Nimble Storage: Fiscal 4Q16 Financial Result

$322 million in revenue in FY16, up 42% Y/Y, 7,580 customers

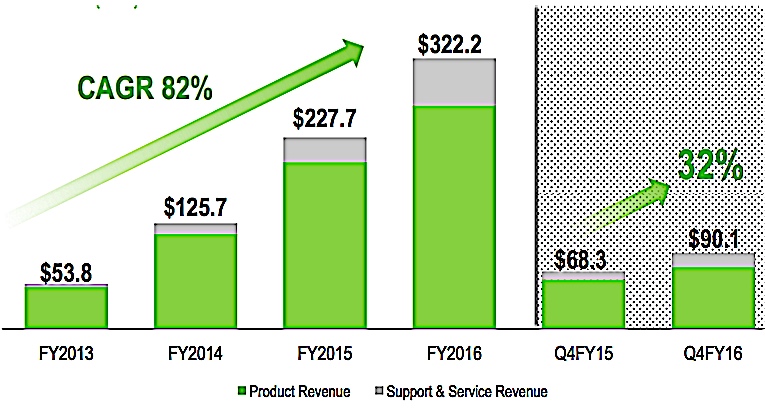

This is a Press Release edited by StorageNewsletter.com on March 7, 2016 at 3:18 pm| (in $ million) | 4Q15 | 4Q16 | FY15 | FY16 |

| Revenue | 68.3 | 90.1 | 227.7 | 322.2 |

| Growth | 32% | 42% | ||

| Net income (loss) | (24.7) | (32.4) | (98.8) | (120.1) |

Highlights:

- Fiscal Year 2016 Revenues Up 42% year-over-year

- Fiscal Year 2016 Operating Margin up 6 points year-over-year

- Record Pace of Customer Acquisition, 752 New Customers Added in the Fourth Quarter

- 2,600+ New Customers Acquired in FY2016

Nimble Storage, Inc. reported financial results for the fourth quarter and fiscal year 2016.

“Our long-term goal is to emerge as the leader in storage. We executed well against that vision in our fourth quarter, adding a record 752 new customers, ending fiscal year 2016 with 7,580 customers – a pace of customer acquisition that remains unmatched by any emerging vendor in our industry,” said Suresh Vasudevan, CEO. “With the recent expansion of our Predictive Flash platform to include all flash arrays that leapfrog competitive offerings, we now have an industry-leading storage portfolio that delivers absolute performance, superior scalability and non-stop availability to our customers, at a TCO that is up to 33% to 66% lower than competitive all flash arrays.“

“We finished fiscal year 2016 with solid results. Looking ahead at fiscal year 2017, we are very excited about the prospects and traction of our Predictive Flash platform,” said Anup Singh, CFO. “The investments we are making in accelerating our commercial business, and in entering the all flash market will allow us to accelerate market share gains and position Nimble to emerge as the next storage leader.“

Fourth Quarter Fiscal 2016 Financial Highlights:

- Total revenue increased 32% to $90.1 million, up from $68.3 million in the fourth quarter of fiscal 2015.

- Excluding fluctuations in foreign currency over the past year, revenue would have been $92.6 million representing a 36% increase over the fourth quarter of fiscal 2015.

- Non-GAAP gross margin for the fourth quarter of fiscal 2016 was 66.4% compared to 67.2% in the fourth quarter of fiscal 2015.

- Non-GAAP operating loss was $9.4 million or negative 10% of revenue for the fourth quarter of fiscal 2016, compared to a loss of $8.5 million or negative 12% of revenue in the fourth quarter of fiscal 2015.

- GAAP net loss for the fourth quarter of fiscal 2016 was $32.4 million, or $0.40 per basic and diluted share, compared with a net loss of $24.7 million, or $0.33 per basic and diluted share in the fourth quarter of fiscal 2015.

- Non-GAAP net loss for the fourth quarter of fiscal 2016 was $9.9 million, or $0.12 per basic and diluted share, compared with a net loss of $9.8 million, or $0.13 per basic and diluted share in the fourth quarter of fiscal 2015.

- Adjusted EBITDA for the fourth quarter of fiscal 2016 was negative $5.1 million or negative 6% of revenue compared to negative $6.8 million or negative 10% of revenue in the fourth quarter of fiscal 2015.

- Total cash ended fiscal 2016 at $211.2 million, an increase of $1.5 million during the fourth quarter.

Fiscal Year 2016 Financial Highlights:

- Total revenue for fiscal 2016 was $322.2 million, compared to $227.7 million in fiscal 2015, representing growth of 42% year-over-year.

- Non-GAAP gross margin was 67.1% for fiscal 2016, compared to 67.0% in fiscal 2015.

- Non-GAAP operating margin was negative 11% for fiscal 2016, compared to negative 17% in fiscal 2015.

- Adjusted EBITDA margin was negative 6% for fiscal 2016 compared to negative 14% in fiscal 2015.

- GAAP net loss for fiscal 2016 was $120.1 million, or $1.52 per basic and diluted share, compared with a GAAP net loss of $98.8 million, or $1.37 per basic and diluted share in fiscal 2015.

- Non-GAAP net loss for fiscal 2016 was $36.8 million, or $0.47 per basic and diluted share, compared with a non-GAAP net loss of $41.8 million, or $0.58 per basic and diluted share in fiscal 2015.

- Total cash ended fiscal year 2016 at $211.2 million, an increase of $2.8 million during the year.

Forward Outlook:

Nimble Storage provides guidance based on current market conditions and expectations. The guidance for the first quarter of fiscal 2017 takes into account the following factors: Q1 is the company’s seasonally slowest quarter and one in which the large companies in the industry typically see double digit sequential declines in revenue from the fourth quarter. In addition, the company has taken into account the potential impact of the all flash array product introduction during the quarter on existing sales cycles.

At the mid-point of guidance, the form expect a 6% decline in revenue from fourth quarter of fiscal 2016.

The company estimates that the incremental costs associated with the launch and go-to-market costs of its Predictive Flash platform and in particular the all flash array during Q1 will be approximately $4 million.

The company plans to make increased investments in sales and marketing resources, as outlined during the last earnings call, in particular to re-accelerate growth in its commercial business and leverage its new all flash array product line.

For the first quarter of fiscal 2017, Nimble Storage expects:

- Total revenue in the range of $83.0 to $86.0 million

- Non-GAAP operating loss in the range of $20.0 to $22.0 million

- Non-GAAP net loss per basic and diluted share in the range of $0.25 to $0.27 based on weighted average shares outstanding of approximately 83.0 million

Business Highlights

- Introduced Predictive All Flash Arrays. The Nimble AF-Series all flash arrays deliver performance; scalability and non-stop availability, at a TCO that is up to 33% to 66% lower than competitive arrays. The all flash arrays are powered by Samsung 3D V-NAND 4TB SSDs, and scale up to 8.2PB of effective capacity in a 4-node scale-out configuration.

- Introduced Nimble Predictive Flash Platform to Prevent Barriers to Data Velocity. Nimble combines the power of InfoSight Predictive Analytics with a Unified Flash Fabric consolidation architecture to deliver flash performance for all enterprise applications and data velocity to end users. The Nimble Unified Flash Fabric enables flash for all enterprise applications by unifying all flash and Adaptive Flash arrays into a single consolidation architecture with common data services.

- Introduced Timeless Storage Business Model. The Timeless Guarantee provides investment protection and upgrade certainty, with an option to receive a free faster controller upgrade after three years. The Timeless Storage business model offers all-inclusive pricing with no-forklift upgrades and the flexibility to purchase storage as a capital investment or as a Storage on Demand service.

- Achieved Inaugural Net Promoter Survey Yields Score of 85. In January 2016 Nimble executed its inaugural NPS customer survey and earned a score of 85, reflecting an outstanding customer experience with Nimble products and support.

- Nimble Storage Named a Leader in the Gartner Magic Quadrant for General-Purpose Disk Arrays and Recognized in the Gartner Critical Capabilities Report. This marks the initial entrance of Nimble Storage into the leaders quadrant since the company’s founding in 2008, making it the youngest vendor to be named a leader among well-established storage vendors. Nimble was also recognized among competitive products in the Gartner Critical Capabilities for General-Purpose, Midrange Storage Arrays distributed in October 2015.

- Nimble Storage Surpasses 7,500 Customers Worldwide. More than 7,500 customers have deployed the Predictive Flash platform, an increase of more than 2,500 customers in the last 12 months. International customer growth doubled to 1,500 in the same period. The company attributes this rapid growth to its proven ability to develop and deliver innovative technology with an unwavering commitment to superior customer support.

- Introduced InfoSight VMVision VM-level Monitoring. The new monitoring capabilities provide enterprises with granular visibility into VMware VM environments enabling enterprise IT organizations to proactively identify and resolve VM resource contention issues and optimize performance.

- Nimble Storage Delivers Full Benefits of Storage Consolidation with Enterprise-grade Enhancements to the Adaptive Flash Arrays.

- All-Flash Service Level Provides Dynamic Performance and Capacity. The all-flash service level meets the most stringent latency demands – its responsiveness is for transaction processing, data warehouse/business intelligence, and VDI deployments.

- A Single Platform for Optimizing Enterprise-wide Applications. Additional capabilities introduced include software-based Federal Information Processing Standard (FIPS) certified encryption and a REST API- based extensibility framework, which complement existing enterprise functionality, including InfoSight VMVision VM-level monitoring and reporting and integrated data protection.

- SmartStack Integrated Infrastructure Solutions by Nimble Storage and Cisco Deployed by More Than 1000 Global Enterprises. Nimble Storage and Cisco partnered to deliver Cisco Validated Designs (CVD) for SmartStack solutions enabling enterprise IT organizations to accelerate application deployments, independently scale infrastructure resources and reduce overall deployment risk. SmartStack customers obtain end-to-end support directly through Cisco’s Solution Support for Critical Infrastructure offering.

- Established Global Partner Program. The global channel program enables and rewards partners that resell the Nimble Storage Predictive Flash platform with the introduction of certification levels, incentives, and unique sales enablement tools. The channel program received industry recognition from CRN’s 2015 5-Star rating in the Partner Program Guide.

- Nimble Storage Recognized For Exceptional Growth and Innovation.

- The Global Technology Distribution Council named Nimble as a recipient of the Rising Star Award, receiving the organization’s U.S. Gold Rising Star in the Hardware category, which acknowledges technology companies for exceptional regional sales growth through di

Comments

Following the publication of recent financial results, EMC continues to be largely the dominant player in the market of all-flash array, stating that XtremIO ended the calendar year 2015 with over $1 billion in revenue. NetApp claimed to be at a $600 million annual run rate. Pure Storage is at $440 million for its more recent fiscal year ending. Nimble Storage here announces $322 million. In the sector, start-ups Tegile, Kaminario and Tintri are also growing very fast.

For the quarter, Nimble, now with 1,100 employees, saw revenue and loss increasing, as usual, sales growing 32% at $90 million and loss up 31% at $32 million. But this trend will reverse next quarter as the company expects a 6% decline in revenue from 4FQ16.

Here are some details concerning the company's revenue:

- - Record bookings from deals over $100,000 and from deals over $250,000 on 4FQ16.

- - FC is a key driver of larger deployment thus far, and has grown to 26% of the mix of iSCSI and FC from 24% during 3FQ16.

- - Quarterly international revenue grew at 66% Y/Y for the quarter, with strong growth across Europe and AsiaPac.

- - Global enterprise customers reach 443 organizations growing quarterly from 14% to 17%.

- - Cloud service provider customers delivered a record level of bookings compared to any prior quarter and accounted for 20% of 4Q bookings, up from 17% during the former three-month period.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter