Nine Providers That Matter in Enterprise File Sync And Share Platforms, Cloud Solutions – Forrester

Box, Dropbox, Google, Huddle, IBM, Intralinks, Microsoft, Thru, Workshare

This is a Press Release edited by StorageNewsletter.com on June 7, 2016 at 3:03 pmHere is an abstract of a report published by Forrester Search, Inc.

For Enterprise Architecture Professionals

The Forrester Wave: Enterprise File Sync And Share Platforms, cloud Solutions, Q1 2016

The Nine Providers That Matter Most And How They Stack Up

March 10, 2016

By Cheryl McKinnon with Gene leganza, Elizabeth Cullen, and Diane Lynch

By Cheryl McKinnon with Gene leganza, Elizabeth Cullen, and Diane Lynch

Enterprise File Sync And Share Is A Market On The Cusp Of Transition

Enterprise file sync and share (EFSS) is firmly entrenched inside the enterprise, and technology management buyers no longer view it as a primarily consumer-driven technology. The broader market, however, is crowded with a multitude of vendors offering relatively comparable options.

For 2016, Forrester has segmented the most relevant EFSS vendors into two groups: first, products that are native cloud-based software-as-a-service (SaaS) offerings, and second, products that target hybrid cloud or on-premises deployments. Cloud-native EFSS providers are investing in capabilities that make them contenders for tomorrow’s systems of record for corporate content. EFSS solutions addressing the hybrid and/or on-premises use cases focus on delivering secure connectors to existing content applications or storage locations. Thus, they allow enterprises to gain the benefits of mobile-friendly, secure file sharing technology without the burden of migrating content to yet another repository. EA pros, when assessing EFSS requirements, must take this content repository question into account.

Content Is Shifting To The Cloud, And EFSS Providers Are Playing An Essential Role

EFSS cloud vendors have the opportunity to serve not only as collaborative systems of engagement across teams and companies but also as primary systems of record. Enterprises are accelerating their moves to cloud for content management and collaboration requirements.

This means:

- EFSS cloud offerings already compete with ECM providers. Enterprise content management (ECM) is currently an approximately $8 billion market that is under pressure as cloud alternatives emerge and traditional vendors struggle to port legacy offerings to managed services. Overall, EFSS cloud vendors are ahead of these vendors in crafting the next generation of true software-as-a- service (SaaS) content management and collaboration services.

- By 2018, 80% of enterprises plan to use SaaS for some or all content services. Forrester’s data shows that a high proportion of firms plan to meet all or some of their enterprise content management requirements with SaaS over the next two years. As the leading EFSS cloud providers enhance key capabilities such as highly scalable repository services, metadata, search, task or workflow management, simple retention rules, and auditing, EFSS cloud providers can address a chunk of this market.

- The EFSS hybrid solution providers are also important to assess. Other key vendors in the broad EFSS market offer a mix of hybrid, cloud, and on-premises deployment options. While categorized as hybrid providers in Forrester’s market segmentation, products such as Citrix ShareFile, Egnyte, and Syncplicity also offer complete cloud solutions for application delivery, content, and metadata management, in addition to hybrid options. These alternate products offer compelling approaches for firms still transitioning to cloud services for content storage or management.

Usability Is The Ultimate Competitive Advantage For EFSS Providers

Successful EFSS deployments are driven primarily by how users embrace the tool. The leading EFSS providers in this evaluation benefit from their multitenant, SaaS deployment models. Vendors are able to glean insights into how users engage with the applications and use that data to drive their road maps and user interface evolution.

This means:

- Customers must view ease-of-use and fit for the mobile workforce as key criteria. A common theme in both the customer reference survey for this evaluation and client inquiry calls with Forrester is that enterprise buyers focus on usability as a top consideration during vendor selection. Steering busy information workers to a corporately sanctioned offering rather than to self-provision or freemium editions is successful only when the approved tool meets or exceeds the usability standards of other alternatives.

- Vendors with high customer satisfaction levels are likely to be chosen again. Even when EFSS solutions have feature gaps in areas such as advanced security or life-cycle management, the customers we surveyed were very likely to reselect their existing solution providers if they viewed overall usability positively.

- A low barrier of adoption is key to serve the extended enterprise. EFSS providers have filled a critical gap left by traditional content management and collaboration products: the ability to securely and simply share files with external participants. Corporate priorities now focus on improving customer experience and digitizing business processes, meaning that engaging critical outside stakeholders such as partners, suppliers, and customers with content is a key concern. EFSS providers offer the licensing models and a ‘no training required’ experience to get external collaborators productive quickly and with minimal administrative efforts.

Enterprise File Sync And Share Evaluation Overview

To assess the state of the EFSS cloud market and see how the vendors stack up against each other, Forrester evaluated the strengths and weaknesses of top vendors in the marketplace. After examining past research, user need assessments, customer surveys, and vendor and expert interviews, we developed a comprehensive set of evaluation criteria.

We evaluated vendors against 40 criteria, which

we grouped into three high-level buckets:

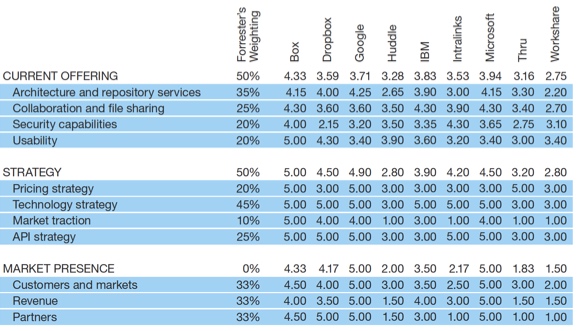

- Current offering. We assessed the technologies based on the breadth of the tool set, with particular emphasis on usability, security, and support for basic content repository services. We surveyed customers to get firsthand observation on the strength of particular capabilities and tested each vendor’s mobile app with at least one large shared file.

- Strategy. EFSS cloud vendors must show coherent strategies to help their customers share and manage content in the cloud. We assessed vendors on strategies for pricing models, APIs, and overall technology direction.

- Market presence. We evaluated each vendor based on its current customer base, size of its EFSS cloud revenue, geographic presence, and vertical focus. We also considered the level of interest in the vendor based on the volume of inquiries from Forrester clients on the product.

Vendors Are Committed To Cloud,

Have A Strong Install Base, And Shape The Marketplace

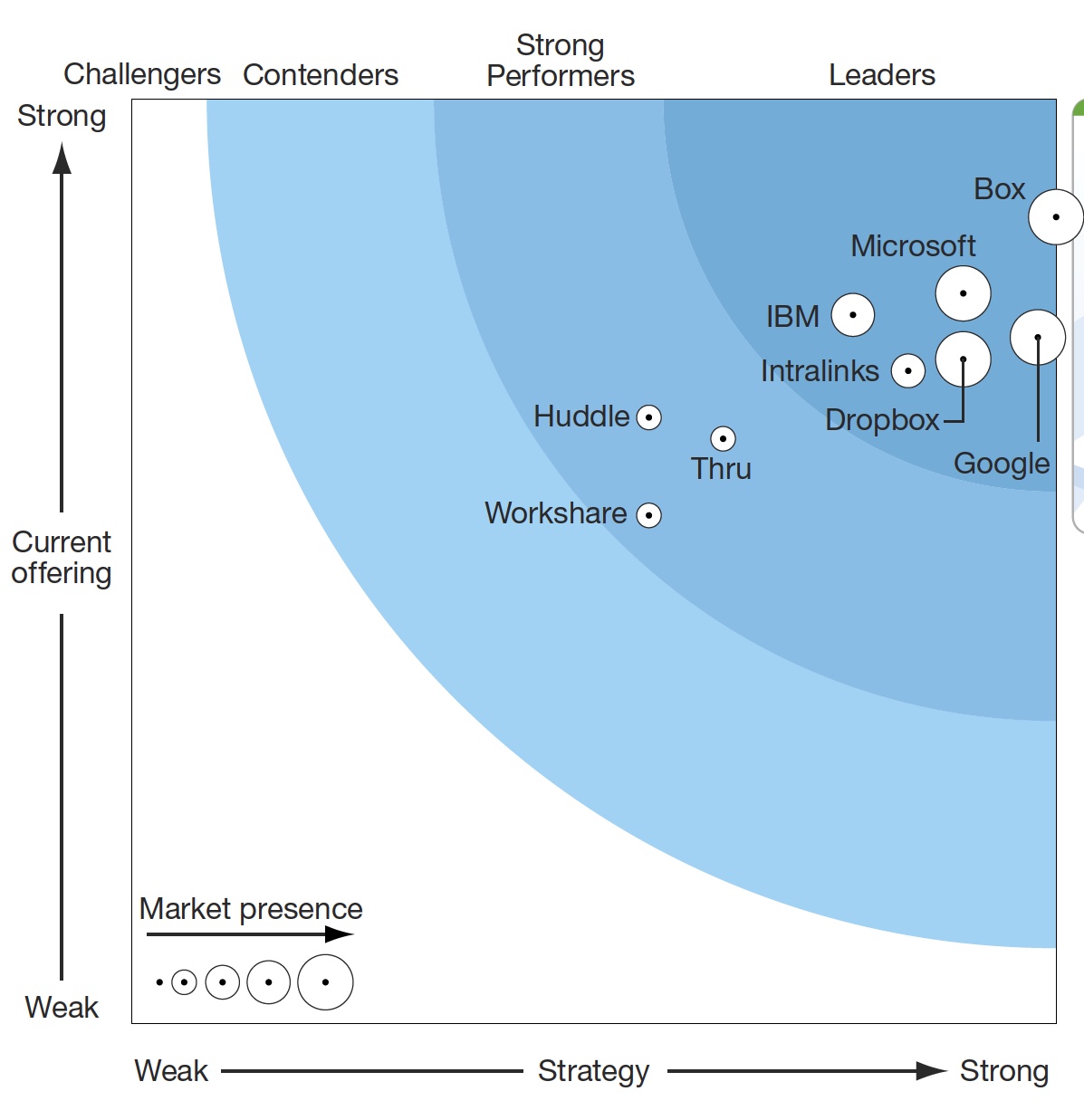

Forrester included nine vendors in the assessment: Box, Dropbox, Google, Huddle, IBM, Intralinks, Microsoft, Thru, and Workshare. Each of these vendors has a strong current EFSS cloud offering and actively markets its tool as a standalone solution.

We selected vendors based on the following criteria (see Figure 1):

- A dedicated roadmap and go-to-market strategy focused on SaaS EFSS. Each vendor demonstrated that cloud was the predominant model for delivery of its EFSS technology and that it was investing in cloud-based content repository services.

- Leadership in the EFSS market. Selected vendors demonstrated the ability to shape the direction of the market, whether through innovative delivery models, technology leadership, or their dominant market presence.

- A proven install base among enterprise customers. Vendors demonstrated revenues of over $10 million with their EFSS cloud product offerings or had a minimum of 350 paying enterprise customers.

Figure 1 Evaluated Vendors:

Product Information And Selection Criteria

| Vendor | Product evaluated |

| Box | Box |

| Dropbox | Dropbox Business |

| Google Drive | |

| Huddle | Huddle |

| IBM | IBM Connection Files |

| Intralinks | Via |

| Microsoft | OneDrive for Business |

| Thru | Thru |

| Workshare | Workshare |

Vendor selection criteria

A dedicated roadmap and go-to-market strategy focused on SaaS EFSS. Each vendor demonstrated that cloud was the predominant model for delivery of its EFSS technology and that it was investing in cloud-based content repository services. Leadership in the EFSS market. Selected vendors demonstrated the ability to shape the direction of the market, whether through innovative delivery models, technology leadership, or their dominant market presence. A proven installed base among enterprise customers. Vendors demonstrated revenues of over $10 million with their EFSS cloud product offerings or had a minimum of 350 paying enterprise customers.

Vendor Profiles

This evaluation of the enterprise file sync and share cloud solutions market is intended to be a starting point only. We encourage clients to view detailed product evaluations and adapt criteria weightings to fit their individual needs through the Forrester Wave Excel-based vendor comparison tool (see Figure 2).

Figure 2 Forrester Wave: Enterprise File Sync And Share, Cloud Solutions, 1Q16

Figure 2 Forrester Wave: Enterprise File Sync And Share, Cloud Solutions, 1Q16 (Cont.)

All scores are based on a scale of 0 (weak) to 5 (strong).

Survey Methodology

Forrester’s Business Technographics Global Software Survey, 2015, was fielded to 3,651 business and technology decision-makers located in Australia, Brazil, Canada, China, France, Germany, India, New Zealand, the UK and US from companies with two or more employees. This survey is part of Forrester’s Business Technographics and was fielded from July 2015 to August 2015. Research Now fielded this survey on behalf of Forrester. Survey respondent incentives include points redeemable for gift certificates. We have provided exact sample sizes in this report on a question-by-question basis. Forrester’s Business Technographics provides demand-side insight into the priorities, investments, and

customer journeys of business and technology decision-makers and the workforce across the globe. Forrester collects data insights from qualified respondents in 10 countries spanning the Americas, Europe, and Asia. Business Technographics uses only superior data sources and advanced data cleaning techniques to ensure the highest data quality.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter