All Facts and Figures on Cloudera, in Data Management Solutions for Analytics

Ready for IPO

By Jean Jacques Maleval | April 20, 2017 at 3:01 pmA company trying to be public is obliged to reveal about all its facts and figures ny publishing Form S-1. We have condensed here the main ones from this massive document of more than 180 pages to help our loyal StorageNewsletter.com’s visitors.

Founded in 2008 and incorporated in Delaware, Cloudera, Inc.‘s HQs is based in Palo Alto, CA, with additional offices in Atlanta, Boston, Chicago, Kirkland, Nashua, Raleigh, San Francisco, New York City, Tysons, and Austin in the United States and internationally in Australia, Brazil, Budapest, Tokyo, Dubai, London, India, Japan, Mexico, Munich, Paris (France), Seoul and Singapore.

Financial rounds

Huge total of $1,041 million including:

- 2009: $5 million

- 2009: $6 million

- 2010: $25 million

- 2011: $40 million

- 2012: $65 million

- 2014: $900 million, including $740 million investment of Intel, becoming 18% shareholder – Intel investing total $741.8 million in capital stock

Main stockholders

- Intel Corporation: 22%

- Entities affiliated with Accel: 16.3%

- Ping Li: 16.3%

- Entities affiliated with Greylock Partners: 12.5%

- Thomas J. Reilly: 6.1%

- Michael A. Olson: 4.4%

Acquisitions

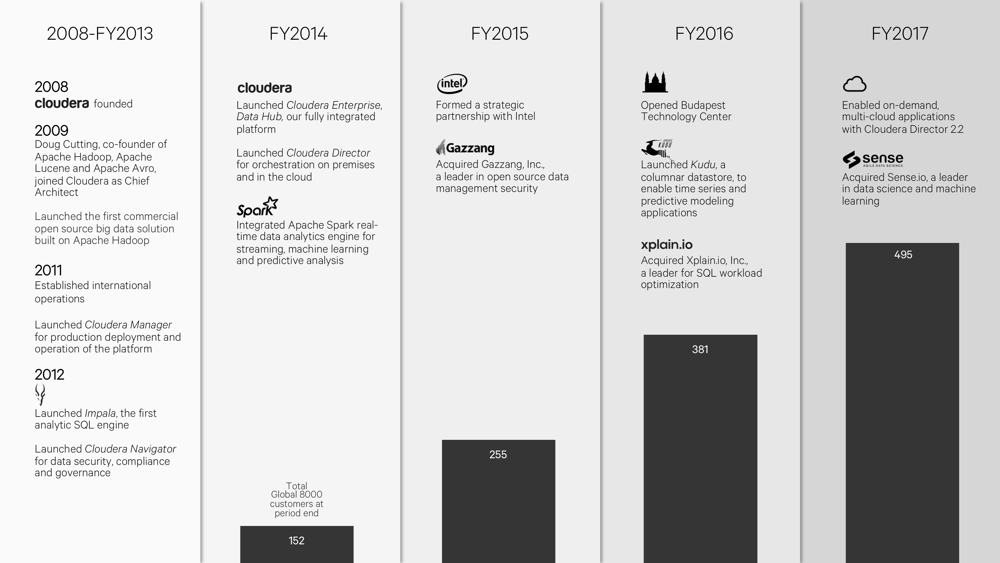

Cloudera acquired Gazzang, Inc. in 2014 to get encryption for Hadoop environment, DataPad, a start-up that had built a technically impressive business-intelligence application and had Python programming language savvy, and the following year Xplain.io, a start-up with software for analyzing database queries.

Product

The Californian firm has developed a platform for data management, machine learning and advanced analytics. Its pioneering hybrid open source software (HOSS) model incorporates open source with proprietary software to form an enterprise-grade platform. It delivers an integrated suite of capabilities for data management, machine learning and advanced analytics, affording customers an agile, scalable and cost effective solution for transforming their businesses.

Its scale-out distributed architecture delivers high performance on industry standard hardware or cloud infrastructure. It allows enterprises to operate, manage and move workloads across multiple architectures, mixing on-premises and cloud environments, including major public cloud infrastructure providers – Amazon Web Services, Microsoft Azure and Google Cloud Platform – as well as MSPs.

Cloudera offers subscriptions for five editions of its platform, ranging from Cloudera Essentials to Cloudera Enterprise. Other editions are designed to address the most common and critical data challenges enterprises face: Cloudera Data Science for programmatic preparation, predictive modeling and machine learning; Cloudera Real Time for online, streaming and real-time applications; and Cloudera Analytics for business intelligence and SQL analytics.

As part of its ecosystem, the firm have developed a strategic partnership with Intel Corporation to optimize its software for use with Intel processors and architecture.

Patents

As of January 31, 2017, it had been granted 17 U.S. patents and had 19 U.S. patent applications pending.

IPO

The tech company recently files for IPO, looking to raise up to $200 million that seems to be a small amount as CB Insights estimated the firm to be valued at $4.1 billion, and considering the figures below. The firm will list on the New York Stock Exchange under the symbol CLDR.

According to The Wall Street Journal, Cloudera just announced a price estimate for its IPO that values it as high as $1.79 billion, though the per-share price range is still well below levels previously paid for company stock. The start-up said 17.3 million shares of its common stock could be sold in the IPO for a price of between $12 and $14 a share. With 128 million shares outstanding expected after the offering, that values the company at between $1.54 billion and $1.79 billion. Big investor Intel is interested in buying up to 10% of its to-be-offered shares. At Cloudera’s estimated price range, up to $241 million of shares would be sold during its IPO, and Intel’s potential 10% stake would cost it up to $24 million.

Financial figures in $ million

| Revenue | Growth | Net loss | |

| FY15 | 109.1 | NA | (135.4) |

| FY16 | 166.0 | 52% | (203.1) |

| FY17 | 261.0 | 57% | (187.3) |

| Quarter ended in |

Revenue | Q/Q growth |

Loss from operations |

| April 30, 2015 | 33.7 | NA | (38.0) |

| July 31, 2015 | 38.3 | 14% | (81.5) |

| October 31, 2015 | 43.7 | 14% | (41.5) |

| January 31, 2016 | 50.4 | 15% | (43.5) |

| April 30, 2016 | 56.5 | 12% | (43.5) |

| July 31, 2016 | 64.5 | 14% | (38.8) |

| October 31, 2016 | 67.3 | 4% | (44.0) |

| January 31, 2017 | 72.8 | 8% | (1.0) |

Cash, cash equivalents and marketable securities were $255,666 on January 31, 2017.

It has history of losses and will not become profitable in the next future

Customers

Cloudera has approximately 500 Global 8000 customers. For the fiscal year ended January 31, 2017, revenue from our Global 8000 and public sector (including large public sector customers) represented 73% and 10% of total revenue, respectively. Total number of Global 8000 customers grew from 255 as of January 31, 2015 to 381 as of January 31, 2016, and reach 495 as of January 31, 2017.

In FY17, for customers who generated more than $1,000,000 of subscription revenue, sales and marketing expense attributable to those clients represented 30% of subscription revenue. For customers who generated between $500,000 and $1,000,000 in subscription revenue, sales and marketing expense attributable to those customers represented 54% of subscription revenue. Customers who generated more than $500,000 of subscription revenue represented more than 60% of subscription revenue in FY17 but no client accounted for more than 10% of total revenue.

The net expansion rate for subscription revenue was 143% as of January 31, 2017.

As of January 31, 2017, 18% of Global 8000 customers run the platform in the cloud..

Customers include BT Group plc, Citi, Experian plc, Navistar International Corporation, DISH, Marks&Spencer, Cisco, Quotient, drawbridge, Siemens, Samsung, SanDisk/WDC and Mastercard.

Headcount

It increased from 1,140 employees as of January 31, 2016 to 1,470 employees in January 31, 2017.

Founders

The big data company was founded in 2008 by some of the bright minds at Silicon Valley’s companies – including Google (Christophe Bisciglia), Yahoo! (Amr Awadallah), Oracle (Mike Olson), and Facebook (Jeff Hammerbacher). Doug Cutting, co-creator of Hadoop, joined the company in 2009 as chief architect and remains in that role.

Main executives and total compensation

Mike Olson, chairman and CSO , served as CEO until 2013 when he took on his current role of chief strategy officer. Prior to Cloudera, he was CEO of Sleepycat Software, makers of Berkeley DB, the open source embedded database engine. He spent two years at Oracle as VP for embedded technologies after Oracle’s acquisition of Sleepycat in 2006. Prior to joining Sleepycat, he held technical and business positions at database vendors Britton Lee, Illustra Information Technologies and Informix Software.

Mike Olson, chairman and CSO , served as CEO until 2013 when he took on his current role of chief strategy officer. Prior to Cloudera, he was CEO of Sleepycat Software, makers of Berkeley DB, the open source embedded database engine. He spent two years at Oracle as VP for embedded technologies after Oracle’s acquisition of Sleepycat in 2006. Prior to joining Sleepycat, he held technical and business positions at database vendors Britton Lee, Illustra Information Technologies and Informix Software.

Tom Reilly, CEO, was formerly VP and GM of enterprise security at HP. Previously, he served as CEO of enterprise security company ArcSight, which HP acquired in 2010. He led ArcSight through an IPO and subsequent sale to HP. Before ArcSight, he was VP of business information services for IBM, following the acquisition of Trigo Technologies Inc., a master data management software company, where he had served as CEO. He currently serves as a board member for Jive Software, privately held Ombud Inc., ThreatStream Inc. and Cloudera.

Tom Reilly, CEO, was formerly VP and GM of enterprise security at HP. Previously, he served as CEO of enterprise security company ArcSight, which HP acquired in 2010. He led ArcSight through an IPO and subsequent sale to HP. Before ArcSight, he was VP of business information services for IBM, following the acquisition of Trigo Technologies Inc., a master data management software company, where he had served as CEO. He currently serves as a board member for Jive Software, privately held Ombud Inc., ThreatStream Inc. and Cloudera.

Total compensation in 2016 and 2017 in $

| Name and position | 2016 | 2017 | Y/Y growth |

| Thomas J. Reilly, CEO | 7,380,020 | 4,643,667 | -37% |

| Jim Frankola, CFO | 346,750 | 2,854,589 | 723% |

| Michael A. Olson, chairman and CSO | 322,000 | 2,401,000 | 646% |

Gartner’s opinion

In its report, Magic Quadrant for Data Management Solutions for Analytics (February 20, 2017),

Gartner positions Cloudera as a challenger.

Magic Quadrant for Data Management Solutions for Analytics

Here are the comments of Gartner’s analysts on Cloudera:

Strengths

• Market presence: Among all Hadoop distributions, Cloudera is the most successful in this market based upon Gartner’s published revenue numbers, partner traction and Gartner end-user clients’ reported interest – demonstrating an ongoing year-over-year trend.

• Cloud support: Cloudera’s cloud support is progressing; it has begun, and will continue, to evolve its product to meet the requirements of cloud deployments. For example, Cloudera Director now supports the ability to spin up or down transient clusters as well as scaling up or scaling down clusters.

• Technical support: Reference customers praise Cloudera for the quality of its technical support, which is essential given the limited availability of skills in the market.

Cautions

• Potential erosion of the core Hadoop stack: Cloudera, like other Hadoop distribution vendors, is being challenged as new processing alternatives (such as Spark) and new storage options (such as S3 for cloud object storage) offer alternatives that do not require a Hadoop stack. Cloudera is already addressing this risk by adding Spark to its distribution and offering direct access for files stored in S3.

• Increased cloud competition: Demand for cloud solutions, and cloud and on-premises hybrids, is rapidly growing. Cloudera has been addressing these demands with its cloud-native capabilities and consumption-based pricing on AWS, Azure, and Google Cloud. However, its ability to drive traction on its cloud offering will be crucial and will require it to be combined with easier administration capabilities. Cloudera’s reference customers point out the complexity of its UI and the expertise required for it.

• Quality concerns: As the technology is being more widely used for more complex workloads and data of multiple formats, Cloudera’s reference customers point out their concerns about maturity issues and bugs. Cloudera has been addressing these with enhanced scale and stability testing, as part of an overall quality initiative.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter