Imation: Fiscal 3Q14 Financial Results

"We have much more to do," said CEO. We think so.

This is a Press Release edited by StorageNewsletter.com on November 6, 2014 at 2:53 pm| (in US$ million) | 3Q13 | 3Q14 | 9 mo. 13 | 9 mo. 14 |

| Revenues | 191.9 | 175.0 | 628.0 | 532.5 |

| Growth | -9% | -15% | ||

| Net income (loss) | (34.9) | (61.4) | (61.1) | (100.3) |

Imation Corp. released financial results for the third quarter ended September 30, 2014, which were generally in line with expectations, excluding a one-time, non-cash goodwill impairment charge.

Q3 Overview

For Q3 2014, it reported net revenue of $175.0 million, down 8.8% from Q3 2013. Operating loss from continuing operations totaled $55.8 million, or $1.49 per share, in Q3 2014, including special charges of $44.2 million, or $1.07 per diluted share. This compares to an operating loss from continuing operations of $26.5 million, or $0.65 per share, in Q3 2013, including special charges of $11.7 million or $0.23 per share. Excluding these charges, operating loss from continuing operations in Q3 2014 totaled $11.6 million, or $0.42 per share, compared to $14.8 million, or $0.42 per diluted share, in Q3 2013. The company had a cash balance of $110.7 million as of September 30, 2014, and generated positive operating cash flows during the third quarter.

Imation’s CEO Mark Lucas commented: “We continue to make progress in our evolution; however, we recognize we have much more to do as we position the business for consistent and sustainable growth. Strategically in the quarter, we continued to introduce new storage products, initiate corporate and government trials for IronKey PC on a Stick, lower our operating expenses and maximize cash flow.”

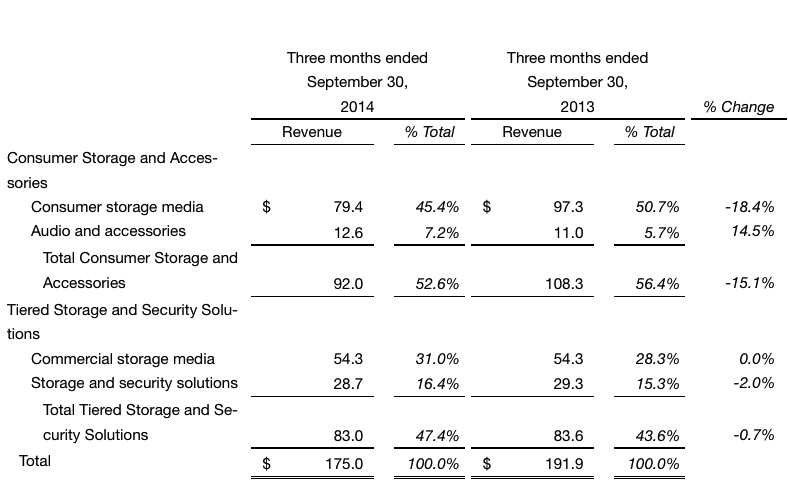

Declines in Imation’s legacy businesses of magnetic tape and optical media moderated in the quarter. The Consumer Storage and Accessories (CSA) segment revenue declined 15.1%, but gross margins improved by 3.0% from Q3 2013. Imation’s Tiered Storage and Security Solutions (TSS) revenue and gross margins were essentially flat compared to the prior year.

Business Segment Overview

Lucas said: “Our Nexsan storage portfolio posted another sequential quarter of growth, as did gross margins in TSS, which serve as further indication that our ongoing efforts to generate accelerated momentum are working. We remain optimistic about the growth potential of our mobile security business – we have completed more than 100 proof of concepts for IronKey PC on a Stick and are beginning to see customers launch deployments as organizations pursue secure and easy to use ‘Windows to Go’ solutions.“

Lucas added: “In our legacy businesses, we saw solid margin and cash flows. In our Audio and Accessories category, we experienced strong demand with revenue growth of nearly 15% for the third quarter.”

“Looking ahead, we remain focused on building a platform based on Imation’s storage roots for profitable growth over the long term. We are confident that the momentum in our Storage and Security solutions portfolio will deliver sustained revenue and operating earnings growth. We are especially excited with the introduction of a number of new products including our latest addition to the Nexsan NST family of storage solutions, the ultra-efficient hybrid storage appliance NST4000 and the expanded industry adoption of our IronKey products,” concluded Lucas.

Detailed Q3 2014 Analysis

The following financial results are for continuing operations for the current and prior periods unless otherwise indicated.

- Net revenue was $175.0 million, down 8.8% from Q3 2013. Foreign currency exchange rates did not impact Q3 2014 revenue compared to Q3 2013.

- Gross margin was 17.8%, down 1.0% point from 18.8% in Q3 2013 and included a $4.6 million inventory write-off related to magnetic tape outsourcing changes. Excluding the impact of the write-off, gross margin was 20.5%. CSA gross margin was 21.5%, up from 18.5% in Q3 2013, and TSS gross margin was flat in Q3 2014 compared to the prior year.

- Selling, general and administrative (SG&A) expenses were $42.5 million, down $3.8 million compared with Q3 2013 levels of $46.3 million. The company continued to actively rationalize its legacy business SG&A expense, which has decreased more than 35% from Q3 2012. During the quarter the company continued to strategically invest in Imation Storage Solutions to accelerate growth.

- R&D expenses were $4.9 million, up slightly from $4.6 million in Q3 2013, which reflects the company’s increased investment in higher-margin projects in TSS. The company continued to invest in new product development in its priority businesses and has aggressively reduced R&D expense associated with legacy media products.

- Special charges consisted of a one-time, non-cash goodwill impairment charge of $35.4 million associated with the Nexsan acquisition and other charges of $8.8 million primarily from previously announced restructuring programs. The company conducted an impairment test and determined that the valuation of goodwill related to the Nexsan acquisition required an adjustment. The impairment is principally the result of Nexsan not yet achieving its anticipated growth rate, therefore requiring a corresponding increase in the discount rate applied in the valuation. This non-cash charge will have no impact on the company’s business. Special charges were $11.7 million in Q3 2013 and included a $10.6 million non-cash loss associated with the settlement of a UK pension plan.

- Operating loss from continuing operations was $55.8 million compared with an operating loss of $26.5 million in Q3 2013. Excluding the impact of the special charges described above, adjusted operating loss from continuing operations would have been $11.6 million in Q3 2014 compared with an adjusted operating loss from continuing operations of $14.8 million in Q3 2013.

- Income tax expense was $3.4 million compared with an income tax benefit of $2.0 million in Q3 2013. The expense in Q3 2014 is primarily due to the mix of taxable income by country. The company maintains a valuation allowance related to its U.S. deferred tax assets and, therefore, no tax provision or benefit was recorded related to its U.S. results in either period.

- Discontinued operations were breakeven compared with a loss of $8.7 million in Q3 2013. Discontinued operations include both the results of the XtremeMac and Memorex consumer electronics businesses which were sold.

- Loss per diluted share from continuing operations was $1.49 compared with a loss per diluted share of $0.65 in Q3 2013. Excluding the impact of the special charges described above, loss per diluted share from continuing operations would have been $0.42 in Q3 2014 compared with a loss per diluted share from continuing operations of $0.42 in Q3 2013 (See Tables Five and Six for non-GAAP measures).

- Cash and cash equivalents balance was $110.7 million as of September 30, 2014, down $4.0 million during the quarter. The company had positive operating cash flows and also repurchased 500,000 shares of common stock for $1.6 million during Q3. As of September 30, 2014, Imation had remaining authorization to repurchase up to 2.4 million additional shares.

Year-To-Date Summary

- For the nine months ended September 30, 2014, Imation reported net revenue of $532.5 million, down 15.2% compared with the same period last year. Operating loss from continuing operations totaled $92.0 million, or $2.39 per share, in Q3 2014, including special charges of $51.5 million, or $1.26 per diluted share. For the nine months ended September 30, 2013, Imation reported net revenue of $628.0 million, an operating loss from continuing operations of $41.2 million, including special charges of $21.0 million, and a diluted loss per share from continuing operations of $1.08.

- Operating results for the nine months ended September 30, 2013 include the second quarter reversal of an accrual of $13.6 million for copyright levies as a result of an Italian Court ruling.

Comments

We have a lot of respect about what did 3M and then Imation in storage, especially in tape media technology but time is changing.

Now it has poor board of directors, poor CEO, poor management, poor vision, and poor financial results in the most recent quarter following an ugly one for the former six-month period, and furthermore noguidance revealed.

"We have much more to do," said CEO Mark Lucas. We think so but is there something to do now for the company to rebound after 7 years with declining yearly sales and continuing losses?

"When we started this transformation 90% of our revenues came from our legacy media businesses. Today only 65% of our revenues come from these businesses", he added.

Today's portfolio includes the Imation, Memorex, Life on Record, IronKey and Nexsan brands.

The only business growing concerns audio and accessories but it's a very small part of the company's activity.

The troubled financing firm does not separate the results of its storage (Nexsan) and security (IronKey) segment, together down 13% in revenue for the nine months of its current fiscal year and 0.7% sequentially. But the company said that Nexsan sales grew sequentially, which means that smaller business security is not going quite well, and furthermore admitted that Nexsan "is not yet achieving its anticipated growth rate."

For sure, Nexsan has good products and technology - but nothing revolutionary and not being really in all-flash but in hybrid systems - in the highly competitive market of mid-range arrays, with many participants everywhere in the world, about all storage giants and smaller ones in many countries, even in Taiwan.

Imation was totally betting on the purchase of Nexsan for its revival, acquired for a total of $120 million in 2013 and putting a huge part of its cash ($105 million) in the deal.

Now, with only $111 million on cash and cash equivalents balance - a figure diminishing, there is no way for the Oakdale firm to go strategically elsewhere. We don't see how it will be possible to be back to growth and profitability on the long term, and it's possible to see the company finishing like Eastman Kodak.

The giant of the photo industry lost the transit to digital imaging. The specialist of computer magnetic media lost the transit to optical and then flash memories.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter