Yearly Growth of 9% for EMEA Integrated Platforms in 1Q15 – IDC

Oracle, VCE, Cisco/NetApp, HP market leaders

This is a Press Release edited by StorageNewsletter.com on July 16, 2015 at 2:39 pmThe integrated systems market in EMEA saw weak growth in 1Q15, reporting $593.66 million in user value to account for year-on-year growth of 9.3%, according to IDC Corp.‘s latest Quarterly Integrated Infrastructure and Platforms Tracker.

Integrated infrastructure systems, single SKU systems optimized for virtualization, have shown weak growth this quarter, accounting for 62.1% ($368.8 million) of total sales in EMEA in 1Q15, while revenue generation increased Y/Y by 2.8%. This was mainly driven by a weaker quarter from the larger vendors in this sector as the maturity of the market begins to play a bigger role in reducing the rate of growth. Another key growth inhibitor this quarter was the increased adoption rates in the hyper-converged market.

Looking at the EMEA integrated systems market in euros, IDC saw the weakening euro play a stronger role as a growth inhibitor in 1Q15, with a slightly improved outlook compared with the dollar. Year-on-year user euro value grew 32.8%, or 37.1% points lower than in 1Q14. The dollar, however, fared even worse, reporting a 61.2% point decline compared with 1Q14. For U.S.-based vendors in the European market, this was a difficult quarter.

“1Q15 saw increased traction for newer technologies such as flash storage and hyper-converged systems in the EMEA market,” said Eckhardt Fischer, research analyst, european infrastructure, IDC. “Integrated systems are not isolated from these trends, though hyper-converged is a technology that IDC believes will be a source of significant competition for the integrated system market.”

Regional Highlights

In the EMEA region, Western European revenues accounted for 80.4% of sales, for year-on-year gowth of 3.9%. Historically this is a very weak quarter in terms of Y/Y growth, and compared with 1Q14 it is a full 51.6% points lower. The top 3 countries by spend are unchanged from the previous quarter, but IDC’s reclassification of Rest of Western Europe (RWE) in 1Q15 – by releasing the Nordic and Benelux data at a country level – has reduced RWE’s impact on Western Europe. These additional six countries account for 20.3% of the Western European market, reducing RWE’s revenue share to 17.4% in 1Q15 from 41% in 1Q14. The strongest growth in the quarter was seen by Denmark, growing 22.4% Y/Y.

The lower growth in the Western European integrated systems market stems from a weaker integrated infrastructure quarter, though this market has accounted for the bulk of revenue growth in the integrated systems market over the last three years. As IDC discusses in the report EMEA Integrated System 2014-2018 Forecast and Analysis ($4,500, 16 pages), slower growth in this market is a result of increasing saturation levels. 1Q15 is the first quarter in which integrated infrastructure has reported negative growth (-1.9%). This increased maturity, however, has not impacted the platform market as its slower YoY growth has remained unaffected, with Y/Y growth of 14.4% for Western Europe in 1Q14.

“This higher stability in the integrated platforms market has been driven by increasing adoption of emerging new workloads such as big data and business analytics – they have not seen the same explosive traction as integrated infrastructure, but they are less affected by the introduction of newer technologies on the market,” said Silvia Cosso, senior research analyst, European infrastructure, IDC.

“Despite a history of strong growth patterns, some hurdles will need to be overcome by the integrated infrastructure market, as the market looks to newer market technologies that allow the implementation of a commoditized hardware scale-out approach. This, coupled with improvements in software-defined networking and storage, will begin to ask real questions of which workloads are best suited to which hardware,” said Giorgio Nebuloni, associate research director, European infrastructure, IDC.

Central and Eastern Europe, the Middle East, and Africa (CEMA) recorded revenue growth of 38.7% year over year to reach $116.46 million in the first quarter of 2015, accounting for 20% of EMEA market value in the quarter, which was a small improvement over the previous quarter. Central and Eastern Europe (CEE) sales increased 47%, making it the fastest-growing region in EMEA, benefitting from a number of infrastructure deals in Russia. The Middle East and Africa (MEA) continued to record strong growth as well, up 33% year on year, driven by projects in financial and government sectors.

“Integrated systems play an increasing role in the infrastructure market as many organizations in the CEMA region are changing their approach to infrastructure investments by adopting integrated systems as a practical solution to address efficiency and manageability challenges,” said Jiri Helebrand, research manager, servers, systems, and infrastructure solutions, IDC CEMA.

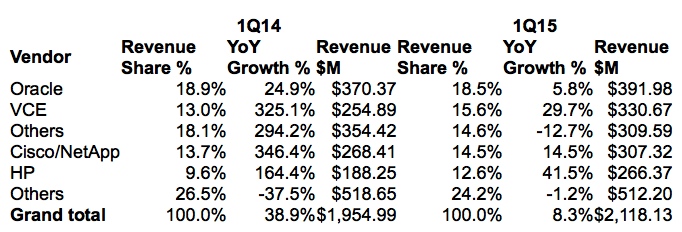

Top 5 Integrated Systems Vendors by Value

New Way of Purchasing Infrastructure and Applications

IDC defines integrated infrastructure and platforms as preintegrated, vendor-certified systems containing server hardware, disk storage systems, networking equipment, and basic element/systems management software at the point of sale. Systems not sold with all four of these components are not counted in this tracker.

IDC segments this market into two categories:

- Integrated platforms are systems sold with additional preintegrated packaged software and customized system engineering optimized to enable such functions as application development software, databases, testing, and integration tools.

- Integrated infrastructure systems are designed for general-purpose, distributed workloads that are likely to have differing performance profiles. While integrated infrastructure is similar to integrated platforms in that it will leverage the same infrastructure building blocks, it is not optimized for a specific workload.

Taxonomy Changes

IDC has included six new Western Europe counties in the 1Q15 release. Previously categorized within Rest of Western Europe, these countries now include full data sets, as far back as the first quarter of 2014.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter