVM, and VMware. FusionCube includes FusionSphere, Huawei’s proprietary virtualization platform, and FusionStorage, its proprietary software-defined storage layer. While new to the market (FusionCube started shipping in January 2014), Huawei’s product appears to be technically mature regarding performance and stability, as evidenced by SAp’s certification of a FusionCube-based Hana appliance. Compared with most of the other products, Huawei’s data services are weak, but its interface was among the easier to use. For applications that require high speed and high performance, FusionCube supports IB network.

Contender

Scale Computing

It is a small-scale HCI solution that is appropriate for SMB and ROBO users.(1)2 Its solution offers good data services, easy installation, and streamlined management. Scale Computing is a small company but has a large installed base in relation to its revenues.

Endnotes

(1) As far as we know, Nutanix was the first user of the term. While we’re not overly fond of allowing vendors to brand a category, that’s often the advantage of being a first mover, and in this case, the moniker seems to have stuck. the ‘hyperconvergence’ term may someday disappear, but the model is sound and will grow. Nutanix claims it shipped its first system in 2011.

(2) When they began to appear on the market approximately seven years ago, converged infrastructure systems, epitomized by offerings such as HP ConvergedSystem, NetApp Cisco Flexpod, and VCE Vblocks, represented a major jump in productivity for customers. The integration of the core hypervisor with the requisite drivers, system software stack, and storage that we almost take for granted today was a nontrivial exercise then. As HCI technology matures, the picture gets a little more blurred, with the ability to offer storage services to external non-virtualized systems emerging as a competitive differentiator among various HCI vendors, as indicated in the criteria of this Wave.

(3) Fully preconfigured systems are smart choices for specific, well-defined needs (e.g., IBM’s PureSystems or Oracle’s Exadata) where the vendor has optimized the whole package for that need, but these systems are not optimized for more flexible, generalized models like IaaS and other cloud-like services.

(4) The necessity of providing integrated storage doesn’t preclude the optional ability to incorporate external existing storage resources into the HCI pool. Today, this is a work in progress, with a few vendors able to access external storage through their management consoles but none of them able to incorporate the external storage into the HCI pool.

(5) This report covers some of the more popular private cloud products that can benefit from hyperconverged infrastructure.

(6) VDI is an inherently scalable workload due to the high ratio of read to write and the generally low CPU and I/O activity of any given desktop in a large environment.

(7) Snapshots capture highly granular states-in-time that are valuable for any DR/BC strategy. they enable you to restore the state of an environment to a given point in time and are more effective than the traditional manual backup-and-restore model.

(8) Swisscom claims that it was able to get a 50-to-1 capacity savings by leveraging SimpliVity’s platform for consolidating and implementing data protection (backup and disaster recovery) for its Microsoft SQL servers.

(9) The largest single storage pool that Forrester discovered as part of this report is an approximately 6PB Pivot3 cluster that is part of a total installation that exceeds 10PB.

(10) For more information on recent changes to analytics infrastructure, go to this recent Forrester blog post. Source: Richard Fichera, Rethinking Analytics Infrastructure, Richard Fichera’s blog, January 28, 2015.

(11) The HPE Dl380 is the most popular enterprise server in the world. HPE has been selling hundreds of thousands of units of this server family annually to enterprises of all sizes for more than a decade.

(12) Vendors often highlight the ROBO category.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter