Brocade: Fiscal 4Q15 Financial Results

Decent quarter but weak guidance

This is a Press Release edited by StorageNewsletter.com on November 25, 2015 at 2:47 pm| (in $ million) | 4Q14 | 4Q15 | FY14 | FY15 |

| Revenue | 564.4 | 588.8 | 2,211 | 2,263 |

| Growth | 4% | 2% | ||

| Net income (loss) | 83.4 | 84.4 | 340.4 | 238.0 |

Brocade Communication Systems, Inc. reported financial results for its fourth quarter and full fiscal year 2015 ended October 31, 2015.

Brocade reported fourth quarter revenue of $589 million, an increase of 4% year-over-year and 7% quarter-over-quarter.

Revenue for fiscal year 2015 was $2,263 million, up 2% year-over-year.

The resulting GAAP diluted earnings per share (EPS) was $0.20 for the fourth quarter and $0.79 for fiscal year 2015, up 6% and up 48% year-over-year, respectively. The fiscal year 2014 GAAP EPS included a non-cash goodwill impairment charge associated with the strategic repositioning of the Brocade ADX product family. Non-GAAP diluted EPS was $0.26 for the fourth quarter and $1.01 for fiscal year 2015, up 8% and up 12% year-over-year, respectively.

“Fiscal 2015 was a productive year in which we achieved many significant milestones,” said Lloyd Carney, CEO. “We delivered annual revenue growth in fiscal 2015, with a year-over-year revenue increase in each fiscal quarter. We grew our non-GAAP EPS by 12% for the fiscal year, delivering more than a dollar per share for the first time. We continued to expand our portfolio of software and hardware products through both technology innovation and strategic acquisitions. Looking forward, these investments create new opportunities for us to continue to grow revenue and EPS in 2016 and beyond.”

Highlights:

- Q4 2015 SAN product revenue was $325 million, flat year-over-year and up 5% quarter-over-quarter. The Q4 year-over-year product revenue performance reflects a 14% increase in director sales and a 1% increase in embedded switch sales, offset by a 12% decrease in switch sales. For fiscal year 2015, SAN product revenue was $1,301 million, down 2% year-over-year, primarily due to lower switch and embedded switch sales, partially offset by higher director sales.

- Q4 2015 IP networking product revenue was $170 million, up 12% year-over-year and 10% quarter-over-quarter. The Q4 year-over-year increase was primarily driven by a 28% increase in Ethernet switch sales and improved software sales, partially offset by a 20% decline in router revenue. For fiscal year 2015, IP Networking product revenue was $601 million, up 14% year-over-year due to stronger switch, router, and software sales.

- During Q4, Brocade launched the Brocade Analytics Monitoring Platform, a new, innovative, SAN solution designed for both new and existing FC storage networking customers. This solution allows customers to better monitor, analyze and control their SAN environments, while also improving the operational performance, stability, and security of data flowing between servers and storage devices.

- In fiscal year 2015, Brocade’s full-year GAAP gross margin and operating margin were 67.5% and 21.8%, respectively. Full-year non-GAAP gross margin and operating margin increased to 68.4% and 26.3%, a full-year improvement of 110 basis points and 30 basis points, respectively. The full-year non-GAAP gross margin improvement was primarily due to lower excess and obsolete inventory charges and lower manufacturing overhead spending, while the operating margin improvement was due to higher gross margins, partially offset by higher sales and marketing and R&D expenses.

- Full-year fiscal 2015 operating cash flow was $447 million, a 17% decrease from fiscal year 2014. The decrease in operating cash flow was primarily due to higher payments with respect to employee incentive compensation earned in fiscal year 2014 and paid in fiscal year 2015, changes in accounts receivable collections, and higher fiscal year 2015 tax payments related to fiscal year 2014 earnings. During fiscal year 2015, the company repurchased $344 million of stock, or approximately 30 million shares, and paid $67 million in dividends. This return of capital to shareholders represents 96% of adjusted free cash flow for the year.

The Brocade board of directors has declared a quarterly cash dividend of $0.045 per share of the company’s common stock. The dividend payment will be made on January 4, 2016, to shareholders of record at the close of market on December 10, 2015.

Comments

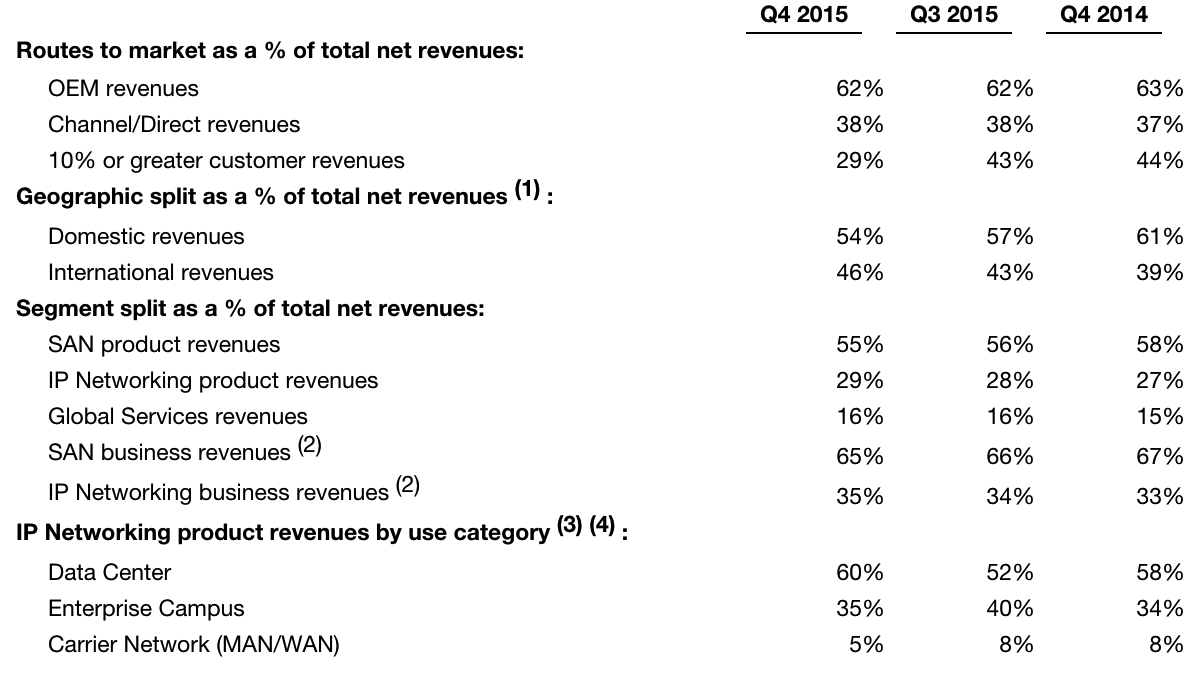

(1) Revenues are attributed to geographic areas based on product delivery location. Since some OEM partners take delivery of Brocade products domestically and then ship internationally to their end users, the%age of international revenues based on end-user location would likely be higher.

(2) SAN and IP networking business revenues include hardware and software product, support, and services revenues.

(3) Product revenue by use category is estimated based on analysis of the information the company collects in its sales management system. The estimated percentage of revenue by use category may fluctuate quarter to quarter due to seasonality and the timing of large customer orders.

(4) Each use category includes enterprise, service provider, and government revenues.

Abstracts of the earnings call transcript:

Lloyd Carney, CEO:

"FY’15 was a productive year, in which we achieved several important milestones, including completing our 20th year with a record results. We delivered annual revenue growth of 2%, a year-over-year increase in each fiscal quarter.

"For the year, our SAN revenue declined 2%, largely due to the result of weaknesses in our Fibre Channel switches and embedded switches, while we saw solid growth in directors.

" (...) we were pleased to announce the expansion of two key partnerships in China with Huawei and Lenovo. These important partnerships give Brocade greater access to China’s dynamic economy, which is emerging as a growth market for FC storage networking."

Dan Fairfax, CFO:

"( ...) our Q4 SAN revenue benefited from a $6 million sequential improvement in our embedded switch business, which has been an area of focus for the company.

"For Q1 '16 then, we expect SAN product revenue to be flat to up 3% quarter-over-quarter as we enter a seasonally stronger SAN quarter. This outlook which is slightly below normal seasonality assumes certain OEM partners with calendar year ends will not see a strong uplift in Q4 as in prior years.

"As reflected in our Q1 outlook we expect Q1 SAN and IP networking revenue to be below the respective two-year target model revenue ranges provided at Investor Day in September. However, we expect both, SAN and IP revenue to be within or at the low end of those two-year target model ranges for the full-year."

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter