Ten Providers That Matter in Enterprise File Sync And Share Platforms, Hybrid Solutions – Forrester

Accellion, Acronis, BlackBerry, Citrix, Egnyte, IBM, Microsoft, Syncplicity, Varonis, VMware

This is a Press Release edited by StorageNewsletter.com on May 12, 2016 at 2:59 pmHere is an abstract of a report published by Forrester Search, Inc.

For Enterprise Architecture Professionals

The Forrester Wave: Enterprise File Sync And Share Platforms, Hybrid Solutions, Q2 2016

The 10 Providers That Matter Most And How They Stack Up

April 26, 2016

by Cheryl McKinnon with Gene Leganza, Shaun McGovern, and Diane Lynch

by Cheryl McKinnon with Gene Leganza, Shaun McGovern, and Diane Lynch

Not All Enterprises Are Ready to Go All-In on Cloud

Enterprise file le sync and share (EFSS) is firmly entrenched inside the enterprise, and technology management buyers no longer view it as a primarily consumer-driven technology. The broader market, however, is crowded, with a multitude of vendors offering relatively comparable options. For 2016, Forrester has segmented the most relevant EFSS vendors into two groups. These two segments are, first, products that are native cloud-based software-as-a-service (SaaS) offerings, and second, products that target the hybrid cloud or on-premises deployments. Leaders in the cloud EFSS market are investing in capabilities that make them contenders for tomorrow’s systems of record for corporate content; we’ve assessed them in the Forrester Wave: Enterprise File Sync And Share Platforms, Cloud Solutions, Q1 2016. This evaluation for enterprise file sync and share platforms assesses the vendors that address the hybrid and/or on-premises use cases.

Files Still Reside Predominantly on-Premises, Even As The Shift To Cloud Begins

Hybrid EFSS vendors deliver secure connectors to existing content applications or storage locations, which may be on-premises, cloud, or a mix of both. Flexibility of deployment options is what gives these vendors competitive differentiation over the cloud-only providers. Hybrid EFSS providers allow enterprises to gain the benefits of mobile-friendly, secure file-sharing technology without the burden of migrating content to yet another repository. EA pros, when assessing EFSS requirements, must take this content repository question into account.

EA pros must also consider that:

- Cloud EFSS tools may compete with ECM, while hybrid providers complement it. Enterprise content management is currently an approximately $8 billion market that is under pressure as cloud alternatives emerge and traditional vendors struggle to port legacy offerings to managed services. As cloud EFSS providers enhance their repository services, they are increasingly viewed as credible alternatives to manage business content. Many of the EFSS hybrid vendors in this Forrester Wave have connectors for mainstream ECM systems such as EMC Documentum and SharePoint, among others. Some hybrid providers also use the content management interoperability services (CMIS) standard to ease integration with a broad set of content applications. These integrations allow documents to reside in their home repository systems but be shared and/or synched across teams and devices.

- Businesses still have hundreds of terabytes of unstructured data on-premises. Forrester’s data shows that the volume of files residing on internal network drives or content repository systems continues to be substantial. In 2015, 47% of data and analytics decision-makers stated that their enterprises held between 1TB and 99TB of unstructured data within their company networks. A further 21% held 100TB to 999TB, with 14% holding over 1,000TB in-house. In organizations where active, useful content is stored on-premises, there may be little appetite to move, migrate, or duplicate content to take advantage of EFSS.

- EFSS tools from existing solution providers may be a good fit. ECM and archiving vendors have also stepped up to offer secure EFSS capabilities as an integral part of their products. EA pros with deep investments in existing content applications should assess these existing suppliers to see if they offer the range of mobility, security, usability, and integration capabilities to meet EFSS requirements. Examples of ECM vendors with EFSS capabilities include Alfresco Software, Hyland Software, iManage, Lexmark International, M-Files, and OpenText. Archiving providers include Commvault and Hitachi Data Systems. A typical limitation of these offerings, however, is the ability to integrate with a broad range of content applications – many integrate only with their own repository systems.

- EFSS is a crowded market with many vendors worthy of investigation. There are dozens of EFSS providers that may fit particular needs. Vendors with solid offerings that did not meet one or more inclusion criteria for this Forrester Wave include AeroFS (which uses a chat-channel approach to file sharing), Ctera, FinalCode (a relatively new vendor with success and backing in Asia), and ownCloud (one of the few open source options in the EFSS market). Avepoint offers SharePoint specific EFSS extensions, and Metalogix offers tools to bring consistent governance to cloud file sharing systems.

Flexibility of Deployment Options Is The Hallmark of Top Hybrid EFSS Providers

The top EFSS providers in this evaluation benefit from their flexible deployment models, as they serve enterprises that are at various stages of cloud adoption. Hybrid EFSS offers EA pros a way to cope with the reality that key enterprise applications, storage locations, and content repositories will be scattered across a mix of on-premises, public, or private cloud services for the near future.

This means that enterprises can:

- Adopt EFSS and meet data sovereignty requirements. Businesses operating in jurisdictions with stringent data protection laws often prefer content-sharing systems that provide granular controls over file storage. Enterprises can leave sensitive information on-premises or within private cloud instances in their preferred region yet still get the benefit of simple file collaboration across mobile devices, even with external parties.

- Move to the cloud at their own pace, without changing EFSS providers. Large enterprises are at varying stages of cloud adoption for enterprise applications and document storage. Top hybrid EFSS providers provide the flexibility to allow an organization to start with predominantly on-premises content storage and shift this to cloud over time. Several of the assessed hybrid providers can also offer entirely cloud solutions, including basic content repository services, that are comparable with the cloud EFSS providers.

- Serve their extended enterprises from existing content systems. EFSS providers can fill a critical gap left by traditional content management and collaboration products: the ability to securely and simply share files with external participants. Corporate priorities are now focused on improving customer experience and digitizing business processes, which means that engaging critical outside stakeholders such as partners, suppliers, and customers with content is a key requirement. EFSS providers offer the licensing models and a ‘no training required’ experience to get external collaborators productive quickly and with minimal administrative efforts.

Enterprise File Sync And Share Evaluation Overview

To assess the state of the EFSS hybrid market and see how the vendors stack up against each other, Forrester evaluated the strengths and weaknesses of top vendors in the marketplace. After examining past research, user need assessments, customer surveys, and vendor and expert interviews, we developed a comprehensive set of evaluation criteria.

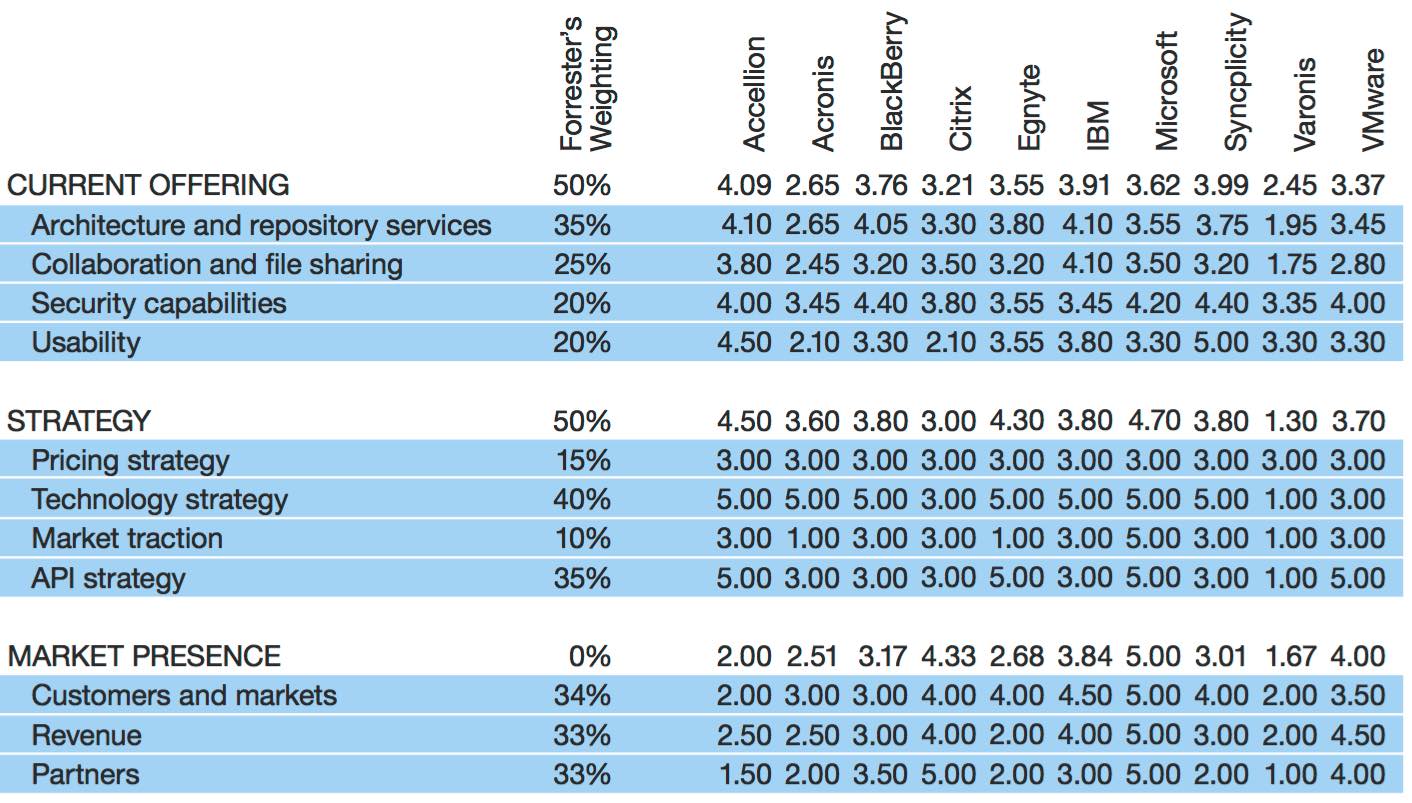

We evaluated vendors against 37 criteria, which we grouped into three high-level buckets:

- Current offering. We assessed the technologies based on the breadth of the tool set, with particular emphasis on usability, ease of sharing with external participants, security, and flexibility in supporting customers not ready for a cloud-based EFSS solution. We surveyed customers to gain firsthand knowledge on the strength of particular capabilities and tested each vendor’s mobile app with at least one large shared file.

- Strategy. EFSS hybrid vendors must show coherent strategies to help their customers share and manage content across a range of cloud and on-premises content applications, recognizing that enterprises are in various stages of cloud adoption. We assessed vendors on strategies for pricing models, APIs, and overall technology direction.

- Market presence. We evaluated each vendor based on its current customer base, the size of its EFSS revenue, and its geographic presence, partnerships, and vertical focus. We also considered the level of interest in the vendor based on the volume of inquiries from Forrester clients on the product.

Evaluated Vendors And Inclusion Criteria

Forrester included 10 vendors in the assessment: Accellion, Acronis, BlackBerry, Citrix, Egnyte, IBM, Microsoft, Syncplicity, Varonis, and VMware. Each of these vendors has a strong current EFSS offering and actively markets its tool as a standalone solution.

We selected vendors based on the following criteria (see Figure 1):

- A dedicated roadmap and go-to-market strategy focused on EFSS. Each vendor demonstrated that hybrid or on-premises was the predominant model for delivery of its EFSS technology and that it was investing in these services.

- Leadership in the EFSS market. Selected vendors demonstrated the ability to shape the direction of the market through innovative delivery models, technology leadership, or their dominant market presence.

- A proven install base among enterprise customers. Vendors demonstrated revenues of over $10 million with their EFSS hybrid product offerings or had a minimum of 350 paying enterprise customers.

Figure 1 Evaluated Vendors: Product Information And Selection Criteria

| Vendor | Product Evaluated | Version |

| Accellion | kiteworks | kw2016.01.00 |

| Acronis | Acronis Access Advanced | 7.2 |

| BlackBerry | WatchDox by BlackBerry | |

| Citrix | ShareFile Enterprise | |

| Egnyte | Egnyte Adaptive Enterprise File Services | |

| IBM | IBM Connections Cloud IBM Connections |

5.5 |

| Microsoft | Office 365 OneDrive for Business SharePoint 2013 |

|

| Syncplicity | Syncplicity | |

| Varonis | DatAnywhere | |

| VMware | VMware AirWatch EMM VMware Airwatch Video VMware Content Locker VMware Socialcast |

Vendor inclusion criteria:

- A dedicated roadmap and go-to-market strategy focused on EFSS. Each vendor demonstrated that hybrid or on-premises was the predominant model for delivery of its EFSS technology and that it was investing in these services.

- Leadership in the EFSS market. Selected vendors demonstrated the ability to shape the direction of the market through innovative delivery models, their technology leadership, or their dominant market presence.

- A proven install base among enterprise customers. Vendors demonstrated revenues of over $10 million with their EFSS hybrid product offerings or had a minimum of 350 paying enterprise customers.

Vendor profiles

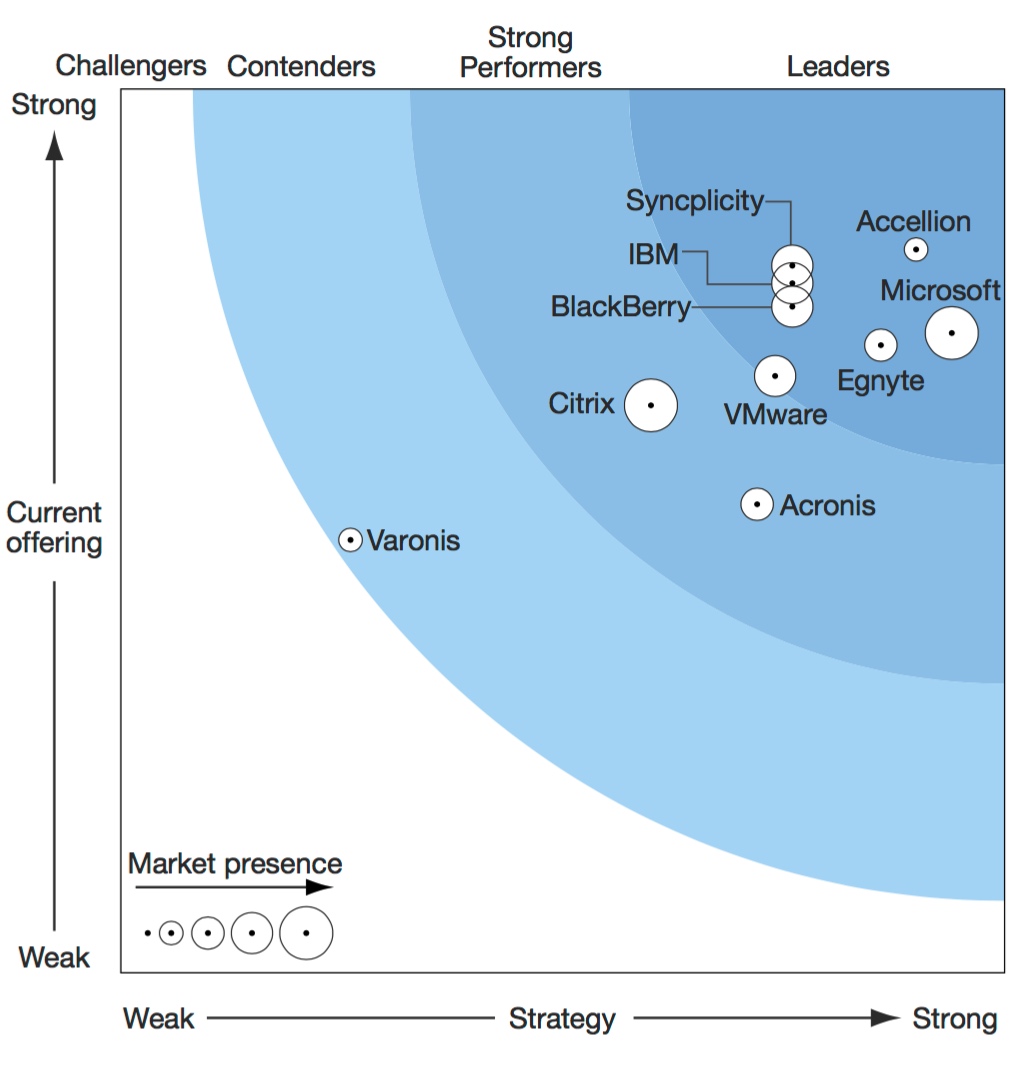

We intend this evaluation of the enterprise file sync and share hybrid solutions market to be a starting point only. We encourage clients to view detailed product evaluations and adapt criteria weightings to fit their individual needs through the Forrester Wave Excel-based vendor comparison tool (see Figure 2).

Figure 2 Forrester Wave: Enterprise File Sync And Share, Hybrid Solutions, Q2 ’16

Figure 2 Forrester Wave: Enterprise File Sync And Share, Hybrid Solutions, Q2 ’16 (Cont.)

All scores are based on a scale of 0 (weak) to 5 (strong).

Survey Methodology

Forrester’s Global Business Technographics Data And Analytics survey, 2015 was conducted using an online survey fielded in January through March 2015 of 3,005 business and technology decision- makers located in Australia, Brazil, Canada, China, France, Germany, India, New Zealand, the UK, and the US from companies with 100 or more employees.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter