Unstoppable SSD Growth – Trendfocus

30.8 million units shipped in 1Q16, increasing in nearly every category

This is a Press Release edited by StorageNewsletter.com on May 17, 2016 at 3:00 pmTrendfocus, Inc. has published this Executive Summary on NAND/SSD Information Service – CQ1 ’16 Quarterly Update.

Abstracts:

CQ1 ’16 SSD Shipments Increase in Nearly Every Category

Despite Declining Notebook PC Sales – 30.8 Million Sold

Enterprise segment shows growth in all interfaces,

with enterprise SATA approaching 3 million units shipped

- All segments, except caching, once again grew in CQ1’16; client SSDs exceeded 27 million units, an increase of 4% from the previous quarter.

- SATA SSDs still dominate the client SSD market, representing about 83% of all client SSDs shipped; PCIe accounted for the balance.

- Client modules, including M.2 and mSATA, shipped over 12 million units in CQ1 ’16, an increase of 3.8% from the prior quarter; this accounted for almost 45% of all client SSDs shipped.

- Every interface of enterprise SSDs posted sequential growth – total reached 3.7 million units driven once again by enterprise SATA SSDs.

- SAS SSDs increased 6.1% to 592,000 units, with measurable share shifts between vendors.

- Enterprise PCIe showed the strongest percentage growth of all product categories at 16.3% with a total of 164,000 units shipped.

- Exabytes shipped for all SSDs reached 10EB, but remained relatively flat as a percentage of all NAND shipped.

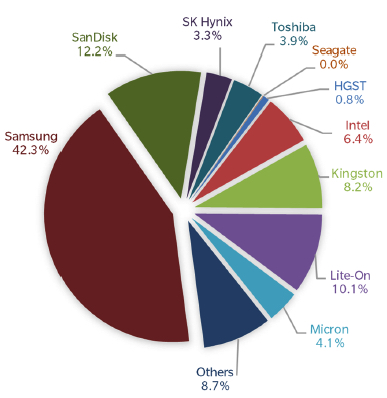

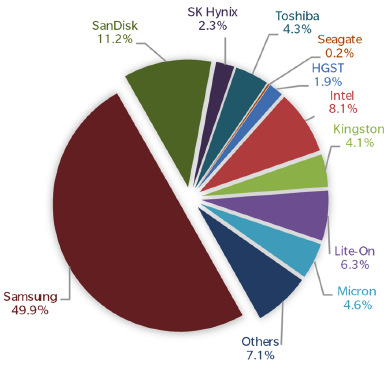

Total SSD Supplier Market Share, by Supplier, Units (M), EBs

Comments

Here is a comment from Don Jeanette, VP, Trendfocus, Inc.:

Here is a comment from Don Jeanette, VP, Trendfocus, Inc.:

Unstoppable SSD Growth

As many storage companies have recently released their 1CQ16 results, it is very clear - SSDs are winning the race! Even as we witnessed a drastic decline in the client PC market in Q1 (almost -15% Q-Q), client SSDs are anticipated to show yet another increase in unit shipments (sorry HDDs). Even with the declining notebook market, people want their SSDs. Remember, 1CQ16 posted the lowest HDD shipment number since 2CQ16, with this current quarter estimated to be below 100 million units.

For enterprise SSDs, when all the numbers are added up, all three segments will most likely show growth yet again. Hyperscale demand for SATA SSDs continues to show solid growth, and SAS SSDs going to storage networking companies continued to grow despite the woes of the traditional enterprise storage market (sorry 10,000 and 15,000 HDDs). And lastly comes PCIe, still the lowest unit share of all three, but still displaying strong growth with 1CQ16 being no different.

One thing remains a bright spot for HDDs - let's go sell as many of those nearline HDDs as we can.

Anyone who has children knows that the cloud will need all the storage capacity possible to store all of those videos and photos kids spend 18+ hours of the day taking and posting.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter