Flat Market for Central and Eastern Europe External Storage in 2014 – IDC

Confounded by economic and political factors

This is a Press Release edited by StorageNewsletter.com on April 8, 2015 at 3:08 pmThe last quarter of 2014 was the weakest quarter of the year for the external storage market in Central and Eastern Europe (CEE), with a 4.7% year-on-year value decline and only 15.9% capacity growth.

Market performance for the entire year was almost flat (-0.3%), with total value just below the 1 billion dollar threshold.

Overall capacity in the region jumped 23.9% from the previous year, almost reaching 1EB.

Spending in SMB segment increased 15.2% year on year, which helped prevent a more significant decline of the total market.

These results were revealed in EMEA Disk Storage Systems Quarterly Tracker published recently by International Data Corporation.

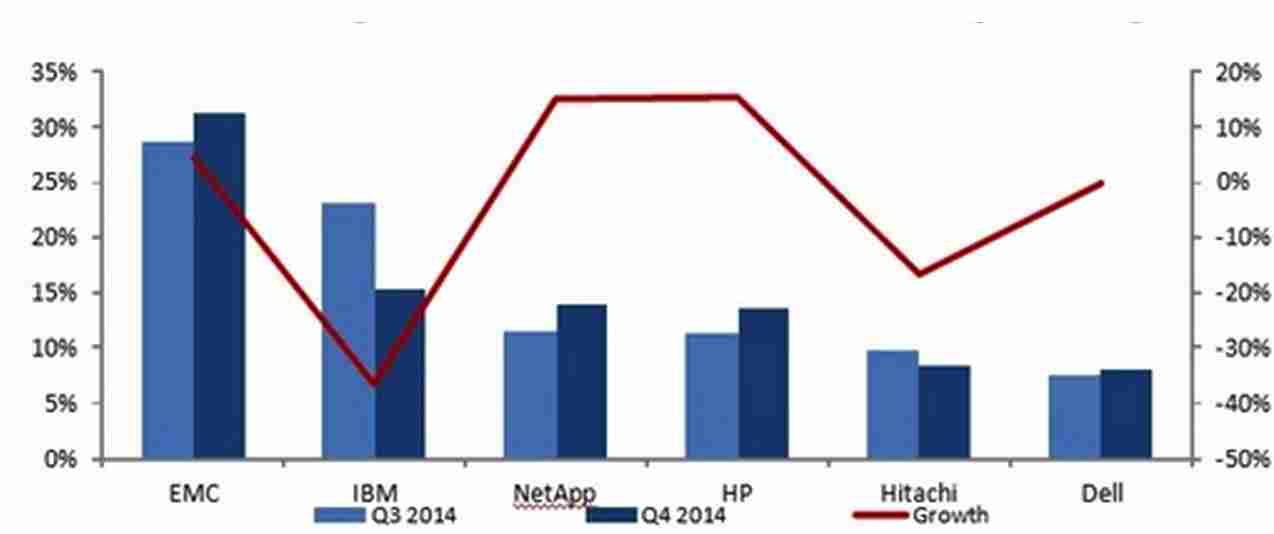

CEE External Storage Systems Market Share, 4Q13-4Q14

(Source: IDC, 2015)

Factors shaping market trends could be viewed as reflecting two distinct groups: macroeconomic and political versus technological. While the first has mainly short to medium-term effects, the effects of the second are more long-term, related to the ongoing transition to 3rd-Platform technologies.

The poor performance on Russia and Ukraine markets in the second half of 2014 was responsible for the overall CEE market decline. Demand was affected by international sanctions, plummeting oil prices, and currency devaluation, and the market will take a further hit from the imposed restrictions on big international vendors such as HP, EMC, IBM, and HDS from dealing with official partners in Russia and large government and corporate clients. As a result, the importance of Chinese manufacturers (Huawei Technologies Co. Ltd, Inspur Co., Ltd) and local server and storage companies, which are unaffected by the sanctions is on the rise.

The remaining CEE countries, particularly EU member states such as Poland, Romania, Bulgaria, and Slovakia, exhibit the long-term IT trends but are free of the socio-political inhibitors. The additional support of EU funds allocated for 2014-2020 period and planned egovernment programs, resulted in a successful year in terms of storage spending.

Although SMBs buy significant numbers of primary and backup storage systems, these are typically entry-level products. On the other hand, large organizations and service providers tend to invest in midrange solutions, flash-optimized storage, and SDS solutions, while the government buys high-end storage systems, which contributes strongly to the positive development of the market in these countries.

While currently subdued by the political and economic situation in CIS countries, the technology and market trends valid for the global enterprise hardware markets – i.e., a shift to lower-priced storage systems and the rise of flash, cloud, SDS, convergence, and hardware commoditization – can be observed in many CEE markets.

The adoption of flash-optimized storage in datacenters started making an impact in the region in 2014. In the last quarter, even the more niche all-flash arrays recorded skyrocketing value growth and captured 4% of the total external storage market value. The demand for flash solutions gave an additional boost to the recovering midrange segment and confirmed the decline of the high-end.

“We forecast that flash-optimized arrays, both all-flash and hybrid flash, will account for 40% of the external storage market by the end of 2015, spurred by increasing competition and database online transaction processing, big data, VDI, and high-performance computing projects,” says Marina Kostova, storage systems analyst, IDC CEMA.

Cloud adoption in the region was mainly driven by public cloud spending among cost-conscious SMBs and private cloud deployments in larger enterprises that are concerned about security, governance, and data protection requirements.

“Thanks to the proliferation of cloud and flash in the CEE region, the commoditization of hardware and SDS solutions will be the next datacenter strategy consideration for both vendors and end users,” adds Kostova.

Subscribe to our free daily newsletter

Subscribe to our free daily newsletter