NetApp: Fiscal 2Q16 Financial Results

8th consecutive quarter with sales diminishing Y/Y

This is a Press Release edited by StorageNewsletter.com on November 19, 2015 at 2:49 pm| (in $ million) | 2Q15 | 2Q16 | 6 mo. 15 | 6 mo. 16 |

| Revenue | 1,543 | 1,445 | 3,032 | 2,780 |

| Growth | -9% | -10% | ||

| Net income (loss) | 160 | 114 | 248 | 84 |

Highlights

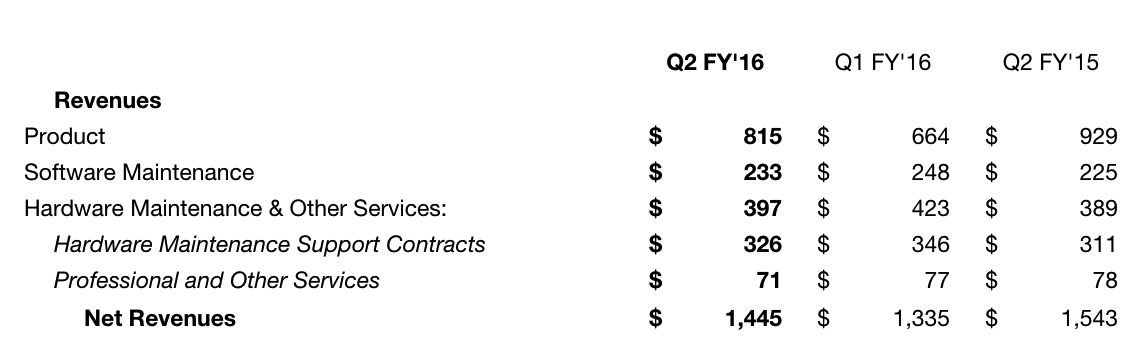

- Product revenue of $815 million, up 23% quarter-over-quarter

- All Flash FAS units grew 246% quarter-over-quarter

- Flash capacity grew 80% quarter-over-quarter

NetApp, Inc. reported financial results for the second quarter of fiscal year 2016, ended October 30, 2015.

Second Quarter Financial Results

Net revenues for the second quarter of fiscal year 2016 were $1.45 billion. GAAP net income for the second quarter of fiscal year 2016 was $114 million, or $0.39 income per share, compared to GAAP net income of $160 million, or $0.49 income per share, for the comparable period of the prior year. Non-GAAP net income for the second quarter of fiscal year 2016 was $181 million, or $0.61 income per share, compared to non-GAAP net income of $226 million, or $0.70 income per share, for the comparable period of the prior year.

Cash, Cash Equivalents and Investments

NetApp ended the second quarter of fiscal year 2016 with $4.8 billion in total cash, cash equivalents and investments and generated $145 million in cash from operations. During the second quarter of fiscal year 2016, the company returned $236 million to shareholders through share repurchases and a cash dividend.

The next dividend in the amount of $0.18 per share will be paid on January 20, 2016, to shareholders of record as of the close of business on January 8, 2016.

“Our Q2 results reflect the progress we are making to pivot NetApp for long-term growth in the data powered digital era. We are moving forward with clarity and speed to better address the changing industry and improve our own execution,” said George Kurian, CEO. “Customer wins and partner feedback drive my strong conviction that our industry leading portfolio and differentiated Data Fabric strategy will expand our opportunity and drive long-term growth.”

Financial guidance for third quarter of fiscal year 2016:

- Net revenues are expected to be in the range of $1.40 billion to $1.50 billion.

- GAAP earnings per share is expected to be in the range of $0.47 to $0.52 per share.

- Non-GAAP earnings per share is expected to be in the range of $0.66 to $0.71 per share.

Business Highlights

NetApp Accelerates Customer and Partner Journey in Hybrid Cloud and Flash Environments:

- Guarantees 3X Performance For All-Flash Workloads. NetApp extended a special offer for buyers of select all-flash systems guaranteeing a 3X increase in enterprise database performance compared to that of traditional, non-flash disk-based systems.

- Makes the Hybrid Cloud More Secure. NetApp unveiled NetApp OnCommandCloud Manager 2.0 and integration with Amazon Simple Storage Service Standard-Infrequent Access (Amazon S3 Standard-IA).

- Offers Free Controller Upgrade. Eligible customers who purchase a three-year SupportEdge Premium contract by December 31, 2015 now qualify for a new All-Flash FAS (AFF) controller free of charge as part of the renewal process.

- Extends Support Price Protection. NetApp enabled customers to extend their standard three-year warranty and support for up to four more years.

- Offers New AFF Series Model. The new AFF8080 EX can be set up to address mainstream SAN workloads in as little as 15 minutes.

- Expands OpenStack Capabilities. As founder of the OpenStack Manila open-source project, NetApp announced production-ready capabilities for enterprises to easily build or enhance a cloud-ready data center capable of handling business-critical and content-management applications.

NetApp InsightTechnical Conference Showcases ow Data Fabric Increases Customer Success in the Hybrid Cloud:

- Data Fabric Solution Essentials. NetApp starter kits make it easier for customers to become hybrid cloud ready and quickly see benefits as they evolve their infrastructures.

- Data Fabric Enablement Services. NetApp experts help customers identify optimal workloads for the cloud and gain the architectural design and deployment insights they need for success.

- Expansion of Cloud Service Provider Relationships. NetApp is now a Google Cloud Platform Technology Partner, providing tools which integrate to extend reach and functionality.

NetApp Celebrates Business and Cultural Milestones:

- Cisco and NetApp Celebrate Five Years of FlexPodCustomer Success. FlexPod integrated infrastructure solutions deliver unprecedented value to customers with shared revenue of $5.6 billion.

- NetApp Named #4 World’s Best Multinational Workplaces. For the fifth consecutive year, NetApp’s unique culture earned the company a top-five position on this prestigious list by Great Place to Work.

Comments

Quarterly revenue increased 8% Q/Q and decreased 9% Y/Y, with next quarter supposed to be sequantially flat.

2FQ16 is the eighth consecutive quarter with sales diminishing Y/Y.

NetApp expects revenue for FY16 to be down over 5% from FY15 or under $6 billion, the lowest figure since FY11.

The US storage company has not found a way to comeback to its historical growth until 2011. Like EMC, it is betting on emerging products, especially SSD subsystems, to compensate poor sales of traditional products, but face competition from new companies also in all-flash subsystems

CEO George Kurian comments: "Based on our analysis, this has resulted in the traditional standalone hybrid storage market declining at approximately 9%, while at the same time, the parts of the market addressed by our scale out, software-defined, flash converged and hybrid cloud solutions are growing at a rate of roughly 20%."

Unit shipments of all-flash FAS products are booming by 445% Y/Y, representing the sixth consecutive quarter of triple digit growth.

Nevertheless, there is a lot to do for NetApp to reverse its slowing trend.

"We've made progress but we still have more work to do to become more efficient and agile, so that we can best take advantage of our long term growth opportunity," Kurian said.

The decline in standalone hybrid storage most notably impacts traditional ONTAP 7-Mode business. The OS was shipped on about 30% of FAS units in the quarter, down from 65% a year ago. ONTAP 7-Mode unit shipments were down almost 60% Y/Y and Q2 marked the first time that the company did not experience growth in the 7-Mode install base. Customers are also slowing investment in the capacity expansion of their traditional 7-Mode storage environment.

Another difficulty come from the sales to U.S. public sector, a business that declined 22% Y/Y in 2FQ16.

NetApp FlexPod, a pre-integrated converged solution in conjunction with Cisco, have generated 5.6 billion in shared revenue delivered by 1,100 partners to 6,300 customers worldwide since its inception five years ago.

Clustered ONTAP was deployed on approximately 70% of NetApp's FAS systems shipped in the quarter, up from 35% a year ago and unit shipments of Clustered ONTAP systems grew over 95% Y/Y. The Clustered ONTAP install base continues to grow and now represents 17% of total install FAS system and 30% of installed FAS capacity. The number of customers who purchase Clustered ONTAP systems in the three-month period grew yearly by 85%.

Product revenue of $815 million was up 23% sequentially in line with expectations but was down 12% year-over-year.

| Period | Revenue | Y/Y Growth | Net income (loss) |

| 1FQ14 | 1,516 | 5% | 82 |

| 2FQ14 | 1,550 | 1% | 167 |

| 3FQ14 | 1,610 | -1% | 192 |

| 4FQ14 | 1,649 | -4% | 197 |

| FY14 | 6,325 | -0% | 638 |

| 1FQ15 | 1,489 | -2% | 88 |

| 2FQ15 | 1,542 | -0% | 160 |

| 3FQ15 | 1,551 | -4% | 177 |

| 4FQ15 | 1,540 | -2% | 135 |

| FY15 | 6,123 | -3% | 560 |

| 1FQ16 | 1,335 | -10% | (30) |

| 2FQ16 | 1,445 | -9% | 114 |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter