WW Personal and Entry-Level Storage Market Declined 15% in 2015 – IDC

Reaching $5.4 billion and 68.5 million units (-9%)

This is a Press Release edited by StorageNewsletter.com on March 6, 2016 at 2:00 pmWorldwide personal and entry-level storage (PELS) shipments totaled 68.5 million units in 2015, representing a decline of -9.2% from a year ago, according to the International Data Corporation‘s Worldwide Personal and Entry-Level Storage Tracker.

Annual shipment values were down -15.1% year over year to $5.4 billion.

Yearly WW PELS Market

| Year | Value in $ billion | Y/Y growth | Shipments in million | Y/Y growth |

| 2013 | 6.701 | 6.2% | 75.2 | 13.6% |

| 2014 | 6.360 | -5.1% | 75.4 | 1.0% |

| 2015 | 5.400 | -15.1% | 68.5 | -9.2% |

(Source: StorageNewslettter.com with the use of former IDC figures)

Unit shipments in 4Q15 experienced a -6.8% decrease from a year ago to 19.1 million units. Shipment values declined along with units in the fourth quarter, down -12.6% to $1.5 billion.

“2015 marks the first year of decline in the personal and entry-level storage market since the Thailand floods in 2011,” said Jingwen Li, senior research analyst, storage systems. “The growing utilization of cloud storage continues to negatively affect the demand for PELS. In response, players in the PELS market are being forced to either capture more market opportunities through M&A or go through re-organization to better position their PELS business.”

Market Highlights

- The relative shares of personal vs. entry-level storage remained stable in 4Q15. Personal storage continued to account for almost 99% of total market shipments. The shrinking of the PELS market has been negatively impacting the entry-level storage segment throughout 2015. Shipments to this SMB-focused segment were down by -2.5% year over year in 2015.

- PELS offerings with higher capacity points continued to gain market share as fierce price competition made these products more affordable. In the 3.5″ segment, 3-5TB drives continued to take share from 1-2TB offerings and accounted for 51.5% units shipped. In the 2.5″ space, 500GB and 1TB offerings still dominated the market. However, offerings of 2-4TB managed to grow their shares over the past two years.

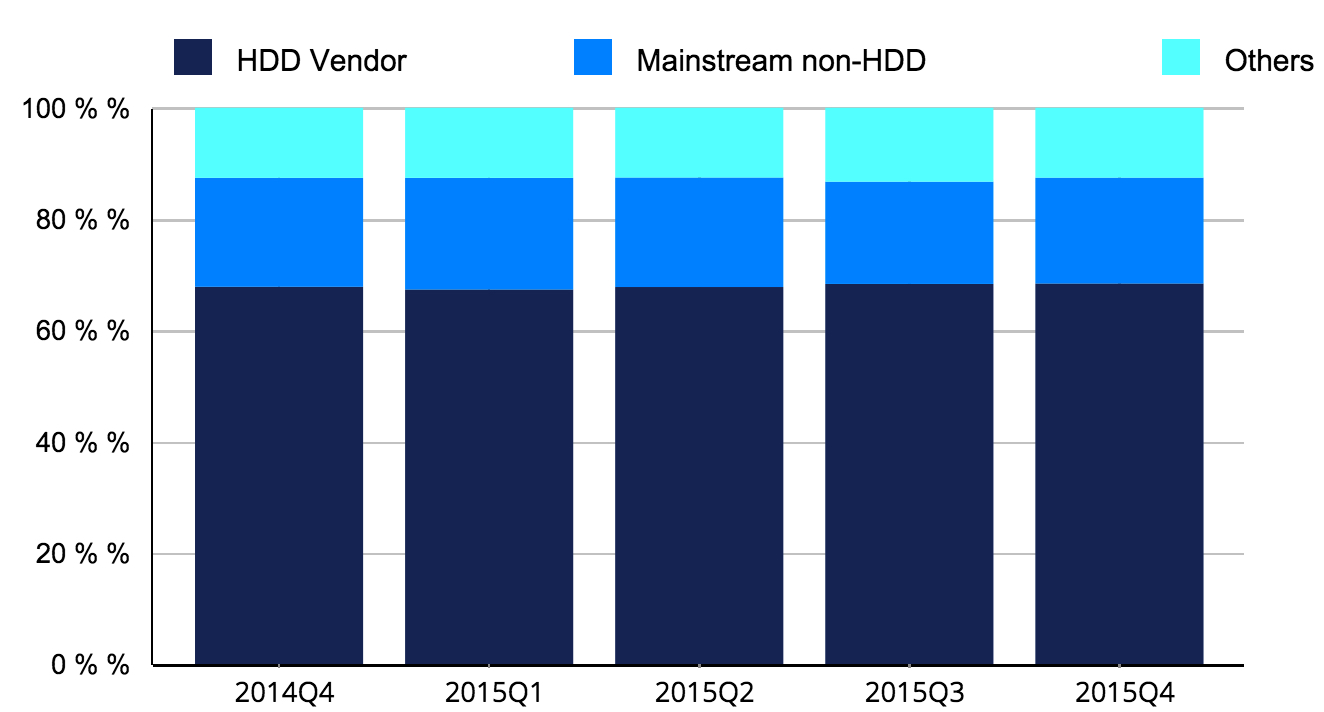

- HDD vendors continued to dominate the personal storage segment (representing 80% of unit share) and gained shipment share in the entry-level segment (capturing 26% unit share). Both HDD and mainstream non-HDD players have been struggling in the PELS market. Western Digital acquired SanDisk to gain more opportunities in the SSD market. Toshiba has been experiencing shipment decline and will have to go through restructuring to better position its HDD business. Smaller vendors like Imation discontinued its personal storage product line while Imation acquired Connected Data to move up to the entry-level space.

- USB remained the most popular interface in the PELS market as major players started to roll out offerings with USB Type-C connectors. These offerings are still in the early stages of development, but with speeds comparable to Thunderbolt, these products will potentially create competition with the Thunderbolt offerings.

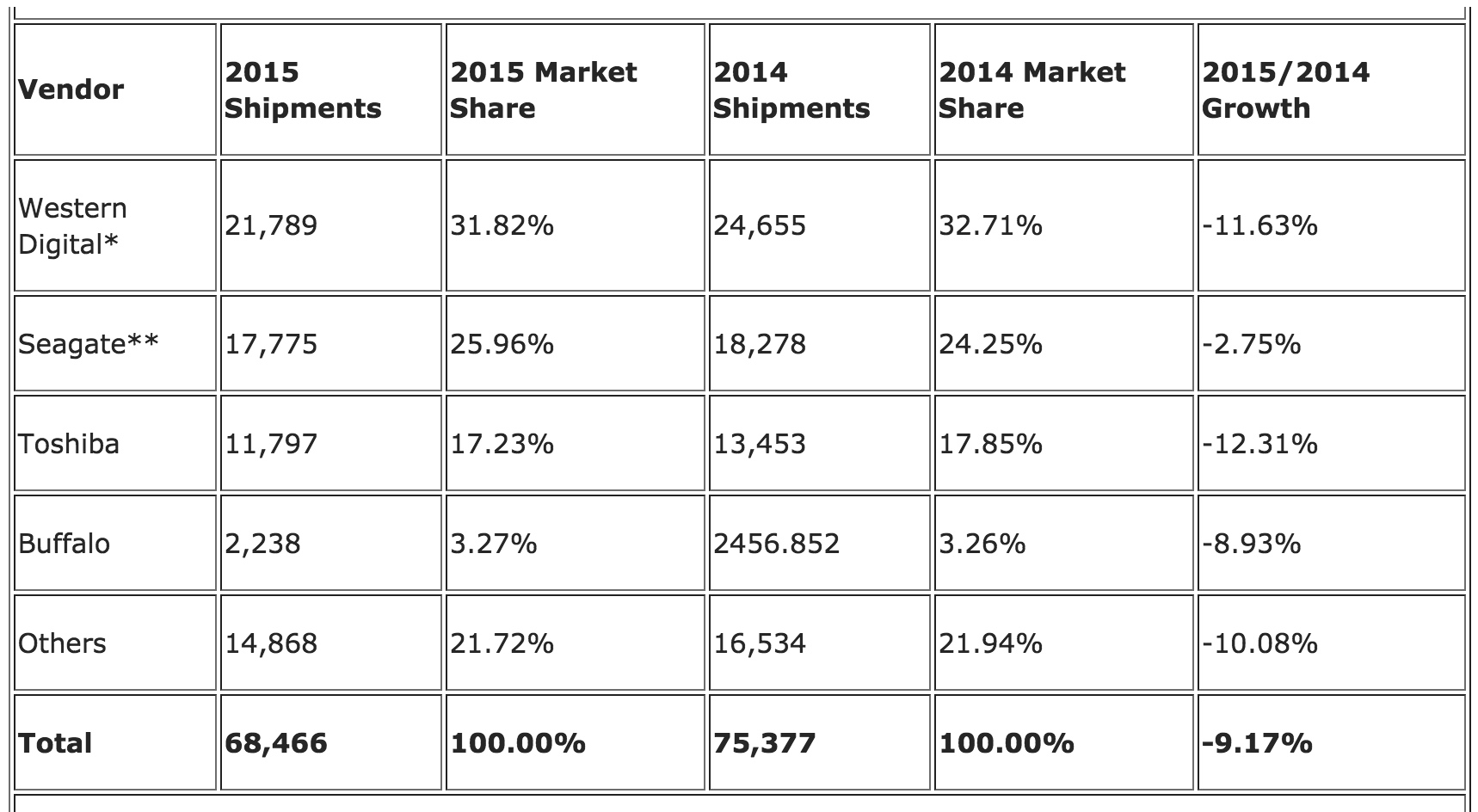

WW PELS Shipment, Market Share, and Year-Over-Year Growth, 2015

(shipment in thousands)

WW PELS Market, Vendor Type 4Q14 – 4Q15

(shares based on value)

(Source: IDC Worldwide Quarterly Personal and Entry Level Storage Tracker, February 2015)

Notes:

* Western Digital does not include HGST

** Seagate does not include LaCie and Samsung

Notes:

- The PELS market includes storage products and solutions with a single bay through twelve bay configurations that are manufactured and marketed for individuals, small offices/home offices, and small businesses.

- IDC defines Personal Storage as having 1-2 bays and Entry-Level Storage as having 3-12 bays.

- IDC defines an HDD vendor as a vendor who manufactures its own HDD drive, in addition to branded external storage.

- IDC defines a Mainstream non-HDD vendor as a major PELS vendor that does not manufacture its own HDD drives.

- Data for the PELS market is reported for calendar periods.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter