Seagate: Fiscal 3Q15 Financial Results

Revenue at $3.3 billion decreased quarterly 10% and yearly 2%.

This is a Press Release edited by StorageNewsletter.com on April 20, 2015 at 2:46 pm| (in $ million) | 3Q14 | 3Q15 | 9 mo. 14 | 9 mo. 15 |

| Revenues | 3,406 | 3,330 | 10,423 | 10,811 |

| Growth | -2% | 4% | ||

| Net income (loss) | 395 | 291 | 1,250 | 1,605 |

Seagate Technology plc reported financial results for the third quarter of fiscal year 2015 ended April 3, 2015.

For the third quarter, the company reported revenue of approximately $3.3 billion, gross margin of 28.7%, net income of $291 million and diluted earnings per share of $0.88. On a non-GAAP basis, which excludes the net impact of certain items, it reported gross margin of 28.9%, net income of $357 million and diluted earnings per share of $1.08. For a detailed reconciliation of GAAP to non-GAAP results, see the accompanying financial tables.

During the third quarter, the company generated approximately $374 million in operating cash flow, paid cash dividends of $176 million and repurchased approximately 12 million ordinary shares for $706 million. Year to date, the company has returned approximately $1.4 billion to shareholders in dividend and stock redemptions. Cash, cash equivalents, restricted cash, and short-term investments totaled approximately $2.6 billion at the end of the quarter.

“In light of dynamic market conditions this quarter we are quite satisfied with our operational performance and ability to return value to shareholders,” said Steve Luczo, chairman and CEO. “Near-term macro uncertainty is affecting certain areas of our addressable market however we remain optimistic that market demand for exabytes of storage will continue to increase over the long-term. Looking ahead, we are focused on aligning our storage technology portfolio effectively to capitalize on market growth opportunities, demonstrating operating profitability and returning value to shareholders.”

Quarterly Cash Dividend

The board of directors has approved a quarterly cash dividend of $0.54 per share, which will be payable on May 15, 2015 to shareholders of record as of the close of business on May 1, 2015. The payment of any future quarterly dividends will be at the discretion of the board and will be dependent upon Seagate’s financial position, results of operations, available cash, cash flow, capital requirements and other factors deemed relevant by the board.

Comments

Revenue for the quarter, at $3.3 billion, decreased quarterly 10% and yearly 2%.

The reasons, according to chairman and CEO Ste Luczo: "Challenges from macroeconomic pressures in Europe and PC demand were factors we needed to manage through the quarter. The magnitude of these factors actually increased in third quarter, resulting in an impact to our top line revenue beyond our initial expectations, particularly in our EMEA business which was down approximately $100 million sequentially."

Net income is down 69% Q/Q and 26% Y/Y.

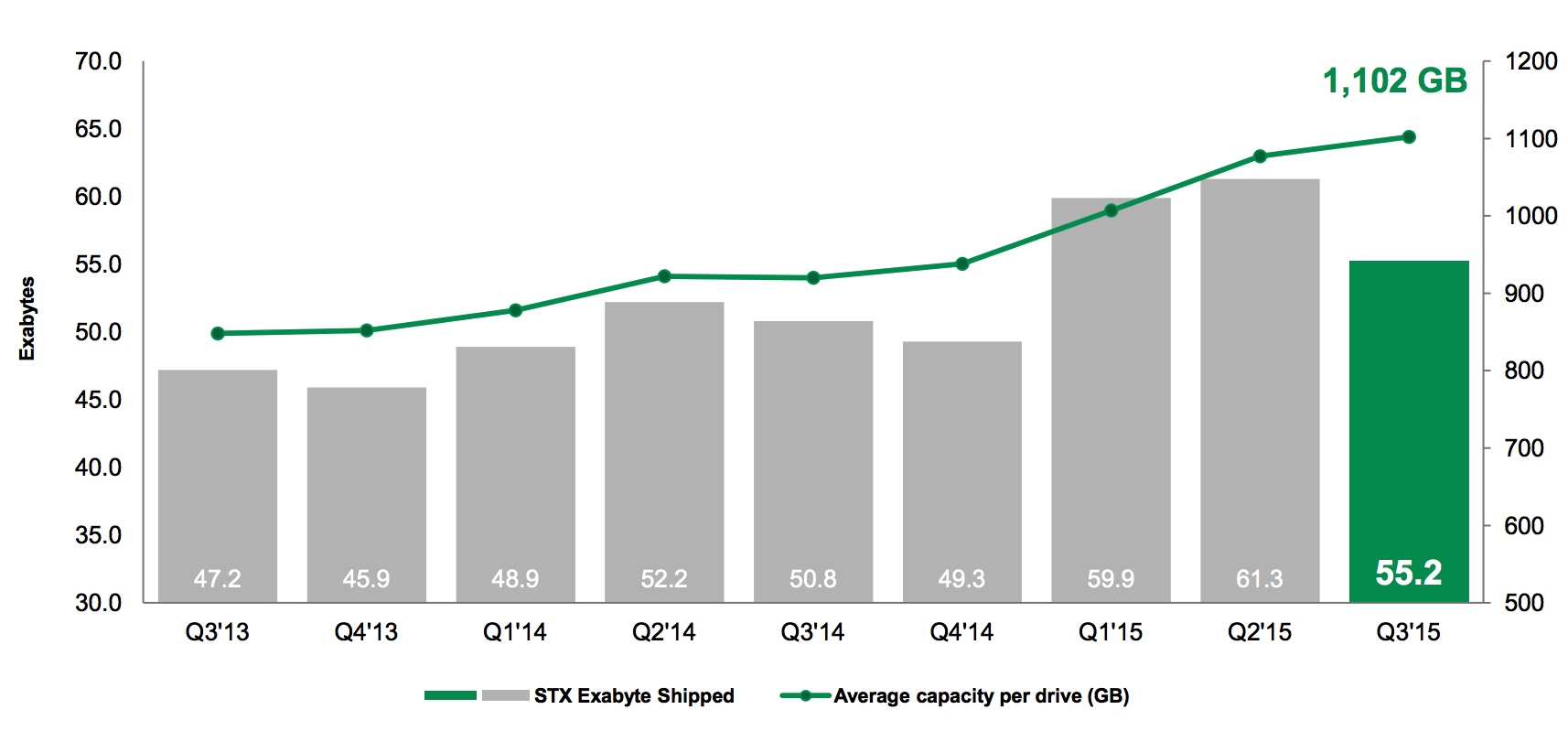

The company shipped $50.1 million HDDs, 12% less than for the former quarter for a total of 55.2EB (-10%) at an average price of $62 (+2%) that is stable since at least two years. Average capacity per drive continues to increase regularly, reaching 1.102 TB, to be compared to 1.077TB for the former three-month period.

Exabytes shipped and average capacity per drive

Enterprise HDD shipments were sequentially flat at 9.1 million units and decrease in all other categories: desktop (-11%), notebooks (-15%), drives for consumer electronics (-21%) and branded drives (-15%).

Nevertheless, "in the high-performance computing space, this past quarter saw major new wins with leading academic, public sector and private labs that combined represent more than 120 petabytes of storage capacity. We also made first delivery of a massive scale-out storage system that when complete will achieve 1.7 terabytes per second while ingesting data, making that the fastest storage system in the world and it’s built end to end on Seagate storage technology", commented Dave Mosley, president, operations and technology.

The future is not bright for the company that expects Europe continuing to be challenged economically for most of 2015. It also believes that the addressable market in the June quarter will be relatively flat with the March quarter. Consequantly it is targeting lower revenue for next quarter, between of $3.2 billion to $3.3 billion. It means that the figure for the complete fiscal year 2015 will reach around $14.1 billion, a tiny 3% increase from FY14.

"Looking further ahead, we continue to believe that the second half of the calendar year will be stronger than the first half with demand coming from the PC market, seasonal gaming demand and continued stability in the enterprise market with potential upside from hyperscale deployments," adds Luczo.

As the global HDD market will continue to decrease in term of revenue, Luczo will have to find a new business model for his company that entered into SSDs ans storage subsystems with the acquisitions of Avago LSI flash business and Xyratex. But these new activities do not compensate the decrease of its core business, HDD manufacturing.

We bet that the financial results of Western Digital, to be announced next April 28, will be comparable, as usual.

Seagate's HDDs from 3FQ13 to 3FQ15 (units in million)

| Fiscal period | Enterprise | Desktop | Notebook | CE | Branded | Total | ASP* | Exabytes | Average |

| HDDs | Shipped | GB/Drive | |||||||

| 2Q13 | 7.3 | 21.9 | 17.3 | 5.6 | 6.0 | 58.2 | $62 | 47.9 | 823 |

| 3Q13 | 7.5 | 19.6 | 17.0 | 5.8 | 5.7 | 55.7 | $63 | 47.2 | 848 |

| 4Q13 | 8.2 | 18.6 | 16.1 | 6.1 | 4.8 | 53.9 | $63 | 45.9 | 852 |

| 1Q14 | 8.1 | 19.1 | 17.2 | 6.2 | 5.1 | 55.7 | $62 | 48.9 | 878 |

| 2Q14 | 7.8 | 19.2 | 16.9 | 6.7 | 6.2 | 56.6 | $62 | 52.2 | 922 |

| 3Q14 | 7.7 | 19.8 | 16.4 | 5.4 | 5.9 | 56.2 | $61 | 50.8 | 920 |

| 4Q14 | 7.4 | 18.4 | 16.8 | 5.1 | 4.8 | 52.5 | $60 | 49.6 | 945 |

| 1Q15 | 8.8 | 18.7 | 20.2 | 6.0 | 5.7 | 59.5 | $60 | 59.9 | 1,007 |

| 2Q15 | 9.1 | 16.0 | 19.7 | 6.1 | 6.0 | 56.9 | $61 | 61.3 | 1,077 |

| 3Q15 | 9.1 | 14.3 | 16.8 | 4.8 | 5.1 | 50.1 | $62 | 55.2 | 1,102 |

* HDDs only

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter