EMC: Fiscal 2Q15 Financial Results

Storage flat, flat, completely flat: revenue up 1% Y/Y

This is a Press Release edited by StorageNewsletter.com on July 23, 2015 at 3:08 pm| (in $ million) | 2Q14 | 2Q15 | 6 mo. 14 | 6 mo. 15 |

| Revenue | 5,880 | 5,997 | 11,359 | 11,610 |

| Growth | 2% | 2% | ||

| Net income (loss) | 589 | 487 | 980 | 739 |

EMC Corporation reported second-quarter 2015 financial results.

Consolidated second-quarter GAAP revenue was $6 billion, up 2% year over year.

GAAP revenue was reduced by the amount of a VMware settlement with the DOJ and the GSA, which was entered into and paid in cash by VMware in the second quarter.

Consolidated second-quarter non-GAAP revenue was $6.1 billion, up 3% year over year and up 8% on a constant currency basis.

GAAP earnings per weighted average diluted share was $0.25, down 11% year over year. Non-GAAP1 earnings per weighted average diluted share was $0.43, flat compared with the year-ago quarter.

EMC generated $1 billion in operating cash flow and $647 million in free cash flow in the second quarter, and ended the quarter with $14.8 billion in cash and investments.

EMC repurchased approximately $2 billion worth of its common stock year-to-date and returned $225 million to shareholders in the second quarter via a quarterly dividend.

Joe Tucci, EMC chairman and CEO, said: “While pleased with many aspects of the second quarter, especially with the market acceptance and rapid growth of our newer products, we also saw customers become more conservative around refreshing their traditional infrastructures as they plan their IT transformations. We also saw ongoing geo-political factors in China and Russia. To capture more opportunity we have honed our growth strategy around four pillars: best-in class products and solutions that are, or will be, offered as a service; an expanded focus on cloud services; tighter coordination of our federated go-to-market approach; and a leadership team that is second to none. We are confident in our strategy in becoming the most trusted partner to customers embarking on digital transformation and hybrid cloud journeys, and we remain laser focused on enhancing shareholder value.“

Zane Rowe, EMC CFO, said: “My thanks to the entire team for their hard work and execution in the second quarter. We are seeing success in the growth areas of our portfolio, while our traditional storage category was impacted by customers focusing on their short-term purchasing needs as they develop their digital agendas. We continue to drive growth, cost efficiency and business transformation, as well as additional alignment across our businesses.“

David Goulden, CEO of EMC Information Infrastructure, said: “In an IT market that is changing rapidly, our new businesses are performing exceptionally well, with the Emerging Storage business now at nearly a $3 billion revenue run-rate, which we expect will grow more than 30% in 2015. We are focused on evolving our storage portfolio, delivering solutions, leading in high-growth areas and getting more aggressive on costs and are taking additional steps to manage the trends in our traditional storage business. Going forward, the favorable mix toward new applications and transformational spend will serve us well beyond 2015.”

Business highlights

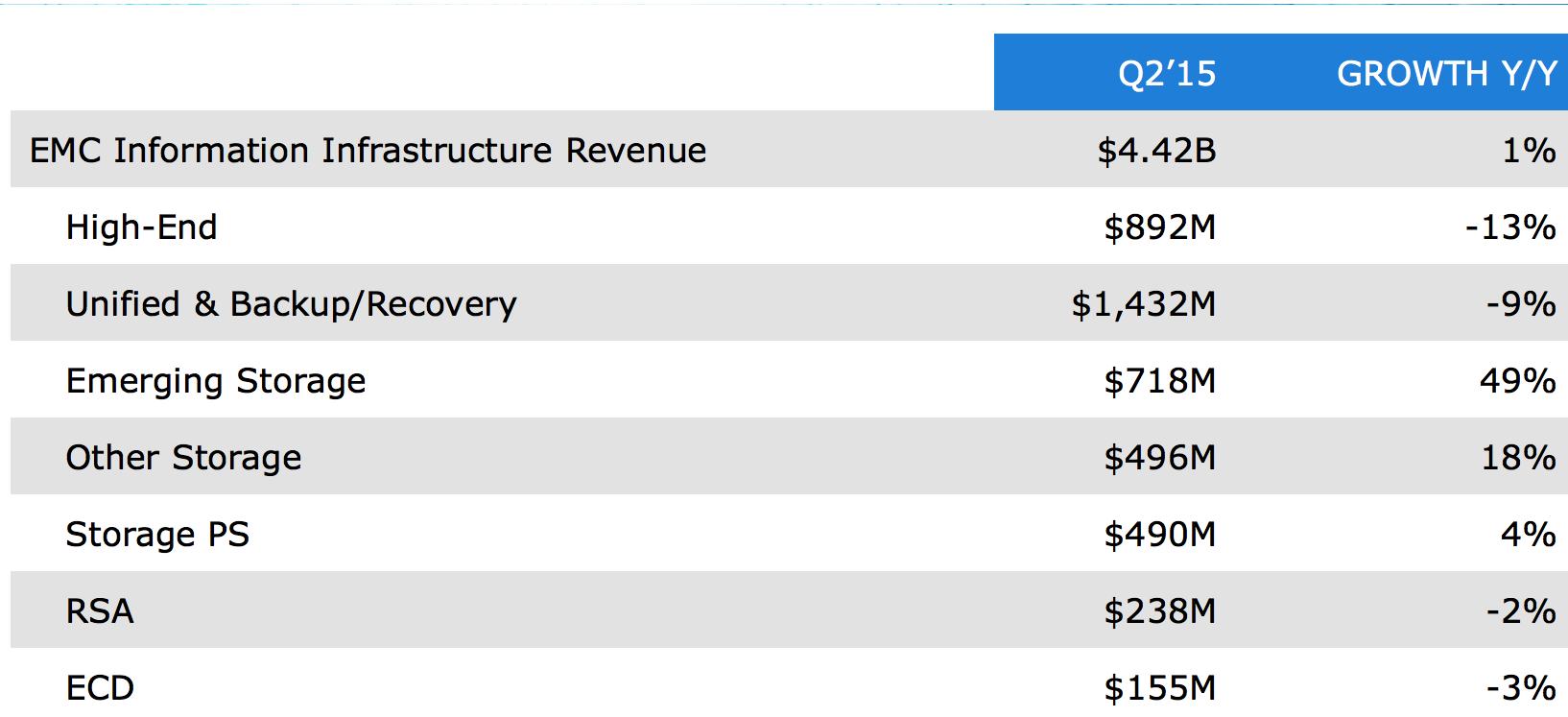

- EMC Information Infrastructure: Second-quarter revenue was up 1% year over year and up 6% on a constant currency basis. Information Storage revenue in the second quarter was up 1% year over year and up 6% on a constant currency basis. Emerging Storage revenue was up 49% year over year in the second quarter, led by XtremIO, Isilon and Software-Defined Storage. Within Emerging Storage, XtremIO revenue growth exceeded 300% year over year, and remains the all-flash array market segment leader. Within the Converged Infrastructure business, Vblock and Vblock-related revenue had greater than 30% growth year over year.

- Pivotal: Second-quarter revenue was up 18% year over year and up 19% on a constant currency basis. Pivotal continues its transition to a subscription business model, more commonly measured by annual recurring revenue (ARR), which in the second quarter was approximately $60 million, up almost 60% quarter over quarter. Pivotal is achieving significant momentum as enterprise customers leverage the Pivotal portfolio for their digital transformation journey.

- VMware: Second-quarter 2015 GAAP revenue was up 4% year over year, non-GAAP revenue was up 10% (up 13% on a constant currency basis) year over year. VMware continues to diversify its business by expanding its portfolio of products to enable the software-defined enterprise, making progress on its strategic initiatives focused on the software-defined data center, hybrid cloud solutions, business mobility and end-user computing.

Global highlights

- Consolidated GAAP revenues are expected to be $25.2 billion for 2015 and consolidated non-GAAP5 revenues are expected to be $25.3 billion for 2015.

- Consolidated GAAP operating income is expected to be 12.8% of revenues for 2015 and consolidated non-GAAP5 operating income is expected to be 20.7% of non-GAAP revenues for 2015.

- Consolidated GAAP earnings per weighted average diluted share are expected to be $1.17 for 2015 and consolidated non-GAAP5 earnings per weighted average diluted share are expected to be $1.87 for 2015.

- The consolidated GAAP income tax rate is expected to be 22.5% and the consolidated non-GAAP5 income tax rate is expected to be 23.6% for 2015. This assumes that the U.S. R&D tax credit is enacted during 2015.

- Consolidated net cash provided by operating activities is expected to be $5.5 billion for 2015 and free cash flow3 is expected to be $4 billion for 2015.

- The weighted average outstanding diluted shares are expected to be 1.96 billion for 2015.

- EMC expects to repurchase an aggregate of $3.0 billion of the company’s common stock in 2015.

Full-year 2015 outlook

GAAP revenues of $25.2 billion and non-GAAP revenues of $25.3 billion; GAAP EPS of $1.17 and non-GAAP EPS of $1.87

Comments

After an horrible 1FQ15 in information storage with revenue down 24% sequentially and completely flat yearly, 2FQ15 is just a little better with sales up 10% Q/Q and 1% Y/Y (up 6% on a constant currency basis).

Finally EMC is far from its prestigious year in storage.

As usual revenue of "emerging storage products" is growing fast, 49% year over year, led by XtremIO, Isilon and software-defined storage - reaching nearly a $3 billion revenue run-rate, the company expecting this bucket to grow more than 30% for this year. Within this category, XtremIO revenue growth exceeded 300% year over year and remains a leader in all-flash array market segment. Within the converged infrastructure business, Vblock and Vblock-related sales had greater than 30% yearly growth.

But they don't compensate large declines in traditional storage products, "as customers are becoming more conservative around refreshing their traditional infrastructures, as they plan their IT transformation and roll out their digital agenda," commented chairman and CEO Joe Tucci.

The install base for VMAX is stable, and VNX wins almost 1,500 new customers for the most recent quarter, both of them continuing to expand installed the company's total flash capacity.

But Zane Rowe, CFO, said: "We are continuing to see pressure in parts of our traditional storage categories like high-end and unified. We're initiating a significant cost reduction and business transformation effort that will reduce our expenses, make us more efficient, and improve how we operate our business."

He is not really optimistic about the storage market: "As enterprises continue their secular shift to the new digital age defined by cloud, mobile, social and big data, we now expect the overall external storage market to grow at a 2% to 3% CAGR from 2014 to 2018. Within this, we expect new storage technologies like flash, converged infrastructure and software-defined storage to grow at a high teens CAGR from 2014 to 2018, while standalone traditional storage systems are expected to decline at low teens CAGR.

"As transactional spending remains cautious, we now believe that the additional storage market will not improve this year. Therefore, while our expectations for growth in overall mix in the storage market for long-term have not changed materially, the overall storage market will grow less than the 2014 to 2018 CAGR this year. Beyond 2015, we expect overall storage growth to improve due to favorable mix shifts towards new applications and IT transformations.

"Given our revised expectations for the storage market, we do not expect the pressure on our traditional storage business, primarily VMAX and VNXe this year. As a result, we now expect our storage business to grow at 1% this year. Excluding both health and consolidating VCE and third from FX, storage growth is also expected to be 1%."

EMC information infrastructure revenue is up 1% year over year (up 6% on a constant currency basis).

EMC Information Infrastructure Revenue

Global revenue of EMC is expected to be $25.2 billion for FY15 to be compared to $24.4 billion in FY 2014 or a tiny growth of +3%.

EMC storage revenue from 1Q13 to 2Q15

(in $ million)

| Products | Services | Total | Q/Q growth | |

| 1Q13 | 2,472 | 1,326 | 3,798 | -11% |

| 2Q13 | 2,577 | 1,377 | 3,954 | 4% |

| 3Q13 | 2,430 | 1,376 | 3,806 | -4% |

| 4Q13 | 3,260 | 1,445 | 4,705 | 24% |

| 1Q14 | 2,302 | 1,378 | 3,680 | -22% |

| 2Q14 | 2,551 | 1,425 | 3,976 | 8% |

| 3Q14 | 2,595 | 1,456 | 4,051 | 2% |

| 4Q14 | 3,338 | 1,497 | 4,835 | 19% |

| 1Q15 | 2,179 | 1,484 | 3,663 | -24% |

| 2Q15 | 2,509 | 1,519 | 4,028 | 10% |

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter