WW Cloud Infrastructure Revenue Grows 3.9% to $6.6 Billion in 1Q16 – IDC

Storage grew 11.5% Y/Y in private cloud, declined 29.6% in public cloud.

This is a Press Release edited by StorageNewsletter.com on July 5, 2016 at 2:52 pmAccording to the International Data Corporation‘s Worldwide Quarterly Cloud IT Infrastructure Tracker, vendor revenue from sales of infrastructure products (server, storage, and Ethernet switch) for cloud IT, including public and private cloud, grew by 3.9% year over year to $6.6 billion in 1Q16 on slowed demand from the hyperscale public cloud sector.

Total cloud IT infrastructure revenues climbed to a 32.3% share of overall IT revenues in 1Q16, up from 30.2% a year ago. Revenue from infrastructure sales to private cloud grew by 6.8% to $2.8 billion, and to public cloud by 1.9% to $3.9 billion.

In comparison, revenue in the traditional (non-cloud) IT infrastructure segment decreased by 6.0% year over year in the first quarter, with declines in both storage and servers, and growth in Ethernet switch.

Ethernet switch also showed strong year-on-year growth in both private and public cloud, 53.7% and 69.4%, respectively.

Storage grew 11.5% year over year in private cloud, but declined 29.6% in public cloud. Conversely, server declined 1.1% in private cloud and grew 8.7% in public cloud.

“A slowdown in hyperscale public cloud infrastructure deployment demand negatively impacted growth in both public cloud and cloud IT overall,” said Kuba Stolarski, research director for computing platforms, IDC. “Private cloud deployment growth also slowed, as 2016 began with difficult comparisons to 1Q15, when server and storage refresh drove a high level of spend and high growth. As the system refresh has mostly ended, this will continue to push private cloud and, more generally, enterprise IT growth downwards in the near term. Hyperscale demand should return to higher deployment levels later this year, bolstered by service providers who have announced new datacenter builds expected to go online this year. As the market continues to work through this short term adjustment period, with geopolitical wild cards such as Brexit looming, end-customers’ decisions about where and how to deploy IT resources may be impacted. If new data sovereignty concerns arise, service providers will experience added pressure to increase local datacenter presence, or face potential loss of certain customers’ workloads.“

From a regional perspective, vendor revenue from cloud IT infrastructure sales grew fastest in the Middle East and Africa at 25.9% year over year in 1Q16, followed by Western Europe at 20.6%, AsiaPac (excluding Japan) at 18.5%, Japan at 17.7%, and Canada at 9.5%. Latin America declined 21.2% year over year, while the United States declined 4.1% and Central & Eastern Europe fell just 0.1%.

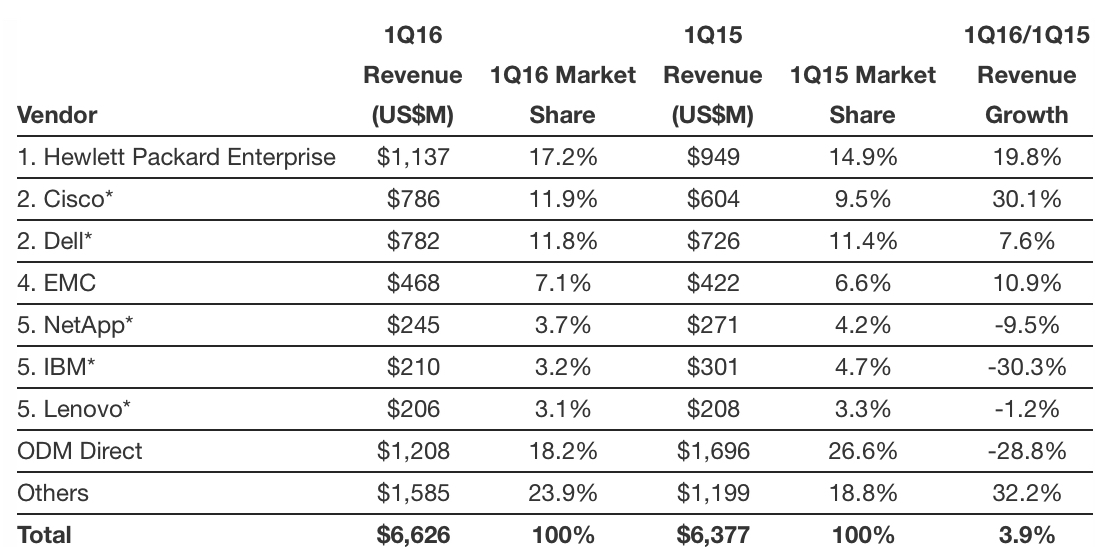

Top 5 corporate family, WW cloud infrastructure vendor eevenue, 1Q16

(revenue in $ million, excludes double counting of storage and servers)

Notes:

* Cisco and Dell finished 1Q16 in a statistical tie for the number two position, while NetApp, IBM, and Lenovo similarly tied for the number five position in 1Q16. IDC declares a statistical tie in the worldwide cloud IT infrastructure market when there is less than 1e% difference in the revenue share of two or more vendors.

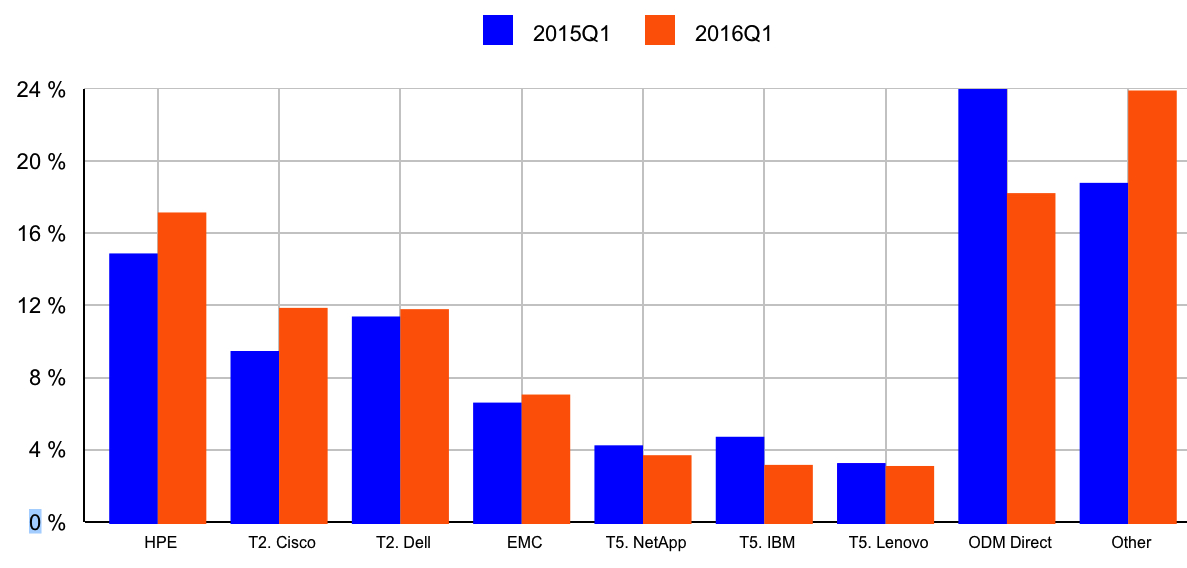

Top 5 cloud IT infrastructure vendors in 1Q15 and 1Q16

(shared based on vendor revenue)

Taxonomy Notes:

IDC defines cloud services more formally through a checklist of key attributes that an offering must manifest to end users of the service. Public cloud services are shared among unrelated enterprises and consumers; open to a largely unrestricted universe of potential users; and designed for a market, not a single enterprise. The public cloud market includes variety of services designed to extend or, in some cases, replace IT infrastructure deployed in corporate datacenters. It also includes content services delivered by a group of suppliers IDC calls Value Added Content Providers (VACP). Private cloud services are shared within a single enterprise or an extended enterprise with restrictions on access and level of resource dedication and defined/controlled by the enterprise (and beyond the control available in public cloud offerings); can be onsite or offsite; and can be managed by a third-party or in-house staff. In private cloud that is managed by in-house staff, ‘vendors (cloud service providers)’ are equivalent to the IT departments/shared service departments within enterprises/groups. In this utilization model, where standardized services are jointly used within the enterprise/group, business departments, offices, and employees are the ‘service users.’

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter